Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Power to the health care consumer – but how much and when?

Oliver Wyman’s Health & Life Sciences group names its latest treatise on the new-new health care The Patient-to-Consumer Revolution, subtitled: “how high tech, transparent marketplaces, and consumer power are transforming U.S. healthcare.” The report kicks off with the technology supply side of “Health Market 2.0,” noting that “the user experience of health care is falling behind” other industry segments — pointing to Uber for transport, Amazon for shopping, and Open Table for reserving a table. The authors estimate that investments in digital health and healthcare rose “easily ten times faster” than the industry has seen in the past. Companies like

PwC on wearables – the health opportunity is huge, but who will pay?

“A wearable future is around the corner,” PwC says. So it’s appropriate the consulting firm’s new report is indeed titled The Wearable Future. Wearable technologies — smartwatches, sensor-laden workout gear, activity tracking wristbands, and Google Glass, among them — are more than individual tracking and information devices. They’re part of a larger ecosystem called The Internet of Things (IoT), which is made of lots of stuff, each ‘thing’ incorporating a sensor that measures something. Those measurements can track virtually everything that someone does throughout the day: beyond the obvious steps taken, hours slept, and GPS coordinates, sensors can sense movement

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

From comprehensive coverage to skin-in-the-game healthcare: Kaiser Family Foundation’s annual survey

For employer-sponsored health care, trends continue for health premium costs to increase, high-deductible health plans to gain adoption, and cost-sharing to shift to workers in companies’ health plans. This is the top-line of the just-released Kaiser Family Foundation (KFF) 2014 Employer Health Benefits Survey, the annual go-to resource on company-sponsored health care trends and realities. As the Kaiser Family Foundation team said during their teleconference to health writers this morning, employer-sponsored health care in America is moving “from comprehensive coverage to skin-in-the-game coverage.” The extent of said skin-in-the-game varies from small to large firms: in small companies (defined in this

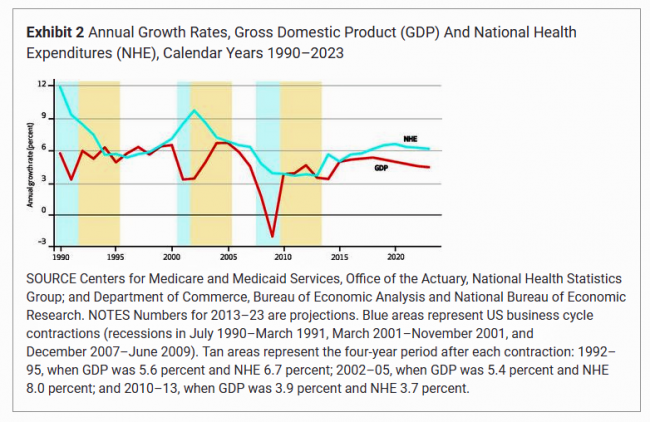

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Over-the-counter drugs – an asset in the collaborative, DIY health economy

Nations throughout the world are challenged by the cost of health care: from Brazil to China, India to the Philippines, and especially in the U.S., people are morphing into health care consumers. Three categories of health spending in the bulls-eye of countries’ Departments of Health are prescription drugs, and the costs of care in hospitals and doctors’ offices. In the U.S., one tactic for cost containment in health is “switching” certain prescription drugs to over-the-counter products – those deemed to be efficacious and safe for patients to take without seeking treatment from a doctor. Over-the-counter drugs (OTCs) are available every

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

In pursuit of healthiness – Lancet talks US public health

It’s Independence Day week in America, and our British friends at The Lancet, the UK’s grand peer reviewed medical journal, dedicate this week’s issue to the Health of Americans – exploring life, death (mortality), health costs, chronic disease, and the Pursuit of Healthiness. This project is a joint venture between The Lancet and the U.S. Centers for Disease Control (CDC) which took 18 months to foster, called The Health of Americans Series. Americans mostly die from chronic diseases, aka non-communicable diseases, which are largely amenable to lifestyle changes like eating right, quitting smoking, drinking alcohol in moderation, and moving around more. 1 in

Dialing Dr. Verizon – the telecomms company launches virtual house calls

Expanding its wireless footprint in health care, Verizon, the telecommunications company, announced the start of Verizon Virtual Visits today. The program will be marketed to employers and health plans to enable patients to see doctors at home or when traveling, via Verizon’s wireless network. I spoke with Christine Izui, Verizon’s quality officer, mobile health solution, earlier this week about Virtual Visits. We discussed the market forces that support the growth of telehealth and, in particular, physician visits “anywhere:” There is an under-supply and poor distribution of primary care doctors and certain specialties around the U.S. Employers and health plan sponsors are

Online is to go-to place for health insurance info, but lots of uninsured people live offline

A vast majority of people shopping for a health plan on a Health Insurance Exchange for coverage in 2014 obtained information online via websites. One-half of these shoppers used only online information, and 29% combined both websites and other sources like direct assistance, informal assistance, and via (offline) media. In the Health Reform Monitoring Survey from the Urban Institute Health Policy Center, a research team, funded by the Robert Wood Johnson Foundation and the Ford Foundation, looked into data collected from the Health Reform Monitoring Survey in March 2014 at the end of the 2014 open enrollment period for the

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Chaos, then Creation, Part 5

The consumer demand side for healthcare transparency is hungry for the light to shine on health care costs, quality and information that’s relevant and meaningful to the individual. The supply side is fast-growing, with websites and portals, government-sponsored projects, commercial-driven start-ups, and numerous mobile apps. These tools endeavor to: Help people find and access services Schedule appointments Compare peer consumers’ reviews for those providers Calculate and prepare for out-of-pocket co-payments deriving from their health plan Negotiate prices with providers Pay for the services, and Reconcile the payment with a high-deductible health plan or health savings account. On the demand side, consumers

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Will Your Health Plan Be Your Transparency Partner? – Part 3

Three U.S. health plans cover about 100 million people. Today, those three market-dominant health plans — Aetna, Humana and UnitedHealthcare — announced that they will post health care prices on a website in early 2015. Could this be the tipping point for health care transparency so long overdue? These 3 plans are ranked #1, #4 and #5 in terms of market shares in U.S. health insurance. Together, they will share price data with the Health Care Cost Institute (HCCI), a not-for-profit organization dedicated to research on U.S. health spending. An important part of the backstory is that the HCCI was

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

Health costs in retirement: the standard of living

On their list of top financial worries, 1 in 2 Americans is most concerned about not having enough money for retirement, not being able to pay medical costs if they get sick, and not being able to maintain a desired standard of living. Gallup’s annual Economy and Personal Finance poll, conducted in early April 2014, finds that even in the wake of a healthier economy, people feel health-finance insecure. While ability to pay medical bills ranked #2 on the list of 9 fiscal worries, the proportion of Americans with this concern fell from a high of 62% in 2012 to

Wearable tech + the workplace: driving employee health

Employer wellness programs are growing in the U.S., bundled with consumer-directed plans and health savings accounts. A wellness company’s work with employee groups is demonstrating that workers who adopt mobile health technologies — especially “wearables” coupled with smartphone apps — helps change behavior and drive health outcomes. Results of one such program are summarized in Wearables at Work, a technical brief from Vitality, a joint venture of Humana and Discovery Ltd., published April 23, 2014. Vitality has been working in workplace wellness since 2005, first using pedometers to track workers’ workouts. In 2008, Vitality adopted the Polar heart rate monitor for

Consumers’ spending on medicine grows – the retailization of health care

People are spending more out of their own pockets on health care, and particularly for medications. There are two sides to the medicine-spending coin: there’s the low-end which are generic drugs, most of which carry a co-pay of $10 or less. Then there’s the high end of specialty pharmaceuticals, a fast-growing category of very expensive products for which many consumers dearly pay — if and when they choose to take their doctors’ recommendations. In Medicine use and shifting costs of healthcare, IMS Institute for Healthcare Informatics reports that while (inexpensive) generic drugs comprise 86% of prescriptions in the U.S., it’s high

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

Risk-shift: employers continue to push more risk to employees and families for health costs

With health costs increase increasing at 4.4% in 2014, a slightly higher rate of growth than the 4.1% seen in 2013. While this is lower than the double-digit increases U.S. employers faced in 2001-2004, it’s still twice the rate of general consumer price inflation. That’s what the first graph shows, based on the The 19th Annual Towers Watson/National Business Group on Health Employer Survey on Purchasing Value in Health Care. Employers generally want to continue to provide health insurance…for the time being. 92% of companies expect to make changes in health plan provisions in 2014, with 1 in 2 anticipating “significant

Hillary Clinton wows the HIMSS14 crowd

At last year’s annual HIMSS conference, I had the pleasure of experiencing Bill Clinton’s keynote speech in New Orleans, which I wrote about here. As a long-time member of HIMSS, this was a great moment in my many years attending HIMSS conferences. Another special moment in HIMSS conference history happened today, as, I had the honor of attending Hillary Clinton’s keynote speech at HIMSS 2014 in Orlando today. I am blessed with fast-typing fingers thanks to my mother’s genes, and took constant notes during Hillary’s talk. My favorite paragraphs are quoted below, indicating “Applause” pauses where Hillary was lauded.

The new retail health: Bertolini of Aetna connects dots between the economy and health consumers

3 in 4 people in America will buy health care at retail with a subsidy within just a few years, according to Mark Bertolini, CEO of Aetna. Bertolini was the first keynote speaker this week at the 2014 HIMSS conference convened in Orlando. Bertolini’s message was grounded in health economics 101 (about which frequent readers of Health Populi are accustomed to hearing). A healthy community drives a healthy local economy, and healthier people are more economically satisfied, Bertolini explained. The message: health care can move from being a cost driver to being an economic engine. But getting to a healthy

Where’s TripAdvisor for health care? JAMA on physician ratings sites

As more U.S. health citizens enroll in high-deductible health plans – now representing about 30% of health-insured people in America – health plan members are being called on to play the role of consumer. Among the most important choices the health consumer makes is for a physician. Ratings sites and health care report cards ranking doctors by various characteristics have been in the market for over a decade. However, little has been known on the public’s knowledge about the availability of these information sources, nor of peoples’ use of physician rating sites. This question is addressed in Public Awareness, Perception, and

A CT for $300 or $2,781 – why health price transparency matters

Charges for medical, pharmacy and dental services can vary by more than 300%. This means that in one place, a procedure that costs $100 can cost $300 for the same treatment in another location or practice, discovered by Change Healthcare in their latest Healthcare Transparency Index 2013 Q3 Report, published in January 2014. The 300% is the average overall across dozens of health services used by the 67,000 plan members Change Healthcare analyzed based on health plan enrollees’ health care utilization in the third quarter of 2013. These health care services include office visits (behavioral health, physical therapy and

What, We Worry? Thinking About Healthcare (Costs) Is Stressing Us Out

Three-quarters of us are concerned about health care, a fraction fewer than those of us worried about the economy. Underneath stress about healthcare, people are worried about costs and the impact of the Affordable Care Act (ACA). Say hello to the Healthcare Worry Scale, developed by Chase Communications, a firm focused on marketing and media, largely in the health industry. Chase found that: – 93% believe that their health care costs will continue to increase – 49% say the ACA’s impact is a “major” worry – 43% say getting a disease, medical condition, or injury that health insurance doesn’t fully

Do People Really Want To Tech Their Health? in Huffington Post

This post appeared in my Huffington Post column on January 16, 2013. In the afterglow of the 2014 Consumer Electronics Show (CES), away from the neon lights of Las Vegas, 4D curved TV screens, and uber-hip Google Glass wearers, a big question remains: Do we, the people, really want to tech our way to self-health? The number of digital health companies exhibiting at CES grew by 40 percent, exceeding 300 based on the count of the International Consumer Electronics Association, sponsor of the event. The hockey-stick growth of “wearable technology” seen at the 2014 Consumer Electronics Show begs the question: Are there

mHealth will join the health ecosystem – prelude to the 2014 Consumer Electronics Show

The rise of digital health at the 2014 Consumer Electronics Show signals the hockey-stick growth of consumer-facing health devices for fitness and, increasingly, more medical applications in the hands of people, patients, and caregivers. This year at #CES2014, while the 40% growth of the CES digital health footprint will get the headlines, the underlying story will go beyond wristbands and step-tracking generating data from an N of 1 to tools that generate data to bolster shared-decision making between people and the health system, and eventually support population health. For example: – Aetna is partnering with J&J to deploy their Care4Today

3 Things I Know About Health Care in 2014

We who are charged with forecasting the future of health and health care live in a world of scenario planning, placing bets on certainties (what we know we know), uncertainties (what we know we don’t know), and wild cards — those phenomena that, if they happen in the real world, blow our forecasts to smithereens, forcing a tabula rasa for a new-and-improved forecast. There are many more uncertainties than certainties challenging the tea leaves for the new year, including the changing role of health insurance companies and how they will respond to the Affordable Care Act implementation and changing mandates

Supermarkets and hospitals most-trusted industries in the U.S.

See the yellow highlighted rows? That single yellow bar at the top, that’s hospitals; at the bottom, you’ll see pharma, health insurance, and managed care. Hospitals, trusted; pharma, insurance, managed care? Down south on the trust barometer with oil, tobacco, phone companies and social media. The Harris Poll has gauged U.S. consumers’ views on honesty and trustworthiness across industries for the past ten years. Over those ten years, trust in these industries has eroded, from huge falls-from-grace for banks (a 17 point fall), packaged food (falling 12 points), and computer hardware and software substantially falling, as well. Hospitals are

A certain forecast: health consumers will be more cost-squeezed in 2014 for Rx and insurance

Gird your wallets, U.S. consumers: watch the dollars flow out-of-pocket for prescription drugs in 2014, as predicted by the 2013-2014 Prescription Drug Benefit Cost and Plan Design Report published by the Pharmacy Benefit Management Institute (PBMI) this week. Constraints covering most plan members are: Step therapy Prior authorization (to get approvals to fill high-cost drugs, notably growth hormones, injectables, controlled substances, Retin-A, and medications for sleep disorders, and Compulsory 90 day refills at retail (90-day dispensing for chronic meds). This Report, sponsored by Takeda, is the gold standard of drug benefit trends, having been published since 1995. Average 30-day copayments

Employers will strongly focus on costs in health benefit plans for 2014; so must consumers

Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system. Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers. Key findings are that: Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees They will expand other tactics they believe will help address cost

Bundles in health care are the prix fixe menu

Ordering up and financing health care in the U.S. looks like the proverbial Chinese food menu, picking and paying for “one from column A, and one from column C.” But that’s no way to operate a well-oiled machine for delivering quality health care, according to Healthcare Shifts from á la Carte to Prix Fixe from Strategy&, an analysis of the fragmented, high-cost and only fair quality American health system. One solution to this challenge is bundled payment. “No one has an overarching view of the entire process,” the report opines, “with an eye toward improving customer service, quality, or costs.” Further exacerbating the sub-optimal

Make health care “feel” more like retail via transparency

Consumers who are well-covered by health insurance are in favor of talking about costs with their doctors. This research finding illustrates the fact that price transparency in health care isn’t just the concern of un- and under-insured people, but that shining the light on the price of health care is everybody’s business. But it’s also the case that most physicians aren’t yet involved in these health-financial conversations with their patients. Two studies presented at the recent 2013 annual meeting of the American Society of Clinical Oncology (ASCO) learned that patients are keen to know more about health care costs from

Health care and costs on front-burner for people in America (again)

This week in America, the concept of “health care consumer” is in a tug-of-war, and those of us trying to behave as such feel bloodied in the skirmish. One side of the tug-of-war is the obvious, post October 1st reality of the sad state of the Health Insurance Exchanges. This has been well covered in mass media, right, left and center. And Americans polled by Gallup last week express their knowledge of that fact — even if they didn’t know what Healthcare.gov was on the 1st of October. The first chart shows that health care is now a front-burner issue

Moneytalk: why doctors and patients should talk about health finances

Money and health are two things most people don’t like to talk about. But if people and their doctors spoke more about health and finance, outcomes (both fiscal and physical) could improve. In late October 2013, Best Practices for Communicating with Patients on Financial Matters were published by the Healthcare Financial Management Association (HFMA). Michael Leavitt, former head of the Department of Health and Human Services, led the year-long development effort on behalf of HFMA, with input from patient advocates, the American Hospital Association, America’s Health Insurance Plans, the American Academy of Family Physicians and the National Patient Advocate Foundation, along

America’s health care is better due to Todd Park – detractors, be careful what you wish for

In the aftermath of the snafu that was/is the failed launch of the Affordable Care Act’s Health Insurance Exchange comes, today via Reuters, an article called Obama’s tech expert becomes target over healthcare website woes. The piece, by Roberta Rampton and Sarah McBride, states that Todd Park, Chief Technology Officer at The White House, “now finds himself among a handful of officials with targets on their backs as Republicans try to root out who is responsible for this month’s glitch-ridden rollout of Healthcare.gov,” going on to say that “The White House trotted him out in July to talk up the new version”

Innovating and thriving in value-based health – collaboration required

In health care, when money is tight, labor inputs like nurses and doctors stretched, and patients wanting to be treated like beloved Amazon consumers, what do you do? Why, innovate and thrive. This audacious Holy Grail was the topic for a panel II moderated today at the Connected Health Symposium, sponsored by Partners Heathcare, the Boston health system that includes Harvard’s hospitals and other blue chip health providers around the region. My panelists were 3 health ecosystem players who were not your typical discussants at this sort of meeting: none wore bow ties, and all were very entrepreneurial: Jeremy Delinsky

Consumers trust and welcome health and insurance providers to go DTC with communications

Consumers embrace ongoing dialog with the companies they do business with, Varolii Corporation toplines in a survey report, What Do Customers Want? A Growing Appetite for Customer Communications. Across all vertical industries consumers trust for this dialogue, health care organizations – specifically doctors, pharmacists, and insurance companies – are the most trusted. Examples of “welcome-comms” would be reminders about upcoming appointments or vaccinations (among 69% of people), notices to reorder or pick up a prescription (57%), and messages encouraging scheduling an appointment (39%). In banking, notices about fraudulent activity on one’s account is the most welcomed message beating out appointment

Whither price transparency in health care? The supply side may be growing faster than consumer demand

Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers). Healthsparq partnered with one of the company’s health insurance company clients to conduct this study, which demonstrated that, over two years, consumers who used an online treatment cost estimator saved money on care for hernia conditions, digestive conditions, and women’s health issues. It’s early days for health care price transparency in health care, but HealthSparq’s findings demonstrate positive evidence that when consumers are offered a tool

U.S. Health Citizens Needed a Dummies Guide to the ACA

The Affordable Care Act (ACA) was signed in March 2010; that month, 57% of U.S. adults did something to self-ration health care, such as splitting prescription pills, postponing necessary health care, and putting off recommended medical tests, according to the Kaiser Family Foundation (KFF) Health Tracking Poll of March 2010. 57% of U.S. adults are still self-rationing health care in September 2013, according to KFF’s latest Health Tracking Poll, completed among 1,503 U.S. adults just two weeks before the launch of the Health Insurance Marketplaces on October 1, 2013. As of September 2013, only 19% of U.S. adults said they had heard

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

Health care and survey taking at the Big Box Store

Where can you shop the health and beauty aisles, pick up some groceries and a prescription, get a flu vaccine, and weigh in on Obamacare and what digital health tools you like? Why, at one of several thousand retail stores where you can find a SoloHealth kiosk. As of yesterday afternoon, over 32 million encounters were recorded on SoloHealth kiosks, based on an app I saw on the company CEO Bart Foster’s smartphone. Kiosks are locatted around the United States in retailers including Walmart and Sam’s Clubs, along with major grocery chains like Schnuck’s and Publix, and the CVS pharmacy

The slow economy is driving slower health spending; but what will employers do?

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America. From biggest line item on down, health spending will go to payments to: Hospitals, representing about 32% of all spending Physicians and clinical costs, 20% of spending Prescription drugs, 9% of spending Nursing, continuing care, and home health care, together accounting for over 8% of health spending (added together for purposes of this analysis) Among other categories like personal care, durable medical equipment, and the cost of health insurance.

Food and the household health budget: one pocket, shrinking access

Over 1 in 5 people in the U.S. have not had enough money to buy food for themselves or their families in the past year, according to the August 2013 Gallup Healthways Index. This is as many consumers as those who couldn’t afford food during the deepest months of the last recession. Lack of access to food is a challenge for a cadre of Americans who lack access to other basic needs such as shelter and health care. Gallup’s Basic Access Index looks at this market basket, and has found that Americans’ access to basic needs at 81.4 in August

Consumers don’t get as much satisfaction with high-deductible health plans

Since the advent of the so-called consumer-directed health care era in the mid-2000s, there’s been a love-gap between health plan members of traditional plans, living in Health Plan World 1.0, and people enrolled in newer consumer-driven plans – high-deductible health plans (HDHPs) and consumer-directed health plans (CDHPs). That gap in plan satisfaction continues, according to the Employee Benefits Research Institute (EBRI)’s poll of Americans’ consumer engagement in health care. The survey was conducted with the Commonwealth Fund. As the bar chart illustrates, some 62% of members in traditional plans were satisfied (very or extremely) with their health insurance in 2012.

People with doctors interested in EMRs, but where’s the easy button?

1 in two people who are insured and have a regular doctor are interested in trying out an electronic medical record. But they need a doctor or nurse to suggest this, and they need it to be easy to use. The EMR Impact survey was conducted by Aeffect and 88 Brand Partners to assess 1,000 U.S. online consumers’ views on electronic medical records (EMRs): specifically, how do insured American adults (age 25 to 55 who have seen their regular physician in the past 3 years) view accessing their personal health information via EMRs? Among this population segment, 1 in 4 people (24%)

Criticizing health reform has jumped the shark for mainstream Americans

You might see potato and I might see po-tah-to when looking at the Affordable Care Act – health reform — but it’s clear we don’t want to call the whole thing off. (Go to 1:44 seconds in this video to get my drift, thanks to the Gershwin’s). I’m talking about the latest August 2013 Kaiser Health Tracking Poll from Kaiser Family Foundation finds a health citizenry suffering ennui or a form of split personality about health reform: while many Americans don’t believe the Affordable Care Act (ACA) will help them, most don’t want Congress to de-fund it, either. Several graphs from

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Chief Health Officers, Women, Are In Pain

Women are the Chief Health Officers of their families and in their communities. But stress is on the rise for women. Taking an inventory on several health risks for American women in 2013 paints a picture of pain: of overdosing, caregiver burnout, health disparities, financial stress, and over-drinking. Overdosing on opioids. Opioids are strong drugs prescribed for pain management such as hydrocodone, morphine, and oxycodone. The number of opioid prescriptions grew in the U.S. by over 300% between 1999 and 2010. Deaths from prescription painkiller overdoses among women have increased more than 400% since 1999, compared to 265% among men.

Working for health care in 2013: workers’ health insurance cost burden still grows faster than wages

Insurance premium costs grew 4% for families between 2012 and 2013, with workers now bearing 39% of health premiums in 2013 compared with only 26% ten years ago, in 2003. That’s a 50% increase in health plan premium “burden” for working families, by my calculation. This snapshot of health insurance in 2013 comes to us from the 2013 Employer Health Benefits Survey, provided by the Kaiser Family Foundation (KFF) and the Health Research & Educational Trust (HRET). This research is one of the most important annual reports to hit the health care industry every year, and this year’s analysis provides strategic context

Americans’ health insurance illiteracy epidemic – simpler is better

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week. The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions. Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade. See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do.

The health care automat – Help Yourself to healthcare via online marketplaces

Imagine walking into a storefront where you can shop for an arthroscopy procedure, mammogram, or appointment with a primary care doctor based on price, availability, quality, and other consumers’ opinions? Welcome to the “health care automat,” the online healthcare marketplace. This is a separate concept from the new Health Insurance Marketplace, or Exchange. This emerging way to shop for and access health care services is explored in my latest paper for the California HealthCare Foundation (CHCF), Help Yourself: The Rise of Online Healthcare Marketplaces. What’s driving this new wrinkle in retail health care are: U.S. health citizens morphing into consumers,

10 Reasons Why ObamaCare is Good for US

When Secretary Sebelius calls, I listen. It’s a sort of “Help Wanted” ad from the Secretary of Health and Human Services Kathleen Sebelius that prompted me to write this post. The Secretary called for female bloggers to talk about the benefits of The Affordable Care Act last week when she spoke in Chicago at the BlogHer conference. Secretary Sebelius’s request was discussed in this story from the Associated Press published July 25, 2013. “I bet you more people could tell you the name of the new prince of England than could tell you that the health market opens October 1st,” the

In the US health care cost game, doctors have seen the enemy – and it’s not them

When it comes to who’s most responsible for reducing the cost of health care in America, most doctors put the onus on trial lawyers, health insurance companies, pharma and medical device manufacturers, hospitals, and even patients. But physicians themselves ? Not so much responsibility – only 36% of doctors polled said doctors should assume major responsibility in reducing health care costs. And, in particular, most U.S. physicians have no enthusiasm for reducing health care costs by changing payment models, like penalizing providers for hospital re-admissions or paying a group of doctors a fixed, bundled price for managing population health. Limiting

Healthways buys into Dr. Ornish’s approach: will “Ornish-inside” scale wellness in America?

People who live in U.S. cities with low levels of well-being have twice the rate of heart attacks as people who live in healthier America. That’s 5.5% of the population in sicker America versus 2.8% of the population living in healthy America. The first chart illustrates this disparity, taken from the Gallup-Healthways index that examined 190 metropolitan areas in 2012. Based on this study, it’s good to live in parts of Utah, Nebraska and Colorado, but not so healthy to be a resident in West Virginia, Alabama, and parts of Kentucky and Ohio. Heart disease and diabetes are killing a plurality

Urgent care centers: if we build them, will all patients come?

Urgent care centers are growing across the United States in response to emergency rooms that are standing-room-only for many patients trying to access them. But can urgent care centers play a cost-effective, high quality part in stemming health care costs and inappropriate use of ERs for primary care. That’s a question asked and answered by The Surge in Urgent Care Centers: Emergency Department Alternative or Costly Convenience? from the Center for Studying Health System Change by Tracy Yee et. al. The Research Brief defines urgent care centers (UCCs) as sites that provide care on a walk-in basis, typically during regular

What to expect from health care between now and 2018

Employers who provide health insurance are getting much more aggressive in 2013 and beyond in terms of increasing employees’ responsibilities for staying well and taking our meds, shopping for services based on cost and value, and paying doctors based on their success with patients’ health outcomes and quality of care. Furthermore, nearly one-half expect that technologies like telemedicine, mobile health apps, and health kiosks in the back of grocery stores and pharmacies are expected to change the way people regularly receive health care. What’s behind this? Increasing health care costs, to be sure, explains the 18th annual survey from the National

The promise of ObamaCare isn’t comforting Americans worrying about money and health in 2013

In June 2013, even though news about the economy and jobs is more positive and ObamaCare’s promise of health insurance for the uninsured will soon kick in, most Americans are concerned about (1) money and (2) the costs of health care. The Kaiser Health Tracking poll of June 2013 paints an America worried about personal finances and health, and pretty clueless about health reform – in particular, the advent of health insurance exchanges. Among the 25% of people who have seen media coverage about the Affordable Care Act (alternatively referred to broadly as “health reform” or specifically as “ObamaCare”), 3

They call it “primary” care because it comes first — and it should

It’s called “primary” care for a reason: it’s first and foremost important in the health care services a person can use. In its report, Primary care: our first line of defense, The Commonwealth Fund explains why primary care is crucial to one’s individual health, and how primary care is morphing into medical teams and patient-centered medical homes. And that’s a good thing for you and me, the Fund says. That’s because people in the U.S. who have a primary care doctor have 33% lower health costs and 19% lower risk of dying than people who see only a specialist (Source:

Health consumers, meet the medical bank

Health consumers, meet a new player in your health care world: the bank. Financial services companies will play a growing role in U.S. health care as patients morph into health care consumers responsible for making more money-based decisions about their health care. This shift could make paying for health care just like paying other bills in the consumer retail market. And that’s a new role for health providers – doctors and hospitals – to fill. The Impact of Growing Patient Financial Responsibility on Healthcare Providers, prepared for Citi Enterprise Payments by Boundary Information Group, discusses what the impact of consumers’ payments in

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

The part-time medical home: retail health clinics

The number of retail health clinics will double between 2012 and 2015, according to a research brief from Accenture, Retail medical clinics: From Foe to Friend? published in June 2013. What are the driving market forces promoting the growth of retail clinics? Accenture points to a few key factors: Hospitals’ need to rationalize use of their emergency departments, which are often over-crowded and incorrectly utilized in cases of less-than-acute care. In addition, hospitals are now financially motivated under the Affordable Care Act (ACA, health reform) to reduce readmissions of patients into beds (particularly Medicare patients with acute myocardial infarction [heart attacks],

Consumer-directed health isn’t always so healthy

Giving health consumers more skin in the game doesn’t always lead to them making sound health decisions. Over four years in consumer-directed health plans, enrollees used one-quarter fewer visits to doctors every year and filled one fewer prescription drugs. CDHP members also received fewer recommended cancer screenings, and visited the emergency room more often. These rational health consumer theory-busting findings were published in the June 2013 issue of the Health Affairs article, Consumer-Directed Health Plans Reduce The Long-Term Use of Outpatient Physician Visits And Prescription Drugs by Paul Fronstin of the Employee Benefit Research Institute and colleagues from IBM and RxEconomics,

The importance of being banked for getting health insurance

While having money in the bank is always a prescription for feeling well, having a bank account is a precursor to getting health insurance under the Affordable Care Act. That fact could prevent millions of people who are eligible for health insurance premium subsidies under health reform from enrolling in a health plan. The issue of banking the un-banked in health is a little talked-about detail that, if overlooked, will scuttle the best-laid plans for health reform. That’s because if people enroll in health insurance, their monthly premiums will need to be debited from a bank account. So, without a

The health and wellness gap between insured and uninsured people

If you have health insurance, chances are you take several actions to bolster your health such as take vitamins and supplements (which 2 in 3 American adults do), take medications as prescribed (done by 58% of insured people), and tried to improve your eating habits in the past two years (56%). Most people with insurance also say they exercise at least 3 times a week. Fewer people who are uninsured undertake these kinds of health behaviors: across-the-board, uninsured people tend toward healthy behaviors less than those with insurance. This is The Prevention Problem, gleaned from a survey conducted by TeleVox

Health care costs for a family of 4 in 2013: a college education, a diamond or a 4-door sedan

If you have $22,030 in your wallet, you can buy: A princess-cut diamond A Ford Focus 4-door A year’s tuition at James Madison University (in-state, 2013-14) A health plan for a family of four. The 2013 Milliman Medical Index gauges the annual health care costs for a typical American family at $22,030, up $1,302 from 2012 — a 6.3% increase, nearly 6x the all-items increase of 1.1% for the U.S. Consumer Price Index from April 2012-April 2013. That 1.1% includes the costs of food and energy, along with cars, tobacco, shelter, and other consumer goods. In 2013, the average family will

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Americans feeling more financially insecure

One in three workers does not feel financially secure. The proportion of Americans who feel “not at all secure” grew to 16% from 12% between 2011 and 2012, based on the question, “When it comes to paying your bills and keeping up with living expenses, how financially secure do you feel these days?” Women are much more likely than men to feel financially insecure, representing a 33% growth rate in financial insecurity. These sobering financial statistics come to us from the UNUM study, 2012 Employee Education and Enrollment Survey: Employee Perspectives on Financial Security, published May 8, 2013. Based on the question asked – paying

Un-directed Americans in a consumer-directed healthcare world

U.S. employers have been implementing various flavors of consumer-directed health plans for the better part of a decade. But consumers feel neither “directed” nor especially competent in managing their way through these plans. It appears that employers also have their own sort of health plan illiteracy when it comes to understanding health reform — the Affordable Care Act — according to the 2013 Aflac WorkForces Report (AWR) based on a survey of 1,900 benefits managers and over 5,200 U.S. workers conducted in January 2013. While you might know the Aflac Duck, you may not be aware that Aflac is the

The Slow Economy Has Slowed Health Spending

Why has health cost growth in the U.S. slowed in the past few years? It’s mostly due to the economy, argues the Kaiser Family Foundation in Assessing the Effects of the Economy on the Recent Slowdown of Health Spending. The answer to this question is important because, as the American economy recovers, it begs the next question: will costs increase faster once again as they did in previous go-go U.S. economies, further exacerbating the budget deficit problems in the long-term? KFF worked with Altarum to develop an economic model to answer these questions. The chart illustrates the predicted vs. actual

Bending the cost-curve: a proposal from some Old School bipartisans

Strange political bedfellows have come together to draft a formula for dealing with spiraling health care costs in the U.S. iin A Bipartisan Rx for Patient-Centered Care and System-Wide Cost Containment from the Bipartisan Policy Center (BPC). The BPC was founded by Senate Majority Leaders Howard Baker, Tom Daschle, Bob Dole, and George Mitchell. This report also involved Bill Frist, Pete Domenici, and former White House and Congressional Budget Office Director Dr. Alice Rivlin who together work with the Health Care Cost Containment Initiative at the BPC. The essence of the 132-page report is that the U.S. health system is

US Health Executives Predict the ACA Will Increase Health Insurance Premiums

As a result of implementing the Affordable Care Act (health reform), most U.S. health executives crystal balls foresee health care insurance premiums will increase over 10% in the next three years. 4 in 10 predict premiums will grow over 25% over the next 3 years. This sobering forecast comes out of a Munich RE Health survey conducted among 326 health industry executives in March 2013. Those polled included representatives from health plans, managed care, disease management firms, and health insurance brokers and agents. How do health execs expect employers would deal with such fast-rising health premium costs? Why shift more

The need for a Zagat and TripAdvisor in health care

Patient satisfaction survey scores have begun to directly impact Medicare payment for health providers. Health plan members are morphing into health consumers spending “real money” in high-deductible health plans. Newly-diagnosed patients with chronic conditions look online for information to sort out whether a generic drug is equivalent to a branded Rx that costs five-times the out-of-pocket cost of the cheaper substitute. While health care report cards have been around for many years, consumers’ need to get their arms around relevant and accessible information on quality and value is driving a new market for a Yelp, Travelocity, or Zagat in

The value of big data in health care = $450 billion

Exploiting Big Data in industry is Big News these days, and nowhere is the potential for leveraging the concept greater than in health care. McKinsey & Company estimates that harnessing big data across five dimensions of health care could yield nearly one-half trillion dollars’ worth of value in The ‘big data’ revolution in healthcare. The chart summarizes McKinsey’s calculations on the value of Big Data in health care at its maximum. Before digging into the value potential, just what is Big Data in health care? Statistics and information are generated in the health care system about patients: say, during visits

U.S. Health Costs vs. The World: Is It Still The Prices, and Are We Still Stupid?

Comparing health care prices in the U.S. with those in other developed countries is an exercise in sticker shock. The cost of a hospital day in the U.S. was, on average, $4,287 in 2012. It was $853 in France, a nation often lauded for its excellent health system and patient outcomes but with a health system that’s financially strapped. A routine office visit to a doctor cost an average of $95 in the U.S. in 2012. The same visit was priced at $30 in Canada and $30 in France, as well. A hip replacement cost $40,364 on average in the

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Most consumers will look to health insurance exchanges to buy individual plans in 2013

As the Affordable Care Act, health reform, aka Obamacare, rolls out in 2013, American health insurance shoppers will look for sources of information they can trust on health plan quality and customer service satisfaction — as they do for automobiles, mobile phone plans, and washing machines. For many years, one of a handful of trusted sources for such insights has been J.D. Power and Associates. J.D. Power released its 2013 Member Health Plan Study (the seventh annual survey) and found that most consumers currently enrolled in a health plan have had a choice of only “one” at the time

Arianna and Lupe and Deepak and Sanjay – will the cool factor drive mobile health adoption?

Digital health is attracting the likes of Bill Clinton, Lupe Fiasco, Deepak Chopra, Dr. Sanjay Gupta, Arianna Huffington, and numerous famous athletes who rep a growing array of activity trackers, wearable sensors, and mobile health apps. Will this diverse cadre of popular celebs drive consumer adoption of mobile health? Can a “cool factor” motivate people to try out mobile health tools that, over time, help people sustain healthy behaviors? Mobile and digital health is a fast-growing, good-news segment in the U.S. macroeconomy. The industry attracted more venture capital in 2012 than other health sectors, based on Rock Health’s analysis of the year-in-review. Digital health

The lights are still out on health prices for Americans – #healthcost transparency limits consumerism in health

Only two U.S. states have comprehensive health care price transparency regulations that ensure citizens’ access to clear and open health price information. While those two states, Massachusetts and New Hampshire, earn an “A” in the Report Card on State Price Transparency Laws, an addition five state earn a “B,” with the remainder of the United States garnering a “C” or less. The map illustrates that most states are red states, earning the lowest score of “F.” With the growth of high-deductible health plans (under the umbrella of so-called “consumer-directed” plans) where health consumers pay thousands of dollars to meet a spending

Bill Clinton’s public health, cost-bending message thrills health IT folks at HIMSS

In 2010, the folks who supported health care reform were massacred by the polls, Bill Clinton told a rapt audience of thousands at HIMSS13 yesterday. In 2012, the folks who were against health care reform were similarly rejected. President Clinton gave the keynote speech at the annual HIMSS conference on March 6, 2013, and by the spillover, standing-room-only crowd in the largest hall at the New Orleans Convention Center, Clinton was a rock star. Proof: with still nearly an hour to go before his 1 pm speech, the auditorium was already full with only a few seats left in the

A health economics lesson from Jonathan Bush, at the helm of athenahealth

At HIMSS13 there are the equivalent of rock stars. Some of these are health system CIOs and health IT gurus who are driving significant and positive changes in their organizations, like Blackford Middleton, Keith Boone, Brian Ahier, and John Halamka. Others are C-level execs at health IT companies. In this latter group, many avoid the paparazzi (read: health trade reporters) and stay cocooned behind closed doors in two-story pieces of posh real estate on the exhibition floor. A few walk the floor, shake hands with folks, and take in the vibe of the event. We’ll call them open-source personalities. The

Required reading: TIME Magazine’s Bitter Pill Cover Story

Today’s Health Populi is devoted to Steven Brill and his colleagues at TIME magazine whose special report, Bitter Pill: Why Medical Bills Are Killing Us, is required reading for every health citizen in the United States. Among many lightbulb moments for readers, key findings from the piece are: Local hospitals are beloved charities to people who live in their market – Brill calls these institutions “Non-Profit Profitmakers). They’re the single most politically powerful player in most Congressional districts The poor and less affluent more often pay the high chargemaster (“retail list”) price for health products and services vs. the wealthy

Health consumers don’t understand overtreatment, and their role in driving health costs

Overuse of health care is defined as the delivery of health care services for which the risks outweigh the benefits, according to a study into the utilization of ambulatory care health services published in the January 28, 2013, issue of JAMA Internal Medicine (the new title for the Archives of Internal Medicine). “Trends in the Overuse of Ambulatory Health Care Services in the United States” found that, of the estimated $700 billion that is wasted annually in U.S. health care, overuse comprises about $280 billion – over one-third of waste — equal to over 10% of total health spending in

Wealthy Americans’ top financial concern is affording health care in retirement

The wealthiest Americans’ top financial concern is being able to afford healthcare and support they’ll need in old age. The #2 financial concern among wealthy investors is worrying about the financial situation of their children and grandchildren, closely followed by a major family health problem occurring and someone to care for them in their old age. These health-financial worries come out of a survey among 2,056 U.S. investors age 25 and over who have at least $250,000 in investable assets conducted by UBS in January 2013. UBS found that staying health and fit is investors’ top objective, with 73% of wealthy

Health cost transparency on the W-2: sticker shock at the point-of-paystub

If you receive health insurance benefits from your employer, you’ll see a new line item on your W-2, courtesy of the Internal Revenue Service: the cost of employer-sponsored group health plan coverage. This new piece of data, shown in Box 12, DD information, comes as part of health reform, The Affordable Care Act, which requires employers with over 250 workers to show how much they spend on employer-sponsored health benefits in total. This is the employer’s premium cost, and does not include the covered worker’s out-of-pocket spending (e.g., copays, coinsurance and deductibles). It is being furnished on W-2’s “for informational

Health care cost illiteracy: consumers feel the pinch of growing costs, but don’t understand the “why?”

Health care costs for workers lucky enough to receive health insurance at work nearly doubled since 2002. Wages in that decade grew by 33%. This growing affordability gap between health costs vs. wages is shown in the chart. Health consumers in America sharply perceive this gap, according to an analysis of eight focus groups, Consumer Attitudes on Health Care Costs: Insights from Focus Groups in Four U.S. Cities from the Robert Wood Johnson Foundation. To health-covered workers, though, health care “costs” are defined as out-of-pocket health spending for insurance premiums, co-payments and deductibles that come out of paychecks and pocketbooks — not

Aetna and Costco – the broker is ‘us’

Costco and Aetna announced that the Big Box retailer would expand its marketing of Aetna health insurance policies to card-carrying members in California. Costco has already been selling health insurance through stores in Arizona, Connecticut, Georgia, Illinois, Michigan, Nevada, Pennsylvania, Texas and Virginia. Later in 2013, Aetna plans will be available in Costco stores in other state markets. BTW, Costco operates stores in 42 U.S. states (as well as Canada, the UK, Taiwan, Korea, Japan, Australia, and Mexico). All together, the company serves 37 million households. The Costco Personal Health Insurance Program offers five plans, a network of health providers, and

Health reform, costs and the growing role of consumers: PwC’s tea leaves for 2013

PwC has seen the future of health care for the next year, and the crystal ball expects to see the following: Affordable Care Act implementation, with states playing lead roles The role of dual eligibles Employer’s role in health care benefits Consumers’ role in coverage Consumers’ ratings impact on health care Transforming health delivery Population health management Bring your own device Pharma’s changing value proposition The medical device industry & tax impact. In their report, Top health industry issues of 2013: picking up the pace on health reform, PwC summarizes these expectations as a “future [that] includes full implementation of

New Year’s Resolutions for health, and the 2013 Consumer Electronics Show

When it comes to taking on personal responsibility, the #1 New Year’s Resolution is to engage in fitness and exercise, cited by 43% of U.S. adults, followed by healthy eating, noted by 37% of people. Other resolutions involving personal responsibility are Family (26%) Spirituality and faith (22%) Managing personal finances (22%. This survey was undertaken as part of Liberty Mutual’s The Responsibility Project (RP), which is taglined: “Explore what it means to do the right thing.” Launched in 2008, Liberty Mutual’s RP has been diving into the many aspects of daily living for which we, each of us, could take responsibility…including

Cost-conscious health consumers are adopting personal health IT

People enrolled in consumer-directed health plans (CDHPs) and high-deductible health plans (HDHPs) are more cost-conscious than those enrolled in more traditional plans, according to Findings from the 2012 EBRI/MGA Consumer Engagement in Health Care Survey from the Employee Benefit Research Institute (EBRI), published in December 2012. The logic behind CDHPs and HDHPs is that if health plan enrollees have more “skin in the game” — that is, personal financial exposure — they’ll behave more like health “consumers.” By 2012, 36% of employers with over 500 employees offered either HRA- or HSA-eligible plans. About 15% of working age adults are enrolled

People want more control over health care in the midst of rising costs: a tale of two surveys

Two surveys of American consumers point to their growing concern over (1) rising costs and (2) wanting control over their care. More than 1 in 3 U.S. adults put off health care due to costs in the past year, a Gallup poll found. As shown in the graph, this is the highest proportion of people forgoing care due to cost since Gallup began asking the question in 2012. This survey was conducted in November 2012. There are differences between people without insurance and those with commercial or public sector plans such as Medicare and Medicaid. Over one-half of uninsured people

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast