Employees will bear more health costs to 2017 – certainty in an uncertain future

Amidst uncertainties and wild cards about health care’s future in the U.S., there’s one certainty forecasters and marketers should incorporate into their scenarios: consumers will bear more costs and more responsibility for decision making. The 2012 Deloitte Survey of U.S. Employers finds them, mostly, planning to subsidize health benefits for workers over the next few years, while placing greater financial and clinical burdens on the insured and moving more quickly toward high-deductible health plans and consumer-directed plans. In addition, wellness, prevention and targeted population health programs will be adopted by most employers staying in the health care game, shown in

Converging for health care: how collaborating is breaking down silos to achieve the Triple Aim

On Tuesday, 9 July 2012, health industry stakeholders are convening in Philadelphia for the first CONVERGE conference, seeking to ignite conversation across siloed organizations to solve seemingly intractable problems in health care, together. Why “converge?” Because suppliers, providers, payers, health plans, and consumers have been fragmented for far too long based on arcane incentives that cause the U.S. health system to be stuck in a Rube Goldbergian knot of inefficiency, ineffectiveness and fragmentation of access….not to mention cost increases leading us to devote nearly one-fifth of national GDP on health care at a cost of nearly $3 trillion…and going up.

Why we now need primary care, everywhere

With the stunning Supreme Court 5-4 majority decision to uphold the Patient Protection and Affordable Care Act (ACA), there’s a Roberts’ Rules of (Health Reform) Order that calls for liberating primary care beyond the doctors’ office. That’s because a strategic underpinning of the ACA is akin to President Herbert Hoover’s proverbial “chicken in every pot:” for President Obama, the pronouncement is something like, “a medical home for every American.” But insurance for all doesn’t equate to access: because 32-some million U.S. health citizens buy into health insurance plans doesn’t guarantee every one of them access to a doctor. There’s a

The selling of a health plan, part two

Calling Don Draper, Donny Deutsch, and the spirit of David Ogilvy: the President needs you. The President must sell the Affordable Care Act to the American people now that Justice Roberts wrote the Supreme Court’s historic 5-4 majority opinion supporting the Act, and especially the individual mandate. He argued for the majority that while the mandate is unconstitutional under the Commerce Clause which would “command people to buy insurance,” he said that the mandate is a de facto tax, as people who would choose to opt out of insurance would have an alternative of paying an IRS fine. Senator Eric

The gender gap in U.S. health economics

50% more women than men are worried about health care affordability and access in the U.S., revealed in a new Kaiser Opinion Poll, the Health Security Watch, based on interviews from May 2012. Overall, about the same proportion of men and women had problems paying medical bills in the past year — 26% vs. 27%, respectively. However, when it comes to self-rationing health care — delaying or skipping treatment due to cost — gender gap shows, with 52% of men and 64% of women delaying or skipping health care. Underneath these numbers are even greater gaps between men and women.

The Age of Value in Health Care

The idea of value-based purchasing in health care has been around since the 1990s, when 3 researchers named Meyer, Rybowski and Eichler wrote, “The concept of value-based health care purchasing is that buyers should hold providers of health care accountable for both cost and quality of care. Value-based purchasing brings together information on the quality of health care, including patient outcomes and health status, with data on the dollar outlays going towards health. It focuses on managing the use of the health care system to reduce inappropriate care and to identify and reward the best-performing providers. This strategy can be

Health costs will increase in 2013, and employees will bear more: can wellness programs help stem the rise?

Health spending will increase by 7.5% in 2013, with employees’ contributions rising for in-network deductibles, prescription drugs and emergency room visits. 3 in 4 employers, seeking to control rising health expenses, will offer wellness programs, even though a vast majority can’t yet measure an ROI on them. The Health and Well-Being: Touchstone Survey Results from PriceWaterhouseCoopers (PwC). PwC points out that the 7.5% medical cost increase is historically lower than in recent years, as a result of structural changes in the health care market including: A sluggish economy Growing focus on cost containment Lower utilization of health services by patients Employers’ efforts

Sick of health care costs in America

9 in 10 Americans who know the health system — those with a serious illness, medical condition, injury or disability — believe that health care costs are a serious problem for the nation. This problem has gotten worse over the last 5 years, according to 70% of sick Americans. The Sick in America Poll, from National Public Radio, Robert Wood Johnson Foundation, and the Harvard School of Public Health, was released May 2012. The survey presents a picture of the 27% of Americans who use the health system and, as a result of their illness or disability, encounter financial challenges. When

Consumer trust in health care: online information trumps health plans

Trust is a precursor to health engagement. Trust impacts health outcomes such as a patient’s willingness to follow a doctor’s or health plan’s instructions. Two new studies point out that U.S. consumers don’t trust every touchpoint in the health system. Online medical information has become a trusted channel. Health plans? Not so much. Wolters Kluwer’s Health Q1 Poll on Self-Diagnosis found that consumers trust online health information to inform themselves — even for self-diagnosis. 57% of U.S. adults turn to the Internet to find answers to medical information; 25% “never” do, and 18% rarely do. Two-thirds of people say they trust

The pharmaceutical landscape for 2012 and beyond: balancing cost with care, and incentives for health behaviors

Transparency, data-based pharmacy decisions, incentivizing patient behavior, and outcomes-based payments will reshape the environment for marketing pharmaceutical drugs in and beyond 2012. Two reports published this week, from Express Scripts–Medco and PwC, explain these forces, which will severely challenge Pharma’s mood of market ennui. Express-Scripts Medco’s report on 9 Leading Trends in Rx Plan Management presents findings from a survey of 318 pharmacy benefit decision makers in public and private sector organizations. About one-half of the respondents represented smaller organizations with fewer than 5,000 employees; about 20% represented jumbo companies with over 25,000 workers. The survey was conducted in the

A health plan or a car: health insurance for a family of four exceeds $20K in 2012

The saying goes, “you pays your money and you makes your choice.” In 2012, if you have a bolus of $20,700 to spend, you can choose between a health plan for a family of four, or a sedan for the same family. That’s the calculation from the actuaries at Milliman, whose annual Milliman Medical Index is the go-to analysis on health care costs for a family of four covered by a preferred provider organization plan (PPO). While the 6.9% annual average cost increase is lower than the 7.3% in 2011, it is nonetheless, a record $1,335 real dollar increase at

Improving health care through Big Data: a meeting of the minds at SAS

Some 500 data analytics gurus representing the health care ecosystem including hospitals, physician practices, life science companies, academia and consulting came together on the lush campus of SAS in Cary, North Carolina, this week to discuss how Big Data could solve health care’s Triple Aim, as coined by keynote speaker Dr. Donald Berwick: improve the care experience, improve health outcomes, and reduce costs. Before Dr. Berwick, appointed as President Obama’s first head of the Centers for Medicare & Medicaid Services, Clayton Christensen of the Harvard Business School, godfather of the theory of disruptive innovation in business, spokee about his journey

Employers who offer more flexibility yield healthier workforces

The most flexible workplaces are good for worker’s health: they yield the most engaged workforces, greater job satisfaction, increased commitment to the firm, better mental health and lower indicators of depression. But not all firms are all that flexible, which is the top line of the Family and Work Institute‘s 2012 National Study of Employers (NSE), funded by The Alfred P. Sloan Foundation. What makes this survey different from others polling employers is that the NSE looks at the comprehensive array of total benefits offered to employees and their changing needs in terms of family, finance, and social lives. In the past seven years,

The decline and potential renaissance of employer-sponsored health benefits: EBRI and MetLife reports tell the story

Two reports this week suggest countervailing trends for employer-sponsored health benefits: the erosion of the health benefit among companies, and opportunities for those progressive employers who choose to stay in the health benefit game. In 2010, nearly 50% of workers under 65 years of age worked for firms that did not offer health benefits. The uber-trend, first, is that the percentage of workers covered by employer-sponsored health insurance has declined since 2002. Workers offered the option of buying into a health benefit, as well as the percent covered by a health plan, have both fallen, according to the Employee Benefits Research Institute (EBRI), an organization that

Social media in health help (more) people take on the role of health consumer

One in 3 Americans uses social media for health discussions. Health is increasingly social, and PwC has published the latest data on the phenomenon in their report, Social media ‘likes’ healthcare: from marketing to social business, published this week. PwC polled 1,060 U.S. adults in February 2012 to learn their social media habits tied to health. Among all health consumers, the most common use of social media in health is to access health-related consumer reviews of medications or treatments, hospitals, providers, and insurance plans, as shown in the graph. Social media enables people to be better health “consumers” by giving them peers’

$12 water and $10 premium increases: how price elasticity is contextual in health and life

A $10 increase in a health plan premium drove up to 3% of retired University of Michigan employees to leave the plan, according to a study from U-M published in Health Economics, The Price Sensitivity of Medicare Beneficiaries. The U-M researchers analyzed the behaviors of 3,182 retirees over four years, to assess the impact of price on beneficiaries’ health plan choices. During the four years, the premium contribution for retirees increased significantly. The researchers conducted this study, in part, to anticipate how Americans will respond to health insurance exchanges in 2014 as they bring health plan information to the market

A $132 doctor’s visit in Hanoi, Vietnam: a diagnosis, value-based health care and a new friend

$132 won’t go far in a U.S. emergency room, but in Vietnam, it gets you first class treatment, a highly-trained and empathetic French doctor, and cheap prescriptions, as well. You could call it Presidential treatment, as a certificate from the White House was proudly displayed in the lobby waiting area sent in appreciation of great care received by President George W. Bush. After arriving in Hanoi two nights ago, following three airline flights over nearly 24 hours, our daughter developed a rough cough that gave her chest pains. We gave the condition one day to improve and then spoke with

Wellness Ignited! Edelman panel talks about how to build a health culture in the U.S.

Dr. Andrew Weil, the iconic guru of all-things-health, was joined by a panel of health stakeholders at this morning’s Edelman salon discussing Wellness Ignited – Now and Next. Representatives from the American Heart Association, Columbia University, Walgreens, Google, Harvard Business School, and urban media mavens Quincy Jones III and Shawn Ullman, who lead Feel Rich, a health media organization, were joined by Nancy Turett, Edelman’s Chief Strategist of Health & Society, in the mix. Each participant offered a statement about what they do related to health and wellness, encapsulating a trend identified by Jennifer Pfahler, EVP of Edelman. Trend 1: Integrative

Employers shopping for value in health – Towers Watson/NBGH 2012 survey results

Employers expect total health costs to reach $11,664 per active employee this year, over $700 more than in 2011. Employees’ share of that will be nearly $3,000, the highest contribution by workers in history. In 2012, workers are contributing 34% more to health costs than they did 5 years ago. The metric is that for every $1,000 employers will spend on health care in 2012, workers will pay $344 for premium and out-of-pocket costs. Still, health care cost increases are expected to level off to about 6% in 2012, that’s still twice as great as general consumer price inflation. with

Rising cost of healthcare a headache among affluent Americans

For the third year in a row, wealthy Americans cite increasing health costs as their top financial concern. Furthermore, 1 in 3 affluent Americans are more concerned about the financial stress that could accompany a health event than they are about how that condition could affect their quality of life. Merrill Lynch Wealth Management, part of Bank of America, conducted the firm’s annual poll among 1,000 Americans with investable assets of at least $250,000, in December 2011. The investment firm has looked at richer Americans’ views on financial concerns since 2009. The chart shows rising health care costs to be

Moving from operational efficiency to personalized healthcare value – IBM on redefining success in healthcare

A health system that’s built to last: this is the latest sound-bite echoing through health policy circles. The theme of sustainability is permeating all matters of policy, from education and business to health care. Enter IBM, with a rigorous approach to Redefining Value and Success in Healthcare: Charting the path to the future, from the group’s Healthcare and Life Sciences thinkers. What’s inspiring about this report is the team’s integrative thinking, bridging the relationship between operational effectiveness built on a robust information infrastructure that enables team-based care (the “collaboration” aspect in the middle of the pyramid), which then drive personalized healthcare

Consumer engagement in health: greater cost-consciousness and demand for cost/quality information

People enrolled in consumer-directed health plans (CDHPs) are more likely than enrollees in traditional health insurance products to be cost-conscious. In particular, CDHP members check prices before they receive health care services, ask for generic drugs versus branded Rx’s, talk to doctors about treatment options and their costs, and use online cost-tracking tools. Furthermore, CDHP members are also more likely to use wellness programs offered by their employers, and are offered “carrots” to participate in them in the forms of financial rewards and other incentives, as well as reduced health care insurance premiums. The 7th annual Employee Benefits Research Institute

Employees predict reduced benefits in 2012; one-half expect layoffs

On the face of the raw data, tbe good news from the U.S. Bureau of Labor Statistics on the nation’s employment picture was an additional 120,000 jobs in November. This drove the unemployment rate down to 8.6%. Underneath that number, though, remains what is still a shaky economy for both workers and those seeking full employment to match what they might have lost as a result of their layoffs. First and foremost, most people who are fortunate to still have their jobs see 2012 as a year where the benefits they receive through their employers will fall, according to the Randstad Employee Attachment Index,

The New American Dream: personal sustainability, not wealth

The Great American Recession of 2008 will reawaken in 2012, Goldman Sachs expects. In the current economic climate of a jobless recovery and dropping home values, the definition of The American Dream has changed. It’s more about personal fulfillment than financial gain, according to the 2011 MetLife Study of The American Dream: The Do-It-Yourself Dream. This is the rise of the “do-it-yourself” American Dream, MetLife found in its survey of 2,420 online adults conducted in September-October 2011. Across the generations — from Silent (born between 1920 and 1945) to Gen Y (born between 1978 and 1993), this redefining concept is relatively consistent.

What’s baked into the Affordable Care Act? Half of Americans still don’t realize there’s no-cost preventive care

The U.S. public’s views on health reform — the Affordable Care Act (ACT) – remain fairly negative, although the percent of people feeling favorably toward it increased from 34% to 37% between October and November. Still, that represents a low from the 50% who favored the law back in July 2010. It’s quite possible that American health citizens’ views on health reform are largely reflective of their more general feelings about the direction of the country and what’s going on in Washington right now, versus what’s specifically embodied in the health care law, according to the November 2011 Kaiser Health

Retail health is hot, especially for the young, affluent and not particularly sick

Walmart issued a Request for Information to expand its retail health footprint in the communities in which the world’s largest company operates. That was a strong sign that retail health has surpassed a tipping point. Now, there are hard data to support this observation from a RAND Corporation research team. Trends in Retail Clinic Use Among the Commercially Insured, published in the November 25, 2011, issue of The American Journal of Managed Care, quantifies retail clinic utilization among a group of Aetna health plan enrollees between 2007 and 2009. In those two years, use of retail clinics grew 10-fold. RAND looked

Employers aren’t engaging with patient/health engagement

The vast majority of employers who sponsor health benefits look at those benefits as part of a larger organization culture of health. While one-third are adopting value-based health plan strategies — doubling from 16% in 2010 to 37% in 2011 — only 3% of employers are taking an integrated view of value-based benefits and corporate wellness. This is the second year for the International Foundation of Employee Benefit Plans (IFEBP) and Pfizer to examine employers’ approaches to value-based health care (VBHC). As explained by Michael Porter, the guru on health value chains, value in health care focuses on the patient at

Prescription drug spend in 2012: moving from “educating” patients to empowering them

The growth in prescription drug costs covered by employers and Rx plan sponsors are driving them to adopt a long list of utilization management and price-tiering strategies looking to 2012, according to the 2011-2012 Prescription Drug Benefit Cost and Plan Design Report, sponsored by Takeda Pharmaceuticals. The average drug trend for 2011 — that is, the average annual percentage increase in drug cost spending — was 5.5%, 1.5 percentage points greater than general price inflation of about 4%. The generic fill rate was 73% of prescription drugs purchased at retail. While drug price inflation is expected to increase in 2012, plan

Get into the sunshine, church is out – the GAO report on health care price transparency

This morning during my still-dark-at-5:15 am walk, my iPod was motivating me to “get up offa that thing,” as James Brown was motivating me to “release the pressure.” Two minutes into the song, he urges, “Get into the sunshine, church is out.” This brought to mind a publication I’ve taken time to review from the General Accounting Office (GAO) report to the U.S. Congress, Health Care Price Transparency – Meaningful Price Information Is Difficult for Consumers to Obtain Prior to Receiving Care, published in September 2011. While employers and health plans want consumers to become more engaged in their health, a key barrier facing

Walmart’s rollback of health insurance for employees: just another employer facing higher health care costs?

Walmart is increasing premium sharing costs for employees subscribing to health insurance, and cutting the benefit for part-timers. Quoted in the New York Times, a company rep said, “over the last few years, we’ve all seen our health care rates increase and it’s probably not a surprise that this year will be no different. We made the difficult decision to raise rates that will affect our associates’ medical costs.” In so doing, Walmart told the Times that they will, “strike a balance between managing costs and providing quality care and coverage.” MarketWatch wrote that Walmart will increase health care premium costs

Unretirement: the number of Americans planning to retire at 67 is plummeting

Two publications this week reinforce the new reality of health and financial insecurity: The Vanishing Middle America issue of Advertising Age (October 17, 2011 issue) and the Sun Life Financial U.S. Unretirement Index – Fall 2011 with the subtitle, “Americans’ trust in retirement reaches a tipping point.” The chart shows the retirement coin’s two sides: since 2008, the proportion of people in the U.S. who expect to retire by 67 dropped from 52% down to 35%; and, those who believe they will be working full-time (I emphasize “full,” not “part,” time) grew from 19% to 29%. 61% of working Americans plan to

Americans’ new normal in health: paying attention and responding to costs

The passage of health reform in the U.S. has not enhanced peoples’ confidence in the American health system. In fact, U.S. health consumers’ high confidence level in the future of employer-sponsored health benefits has eroded over the past ten years, according to the Employee Benefit Research Institute‘s (EBRI) 2011 Health Confidence Survey: Most Americans Unfamiliar with Key Aspect of Health Reform. Most people are dissatisfied with the U.S. health system overall, with 27% of U.S. adults rating the system as “poor” and 29% giving a rating of “fair.” High costs may be at the root of peoples’ dissatisfaction with the U.S. health

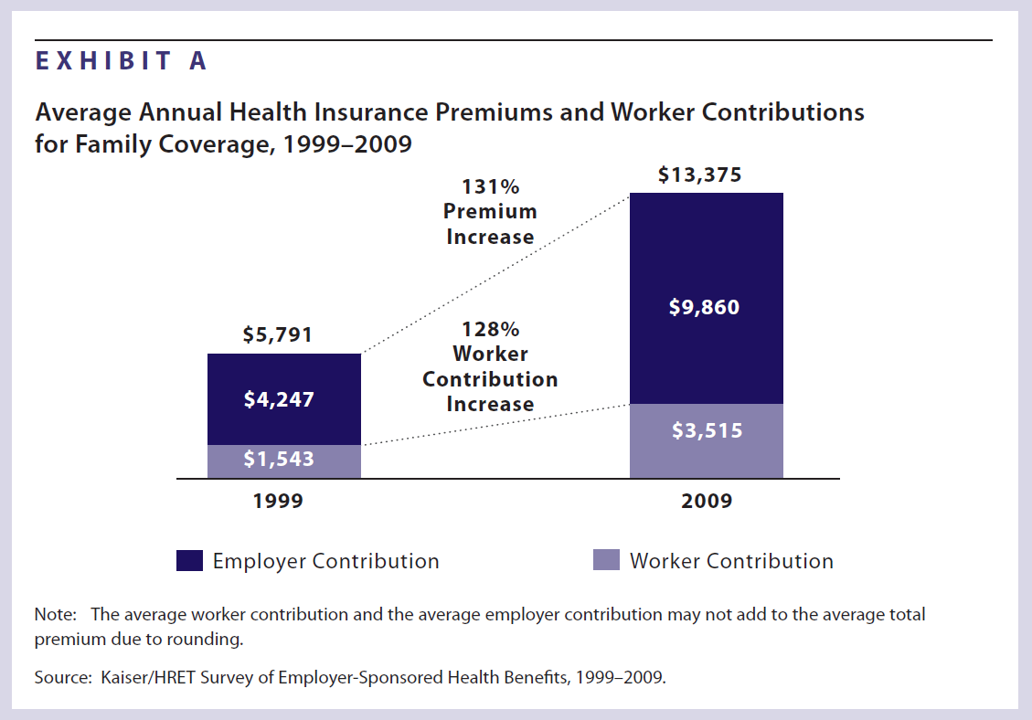

Health insurance costs have doubled in 10 years; the average monthly contribution is nearly $300

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999. In 2009, in raw number terms, family health insurance costs employers, on average, $13,375. Workers pay $3,515 of this premium, on average about 26% of the total. This approaches nearly $300 out of a monthly paycheck. Worker contributions substantially vary between small and large employers: the contribution is nearly $1,000 more if you work in a

Nearly 1 in 2 women delayed health care in the past year due to costs – the economic impact on a woman’s physical, emotional, and fiscal health

Nearly 1 in 2 women put off seeking health care because the cost was too high. The kinds of services delayed included visits to the doctor, medical procedures, and filling prescription medications. The fourth annual T.A.L.K. Survey was released this week by the National Women’s Health Resource Center (NWHRC), focusing on the declining economy and its impact on women and three dimensions of their health — physical, emotional, and fiscal. 40% of women say that their health has worsened in the past five years due to increasing stress and gaining weight, according to the survey. One of the most interesting

For those with health insurance, a growing bounty of benefits

For those employees fortunate enough to receive health insurance from work, there’s a bountiful array of health care services that are still covered by plans. The International Foundation of Employee Benefit Plans (IFEBP) polled its membership in late 2007 and found that employers are not only continuing to cover a broad range of services, but also new services the likes of which weren’t covered even two years ago…from medical tourism to biofeedback. These results are documented in IFEBP’s publication, Health Care Benefits: Eligibility, Coverage and Exclusions. The usual suspects are covered by well over 97% of employers, such as ER

Steel, Coffee Beans and Health Care

The UAW and GM have been debating health care as Friday’s deadline for their national contract approaches. This round of negotiation is about survival. Yesterday, I covered the rising costs of employer-sponsored health insurance. Today, let’s visit the intimately-related topic of retiree health benefits. These are eroding even faster than health benefits for employed workers. Many employers have significantly scaled back health benefits for retirees. Currently, one in three large employers offers retire benefits, compared with two in three in the late 1980s. Consider the predicament of the company ranked #3 on the 2006 Fortune 500 list, General Motors. Retirees

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for