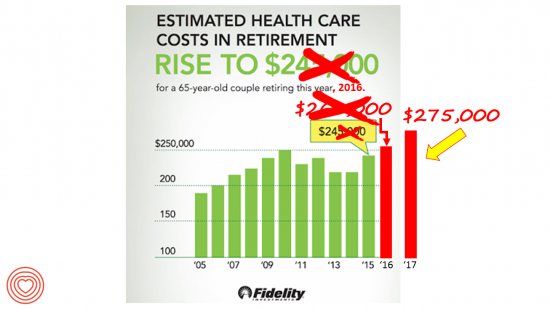

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

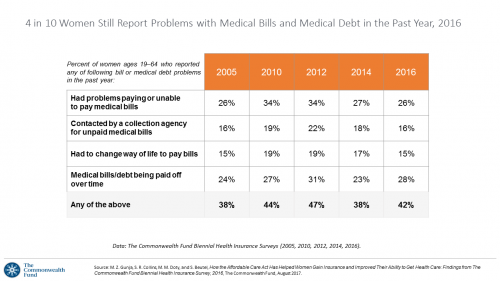

Women’s Access to Health Care Improved Under the Affordable Care Act

The Affordable Care Act (ACT) was implemented in 2010. Since the inception of the ACA, the proportion of uninsured women in the U.S. fell by nearly one-half, from 19 million in 2010 to 11 million in 2016. The Commonwealth Fund has documented the healthcare gains that American women made since the ACA launch in their issue brief, How the Affordable Care Act Has Helped Women Gain Insurance and Improved Their Ability to Get Health Care, published earlier this month. The first chart talks about insurance: health care plan coverage, which is the prime raison d’être of the ACA. It’s

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

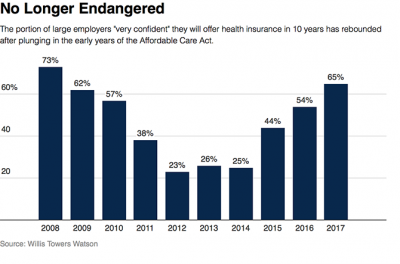

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

Learning From Adam Niskar – Living Beyond The Wheelchair

After diving into Walnut Lake in suburban Detroit, Adam Niskar sustained a spinal injury that would paralyze much of his body for the rest of his life. The trauma didn’t paralyze his life and living, though. But today, my family will celebrate that life at Adam’s memorial service. Adam was my cousin. He was one of the best-loved people on the planet, and that was part of a therapeutic recipe that sustained him from the traumatic accident in 1999 until Monday, July 31st, 2017, when Adam passed away from complications due to an infection that, this time around, his body

Health Equity Lessons from July 23, 1967, Detroit

On July 23, 1967, I was a little girl wearing a pretty dress, attending my cousin’s wedding at a swanky hotel in mid-town Detroit. Driving home with my parents and sisters after the wedding, the radio news channel warned us of the blazing fires that were burning in a part of the city not far from where we were on a highway leading out to the suburbs. Fifty years and five days later, I am addressing the subject of health equity at a speech over breakfast at the American Hospital Association 25th Annual Health Leadership Summit today. In my talk,

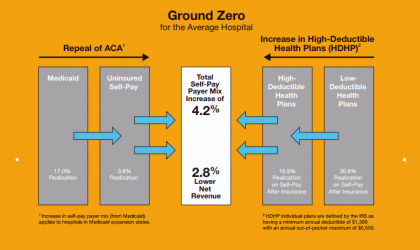

Self-Pay Healthcare Up, Hospital Revenues Down

For every 4.2% increase in a hospital’s self-pay patient population, the institution’s revenues would fall by 2.8% in Medicaid expansion states. This is based on the combination of a repeal of the Affordable Care Act and more consumers moving to high-deductible health plans. That sober metric was calculated by Crowe Horwath, published in its benchmarking report published today with a title warning that, Self-Pay Becomes Ground Zero for Hospital Margins. The “ground zero” for the average U.S. hospital is the convergence of a potential repeal of the Affordable Care Act (ACA), which could increase the number of uninsured Americans by 22 million

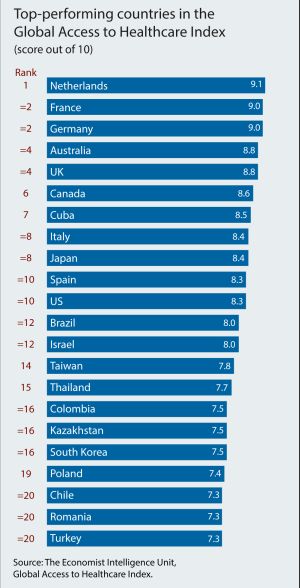

Is There Political Will for Healthcare Access in the US?

The Netherlands, France and Germany are the best places to be a patient, based on the Global Access to Healthcare Index, developed by the Economist Intelligence Unit (EIU). Throughout the world, nations wrestle with how to provide healthcare to health citizens, in the context of stretched government budgets and demand for innovative and accessible services. The Global Access to Healthcare Index gauges countries’ healthcare systems in light of peoples’ ability to access services, detailed in Global Access to Healthcare: Building Sustainable Health Systems. The United States comes up 10th in line (tied with Spain) in this analysis. Countries that score the

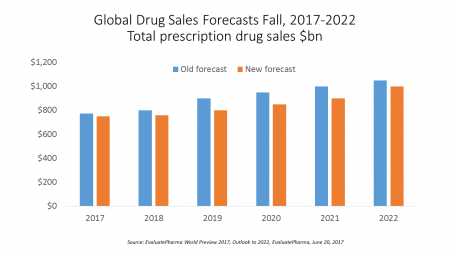

Global Drug Sales Forecasts Fall For Next Five Years

Total prescription drug sales have been trimmed, based on calculations of EvaluatePharma which forecasts a $390 bn drop in revenues between 2017 and 2022. “Political and public scrutiny over pricing of both new and old drugs is not going to go away,” EvaluatePharma called out in its report. The intense scrutiny on pharma industry pricing was fostered by Martin Shkreli in his pricing of Daraprim (taking a $13.50 product raising the price to $750), Harvoni and Sovaldi pricing for Hepatitis C therapies, and last year’s EpiPen pricing uproar. A May 2017 analysis of prescription drug costs by AARP judges that, “Nothing

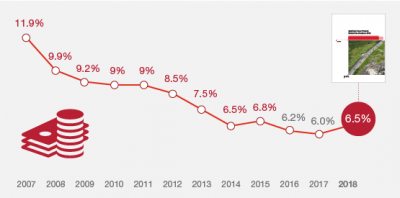

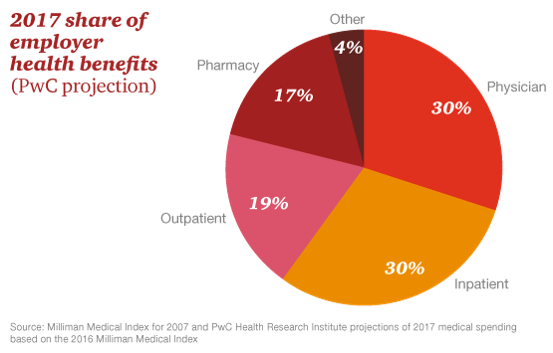

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

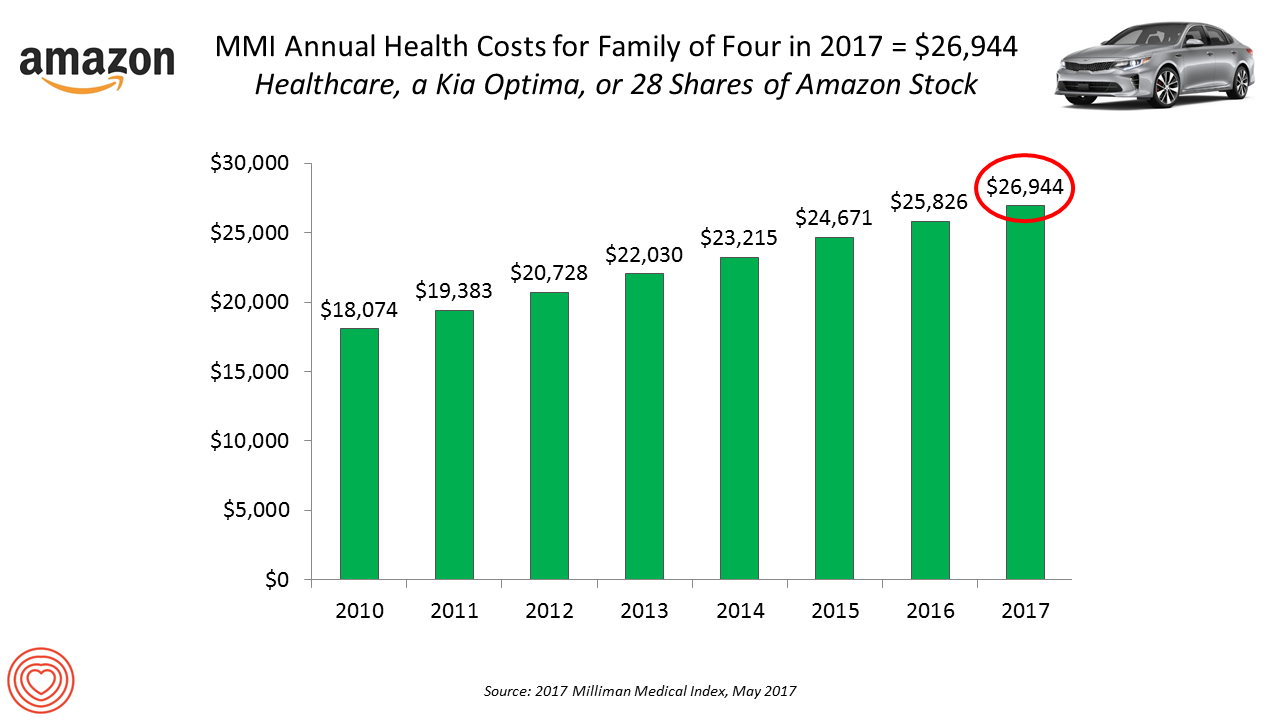

Healthcare Costs for a Family of Four Will Reach $27,000 in 2017

If you had $27,000 in your wallet, would you spend it on a 2017 Kia Optima sedan, 28 shares of Amazon stock, or healthcare? $26,944 is this year’s estimate of what healthcare will cost a family of four in the U.S., based on the 2017 Milliman Medical Index (MMI). This is based on the projected total costs of healthcare for a family covered by an employer-sponsored PPO plan. Milliman, the actuarial consulting firm, has conducted the MMI going back to 2001. I’ve watched the rise and rise of this index for years, explained annually in the Health Populi blog since its inception

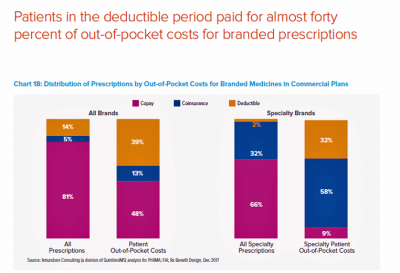

Medicines in America: The Half-Trillion Dollar Line Item

Prescription drug spending in the U.S. grew nearly 6% in 2016, reaching $450 billion, according to the QuintilesIMS Institute report, Medicines Use and Spending in the U.S., published today. U.S. drug spending is forecasted to grow by 30% over the next 5 years to 2021, amounting to $610 billion. In 2016, per capita (per person) spending on medicines for U.S. health citizens averaged $895. Specialty drugs made up $384 of that total, equal to 43% of personal drug spending, shown in the first chart. Spending on specialty drugs continues to increase as a proportion of total drug spending: traditional medicines’ share

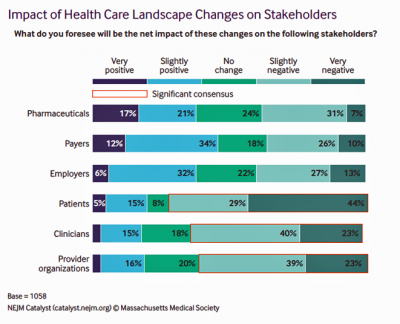

Most Physicians Say Patients, Doctors and Hospitals Are All Losers Under Trump

“Overall, Council members express pessimism about the health are landscape in the wake of the Trump administration’s proposed plans, citing no clear winners, only losers: patients, clinicians, and provider organizations.” This is the summary of the Leadership Survey report, Anticipating the Trump Administration’s Impact on Health Care, developed by the New England Journal of Medicine‘s NEJM Group. The first chart illustrates the “biggest healthcare losers” finding, detailed on the bottom three bars of patients, clinicians, and provider organizations. The stakeholders that will fare best under a President Trump healthcare agenda would be drug companies, payers, and employers. The biggest loser

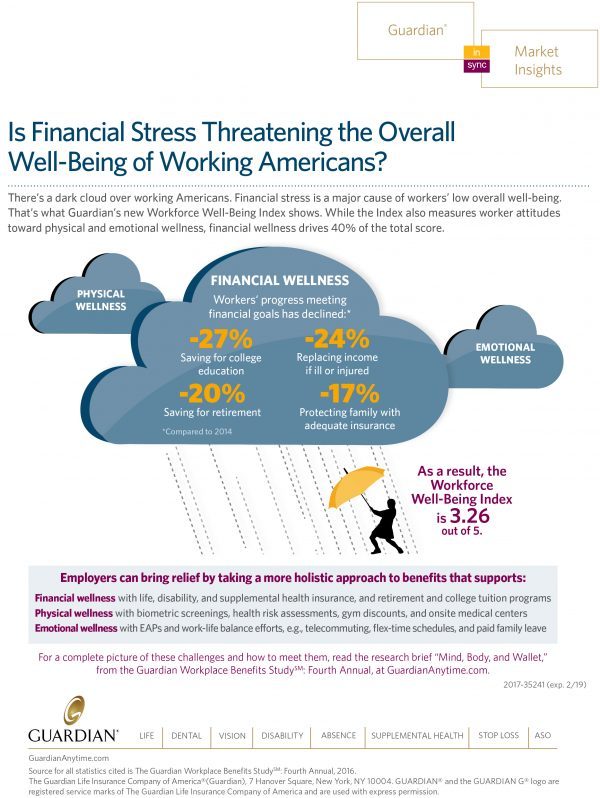

Financial Stress As A Health Risk Factor Impacts More Americans

A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register. The cache of jewelry fetched enough to pay the $10,000 bill. Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings

Health Care Costs Are A Top Worry for Americans Across Political Parties

Health care costs are out-of-reach for more Americans, among both people who have insurance through the workplace or via health insurance exchanges. The first chart illustrates the growing healthcare affordability challenge for American health consumers, discussed in a data note to the Kaiser Family Foundation Health Tracking Poll in March 2017. In 2017, 43% of consumers found it difficult to meet the health care deductible before insurance would kick in 37% of consumers found it difficult to pay for the cost of health insurance each month 31% said it was difficult to pay for copayments for doctor visits and prescription drugs.

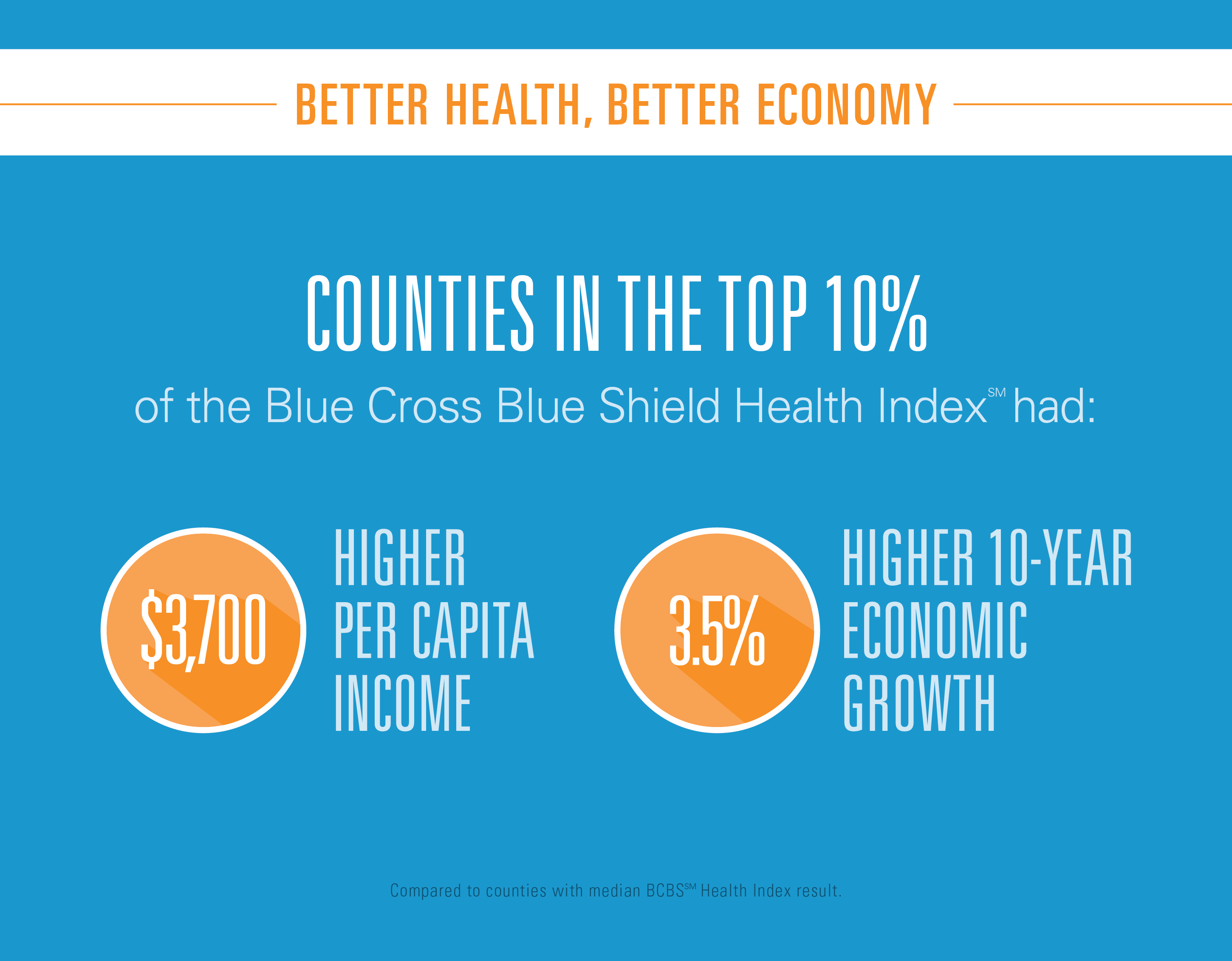

Connecting the Dots Between Population Health and the Local Economy

U.S. counties with better health have better performing economies. There’s a direct link between healthy people and a healthy economy, where healthier regions enjoy lower unemployment and higher incomes, according to the Blue Cross Blue Shield Health Index. When compared to counties with a median BCBS Health Index score, counties within the top 10 percent had: A per capita income that’s $3,700 higher than the median 10-year economic growth that’s 3.5% higher An unemployment rate half a point lower. The Blue Cross Blue Shield Association (BCBSA) worked with Moody’s Analytics (part of the Moody’s financial services company) on this second edition of this

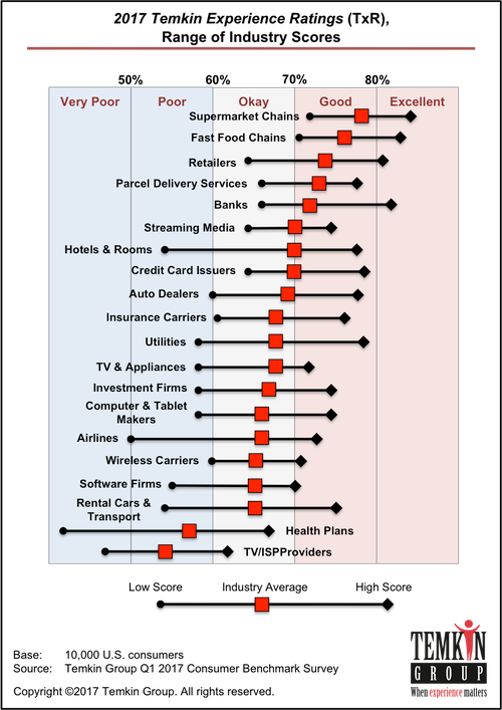

Health Insurance Plans Rank Lowest In Consumer Experience

Consumers love their supermarkets, fast food shops, retailers, delivery services, and banks. These industries rank highest in the 2017 Temkin Experience Ratings, my go-to source for understanding consumer service Nirvana. Health insurance companies and internet service providers (ISPs) are at the bottom of the Temkin Ratings, as shown in the first chart. Note that health plans range from a score approaching 70 to under 50, illustrating the very wide range of consumer experience from okay-to-good, too very poor. The top-ranked health plan was Kaiser Permanente, with a rating of 67%; Health Net was ranked the worst of the health plans

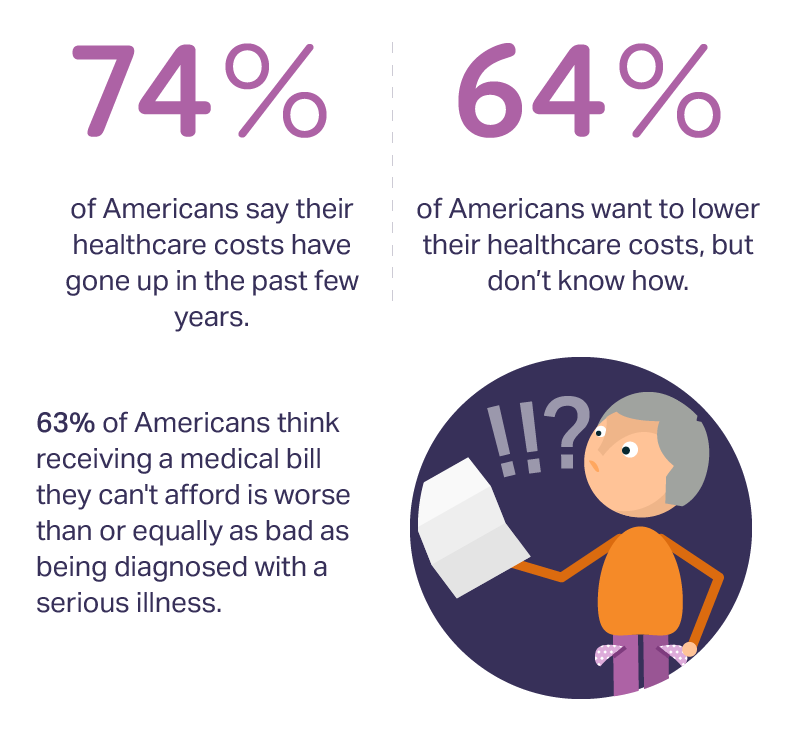

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

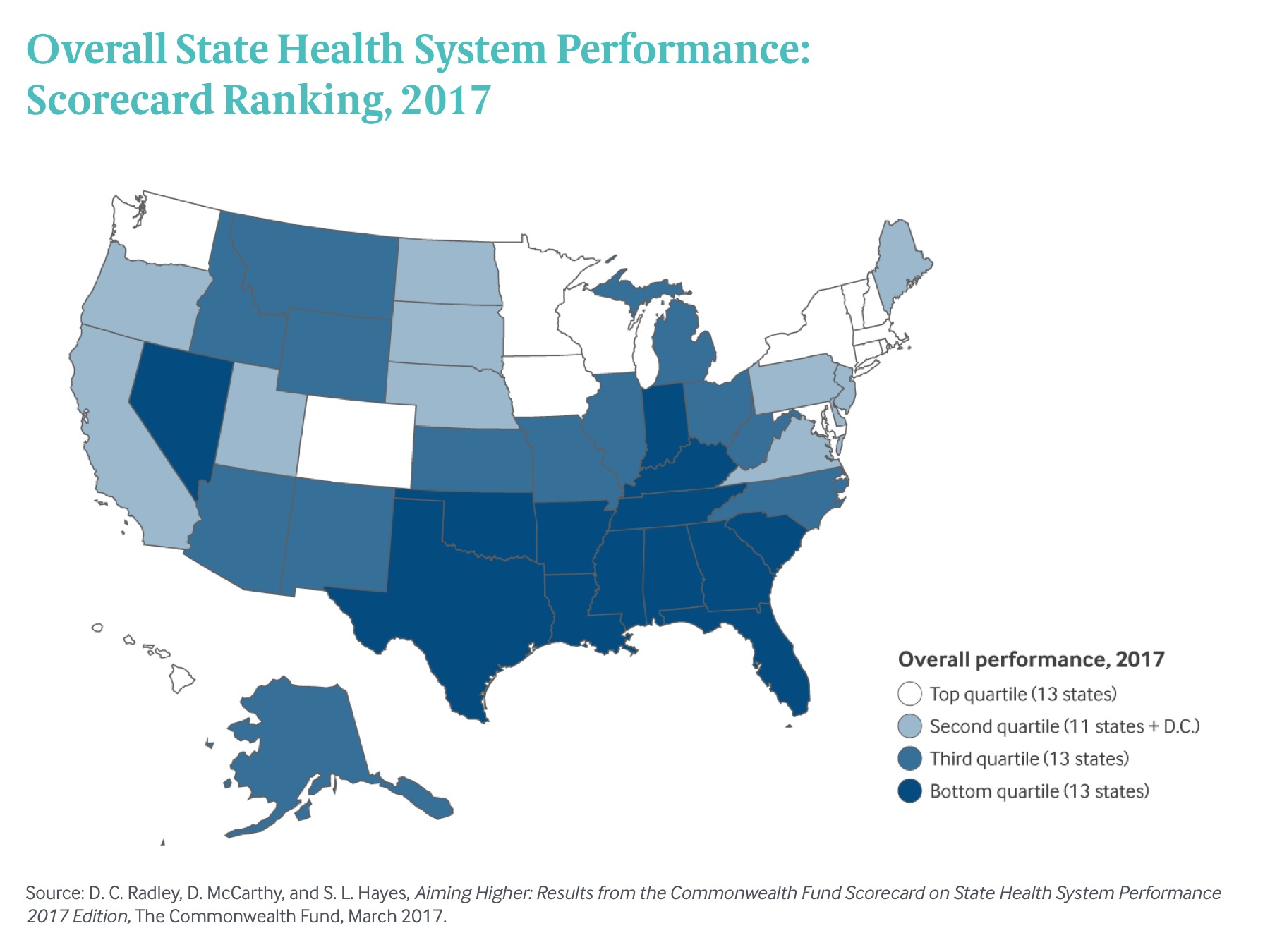

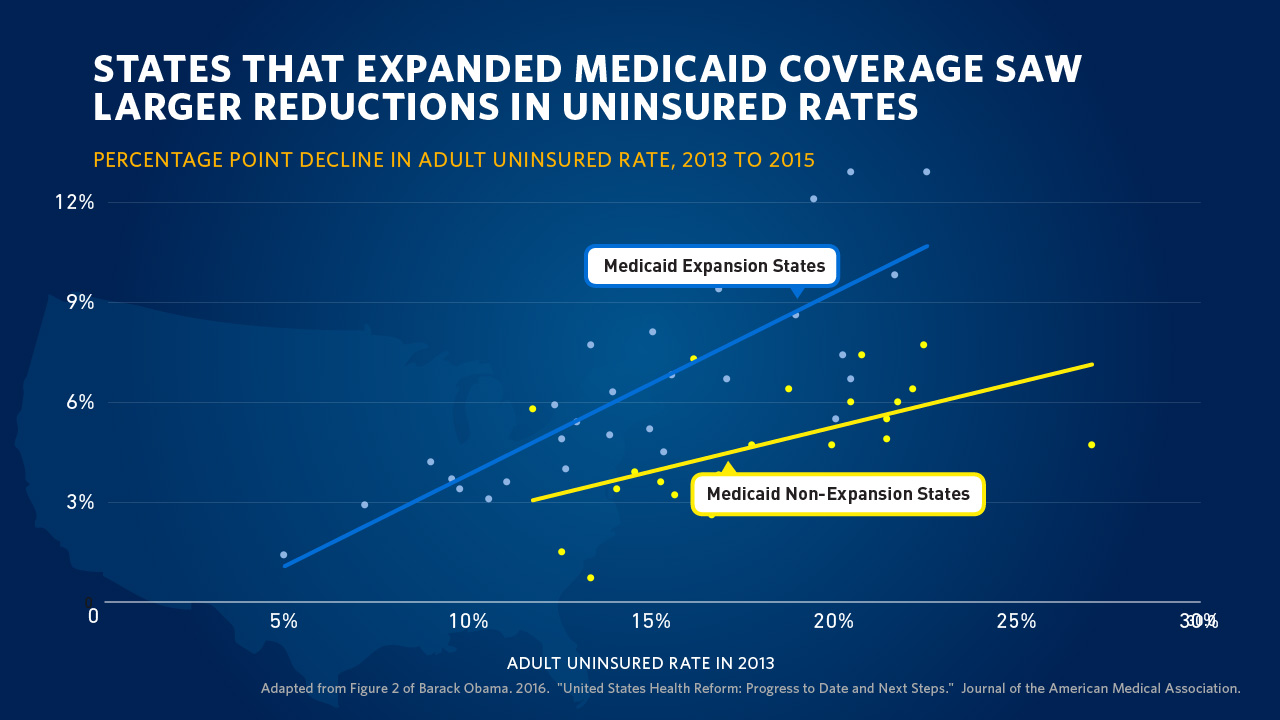

States That Expanded Medicaid Improved Healthcare Access & Patient Outcomes

States that expanded Medicaid since the start of the Affordable Care Act made greater health system access improvements than those States that did not expand Medicaid, according to Aiming Higher: Results from the Commonwealth Fund Scorecard on State Health System Performance. There’s good news and bad news in this report: on the upside, nearly all states saw health improvements between 2013 and 2015, and in particular, for treatment quality and patient safety. Patient re-admissions to hospitals also fell in many states. But on the downside, premature deaths increased in nearly two-thirds of states, a reversal in the (improving) national mortality

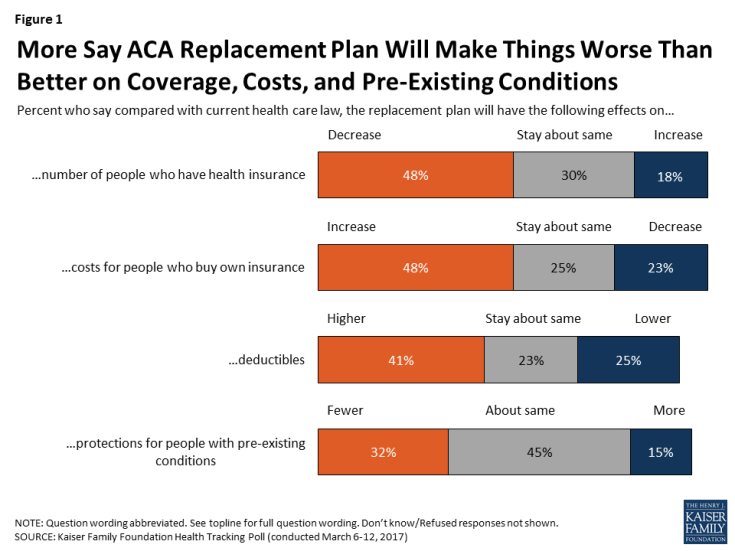

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

Will Republican Healthcare Policy “Make America Sick Again?” Two New Polls Show Growing Support for ACA

Results of two polls published in the past week, from the Kaiser Family Foundation and Pew Research Center, demonstrate growing support for the Affordable Care Act, aka Obamacare. The Kaiser Health Tracking Poll: Future Directions for the ACA and Medicaid was published 24 February 2017. The first line chart illustrates the results, with the blue line for consumers’ “favorable view” on the ACA crossing several points above the “unfavorable” orange line for the first time since the law was signed in 2010. The margins in February 2017 were 48% favorable, 42% unfavorable. While the majority of Republicans continue to be solidly

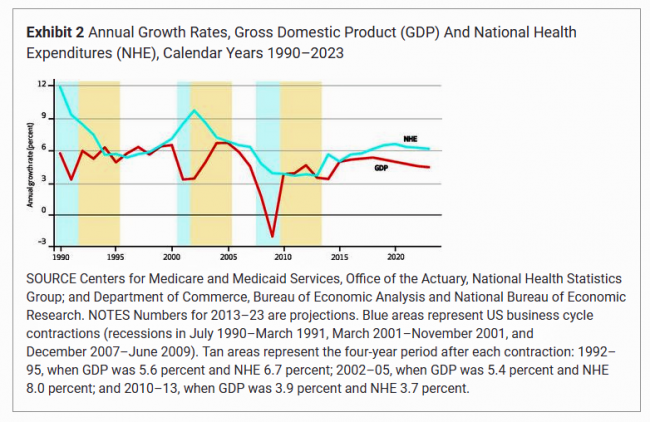

20% of the US Economy Will Be Healthcare Spending in 2025

Price increases and growing use of healthcare services will drive national health spending (NHE) in the U.S. to 20% of the nation’s economy by 2025, according to projections calculated by a team from the Centers for Medicare and Medicaid Services (CMS). Health spending will reach $3.6 trillion dollars this year. These were published in a Web-First article in Health Affairs on 15 February 2017 The caveat on these numbers is that the CMS team used economic models based on “current-law framework:” these make no assumptions about legislative changes that may occur in healthcare reform between 2017 and 2025. While that’s a

My $100 Flu Shot: How Much Paper Waste Costs U.S. Healthcare

An abbreviated version of this post appeared in the Huffington Post on 9 February 2017. This version includes the Health Populi Hot Points after the original essay, discussing the consumer’s context of retail experience in healthcare and implications for the industry under Secretary of Health and Human Services Tom Price — a proponent of consumer-directed healthcare and, especially, health savings accounts. We’ll be brainstorming the implications of the 2016 CAQH Index during a Tweetchat on Thursday, February 16, at 2 pm ET, using the hashtag #CAQHchat. America ranks dead-last in healthcare efficiency compared with our peer countries, the Commonwealth Fund

Health Care Worries Top Terrorism, By Far, In Americans’ Minds

Health care is the top concern of American families, according to a Monmouth University Poll conducted in the week prior to Donald Trump’s Presidential inauguration. Among U.S. consumers’ top ten worries, eight in ten directly point to financial concerns — with health care costs at the top of the worry-list for 25% of people. Health care financial worries led the second place concern, job security and unemployment, by a large margin (11 percentage points) In third place was “everyday bills,” the top concern for 12% of U.S. adults. Immigration was the top worry for only 3% of U.S. adults; terrorism and

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

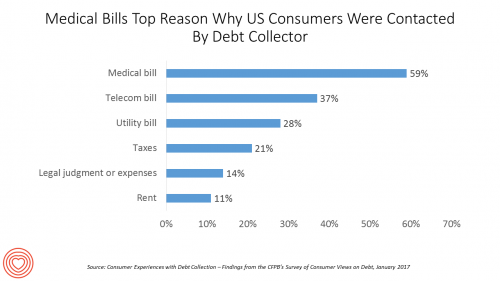

Medical Debt Is A Risk Factor For Consumers’ Financial Wellness

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection. Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills. The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically: 62% of consumers earning $20,000 to

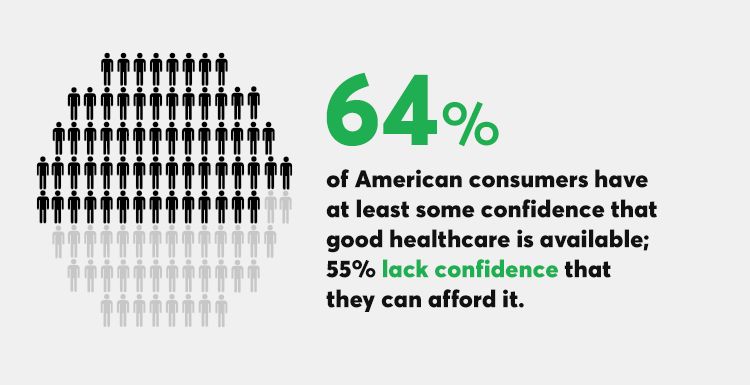

Health Care For All — Only Better, US Consumers Tell Consumer Reports

Availability of quality healthcare, followed by affordable care, are the top two issues concerning U.S. consumers surveyed just prior to Donald Trump’s inauguration as the 45th U.S. President. Welcome to Consumer Reports profile of Consumer Voices, As Trump Takes Office, What’s Top of Consumers’ Minds? “Healthcare for All, Only Better,” Consumer Reports summarizes as the top-line finding of the research. 64% of people are confident of having access to good healthcare, but 55% aren’t sure they can afford healthcare insurance to be able to access those services. Costs are too high, and choices in local markets can be spotty or non-existent.

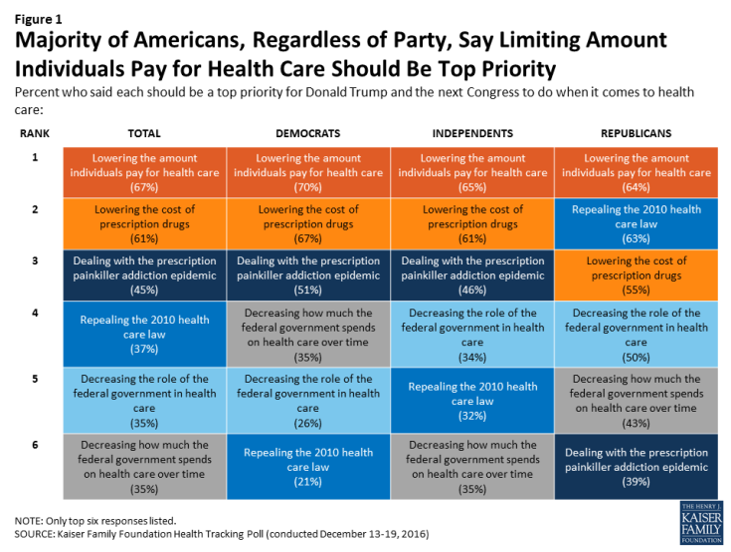

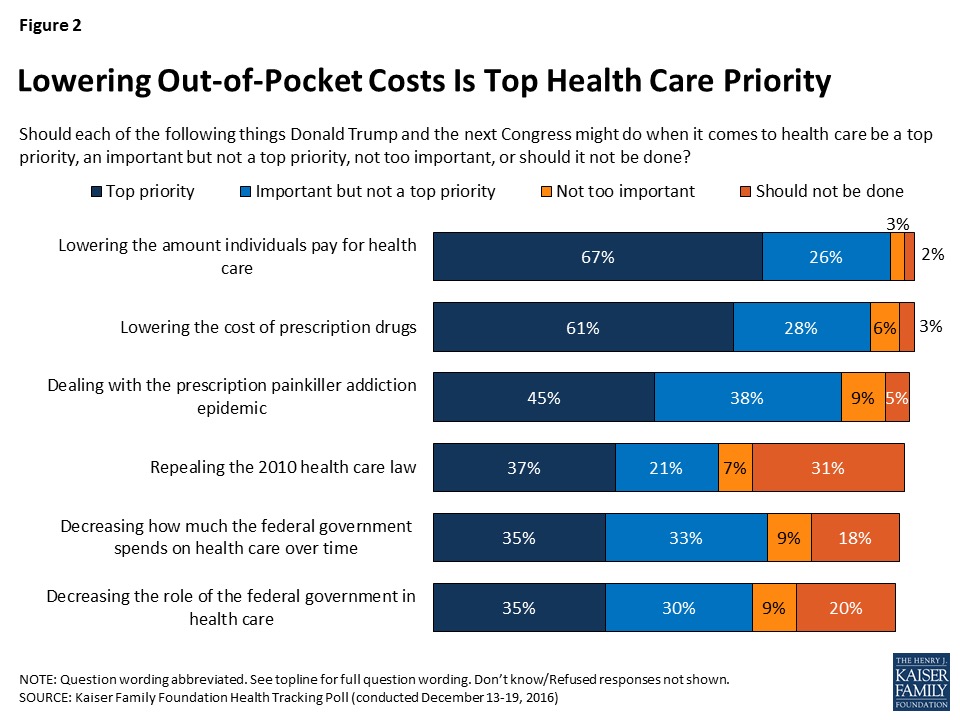

Health Care Costs, Not the ACA, Rank #1 in Americans’ Minds As President Trump Assumes the Presidency

More Americans are worried about their out-of-pocket health care costs than they are about repealing the Affordable Care Act (ACA), according to the Kaiser Family Foundation (KFF) Health Tracking Poll published 6th January 2017, the first KFF poll for the new year. Cost worries fall into two buckets of concerns: the cost of health care, and the cost of prescription drugs. Managing the opioid epidemic falls in third place after health care costs. Repealing the Affordable Care Act? It’s #4 on Americans’ health care priorities as of mid-December 2016, followed by shrinking the Federal’s government’s role in and spending on

Consumers Taking Healthcare Into Own Hands at CES 2017

Consumer electronics (CE) aren’t just big screen TVs, sexy cars, and videogames anymore. Among the fastest-growing segments in CE is digital health, and health-tech will be prominently featured at the 2017 CES in Las Vegas hours after the champagne corks have popped at the start of the new year. On the second day of 2017, I’ll be flying to Las Vegas for several days of consumer technology immersion, learning about connected and smart homes and cars, and shiny new things all devoted to personal health. Welcome to my all-health lens on CES 2017, once referred to as the Consumer Electronics

Retail Trumps Healthcare in 2017: the Health Populi Forecast for the New Year

Health citizens in America will need to be even more mindful, critical, and engaged healthcare consumers in 2017 based on several factors shaping the market; among these driving forces, the election of Donald Trump for U.S. president, the uncertain future of the Affordable Care Act and health insurance, emerging technologies, and peoples’ growing demand for convenience and self-service in daily life. The patient is increasingly the payor in healthcare. Bearing more first-dollar costs through high-deductible health plans and growing out-of-pocket spending for prescription drugs and other patient-facing goods and services, we’re seeking greater transparency regarding availability, cost and quality of

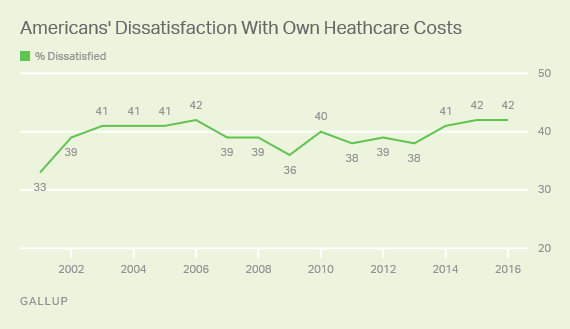

One-Half of Privately-Insured Americans Are Dissatisfied With Healthcare Costs

A plurality of Americans, 4 in 10, are dissatisfied with the healthcare costs they face. The level of dissatisfaction varies by a consumer’s type of health insurance, while overall, 42% of people are dissatisfied with costs… 48% of privately insured people are dissatisfied with thei healthcare costs 29% of people on Medicare or Medicaid are dissatisfied 62% of uninsured people are dissatisfied. Gallup has polled Americans on this question since 2014 every November. Dissatisfaction with healthcare costs is up from 38% from the period 2011-2013. As the line chart illustrates, the current levels of cost-dissatisfaction are similar to those felt

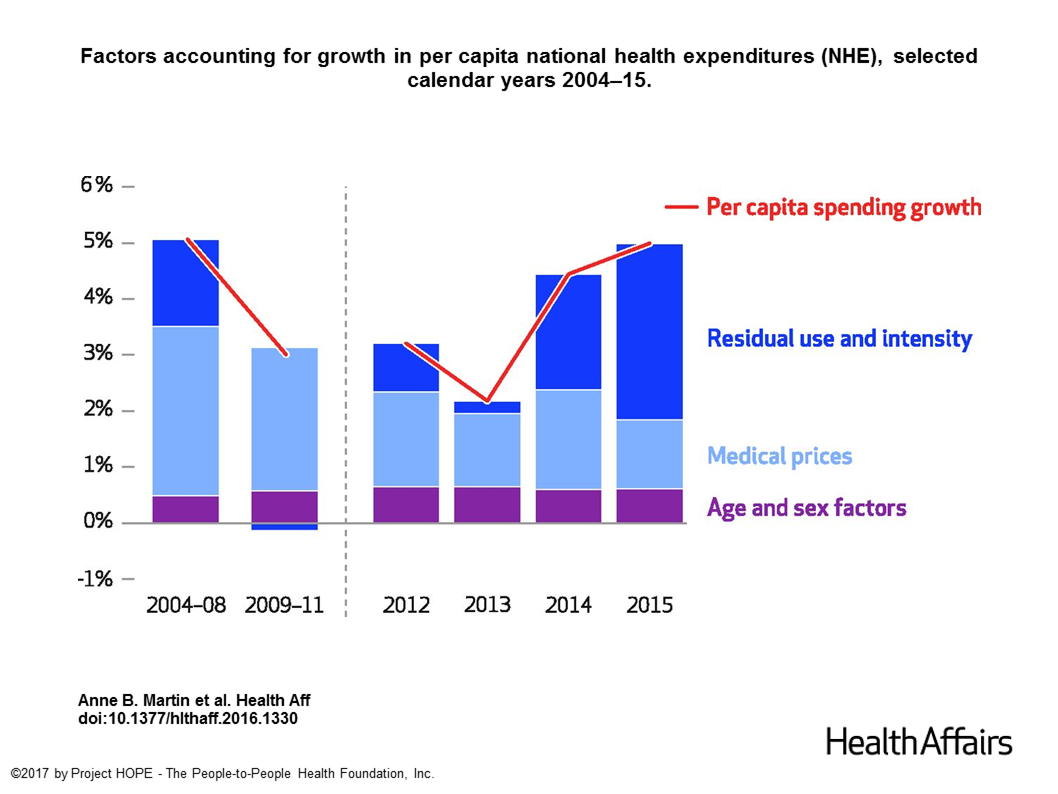

U.S. Healthcare Spending Hit Nearly $10,000 A Person In 2015

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP). Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending). The topic of

See Me, Feel Me, Touch Me, Heal Me – What The Who’s Tommy Can Teach Healthcare

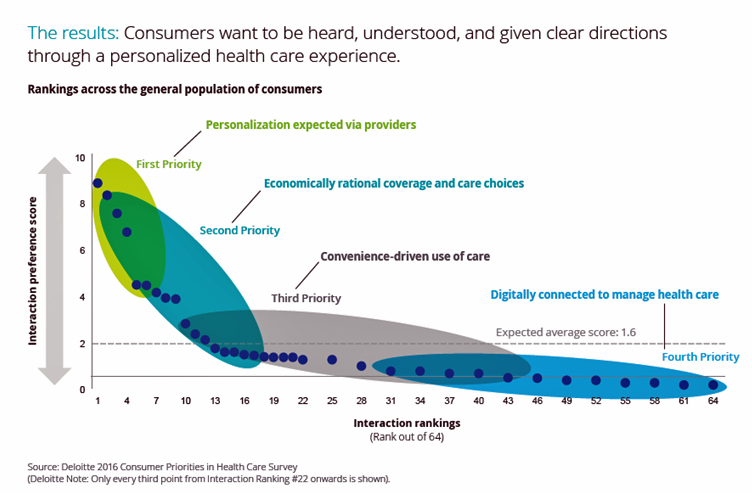

“See me, feel me, touch me, heal me,” is the lyrical refrain from The Who’s Tommy. These eight words summarize what Deloitte has learned from the firm’s latest look into healthcare consumers, published in the report, Health plans: What matters most to the health care consumer. U.S. consumers’ demands for health care are for: Personalization from doctors, hospitals, and other care providers — the most important priority; Economically rational coverage and care choices; Convenience-drive access and care experience; and, Digitally connected care. Personalization is Job 1: “Consumers want to be heard, understood, and given clear directions through a personalized health care

Healthcare Reform in President Trump’s America – A Preliminary Look

It’s the 9th of November, 2016, and Donald Trump has been elected the 45th President of the United States of America. On this morning after #2016Election, Health Populi looks at what we know we know about President Elect-Trump’s health policy priorities. Repeal-and-replace has been Mantra #1 for Mr. Trump’s health policy. With all three branches of the U.S. government under Republican control in 2018, this policy prescription may have a strong shot. The complication is that the Affordable Care Act (aka ObamaCare in Mr. Trump’s tweet) includes several provisions that the newly-insured and American health citizens really value, including: Extending health

Self-Care Is the Best Healthcare Reform

The greater a person’s level of health engagement, the better their health outcome will be. Evidence is growing on the return-on-investment for peoples’ health activation and how healthy they are. That ROI is both in survival (mortality) and quality of life (morbidity), as well as hard-dollar savings — personally bending-the-healthcare-cost-curve. But people are more likely to engage in “health” than “healthcare.” We’d rather ingest food-as-medicine than a prescription drug, use walking in a lovely park for exercise, and laugh while we’re learning about how to manage our health insurance benefits. Thus, Campbell’s Soup Company and Hormel are expanding healthy offerings,

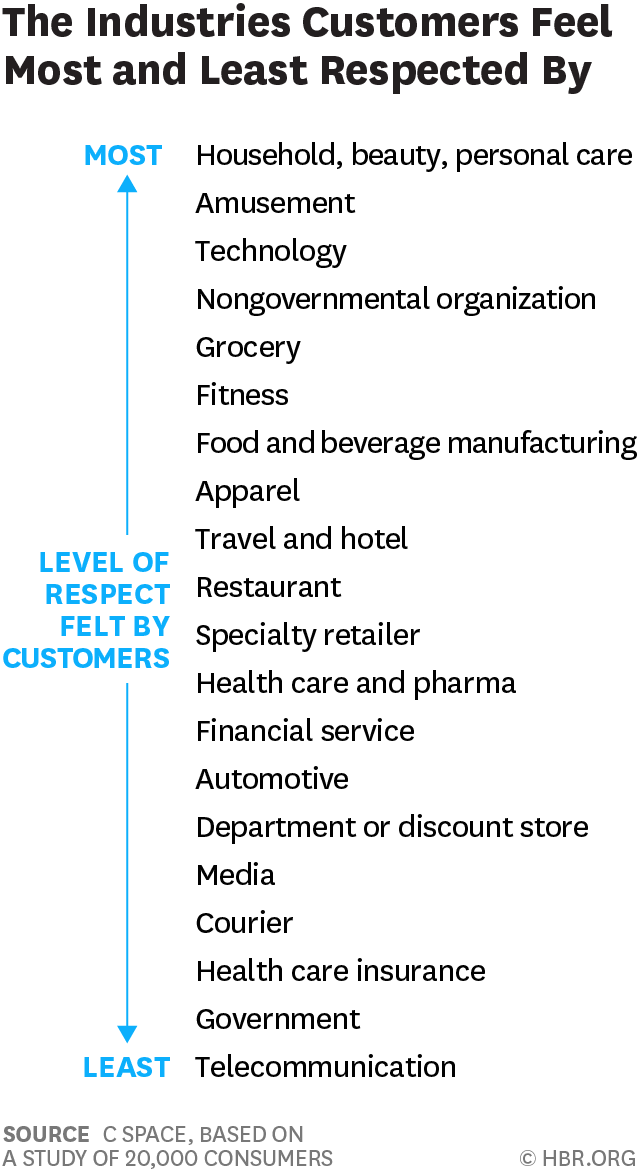

Consumers Feel More Respect from Personal Care and Grocery Brands Than Pharma or Insurance

People feel like get-no-respect Rodney Dangerfield when they deal with health insurance, government agencies, or pharma companies. Consumers feel much more love from personal care and beauty companies, grocery and fitness, according to a brand equity study by a team from C Space, published in Harvard Businss Review. As consumer-directed health care (high deductibles, first-dollar payments out-of-pocket) continues to grow, bridging consumer trust and values will be a critical factor for building consumer market share in the expanding retail health landscape. Nine of the top 10 companies C Space identified with the greatest “customer quotient” are adjacent in some way to health:

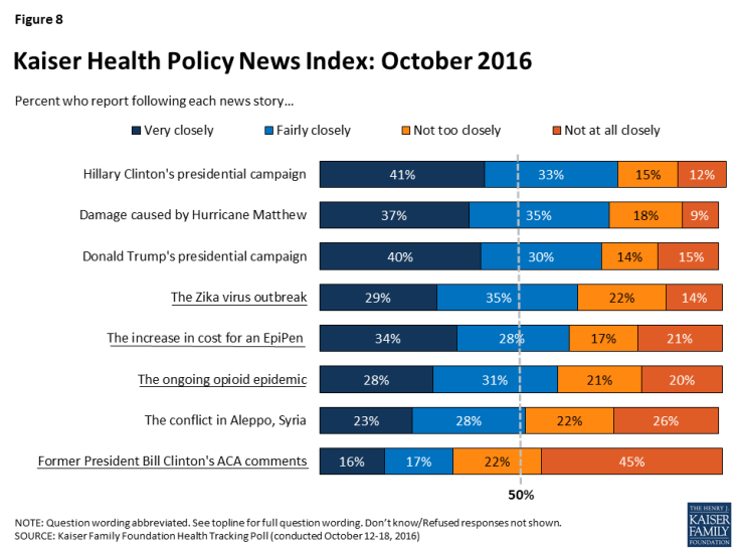

In #Election2016, Americans Care More About the Cost of Prescription Drugs Than the ACA

“When thinking about health care priorities for the next president and Congress to address, dealing with the high price of prescription drugs tops the public’s list while issues specific to the Affordable Care Act (ACA), such as repealing provisions of the law or repealing the law entirely, are viewed as top priorities by fewer Americans,” according to the Kaiser Health Tracking Poll for October 2016 – the last such survey to be taken before the 2016 Presidential election. The poster child snapshot image representing the high cost of prescription drugs is the increase in cost for an EpiPen, which among

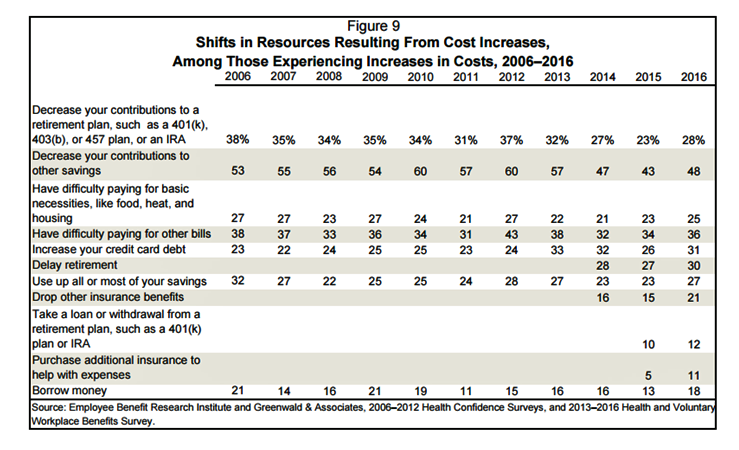

Americans Have Begun to Raid Retirement Savings for Current Healthcare Costs

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%). This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and

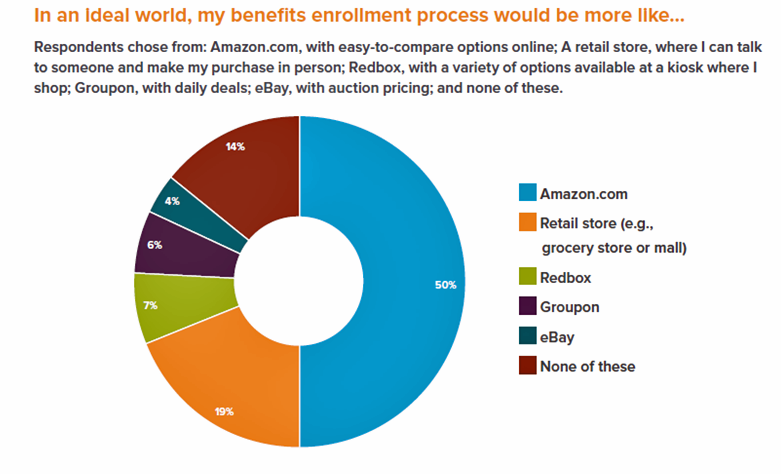

Looking for Amazon in Healthcare

Consumers have grown accustomed to Amazon, and increasingly to the just-in-time convenience of Amazon Prime. Today, workers who sign onto employee benefit portals are looking for Amazon-style convenience, access, and streamlined experiences, found in the Aflac Workforces Report 2016. Aflac polled 1,900 U.S. adults employed full or part time in June and July 2016 to gauge consumers’ views on benefit selections through the workplace. Consumers have an overall angst and ennui about health benefits sign-ups: 72% of employees say reading about benefits is long, complicated, or stressful 48% of people would rather do something unpleasant like talking to their ex or

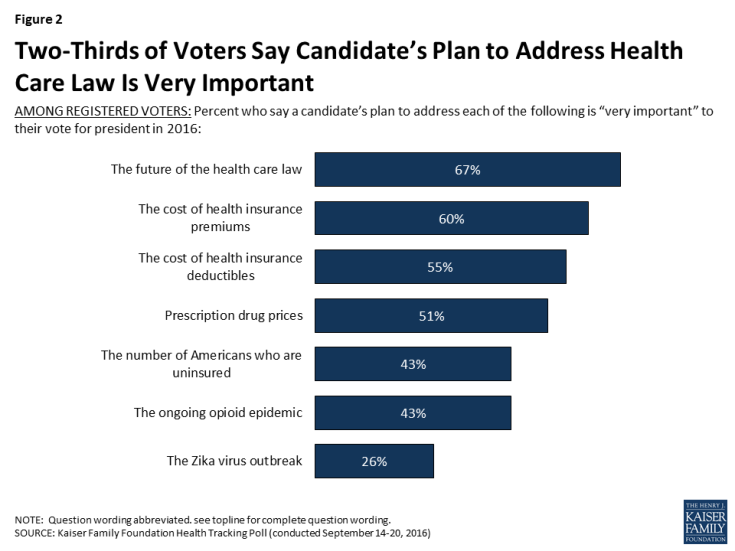

Costs of Care and the ACA Top Voters’ Healthcare Issues

Two in three US voters put the future of the Affordable Care Act as the #1 healthcare issue in the 2016 President election. The ACA is closely followed by healthcare costs — for insurance premiums, deductibles, and prescription drugs, according to the September 2016 Kaiser Health Tracking Poll. The opioid addiction and mortality epidemic is a top healthcare issue for 43% of US voters, and the Zika virus, among 26% of voters. Note that more supporters of Hillary Clinton are healthcare-oriented voters than people who favor Donald Trump. Uninsurance and costs, in addition to the future of the ACA, rank

Let’s Go Healthcare Shopping!

Healthcare is going direct-to-consumer for a lot more than over-the-counter medicines and retail clinic visits to deal with little Johnny’s sore throat on a Sunday afternoon. Entrepreneurs recognize the growing opportunity to support patients, now consumers, in going shopping for health care products and services. Those health consumers are in search of specific offerings, in accessible locations and channels, and — perhaps top-of-mind — at value-based prices as defined by the consumer herself. (Remember: value-based healthcare means valuing what matters to patients, as a recent JAMA article attested). At this week’s tenth annual Health 2.0 Conference, I’m in the zeitgeist

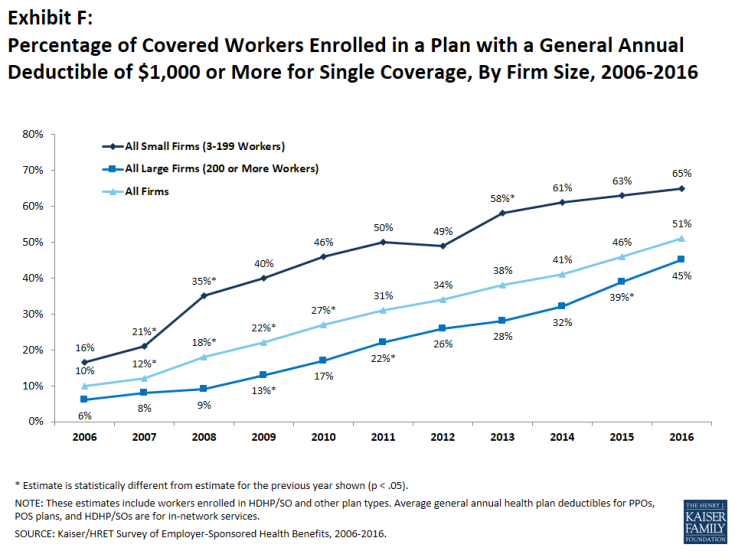

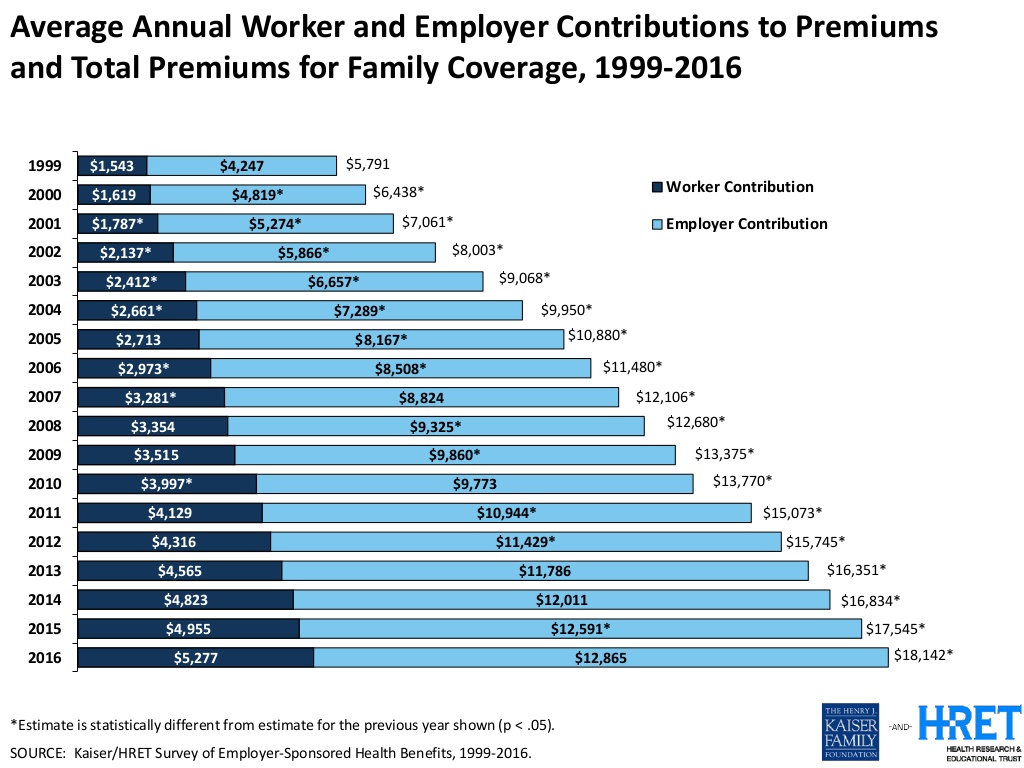

Employer Health Insurance Costs $18,142 in 2016, in KFF Study

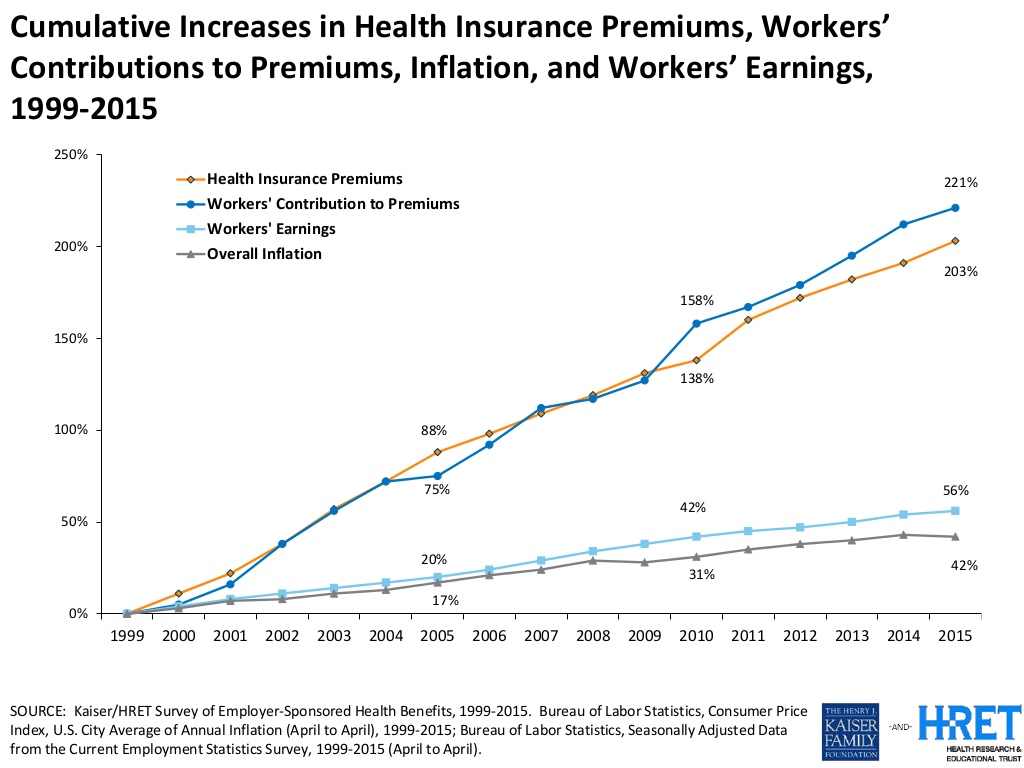

Consumers face increasing health insurance deductibles in 2016, faster-growing than earnings and well above general price inflation, featured in the Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2016. This report, updated annually, is the go-to source on the availability of, cost for, and trends in U.S. employer-based health plans. The average annual health insurance premium in 2016 reached $18,142, the survey found, about $600 more than in 2015. Over the past ten years since 2006, workers’ contributions to health insurance premiums increased 78%; employers’ contributions grew 58% over the decade. To help stem costs, employers are adopting new services to

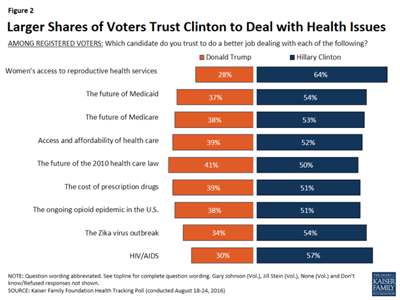

More Americans See Hillary Clinton As the 2016 Presidential Health Care Candidate

When it comes to health care, more American voters trust Hillary Clinton to deal with health issues than Donald Trump, according to the Kaiser Health Tracking Poll: August 2016 from the Kaiser Family Foundation (KFF). The poll covered the Presidential election, the Zika virus, and consumers’ views on the value of and access to personal health information via electronic health records. Today’s Health Populi post will cover the political dimensions of the August 2016 KFF poll; in tomorrow’s post, I will address the health information issues. First, let’s address the political lens of the poll. More voters trust Hillary Clinton to do

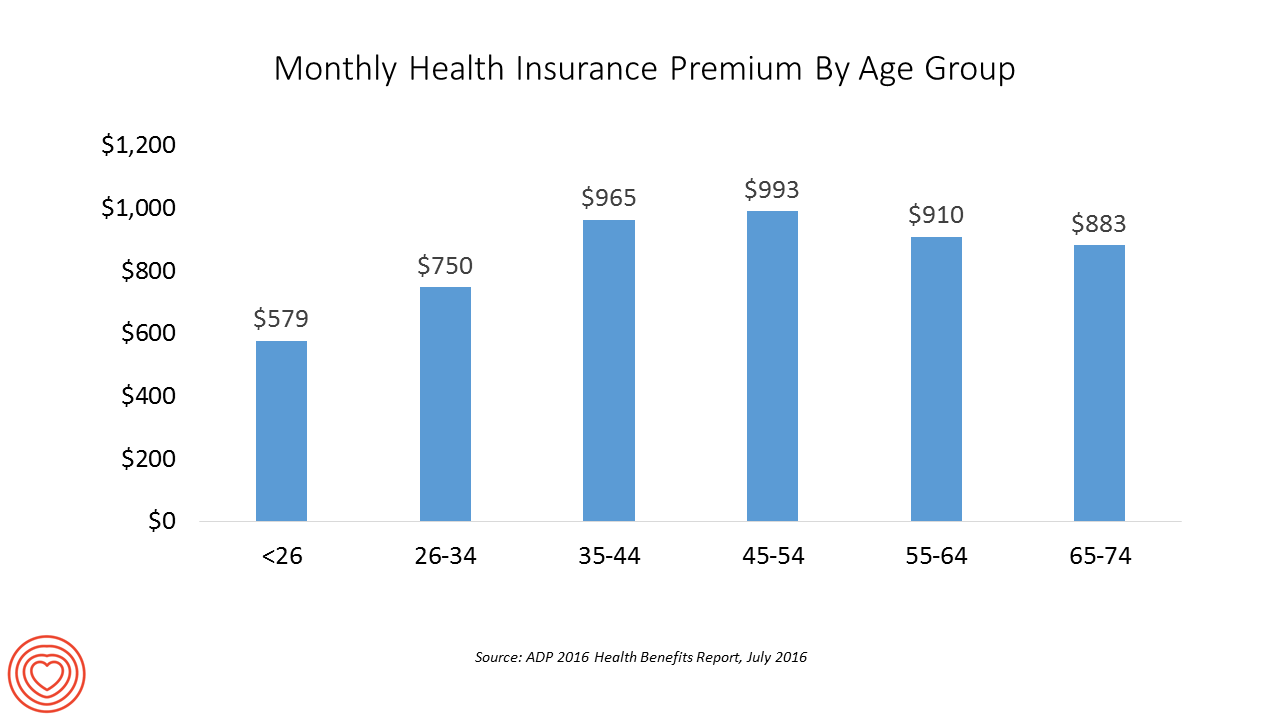

The Average Monthly Health Plan Premium in the U.S. Hit $885 in 2016

Three years after the launch of the Affordable Care Act (ACA), the big picture of employer-sponsored health benefits in the U.S. show stability, with modest changes in costs being kept in check by a growing younger workforce, according to the 2016 ADP Annual Health Benefits Report. Roughly 9 in 10 employees in large companies are eligible to participate in health insurance plans at the workplace, with two-thirds of people participating, shown in the chart. Younger people, under 26 years of age, have much lower participation rates than those over 26, with many staying on their parents’ plans (taking advantage of

Health Care Reform: President Obama Pens Progress in JAMA

“Take Governor John Kasich’s explanation for expanding Medicaid: ‘For those that live in the shadows of life, those who are the least among us, I will not accept the fact that the most vulnerable in our state should be ignored. We can help them.’” So quotes President Barack Obama in the Journal of the American Medical Association, JAMA, in today’s online issue. #POTUS penned, United States Health Care Reform: Progress to Date and Next Steps. The author is named as “Barack Obama, JD,” a nod to the President’s legal credentials. Governor Kasich, a Republican, was one of 31 Governors who

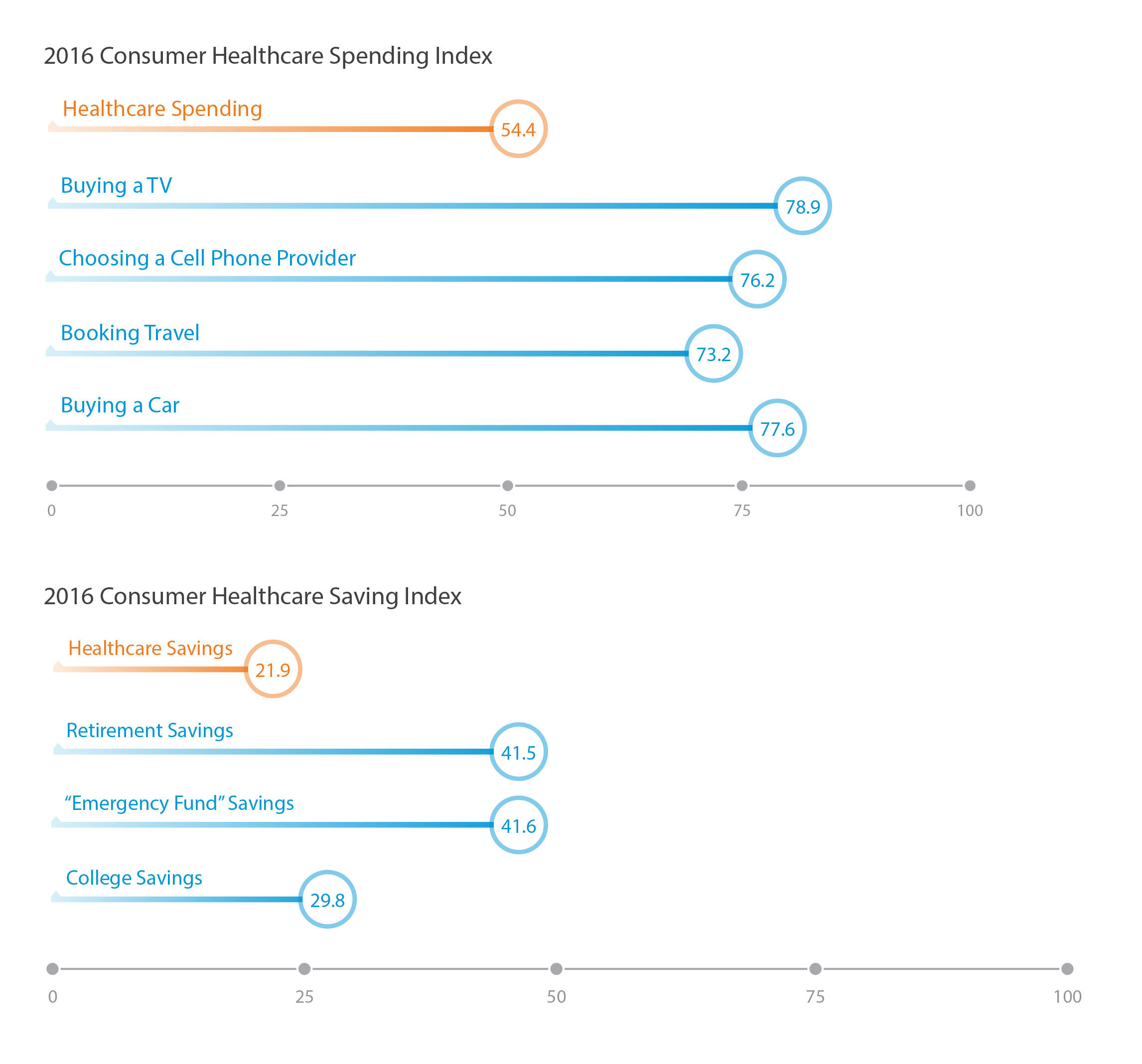

Healthcare Consumerism? Not So Fast, Alegeus Finds

Millions of U.S. patients have more financial skin in the American health care game. But are they behaving like the “consumers” they are assumed to be as members in consumer-directed health plans? Not so much, yet, explained John Park, Chief Strategy Officer at Alegeus, during a discussion of his company’s 2016 Healthcare Consumerism Index. This research is based on an online survey of over 1,000 U.S. healthcare consumers in April 2016. Alegeus looks at healthcare consumerism across two main dimensions: healthcare spending and healthcare saving. As the chart summarizes, consumers show greater engagement and focus on buying a TV or car, choosing

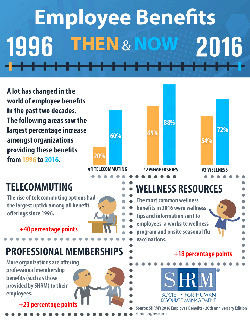

The State of Health Benefits in 2016: Reallocating the Components

Virtually all employers who offer health coverage to workers extend health benefits to all full-time employees. 94% offer health care coverage to opposite-sex spouses, and 83% to same-sex spouses. One-half off health benefits to both opposite-sex and same-sex domestic partners (unmarried). Dental insurance, prescription drug coverage, vision insurance, mail order prescription programs, and mental health coverage are also offered by a vast majority (85% and over) of employers. Welcome to the detailed profile of workplace benefits for the year, published in 2016 Employee Benefits, Looking Back at 20 Years of Employee Benefits Offerings in the U.S., from the Society for Human

PwC’s “Behind the Numbers” – Where the Patient Stands

The growth of health care costs in the U.S. is expected to be a relatively moderate 6.5% in 2017, the same percentage increase as between 2015 and 2016, according to Medical Cost Trend: Behind the Numbers 2017, an annual forecast from PwC. As the line chart illustrates, the rate of increase of health care costs has been declining since 2007, when costs were in double-digit growth mode. Since 2014, health care cost growth has hovered around the mid-six percent’s, considered “low growth” in the PwC report. What’s driving overall cost increases is price, not use of services: in fact, health care

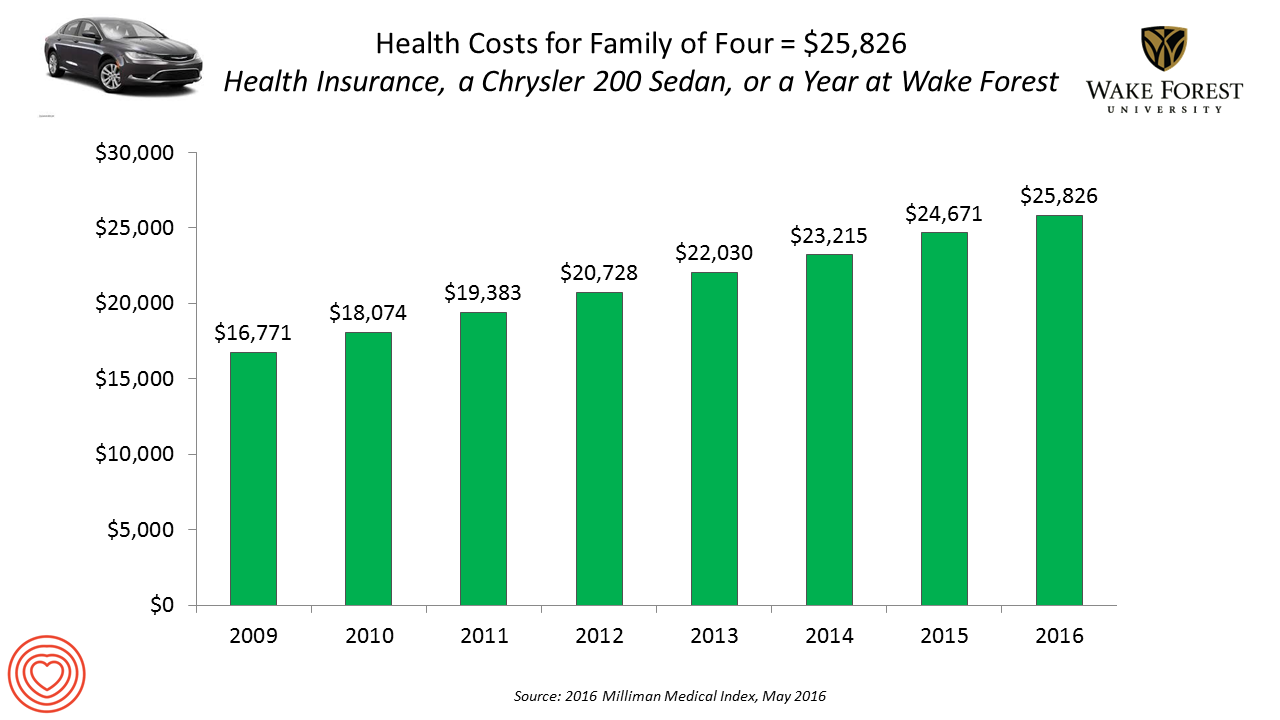

Healthcare Costs for a Family of Four Will Be $25,826 in 2016

If you had exactly $25,826 in your pocket today, would you rather buy a new Chrysler 200 sedan, send a son or daughter to a year of college at Wake Forest University, or pay for your family’s health care in an employer-sponsored preferred provider organization? Welcome to the annual 2016 Milliman Medical Index (MMI), one of the most important health economic studies I’ve relied on for many years. This year’s underlying question is, “Who cooked up this expensive recipe?” posed in the report’s title. The key statistics in this year’s MMI are that: Healthcare costs for a typical family of four

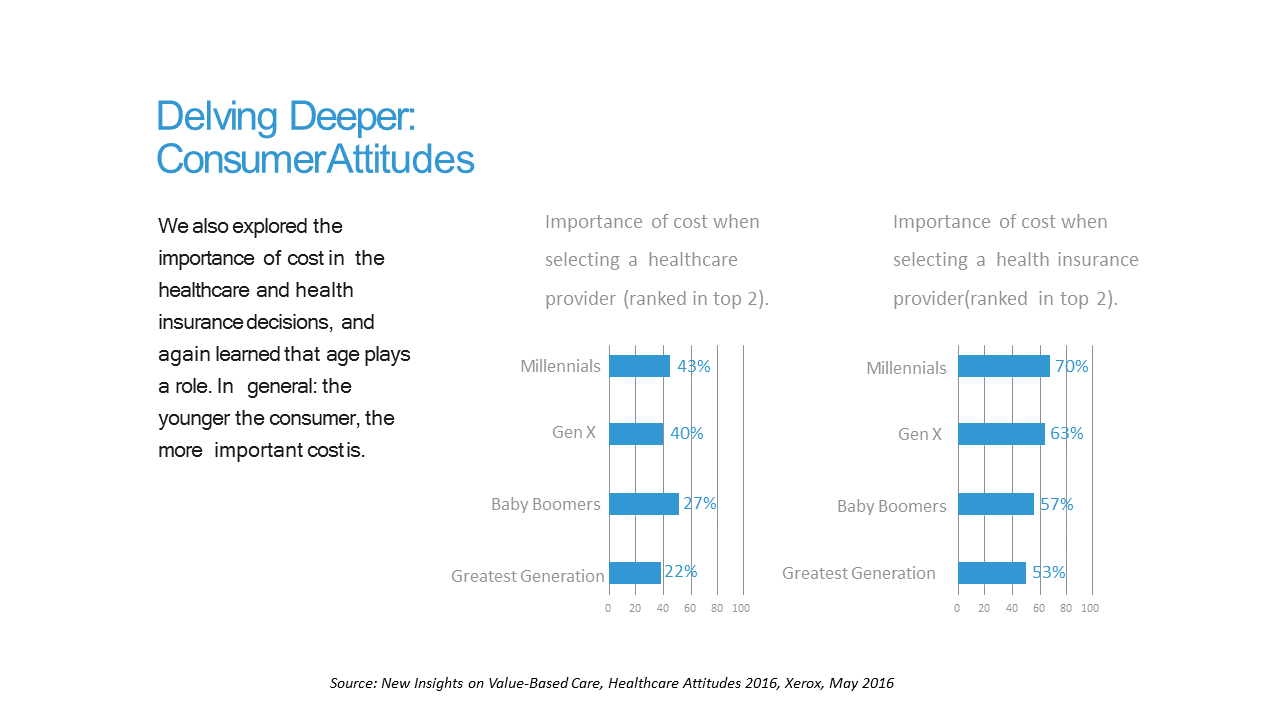

Costs and Connection At the Core of Consumers’ Health-Value Equations

Cost ranks first among the factors of selecting health insurance for most Americans across the generations. As a result, most consumers are likely to shop around for both health providers and health plans, learned through a 2016 Xerox survey detailed in New Insights on Value-Based Care, Healthcare Attitudes 2016. The younger the consumer, the more important costs are, Xerox’s poll found, shown in the first chart. Thus, “shopping around” is more pronounced among younger health consumers — although a majority people who belong to Boomer and Greatest Generation cohorts do shop around for both health providers and health insurance plans —

Generation Gaps in Health Benefit Engagement

Older workers and retirees in the U.S. are most pleased with their healthcare experiences and have the fewest problems accessing services and benefits. But, “younger workers [are] least comfortable navigating U.S. healthcare system,” which is the title of a press release summarizing results of a survey conducted among 1,536 U.S. adults by the Harris Poll for Accolade in September 2015. Results of this Accolade Consumer Healthcare Experience Index poll were published on April 12, 2016. Accolade, a healthcare concierge company serving employers, insurers and health systems, studied the experiences of people covered by health insurance to learn about the differences across age

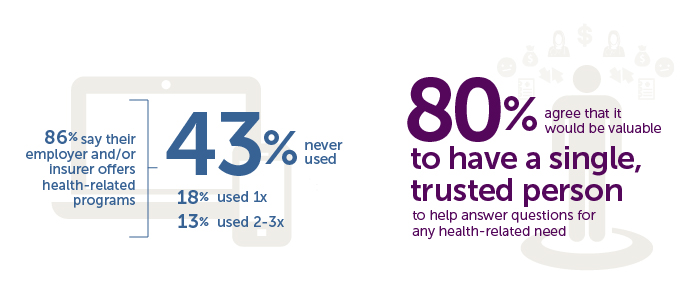

People Want Healthcare Sherpas

8 in 10 Americans would like one trusted person to help them figure out their health care, according to the Accolade Consumer Healthcare Experience Index Poll, conducted by The Harris Poll. The study gauged how Americans feel about their healthcare, especially focusing on employer-sponsored health insurance. One-third of people (32%) aren’t comfortable with navigating medical benefits and the healthcare system; a roughly percentage of people aren’t comfortable with their personal knowledge to make financial investments, either (35%). Buying a car, a home, technology and electronics? Consumers are much more comfortable shopping for these things. Consumers say that the most onerous

What Retail Financial Services Can Teach Healthcare

“Banks and insurance companies that cannot keep pace will find their customers, busy pursuing flawless service models and smart solutions, have moved on without them and they are stranded on the wrong side of the digital divide — from which there will be no return,” according to a report on The Future of Retail Financial Services from Cognizant, Marketforce, and Pegasystems. You could substitute “healthcare providers” for “banks and insurance companies,” because traditional health industry stakeholders are equally behind the consumer demand for digital convenience. This report has important insights relevant to health providers, health plans and suppliers (especially for

Behavioral Economics in Motion: UnitedHealthcare and Qualcomm

What do you get when one of the largest health insurance companies supports the development of a medical-grade activity tracker, enables data to flow through a HIPAA-compliant cloud, and nudges consumers to use the app by baking behavioral economics into the program? You get Motion from UnitedHealthcare, working with Qualcomm Life’s 2net cloud platform, a program announced today during the 2016 HIMSS conference. What’s most salient about this announcement in the context of HIMSS — a technology convention — is that these partners recognize the critical reality that for consumers and their healthcare, it’s not about the technology. It’s about

Getting Beyond Consumer Self-Rationing in High-Deductible Health Plans

The rising cost of health care for Americans continues to contribute to self-rationing care in the forms of not filling prescriptions, postponing necessary services and tests, and avoiding needed visits to doctors. Furthermore, health care costs are threatening the livelihood of most American families, according to the Pioneer Institute. “What Will U.S. Households Pay for Health Care in the Future?” asks the title of a study by the Institute, noting that health care costs for an American family of average income could increase annually to $13,213 by 2025 — and as high as $18,251. Pioneer calculates that this forecasted spend will

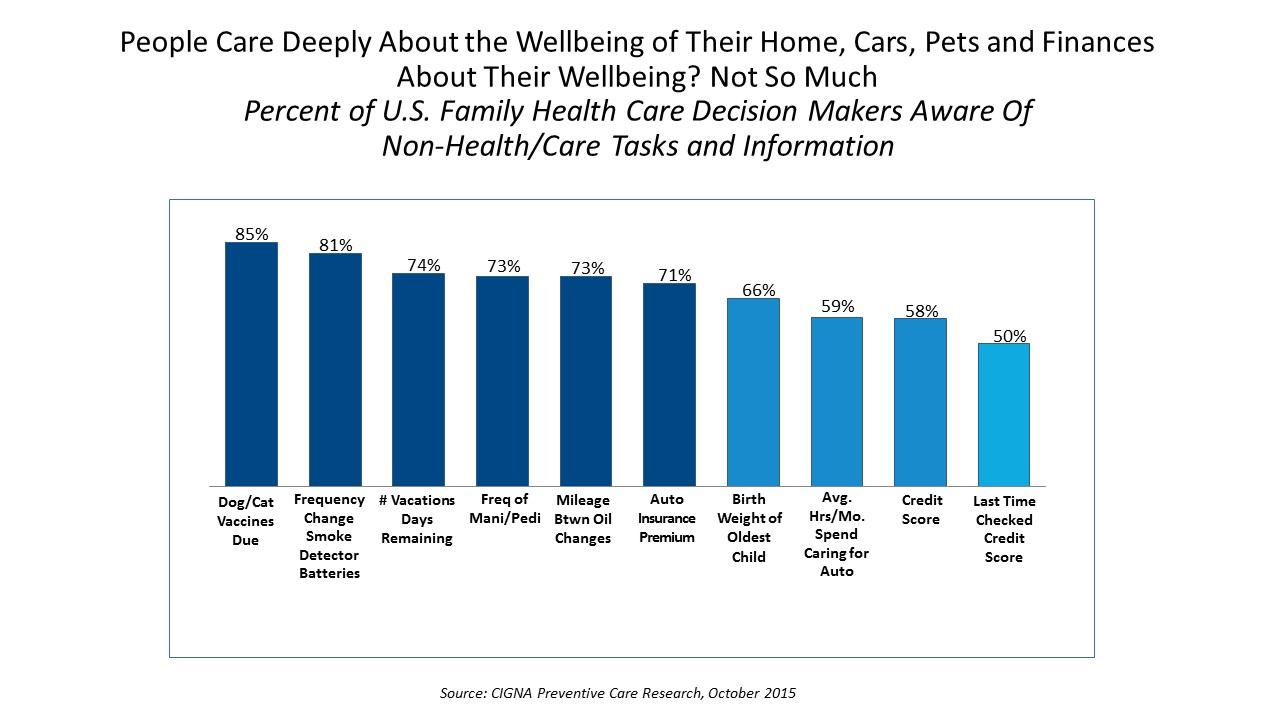

Consumers Take Better Preventive Care of Pets Than Themselves, CIGNA Finds

Nine in 10 pet owners know when their dog or cat is due for their shots. Eight in 10 women know the frequency with which they get manicures and pedicures. 80% of men know the mileage between old changes. But only 50% of family health care decision makers know their blood pressure, and only 20% know their biometric numbers like cholesterol and BMI. Americans are great at doing preventive care for their pets and automobiles; but not so much for their own bodies and health, finds the report CIGNA Preventive Care Research, a survey of 1,000 U.S. consumers between 25 and

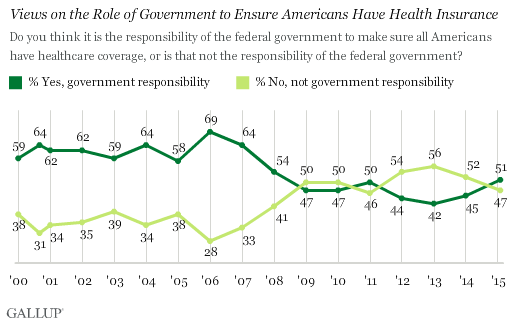

51% of Americans Say It’s Government’s Responsibility To Provide Health Insurance

For the first time since 2008, a majority of Americans say government is responsible for ensuring that people have health insurance. The first chart shows the crossing lines between those who see government-assured health insurance in the rising dark green line in 2015, and people who see it as a private sector responsibility. The demographics and sentiments underneath the 51% are important to parse out: people who approve of the Affordable Care Act are over 3x more likely to believe in government sponsoring health insurance versus those who disapprove, 80% compared with 26%. The demographic differences are also striking, detailed

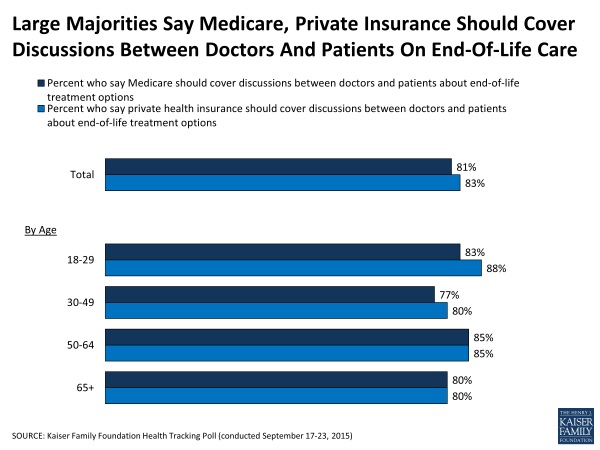

Insurance Should Pay For End-of-Life Conversation, Most Patients Say

8 in 10 people in the U.S. say that Medicare as well as private health insurance plans should pay for discussions held between patients and doctors about hatlhcare at the end-of-life. The September 2015 Kaiser Family Foundation Health Tracking Poll asks people their opinions about talking end-of-life with their doctors. The vast majority of people support the concept and physicians being paid for holding such conversations in doctor-patient relationship. The question is germane because the Obama Administration has announced plans to pay doctors for office visits to discuss end-of-life (EOL) issues with Medicare patients. There isn’t a huge variation across

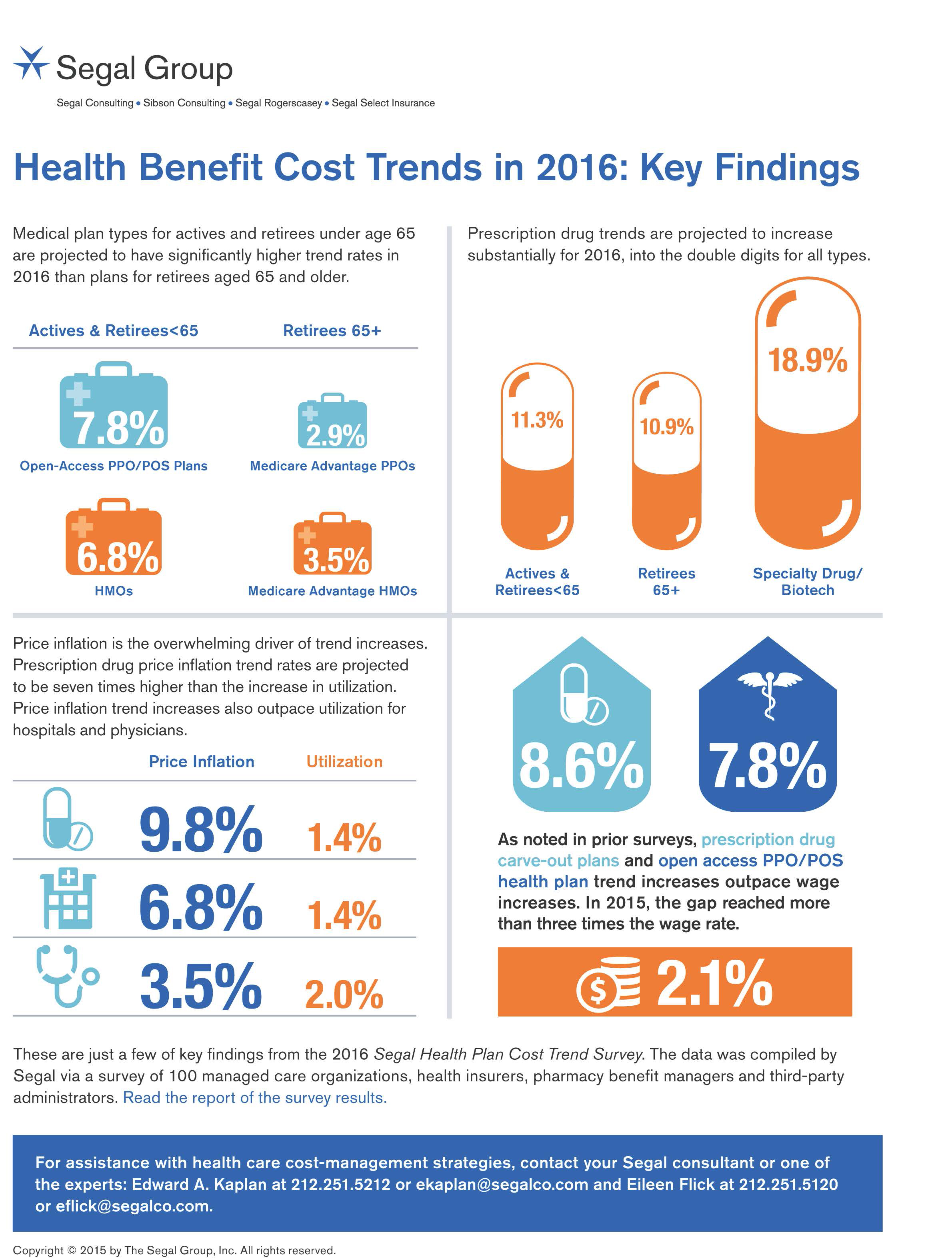

In 2016 Prescription Drugs Will Be The Fastest-Growing Component of Healthcare Costs

In 2016, prescription drug trend will rise over 11%. In contrast, medical trend growth for high-deductible health plans is expected to be 8%, hospital services 8.2%, and physician services 5.5%, according to the 2016 Segal Health Plan Cost Trend Survey released in September 2015. By definition, “trend” is the forecast of per capita health insurance claims cost increases that incorporate many factors include price inflation, utilization, government-mandated benefits, and new therapies and technologies. Consider the upper right portion of the infographic which illustrates Segal’s data: the 3 “capsule” diagrams show that specialty drug trend is anticipated to be 18.9% in

Health consumers’ cost increases far outpace wage growth

American workers are working to pay for health care costs, having traded off wage increases for health premiums, out-of-pocket costs and growing high deductibles. Welcome to the 2015 Employer Health Benefits survey conducted annually by the Kaiser Family Foundation (KFF) and Health Research & Educational Trust (HRET). Premiums are growing seven times faster than wages. The report calculates that high-deductibles for health insurance have grown 67% from 2010 to 2015. In the same period, wages grew a paltry 10%, while the Consumer Price Index rose 9%. The first chart illustrates that growing gap between relatively flat wages and spirally health

From Pedometers to Premiums in Swiss Health Insurance

A Switzerland-based health insurance company is piloting how members’ activity tracking could play a role in setting premiums. The insurer, CSS, is one of the largest health insurance companies in the country and received a “most trusted general health insurance” brand award in 2015 from Reader’s Digest in Switzerland. The company is conducting the pilot, called the MyStep project, with volunteers from the Federal Institute of Technology in Zurich and the Unviersity of St. Gallen. According to an article on the program published in the Swiss newspaper The Local, “the pilot aims to discover to what extend insured people are

A Company’s Healthy Bottom Line Requires Healthy Employees

“What is the meaning of health to our businesses?” asked Dr. Thomas Parry of the Integrated Benefits Institute (IBI) at a dinner last night, convened by the Pittsburgh Business Group on Health on the eve of the organization’s annual meeting being held today in Steel City. I was fortunate to attend the dinner and hear Dr. Parry speak; I will be addressing the meeting today on the topic, “Building a Better Health Consumer.” The IBI is researching the direct link between the top line of a healthy employee base and healthy workers’ impacts on the bottom line. A report will be

Employers pushing consumerism for health benefits in 2016

This is the dawning of the Age of Consumer-Driven Health, the tipping point of which has been passed. The data point for this assertion comes from the National Business Group on Health‘s annual 2016 Large Employers’ Health Plan Design Survey. The tagline, “reducing costs while looking to the future,” suggests some of the underlying tactics employers will use to manage their financial burden of providing health insurance to workers. That burden will continue to shift to employees and their dependents in the form of greater cost-sharing: for premiums, co-pays and co-insurance, and the hallmark of consumer-driven health plans (CDHPs): high(er) deductibles.

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

The 3 tectonic forces shaping patients – it’s BIO week

Patients in the U.S. are transforming into health care consumers, and in 2015 there are 3 underlying forces shaping that new consumer. This week kicks off the annual BIO conference in Philadelphia, and today Klick Health, the digital communications firm, convenes a group of thought leaders in healthcare to brainstorm markets, financing, and the state of pharmaceutical and life science innovation. An underlying theme throughout this meet-up is patient’s role in health/care. Patients are people, consumers, caregivers, mothers, fathers, sisters, brothers, friends, neighbors, community members, taxpayers, all. We’re old, we’re young, we’re mobile and not-so-much, we’re amputees, we’re migraneurs, we’re cancer

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

Employers go beyond physical health in 2015, adding financial and stress management

Workplace well-being programs are going beyond physical wellness, incorporating personal stress management and financial management. Nearly one-half of employers offer these programs in 2015. Another one-third will offer stress management in the next one to three years, and another one-fourth will offer financial management to workers, according to Virgin Pulse’s 2015 survey of workplace health priorities, The Busness of Healthy Employees. The survey was published June 1st 2015, kicking off Employee Wellbeing Month, which uses the Twitter hashtag #EWM15. It takes a village to bolster population health and wellness, so Virgin Pulse is collaborating with several partners in this effort

Health care costs for a family of four in the U.S. reach $24,671 in 2015

The cost of a PPO for a family of four in America hits $24,671 in 2015, growing 6.3% over 2014’s cost. The growth in health care costs will be driven by high specialty prescription drug costs. The 6.3% growth rate in health costs is a stark increase compared with the twelve month April 2014-March 2015 decline in the Consumer Price Index of -0.1%. Welcome to the 2015 Milliman Medical Index, subtitled “Will the typical American family of four be driving a ‘Cadillac plan’ by 2018?” The MMI gauges the average cost of an employer-sponsored preferred provider organization (PPO) health plan and includes all

Purchase of wearable fitness trackers expected to grow in 2015, but one-half of Americans would “never” buy one

Headphones and smartphones are the top two electronics products U.S. consumers intend to purchase in 2015. But the emerging consumer electronics categories of wearable fitness trackers, smart watches, and smarthome devices (especially “smart” thermostats) are positioned to grow, too, in 2015, according to the 17th Annual CE Ownership and Market Potential Study from the Consumer Electronics Association (CEA). Wearable trackers have an installed base of about 17 million devices in the U.S., with 11% of U.S. households intending to purchase a tracker in 2015 — 6 percentage points up from 2014 (about a 50% increase over 2014). There are about 6 million smart

Supersize Rx: the impact of specialty drug spending and Hep C in 2014

The number of people in the U.S. spending over $100,000 a year on prescription drugs tripled in 2014, according to Super Spending: U.S. Trends in High-Cost Medication Use, from The Express Scripts Lab. Express Scripts is a pharmacy benefits management company that manages over one billion prescriptions a year. The company analyzed prescription drug claims for 31.5 million health plan members for this study, in commercially insured, Medicare, and Medicaid plans. The big-dollar story in 2014 was Hepatitis C, with a relatively small patient population but a super-sized drug spend as the first chart shows: a very tall blue bar (Rx

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

Banks — a new entrant in the health/care landscape

TD Bank gifted free Fitbit activity trackers to new customers signing up for savings accounts in the 2015 New Year. John Hancock is discounting life insurance premiums for clients who track steps and take on preventive care strategies. And Banco Sabadell in Spain, along with Westpac in New Zealand and Standard Chartered in the United Kingdom are all piloting wearable technology for consumer financial management. Financial wellness is an integral part of peoples’ overall health, so financial services companies are putting their collective corporate feet into the health/care market. Banks and consumer investment companies are new entrants in health/care as

#OwnYourHealth: Health is everywhere, even underground

Living my mantra of Health is Everywhere, where we live, work, play, pray, and shop, I am always on the lookout for signs of health in my daily life. Today I’m in Washington, DC, speaking on a webinar led by the National Council on Patient Information and Education (NCPIE), discussing the findings in a survey of U.S. adults on self-care health care – my shorthand for healthcareDIY. And the hashtag for the webinar also speaks volumes: #OwnYourHealth. Here’s the link to the survey resources. On my walk from Farragut North Metro station to a nearby office where the meeting will take place,

No relief for consumers’ healthcare costs

U.S. consumers are spending $1 in every $5 dollars in the household on health care, and personal cost curves aren’t going to bend down anytime soon. Three surveys published in April confirm my financially unwell forecast for American health citizens. Kaiser Family Foundation’s April 2015 Health Tracking Poll finds most people say health care costs or going up or holding flat, shown in the first diagram from the KFF survey. U.S. adults told KFF the top health care priorities for the President and Congress should focus on health costs, such as: Making sure high-cost drugs for chronic conditions, such as HIV,

Health = love. Care = love. Healthcare? Meh

Bruce Broussard, CEO of Humana, forgot the charger for his smartwatch on a business trip. Stopping into a consumer electronics store, he was struck by the options he faced of various wearable technologies. He ended up buying a new watch, which he uses for exercise tracking. “Technology is such an important part of the direction of health care,” Broussard told the HIMSS 2015 audience in his keynote address on 14 April 2015. But Broussard was quick to point out to the thousands of technology geeks that comprise HIMSS’s membership that improving the health/care system isn’t just about technology: “we have

John Hancock flips the life insurance policy with wellness and data

When you think about life insurance, images of actuaries churning numbers to construct mortality tables may come to mind. Mortality tables show peoples’ life expectancy based on various demographic characteristics. John Hancock is flipping the idea life insurance to shift it a bit in favor of “life” itself. The company is teaming with Vitality, a long-time provider of wellness tools programs, to create insurance products that incorporate discounts for healthy living. The programs also require people to share their data with the companies to quality for the discounts, which the project’s press release says could amount to $25,000 over the

Workers at work for the health benefits but absent when it comes to talking costs

As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015. Based on a national sample of over 2,000 employees surveyed in October 2014 about workplace benefits. The research re-confirms the long-term reality of workers working in America for the health benefit. Benz/Quantum note that 89% of workers say health benefits play a part in remaining on-the-job, and half say the health benefit is a “major” part of remaining

The Affordable Care Act As New-Business Creator

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC. As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA: Supporting telehealth platforms between patients and providers, such as Vivre Health Educating consumers, such as the transparency provider HealthSparq does Streamlining operations to enhance efficiency, the business of Cureate among others

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Humana and Weight Watchers Partner in Weight Loss for Employers

More employers are recognizing the link between workers who may be overweight or obese on one hand, and health care costs, employee engagement and productivity on the other. As a result, some companies are adopting wellness programs that focus on weight loss as part of an overall culture of health at the workplace. Humana and Weight Watchers are the latest example of two health brands coming together to address what is one of the toughest behavior changes known to humans: losing weight. Humana will extend access to Weight Watchers for the health plan’s enrollees in an integrated wellness program. The program

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

Thinking about health disparities on Martin Luther King Day 2015

On this day celebrating Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would give two months later in Washington, DC. As I meditate on MLK, I think about health equity. By now, most rational Americans know the score on the nation’s collective health status compared to other developed countries: suffice it to say, We’re Still Not #1. But underneath that statistic is a further sad state of health affairs: that people of color in the U.S. have lower quality of

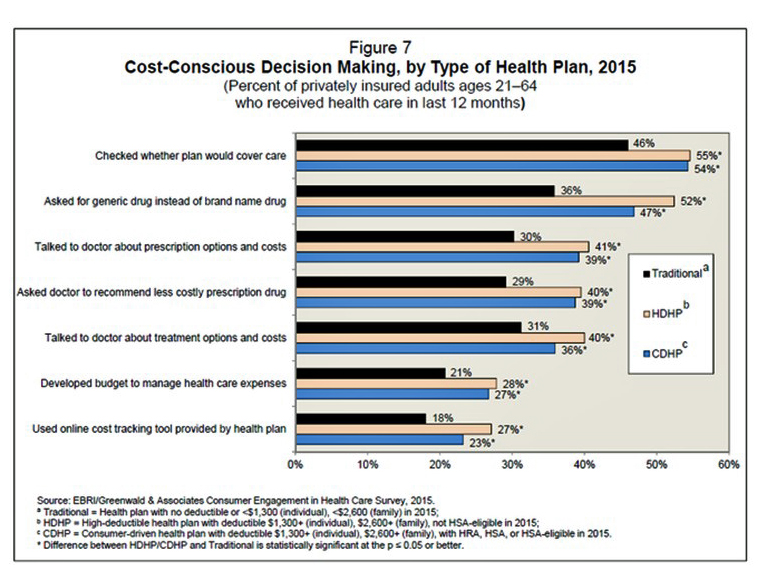

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Self-care is the new black in health care

Consumers’ growing health care cost burden is competing with other household spending: basic costs for Americans are eroding what’s left of the traditionally-defined Middle Class. At the front end of health costs is the health insurance premium, the largest single line item for a family. It looks like a big number because it is: Milliman gauged the cost for an employer to cover a family of four in a PPO in the U.S. at around $23K, with the employee bearing an increasing percent of the premium, copays, coinsurance, and a larger deductible this year than last, on average. There are

Health insurance companies rank low on consumer experience

The corporate reputation, brand equity, of the health insurance continues to be low relative to other financial service industry benchmarks, found in the ACSI Finance and Insurance Report 2014. Customer satisfaction with health insurance companies fell between 2013 and 2014, especially attributed to higher costs hitting consumers in group (employer-based) policies. The 2014 American Customer Satisfaction Index (ACSI) is informed by interviews with 6,819 consumers interviewed via phone and email between July and September 2014. Customers of financial services companies (banks, credit unions, health insurance, life insurance, property & casualty, and internet brokerages) were asked to provide their opinions about named-firms

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Power to the health care consumer – but how much and when?

Oliver Wyman’s Health & Life Sciences group names its latest treatise on the new-new health care The Patient-to-Consumer Revolution, subtitled: “how high tech, transparent marketplaces, and consumer power are transforming U.S. healthcare.” The report kicks off with the technology supply side of “Health Market 2.0,” noting that “the user experience of health care is falling behind” other industry segments — pointing to Uber for transport, Amazon for shopping, and Open Table for reserving a table. The authors estimate that investments in digital health and healthcare rose “easily ten times faster” than the industry has seen in the past. Companies like

PwC on wearables – the health opportunity is huge, but who will pay?

“A wearable future is around the corner,” PwC says. So it’s appropriate the consulting firm’s new report is indeed titled The Wearable Future. Wearable technologies — smartwatches, sensor-laden workout gear, activity tracking wristbands, and Google Glass, among them — are more than individual tracking and information devices. They’re part of a larger ecosystem called The Internet of Things (IoT), which is made of lots of stuff, each ‘thing’ incorporating a sensor that measures something. Those measurements can track virtually everything that someone does throughout the day: beyond the obvious steps taken, hours slept, and GPS coordinates, sensors can sense movement

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

From comprehensive coverage to skin-in-the-game healthcare: Kaiser Family Foundation’s annual survey

For employer-sponsored health care, trends continue for health premium costs to increase, high-deductible health plans to gain adoption, and cost-sharing to shift to workers in companies’ health plans. This is the top-line of the just-released Kaiser Family Foundation (KFF) 2014 Employer Health Benefits Survey, the annual go-to resource on company-sponsored health care trends and realities. As the Kaiser Family Foundation team said during their teleconference to health writers this morning, employer-sponsored health care in America is moving “from comprehensive coverage to skin-in-the-game coverage.” The extent of said skin-in-the-game varies from small to large firms: in small companies (defined in this

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Over-the-counter drugs – an asset in the collaborative, DIY health economy

Nations throughout the world are challenged by the cost of health care: from Brazil to China, India to the Philippines, and especially in the U.S., people are morphing into health care consumers. Three categories of health spending in the bulls-eye of countries’ Departments of Health are prescription drugs, and the costs of care in hospitals and doctors’ offices. In the U.S., one tactic for cost containment in health is “switching” certain prescription drugs to over-the-counter products – those deemed to be efficacious and safe for patients to take without seeking treatment from a doctor. Over-the-counter drugs (OTCs) are available every

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

In pursuit of healthiness – Lancet talks US public health

It’s Independence Day week in America, and our British friends at The Lancet, the UK’s grand peer reviewed medical journal, dedicate this week’s issue to the Health of Americans – exploring life, death (mortality), health costs, chronic disease, and the Pursuit of Healthiness. This project is a joint venture between The Lancet and the U.S. Centers for Disease Control (CDC) which took 18 months to foster, called The Health of Americans Series. Americans mostly die from chronic diseases, aka non-communicable diseases, which are largely amenable to lifestyle changes like eating right, quitting smoking, drinking alcohol in moderation, and moving around more. 1 in

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a