Health Insurance Coverage Among Smaller U.S. Businesses Is Eroding: A Signal From JPMorganChase

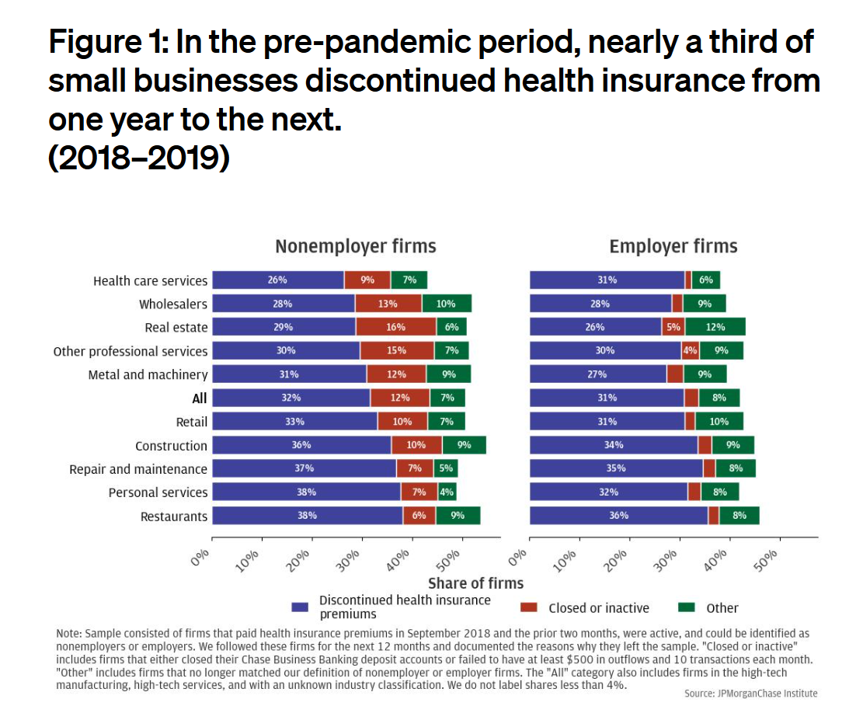

Working-age people in the U.S. depend on their employers to provide health insurance; just over one-half of people in America receive employer-sponsored health insurance. But a concerning signal has emerged that calls into question how sustainable the uniquely American employer-sponsored health plan model is: that is that one in 3 small businesses in the U.S. stopped covering health insurance after the worst of the pandemic health effects in 2023 as the companies payroll expenses continued to increase, a statistic raised in The consistency of health insurance coverage in small business: industry challenges and insights, a report from the JPMorganChase Institute

U.S. Health Care in 2025 Requires Scenario Planning: The Uncertainties (AI!?) That Inspire DIY Healthcare

As Weight Watchers prepares to initiate bankruptcy proceedings, I file the news event under “thinking the unthinkable.” “Thinking about the unthinkable” is what Herman Kahn, a father of scenario planning, asked us to do when he pioneered the process. In this book, for Kahn, “the unthinkable” was thermonuclear war, and the year was 1962. The book was tag-lined as “must reading for an informed public” and in it, Kahn I’ve been drawn back to this book lately because of a more intense workflow using

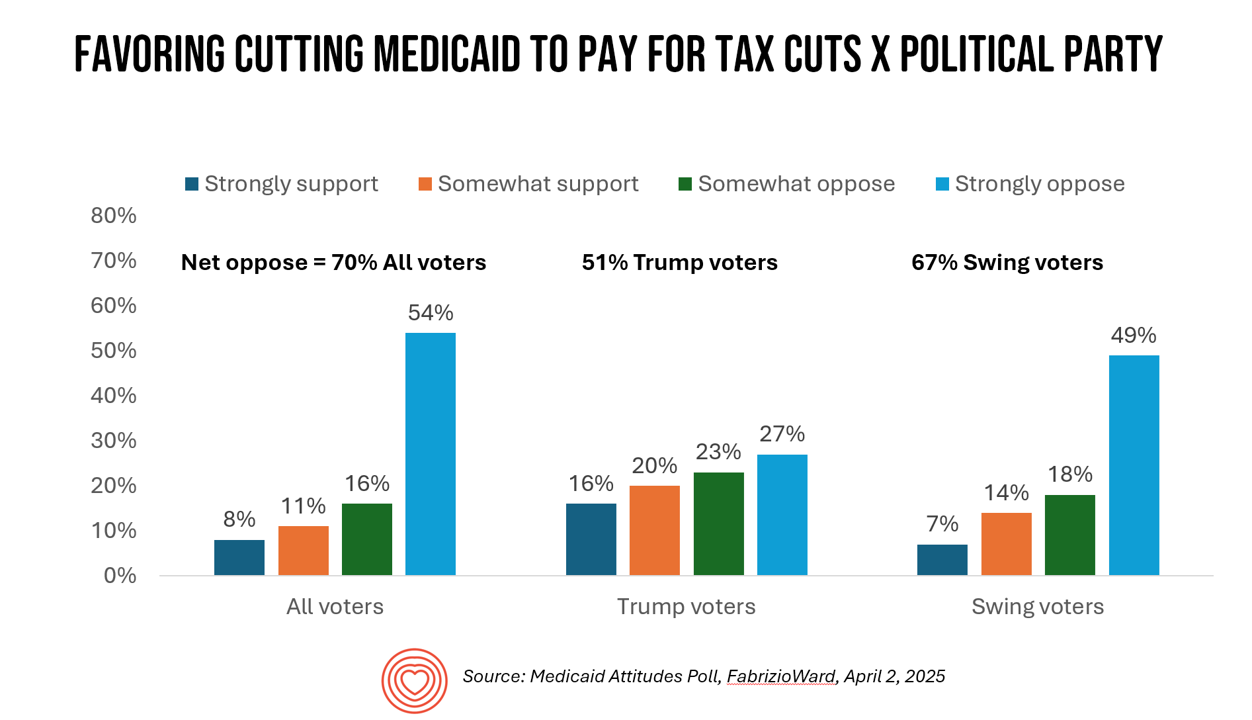

Most Americans Don’t Want to Cut Medicaid (Including Republicans)

With potential down-sizing of Medicaid on the short-term U.S. political horizon, a fascinating poll found that most people identifying as Republican would not favor cuts to Medicaid. What fascinates me about this survey, published earlier this week, is that it was conducted by FabrizioWard, a polling firm that has often been used by President Trump. The firm’s Bob Ward told POLITICO that, “There’s really not a political appetite out there to go after Medicaid to pay for tax cuts. Medicaid has touched so many families that people have made up their minds about what

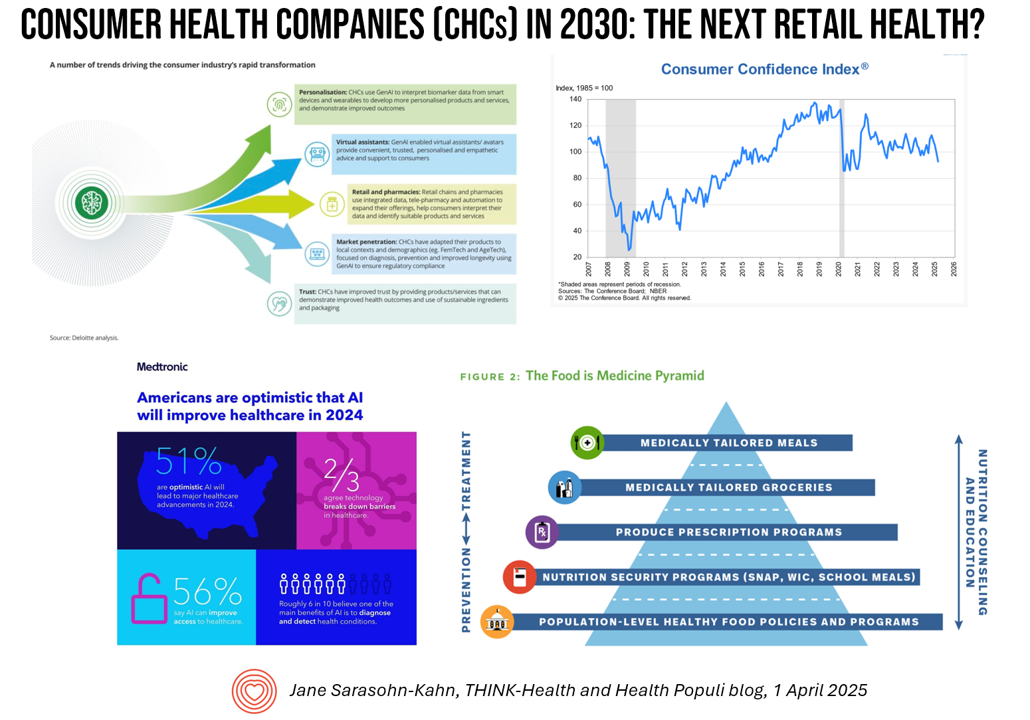

What is a Consumer Health Company? Riffing Off of Deloitte’s Report on CHCs/A 2Q2025 Look at Self-Care Futures

The health care landscape in 2030 will feature an expanded consumer health industry that will become, “an established branch of the health ecosystem focused on promoting health, preventing, disease, treating symptoms and extending healthy longevity,” according to a report published by Deloitte in September 2024, Accelerating the future: The rise of a dynamic consumer health market. While this report hit the virtual bookshelf about six months ago, I am revisiting it on this first day of the second quarter of 2025 because of its salience in this moment of uncertainties across our professional and personal lives — particularly related to

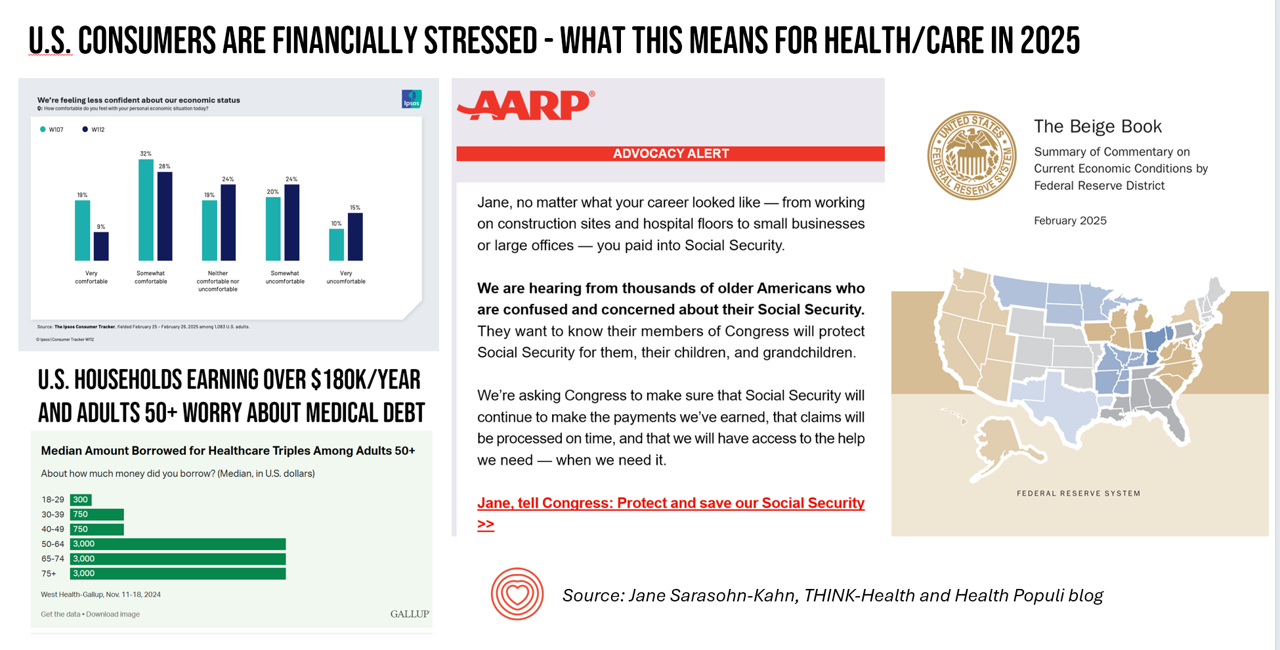

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

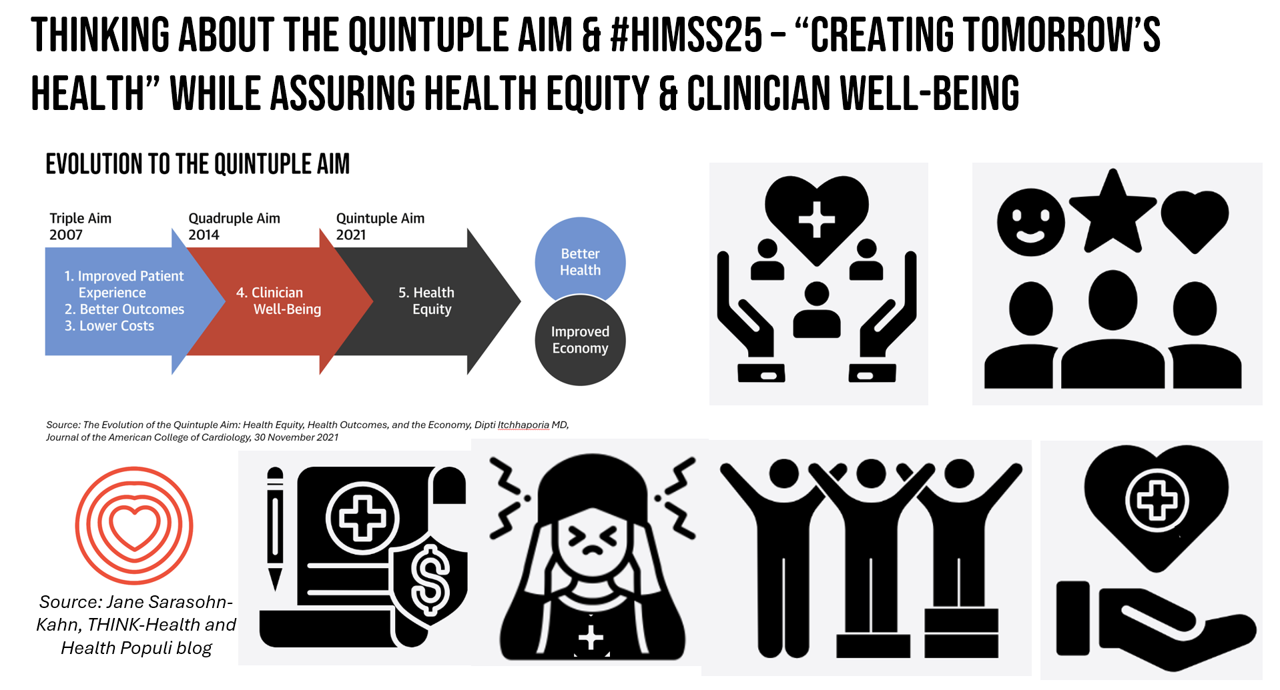

Think Quintuple Aim This Week at #HIMSS25

As HIMSS 2025, the largest annual conference on health information and innovation meets up in Las Vegas this week, we can peek into what’s on the organization’s CEO’s mind leading up to the meeting in this conversation between Hal Wolf, CEO of HIMSS, and Gil Bashe, Managing Director of FINN Partners. If you are unfamiliar with HIMSS, Hal explains in the discussion that HIMSS’s four focuses are digital health transformation, the deployment and utilization of AI as a tool, cybersecurity to protect peoples’ personal information and its use, and, workforce development. I have my own research agenda(s) underneath these themes

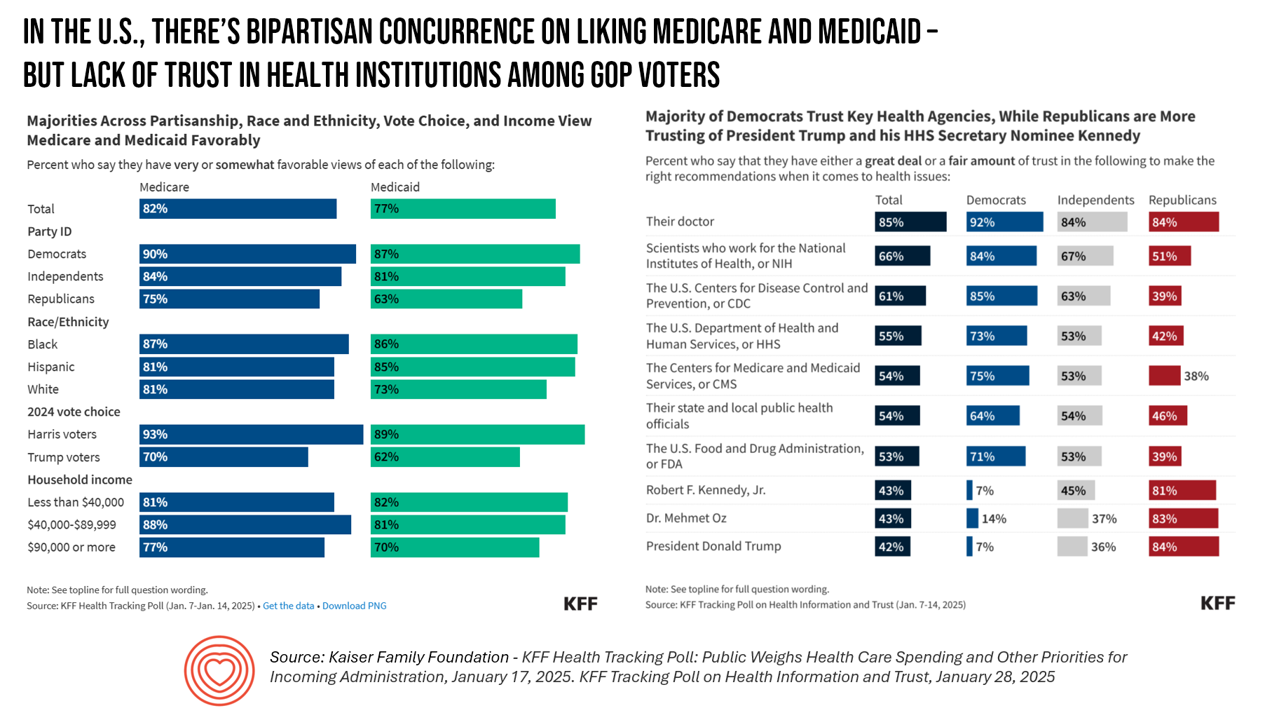

Some Bipartisan Concurrence on Health Care Issues in the U.S. – But Trust in Health Care Isn’t Bipartisan – KFF’s January 2025 Polls

Two polls from one poll source paint at once a bipartisan and bipolar picture of U.S. health citizens when it comes to health care issues versus health care institutions in America. The Kaiser Family Foundation has hit the 2025 health policy ground running in publishing the January 2025 Health Tracking Poll last week and a poll on health care trust and mis-information yesterday. First, the health tracking poll which finds some concurrence between Democrats and Republicans on several big issues facing Americans and various aspects of their health care. As

How Disrupting the Generic ED Meds Sales Model Marries to Our Digital Coexistences – Mark Cuban at the Shelly Palmer Innovation Series Breakfast #CES2025

What was Mark Cuban doing “gate-crashing” Shelly Palmer’s Innovation Breakfast? My worlds of content and health care collided in a serendipitous way this morning when, at the conclusion of my annual beloved experience attending and learning at the Shelly Palmer Innovation Series breakfast which focuses on content, media, entertainment, and now AI mashing up everywhere, all at once, Mark Cuban appeared as a late-breaking guest in fireside chat with Shelly. Here’s my photo to prove it, circa 903 am this morning. Before even chatting about AI, X, and his

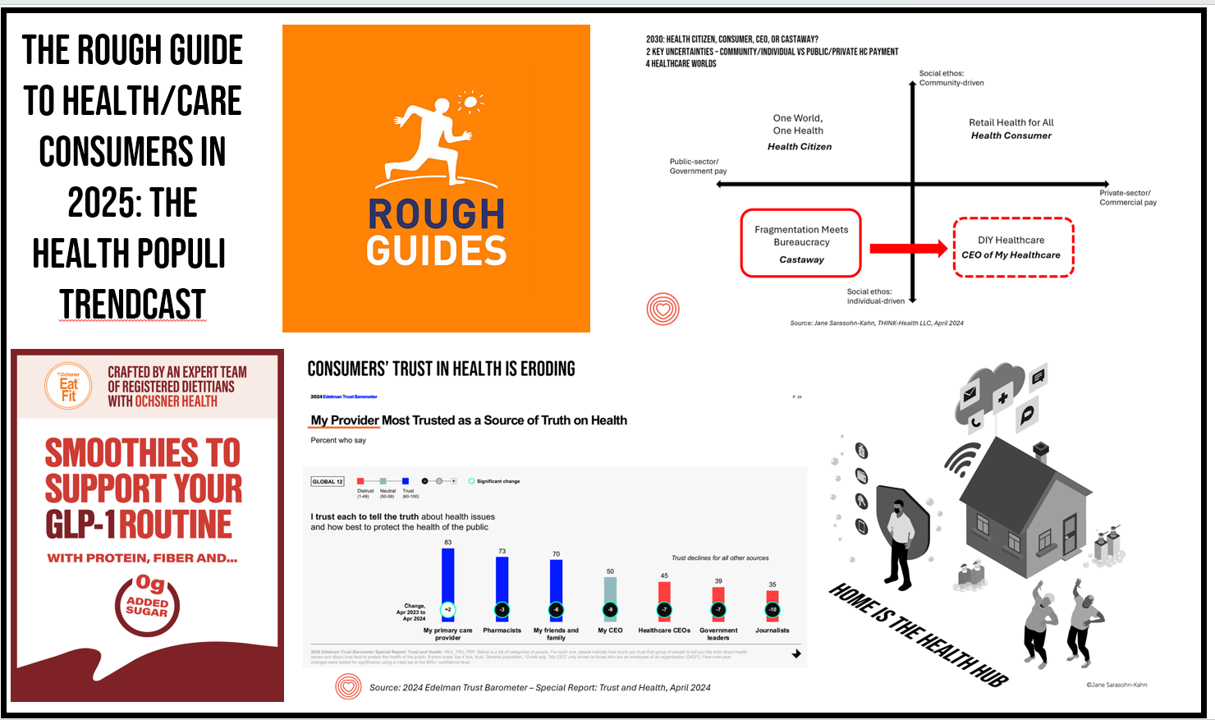

The Rough Guide to Health/Care Consumers in 2025: The 2025 Health Populi TrendCast

At this year-end time each year, my gift to Health Populi readers is an annual “TrendCast,” weaving together key data and stories at the convergence of people, health care, and technology with a look into the next 1-3 years. If you don’t know my work and “me,” my lens is through health economics broadly defined: I use a slash mark between “health” and “care” because of this orientation, which goes well beyond traditional measurement of how health care spending is included in a nation’s gross domestic product (GDP); I consider health across the many dimensions important to people, addressing physical,

Americans’ Views on the Quality of Healthcare Fell to a Record Low — with Costs Ranking as the Most Urgent Problem for Health in the U.S.

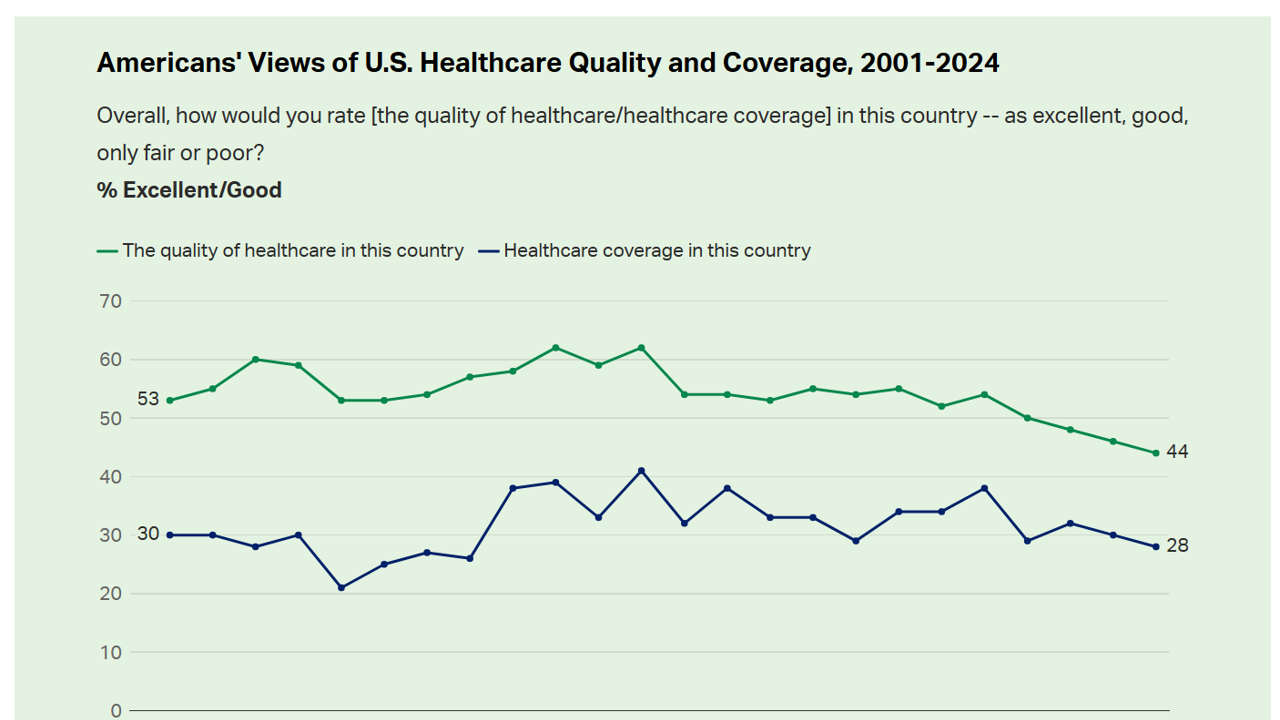

Americans’ perception of the quality of health care in the U.S. fell to the lowest level since 2001, Gallup found in a poll of U.S. health citizens’ views on health care quality, published December 6, 2024. In 2024, only 44% of Americans said that the quality of health care int he U.S. was excellent or good — conversely, 56% of Americans though health care quality was only fair or poor. By political party, that included 50% of Democrats evaluating the quality of care highly compared with 42% of Republicans. Only 28% of people in

Workers Feel “Stuck,” Under-Insured, Financially Stressed, and Neglecting Mental Health

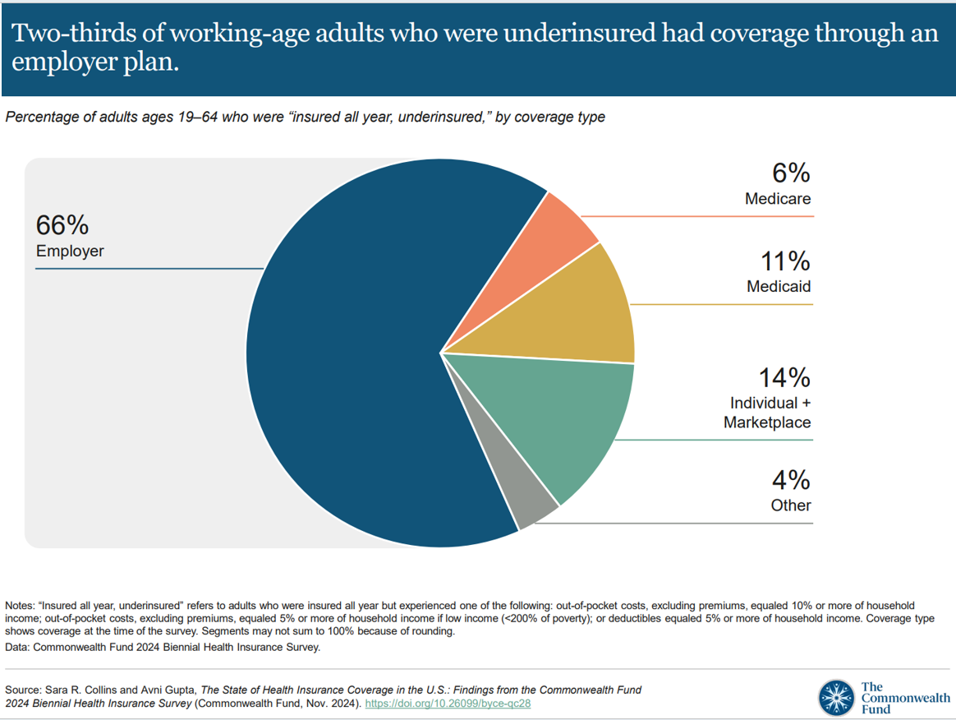

“It’s the economy stupid,” Jennifer Tescher, CEO of the Financial Health Network, titles her latest column in Forbes. Published two weeks after the 2024 U.S. elections, Jennifer’s assertion sums up what, ex post facto, we know about what most inspired American voters at the polls in November 2024: the economy, economics, inflation, the costs of daily living….pick your noun, but it’s all about those Benjamins right now for mainstream American consumers across many demographic cuts. With that realization, we must remind ourselves as we enter a new year under a second-term President Trump that health care spending for everyday people

3 in 4 U.S. Patients Say the Healthcare System is Broken — But Technology Can Help

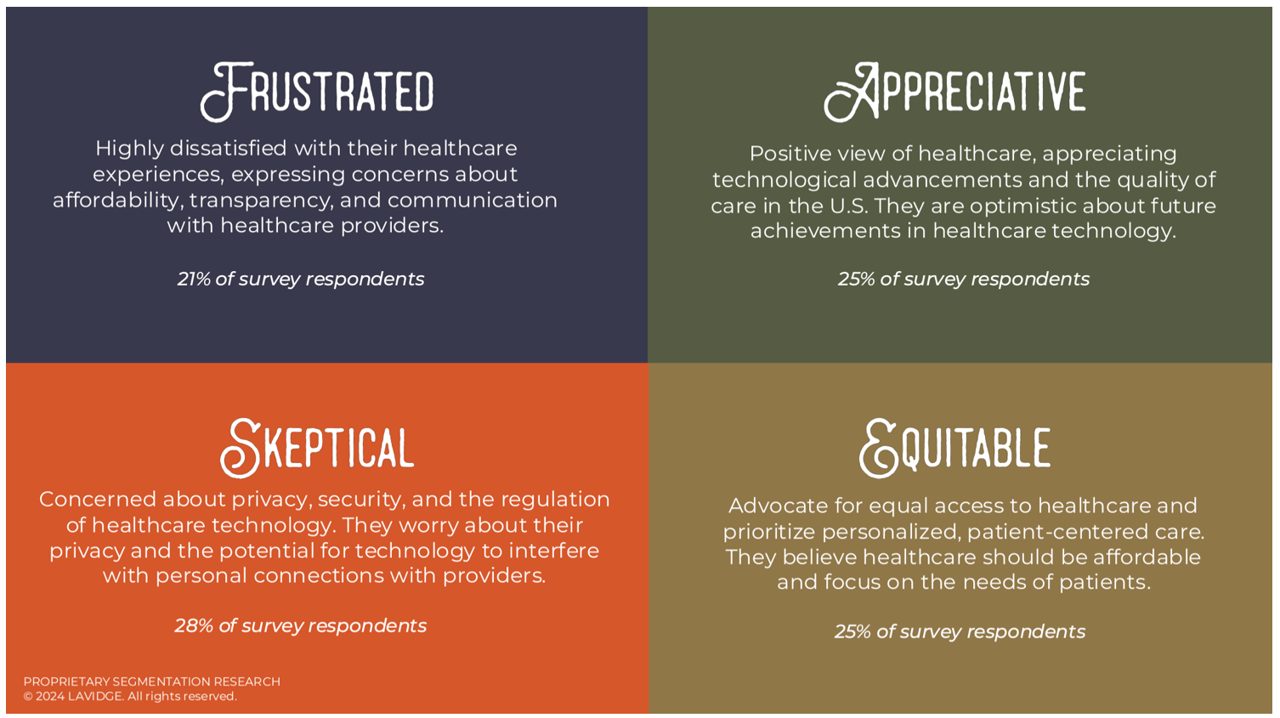

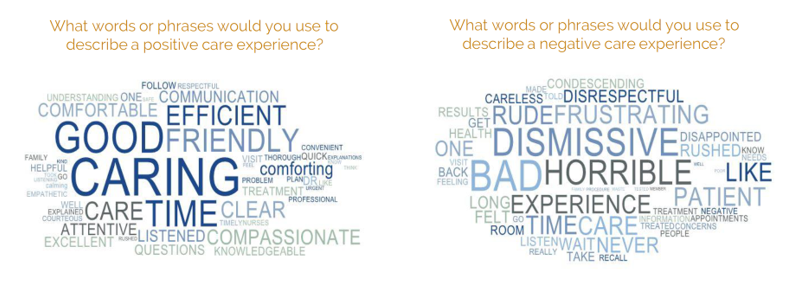

Patients “yearn” for personalized services and relationships in health care — optimistic that technology can help deliver on that hope — we learn in Healthcare’s Future: Balancing Progress and Perception, a health consumer survey report from Lavidge. Lavidge, a communications/PR/marketing consultancy, polled U.S. patients’ attitudes about health care and technology in June 2024, publishing the report earlier this month. Start with over-arching finding that, “Three out of four patients believe the U.S. healthcare system is broken and there is a strong sense of distrust,” Lavidge asserts right at the top of

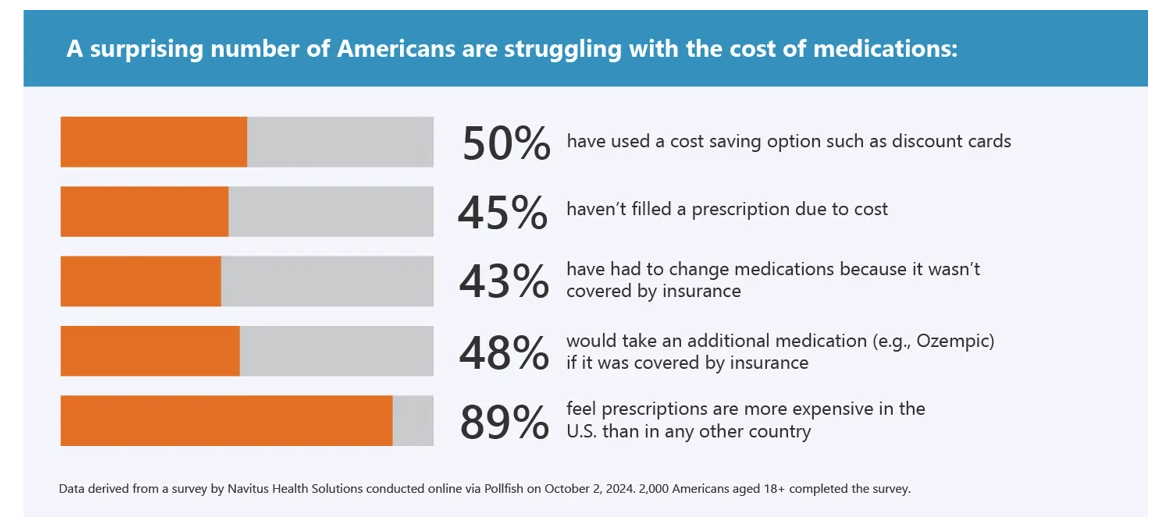

What Stays True for U.S. Health Care Post #Election2024 (1) – Consumers’ Dissatisfaction with Drug Prices

For health care, there are many uncertainties as we reflect, one week after the 2024 U.S. elections, on probably policy and market impacts that we can expect in 2025 and beyond. In today’s Health Populi post, I’ll reflect on the first of several certainties we-know-we-know about U.S. health citizens and key factors shaping the American health ecosystem. In this first of several posts on “What Stays True for U.S. Health Care Post #Election2024,” I’ll focus on U.S. consumer dissatisfaction with drug prices — across political party identification. Let’s set the context with data from a recently-published

Doctors’ Recommendations Are Top Motivators for Consumers Who Buy Digital Health Devices: Trust and Health

Most consumers using digital health devices felt more trust in the technology when coupled with doctors’ office reviews — another lens on the importance of trust-equity between patients and physicians. This insight came out of a report on How Consumers Purchase, Use and Trust Medical Devices based on market research sponsored by Propel Software. For the study, Propel Software engaged Talker Research to conduct a survey among 2,000 U.S. adults in October 2024 to gauge peoples’ views on digital health tools, buying trends, and trust. Start with the rate of 1 in 4 Americans’ experience

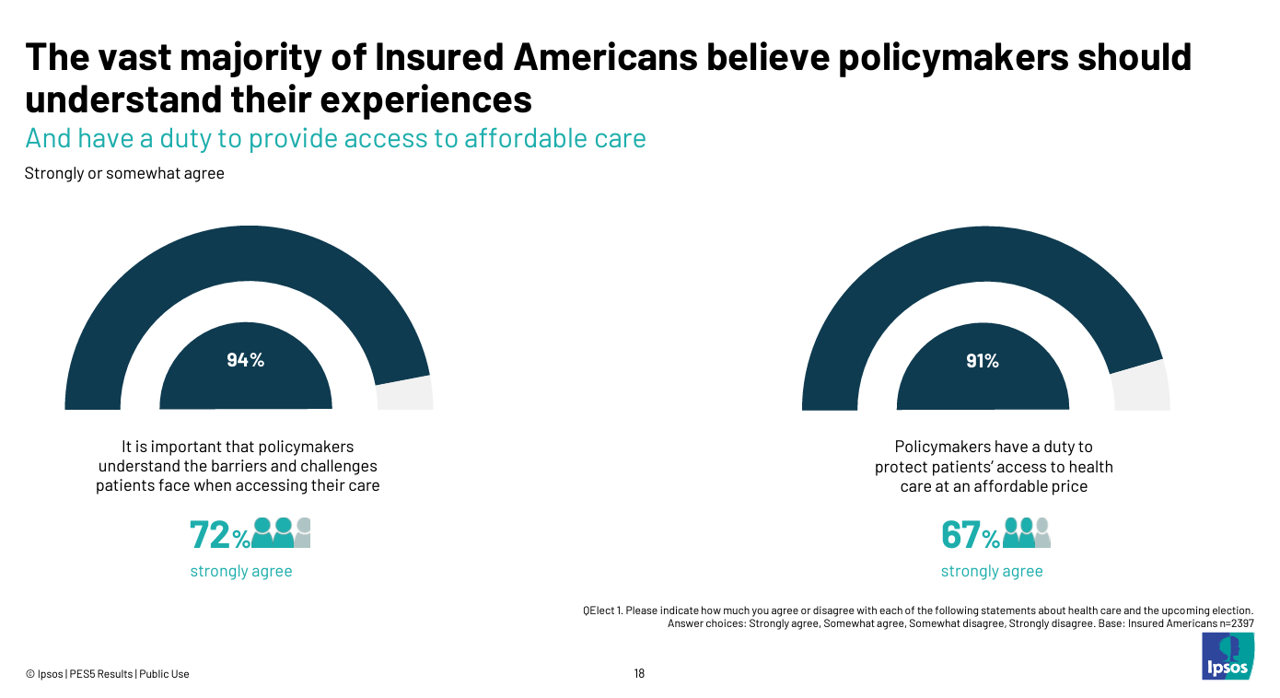

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

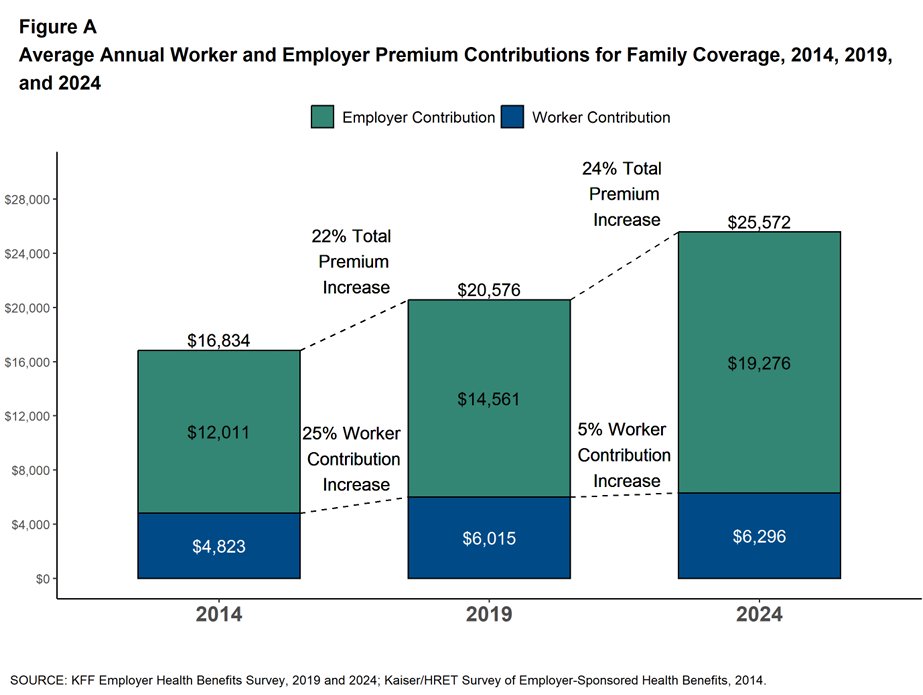

The Health Insurance Premium for a Family Averages $25,572 in 2024 – KFF’s Annual Update on Employer-Sponsored Benefits

The premium for employer-sponsored health plans grew by 6-7% between 2023 and 2024, according to the report on Employer Health Benefits 2024 Annual Survey from the Kaiser Family Foundation, KFF’s 26th annual study into U.S. companies’ spending on workers’ health care. In 2024 the average annual health insurance premium for family coverage is $25,572, split by 75% covered by the employer (just over $19,000) and 25% borne by the employee ($6,296), shown in the first chart from the report. The nearly $26K family premium is the average across all plan types in the

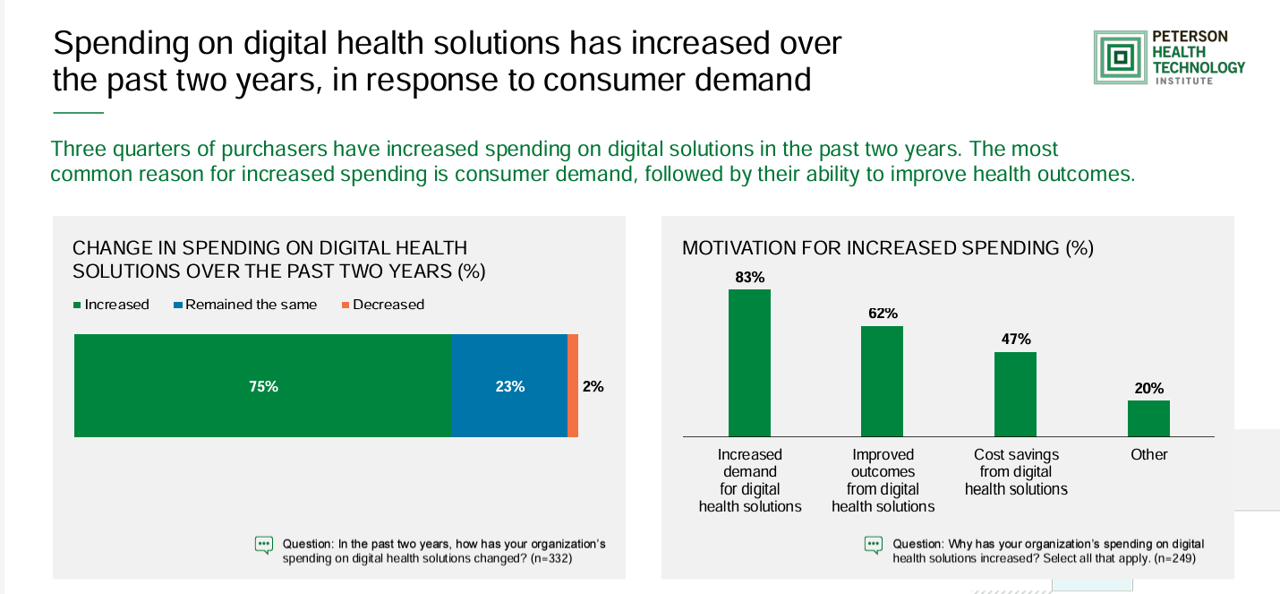

Growing Investments in Digital Health Are Driven by Consumer Demand, Clinical Outcomes, and Cost-Savings

The marketing for purchasing digital health technologies is expecting to grow, driven by increased consumer demands for tech-based solutions, improved outcomes enabled through the innovations, and cost savings derived from deploying the technologies. That’s the top-line finding in the 2024 State of Digital Health Purchasing from the Peterson Health Technology Institute (PHTI). PHTI surveyed 322 digital health decision makers working in employers, health plans, and health systems, fielding the study in July and August 2024. 3 in 4 purchasers grew spending on digital health technologies in the past two years,

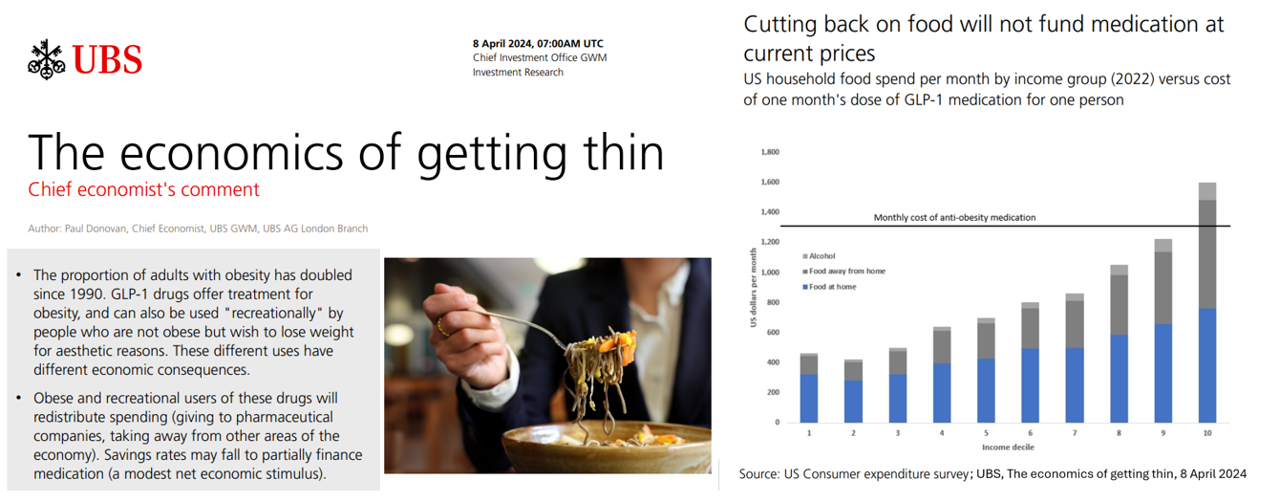

Obesity is a Public Health Epidemic in the U.S. — The Case for GLP-1 Coverage, Affordability and Equity

“If the U.S. were sensible, weight management would be treated as a public health issue,” David Cutler writes in the JAMA Health Forum dated August 15, 2024. Dr. Cutler, distinguished economics professor at Harvard, talks about “the pathology of U.S. health care” citing the example of weight loss medications — in short, the uptake of GLP-1 drugs to address Type 2 diabetes first, and subsequently obesity. Dr. Cutler notes that the price of these drugs in the U.S. “far exceeds” that of other countries: specifically, 9 times that of the prices in Germany and the Netherlands

Where Democrats and Republicans Agree on Health Care Policies – From Medicare and Prescription Drugs to Gun Safety

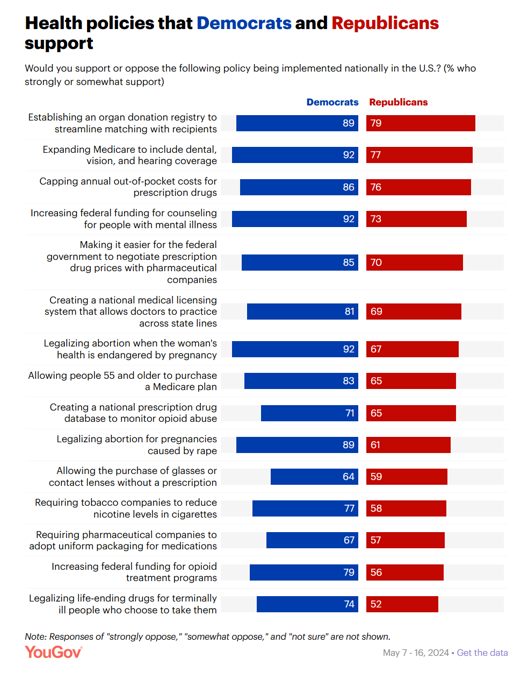

In a super-divided electorate like the U.S. with about 60 days leading up to the 2024 Elections, we might assume there are no “purple” areas of agreement between the Red (Republicans) and the Blue (Democrats) thinking in PANTONE color politics. Surprisingly, there are many health policies on which Democrats and Republicans concur, as found in a series of YouGov polls conducted in May 2024. YouGov fielded the health policies poll in five waves online, each among roughly 1,100 U.S. adults in May 2004. This bar chart summarizes health

Women’s Health Outcomes in the U.S.: Spending More, Getting (Way) Less – 4 Charts from The Commonwealth Fund

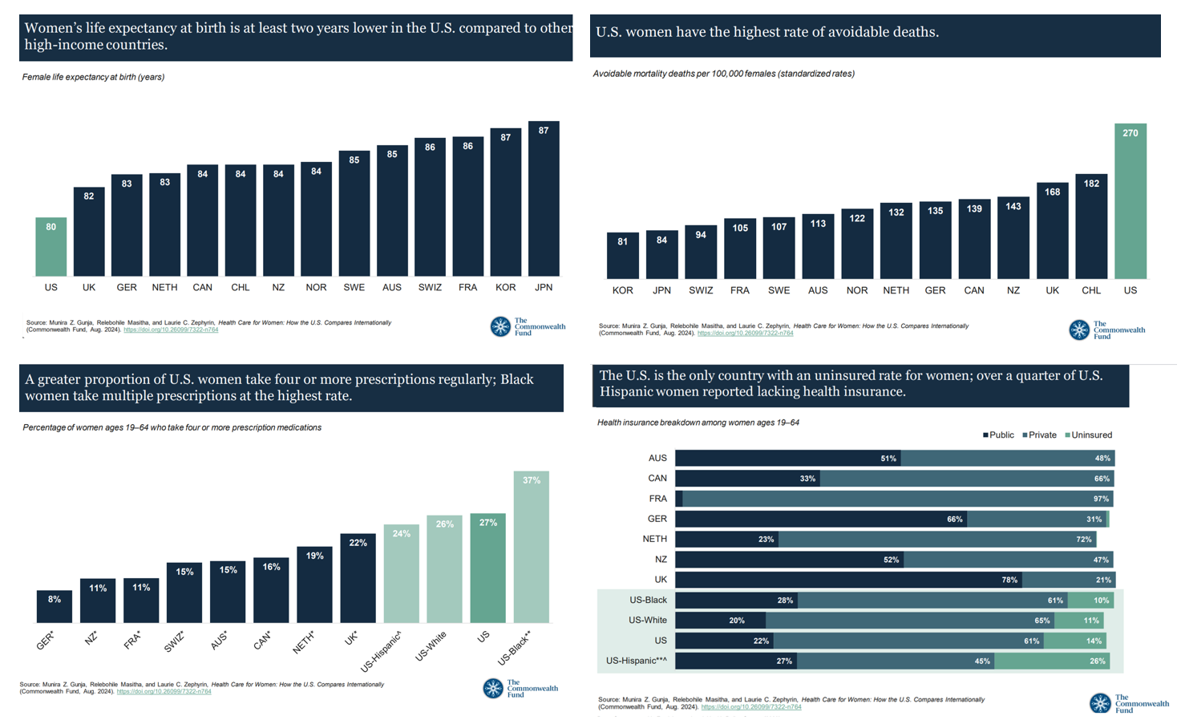

Women in the U.S. have lower life expectancy, greater risks of heart disease, and more likely to face medical bills and self-rationing due to costs, we learn in the latest look into Health Care for Women: How the U.S. Compares Internationally from The Commonwealth Fund. The Fund identified four key conclusions in this global study: Mortality, shown in the first chart which illustrates women in the U.S. having the lowest life expectancy of 80 years versus women in other high-income countries; Health status, with women in the U.S. more likely to consume multiple prescription

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

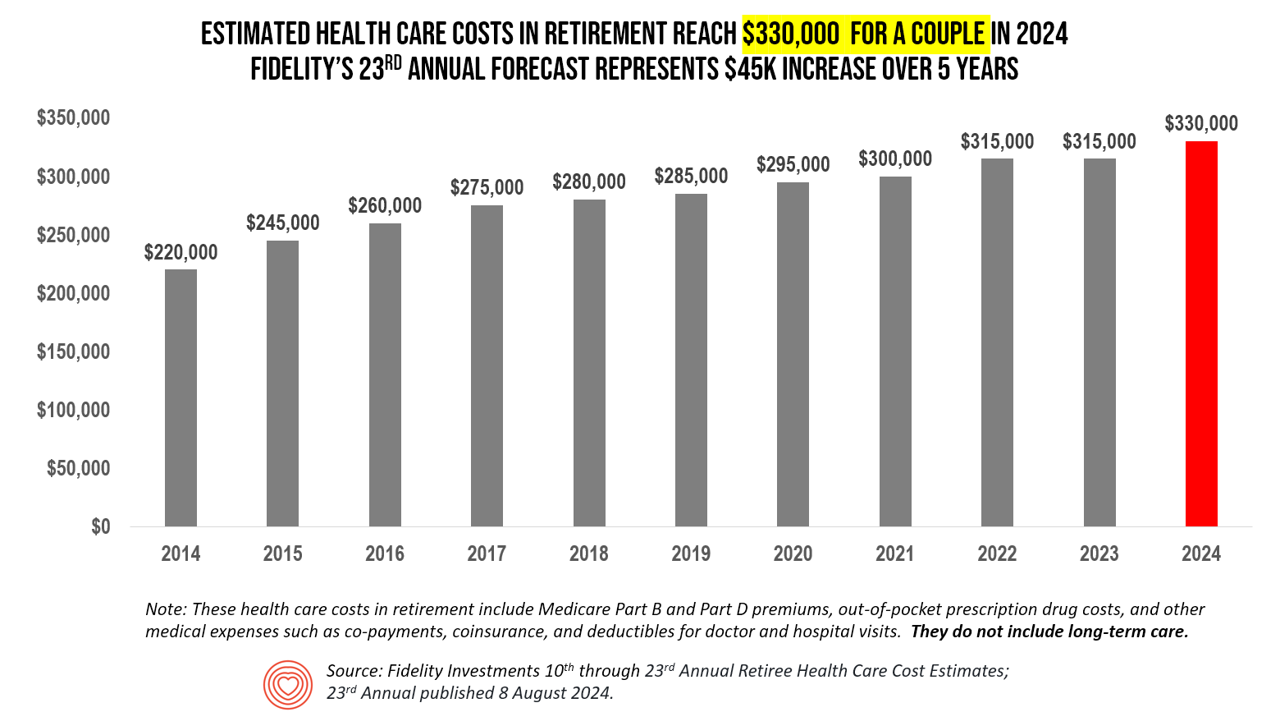

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

Consumers Demand Foods That Are Healthy AND Delicious – and Some Health Equity Implications

The most common food-eating styles practiced by U.S. consumers are low sugar/diabetic diets, low-calorie, dairy-free, anti-inflammatory, and gluten-free, ccording to the Midyear Trends update from Datassential. In their update on the food trends entering the second half of 2024, Datassential offered several insights on consumers and food-as-medicine in a section called the Health Check-Up. These trends are shaping consumers’ food demands in both their grocery shopping preferences (for food consumed in the home) as well as their eating-out ordering strategies — where 35% of consumers want to see menu offerings with foods that are

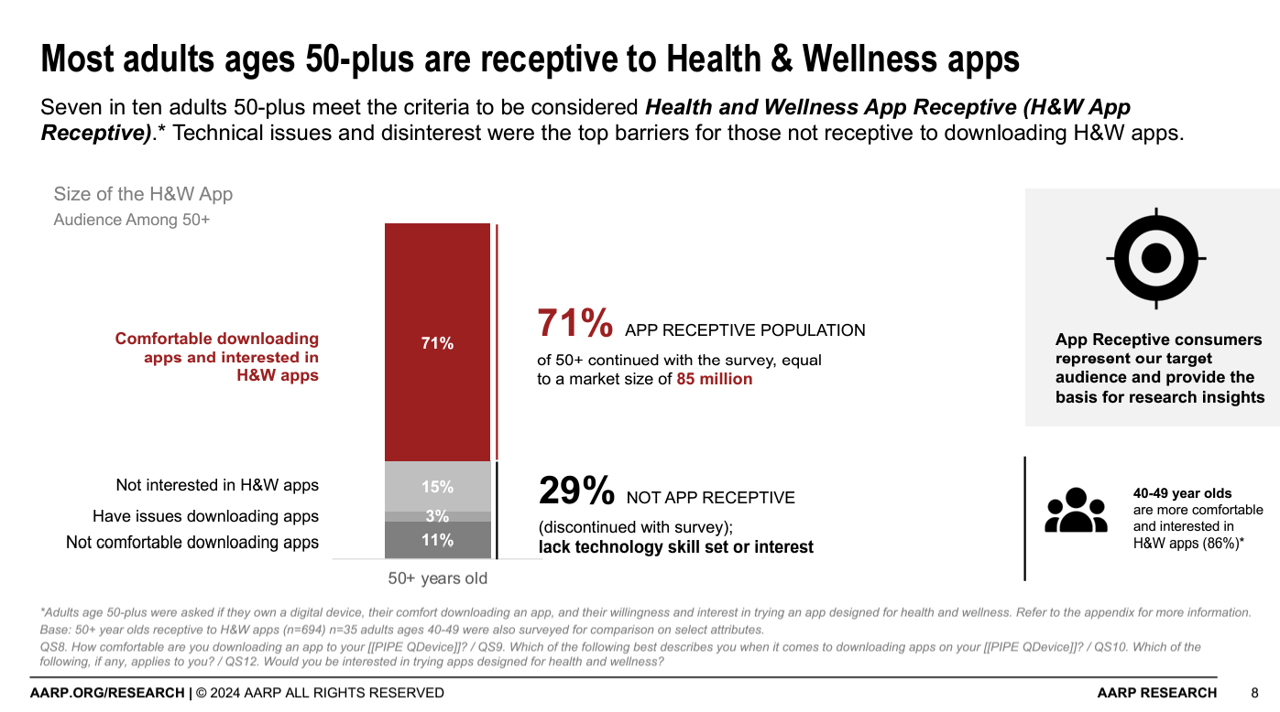

Older Americans Mostly Receptive to Apps for Health, but Chronically Ill People Could Use a Nudge (and a Payer)

AARP found that 7 in 10 people ages 50+ are “app-receptive” for health and wellness apps in Unlocking Health and Wellness Apps: Experiences of Adults Age 50-Plus, a summary of research conducted with U.S. consumers 50 and over from AARP. The methodology for this study included only older consumers who were comfortable in downloading apps to smartphones or tablets, and were willing to do so — whom AARP considered the target audience for this research. In addition, the respondents surveyed were also at least interested in trying apps designed for health and wellness, thus dubbed “health

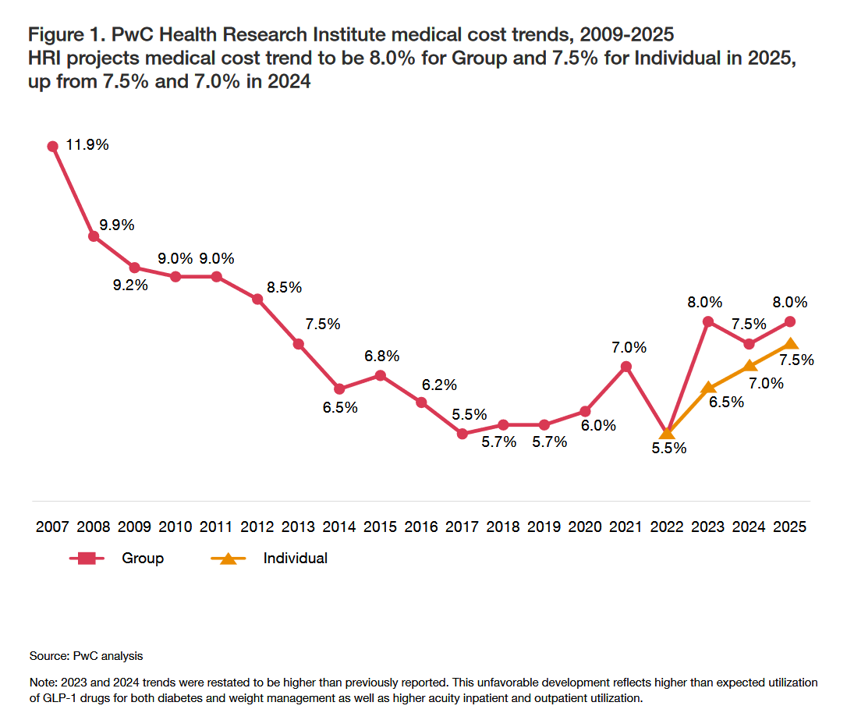

What’s Expected to Drive Up Health Plan Costs in 2025: GLP-1s, Behavioral Health, and Inflationary Pressures for Hospitals and Doctors – PwC’s Behind the Numbers 2025

The U.S. Bureau of Labor Statistics had good news for American consumers long-facing inflation for household spending over the past couple of years, announcing on July 11, 2024, that the general consumer price index (CPI) fell, lowering real prices for people buying airline tickets, used cars and trucks, communication, and petrol to fill auto tanks. That positive economic news did not extend to medical care and personal care, the BLS reported, whose costs increased by 3.3% and 3.2%, respectively. (Motor vehicle insurance costs grew a whopping 19.5% in the report, FYI). Following the

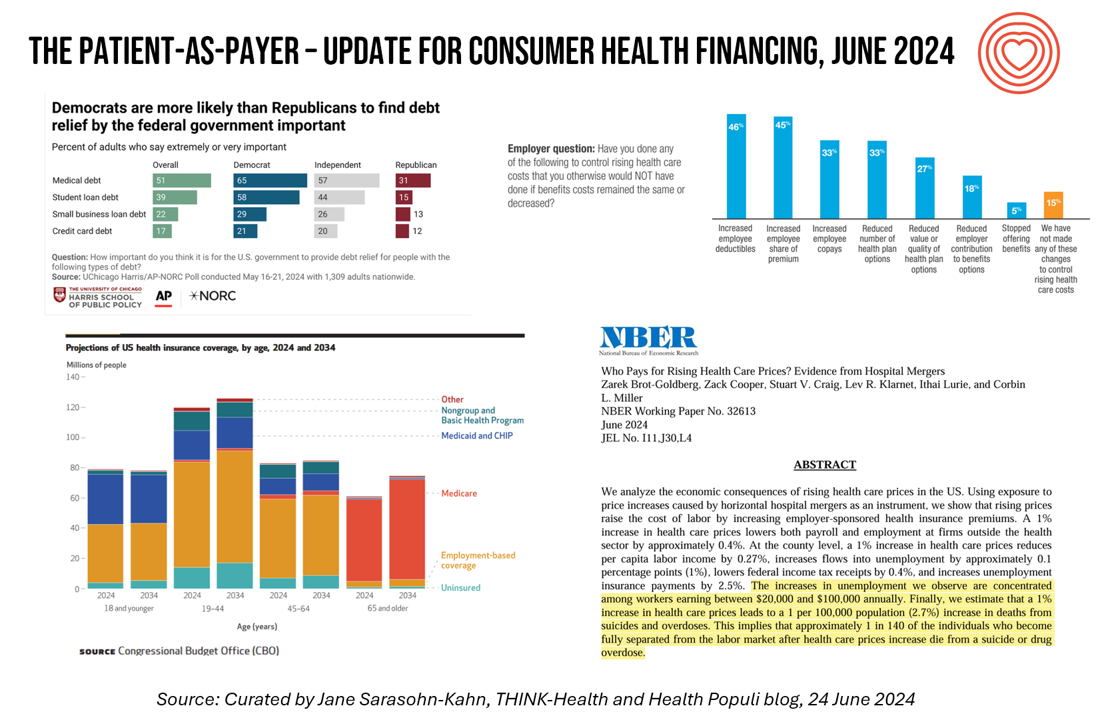

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

The Thematic Roadmap for AHIP 2024: What the Health Insurance Conference Will Cover

Health insurance plans make mainstream media news every week, whether coverage deals with the cost of a plan, the cost of out-of-network care, prior authorizations, or cybersecurity and ransomware attacks, among other front-page issues. This week, AHIP (the acronym for the industry association of America’s Health Insurance Plans) is convening in Las Vegas for its largest annual 2024 meeting. We expect at least 2,400 attendees registered for the meeting, and they’ll not just be representing the health insurance industry itself; folks will attend #AHIP2024 from other industry segments including pharmaceuticals, technology, hospitals and health systems, and the investment and financial services

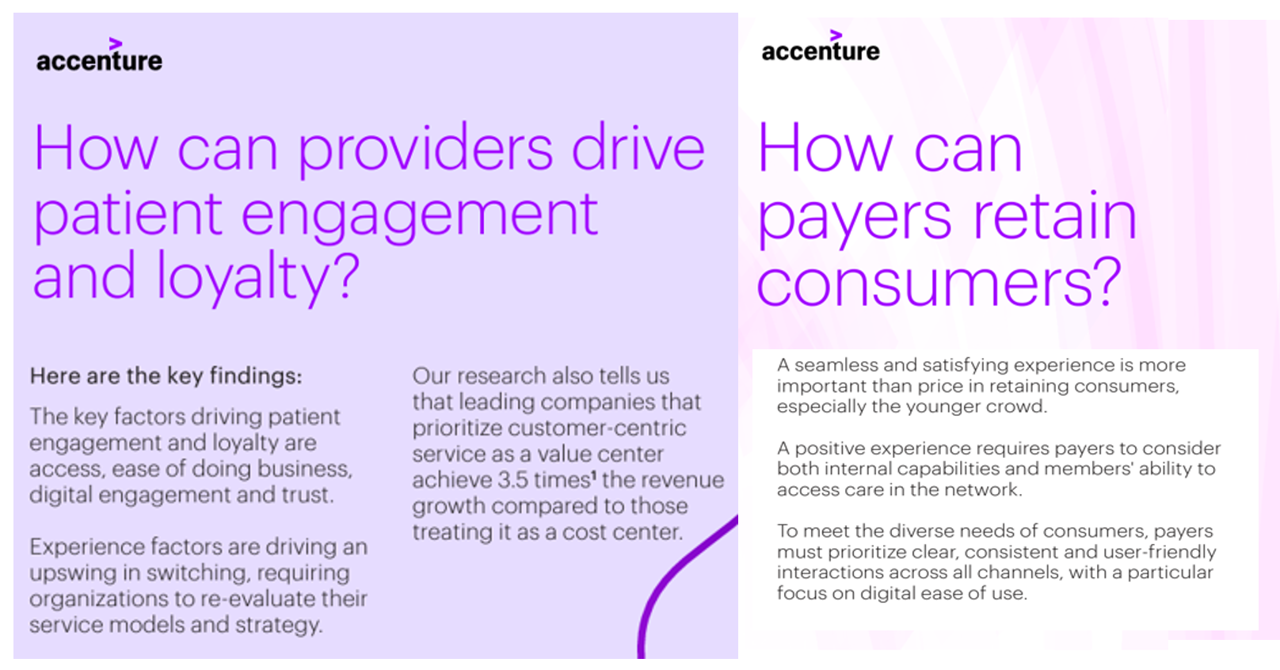

The ROI on Patient Experience = Loyalty, Trust and Revenue – Listening to Accenture

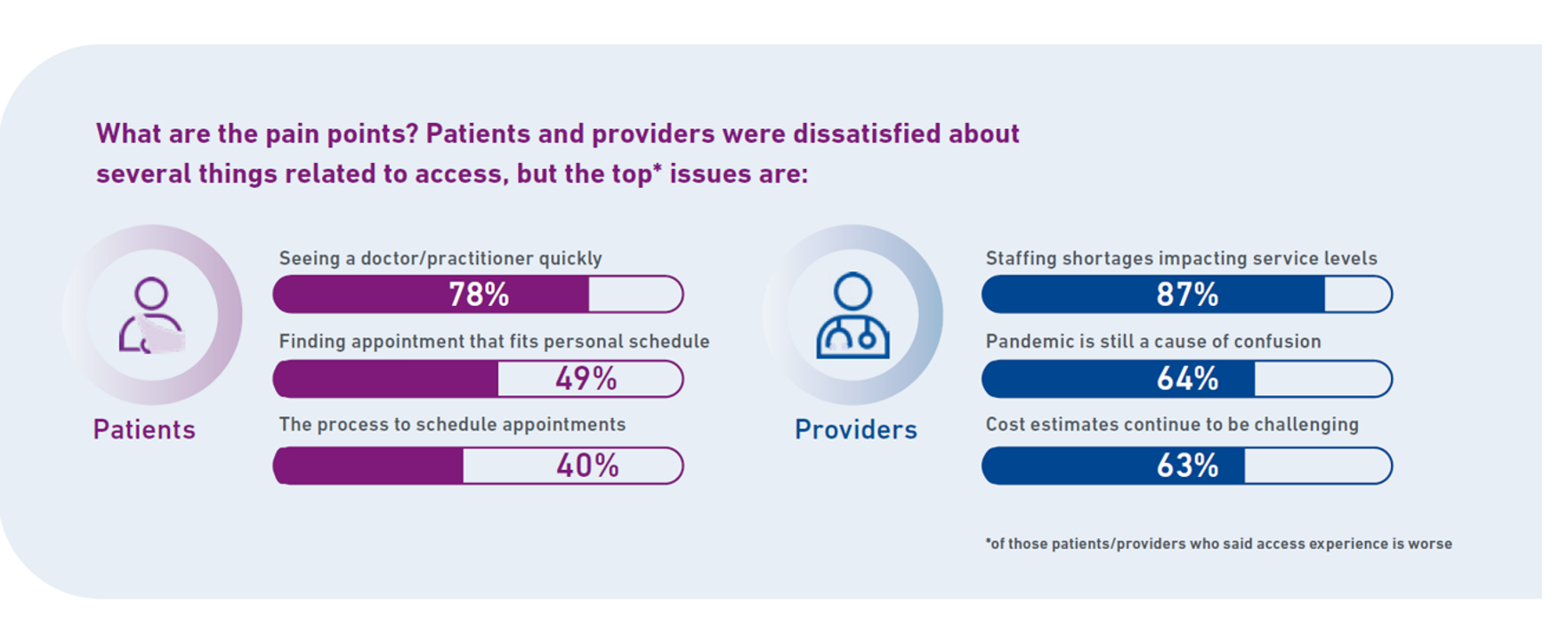

When health care providers and payers make patients’ lives easier, there’s a multiplying factor for loyalty and revenue growth, according to Accenture’s latest look into the value of experience in The Power of Trust: Unlocking patient loyalty in healthcare. Accenture conducted two surveys for this research, assessing nearly 16,000 U.S. adult consumers’ views on healthcare providers and health insurance plans. Several factors underpin patients’ selection of a new health care provider, especially: Access (70%), with a convenient location, quickly available appointments, digital/mobile/social interactions, and virtual care availability; and, The provider being a trusted source

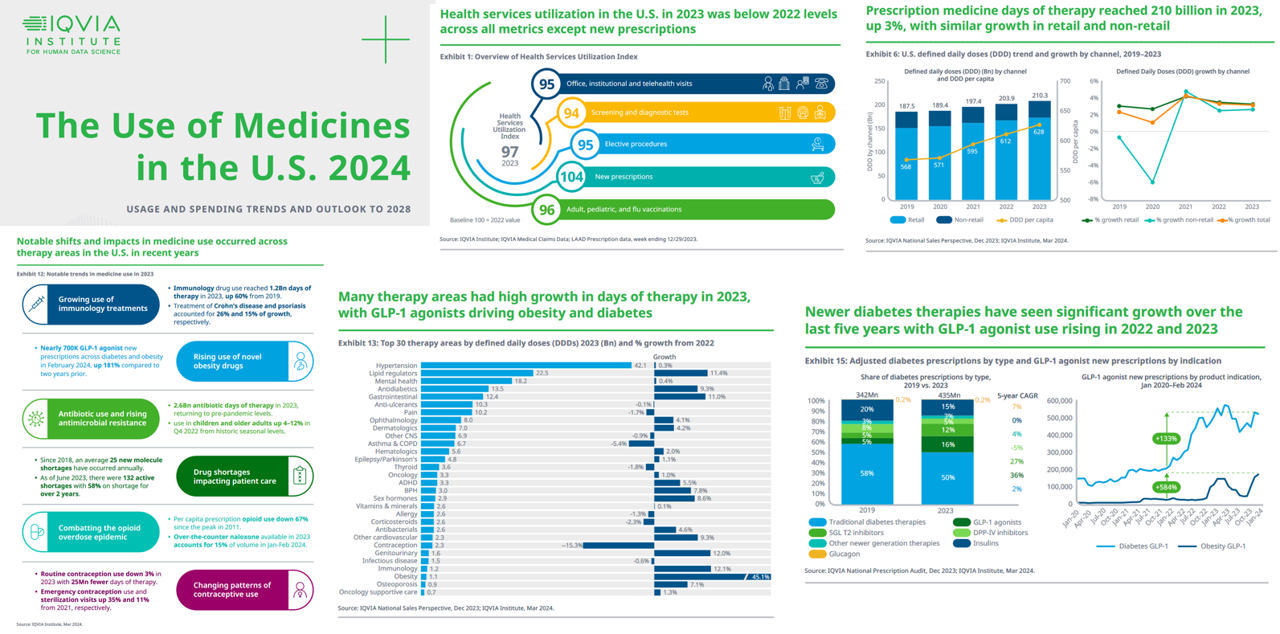

Prescriptions Are Up, Health Services Utilization Down, and GLP-1s Are a Major Growth Driver: IQVIA’s 2024 Update

In the past year, the growth of prescription drug utilization and spending has much to do with the use of GLP-1 agonists to treat diabetes and obesity, along with immunology therapy, and lipid meds, along with specialty medicines now accounting for over half of spending — up from 49% in 2018. This update comes from The Use of Medicines in the U.S. 2024 from the IQVIA Institute for Human Data Science. The annual report details trends in health services utilization, the use of prescription drugs, patient financing of those costs, the drivers underpinning the medicines spending, and an outlook to 2028.

Inflation, Health, and the American Consumer – “The Devil Wears Kirkland”

The Wall Street Journal reported yesterday that surging hospital prices are helping to keep inflation high. Hospital costs rose 7.7% last month, the highest increase in 13 years. This chart from WSJ’s reporting illustrates the >2x change in the CPI for hospitals vs the overall rate of price increases. Hospitals are not alone in price cliffs, with health insurance premiums spiking last year at the fastest rate in a decade, the Labor Statistics data showed. “For patients and their employers, the increases have meant higher health-insurance premiums, as well as limiting wage

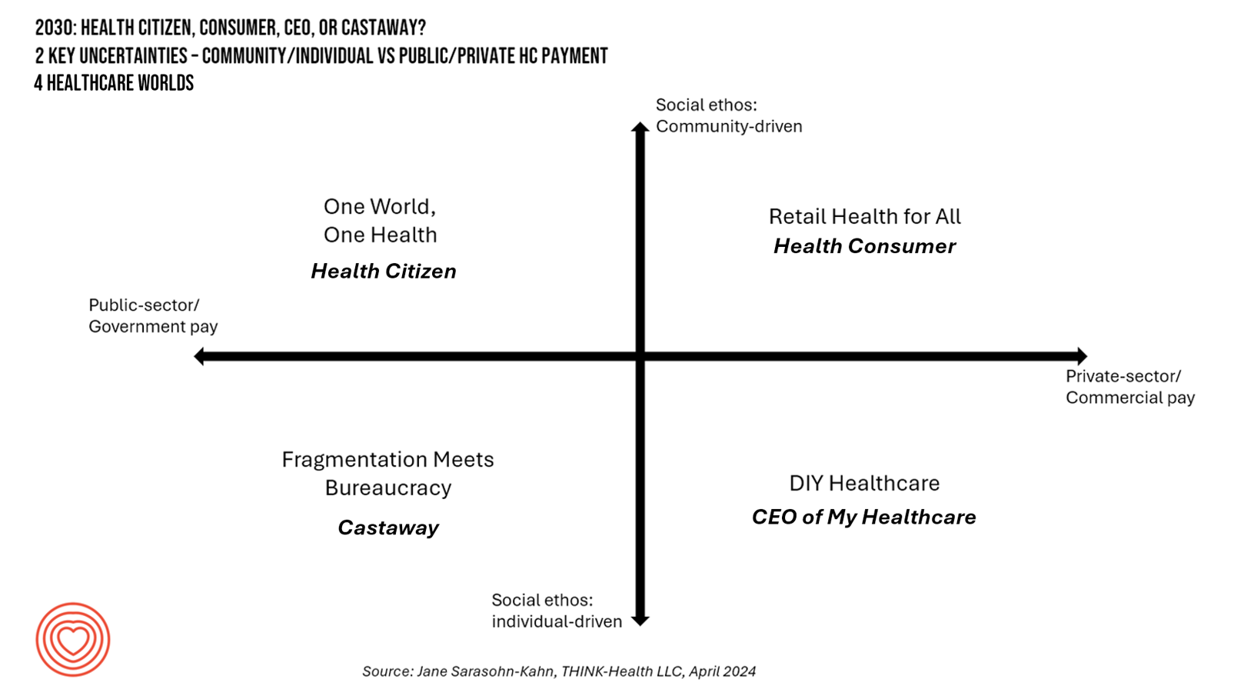

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 2

This post follows up Part 1 of a two-part series I’ve prepared in advance of the AHIP 2024 conference where I’ll be brainstorming these scenarios with a panel of folks who know their stuff in technology, health care and hospital systems, retail health, and pharmacy, among other key issues. Now, let’s dive into the four alternative futures built off of our two driving forces we discussed in Part 1. The stories: 4 future health care worlds for 2030 My goal for this post and for the AHIP panel is to brainstorm what the person’s

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 1

In the past few years, what event or innovation has had the metaphorical impact of hitting you upside the head and disrupted your best-laid plans in health care? A few such forces for me have been the COVID-19 pandemic, the emergence of Chat-GPT, and Russia’s invasion of Ukraine. That’s just three, and to be sure, there are several others that have compelled me to shift my mind-set about what I thought I knew-I-knew for my work with organizations spanning the health care ecosystem. I’m a long-time practitioner of scenario planning, thanks to the early education at the side of Ian

Considering Equity and Consumer Impacts of GLP-1 Drugs – A UBS Economist Weighs In

Since the introduction of GLP-1 drugs on the market, their use has split into two categories: for obesity and “recreationally,” according to the Chief Economist with UBS (formerly known as Union Bank of Switzerland). Paul Donovan, said economist, discusses The economics of getting thin in his regularly published comment blog. “These different uses have different economic consequences,” Donovan explains: Obese patients who use GLP-1s should become more productive employees, Donovan expects — less subject to prejudice, and less likely to be absent from work. While so-called recreational GLP-1 consumers may experience these

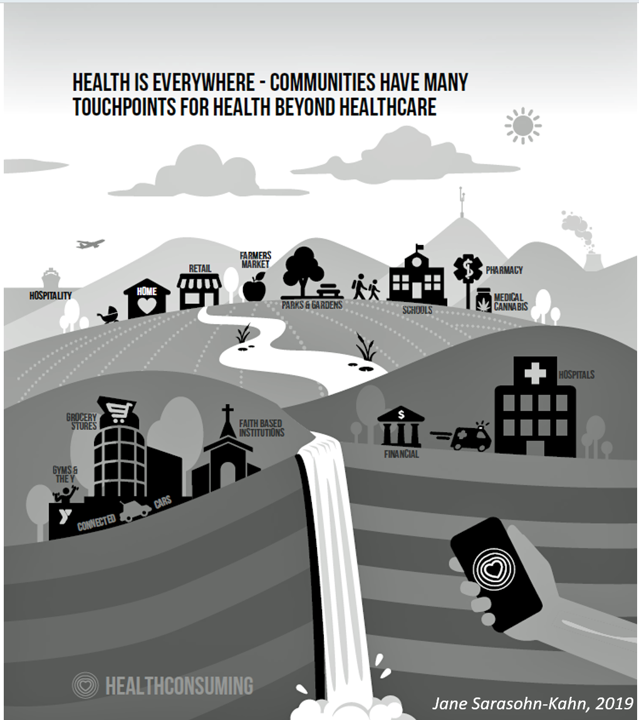

From Evolution to Innovation, from Health Care to Health: How Health Plans With Collaborators Are Re-Defining the Industry

As a constant observer and advisor across the health/care ecosystem, for me the concept of a “health plan” in the U.S. is getting fuzzier by the day. Furthermore, health plan members now see themselves as medical bill payers, seeking value and consumer-level services for their health insurance premium investment. Weaving these ideas together is my mission in preparing a session to deliver at the upcoming AHIP 2024 conference in June, I’m thinking a lot about the evolving nature of health insurance, plans, and the organizations that provide them. To help me define first principles, I turned to the American father

The Health Consumer in 2024 – The Health Populi TrendCast

At the end of each year since I launched the Health Populi blog, I have put my best forecasting hat on to focus on the next year in health and health care. For this round, I’m firmly focused on the key noun in health care, which is the patient – as consumer, as Chief Health Officer of the family, as caregiver, as health citizen. As my brain does when mashing up dozens of data points for a “trendcast” such as this, I’ll start with big picture/macro on the economy to the microeconomics of health care in the family and household,

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

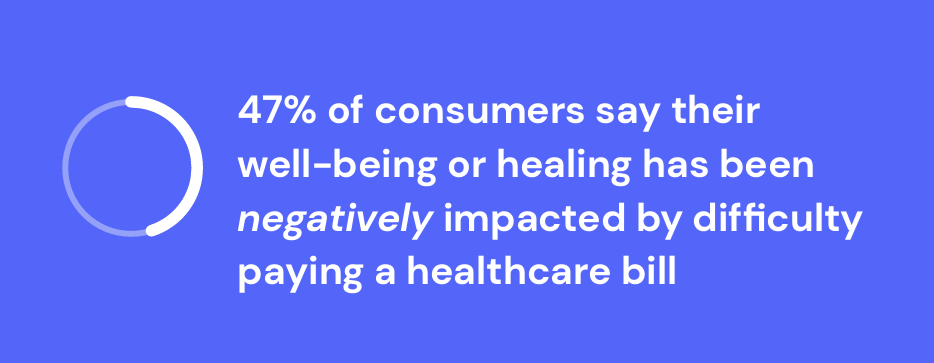

Money and Mental Health in the U.S. – How Difficulty Paying Medical Bills Can Hurt Healing and Well-Being

There is growing evidence on the connection between people’s financial health and their mental health, explored and explained in Understanding the Mental-Financial Health Connection, a study published by the Financial Health Network. Keep that relationship in mind in the context of a new forecast from Kaiser Family Foundation estimate the 2023 cost for employer-sponsored insurance for a family to reach nearly $24,000 in 2023. That cost is a 7% increase over last year, and is expected to be split with companies covering $17K (about 70%) and employees about $6600 (roughly 30%). KFF heard that

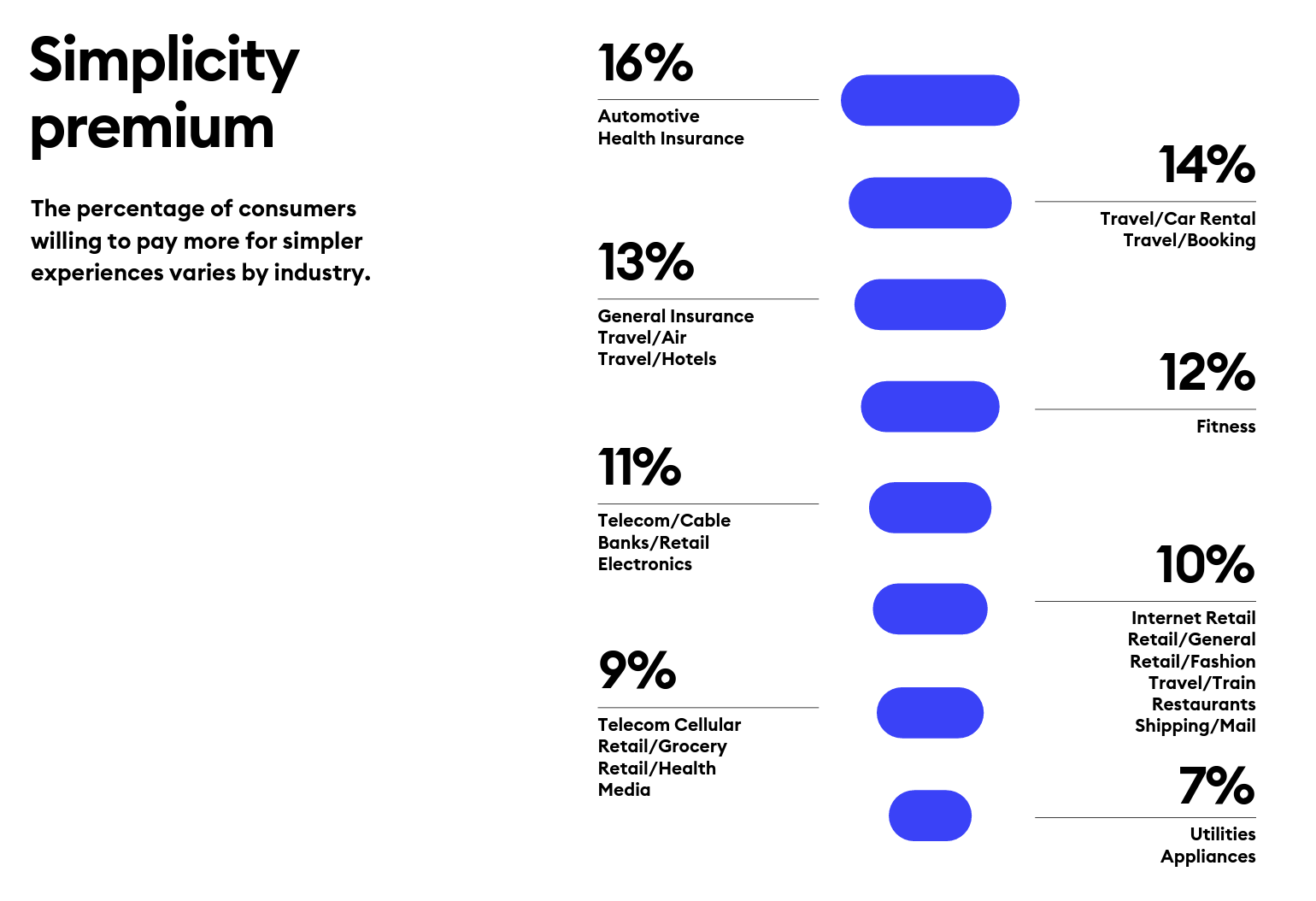

How Healthcare and Patients Can Benefit From a “Simplicity Premium”

“Simplicity is the ultimate sophistication,” Leonardo DaVinci wrote through his lens on innovation. Simplicity can be a transformational cornerstone of health/care innovation, we learn from Siegel+Gale’s report on the World’s Simplest Brands Tenth Edition (WSBX). Siegel+Gale found the most consumers are willing to pay more for simpler brand experiences and are more likely to recommend a brand for those simpler experiences, as well. Across the 15,000 consumers the firm polled globally (across nine countries), five key factors underpin peoples’ experiences with the enchantingly “simple” companies: they are, Easy to understand Transparent and honest Caring for

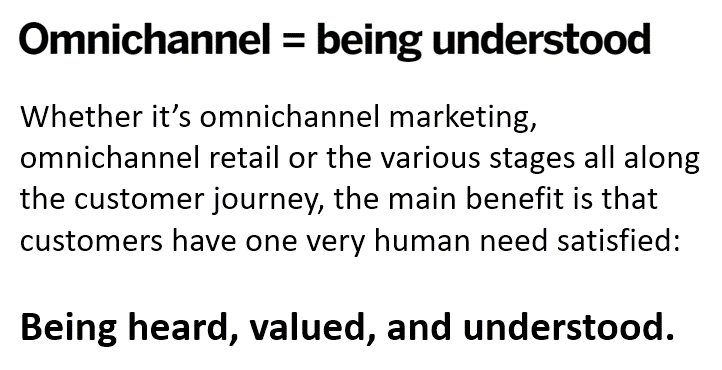

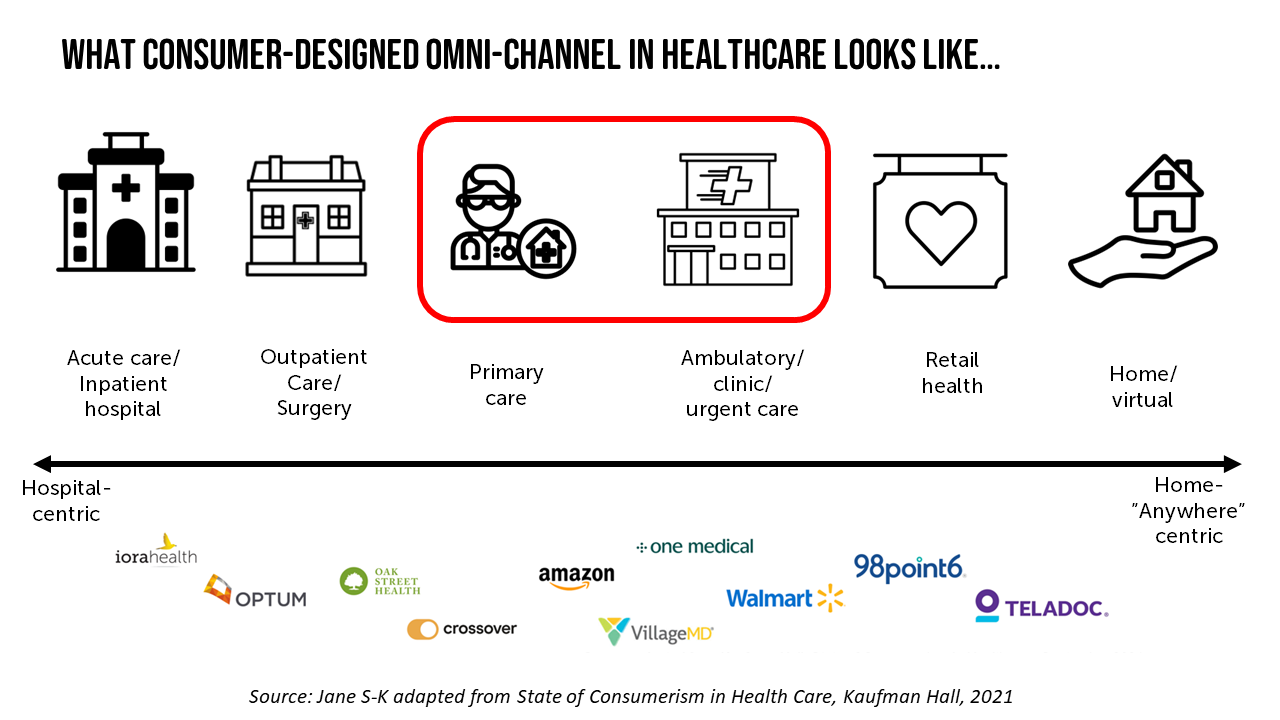

The Omnichannel Imperative for Healthcare: Supporting Telehealth Awareness Week 2023

“What omnichannel really means: hearing the customer wherever they are and making them feel heard, valued, and understood.” That statement comes from Qualtrics’ explanation of omnichannel experience design. The very human needs of feeling one is heard, is valued, and is understood, underpin the rasion d’etre of omnichannel marketing. And these very values are those that underpin the trust between patients and providers and the large healthcare ecosystem. It’s Telehealth Awareness Week, led by the ATA. I celebrate and support the effort; this Health Populi post explains the Association’s mantra that Telehealth is Health, and that

The Clinician of the Future: A Partner for Health, Access, Collaboration, and Tech-Savviness

One-half of clinicians working in the U.S., doctors and nurses alike, are considering leaving their current role in the next two to three years. That 1 in 2 clinicians is significantly greater than the global 37% of physicians and nurses thinking about leaving their roles in the next 3 years, according to the report Clinician of the Future 2023 from Elsevier. Elsevier first conducted research among doctors and nurses for the Clinician of the Future report in 2022, following up this year’s survey research online among 2,607 clinicians working around the world: Elsevier polled

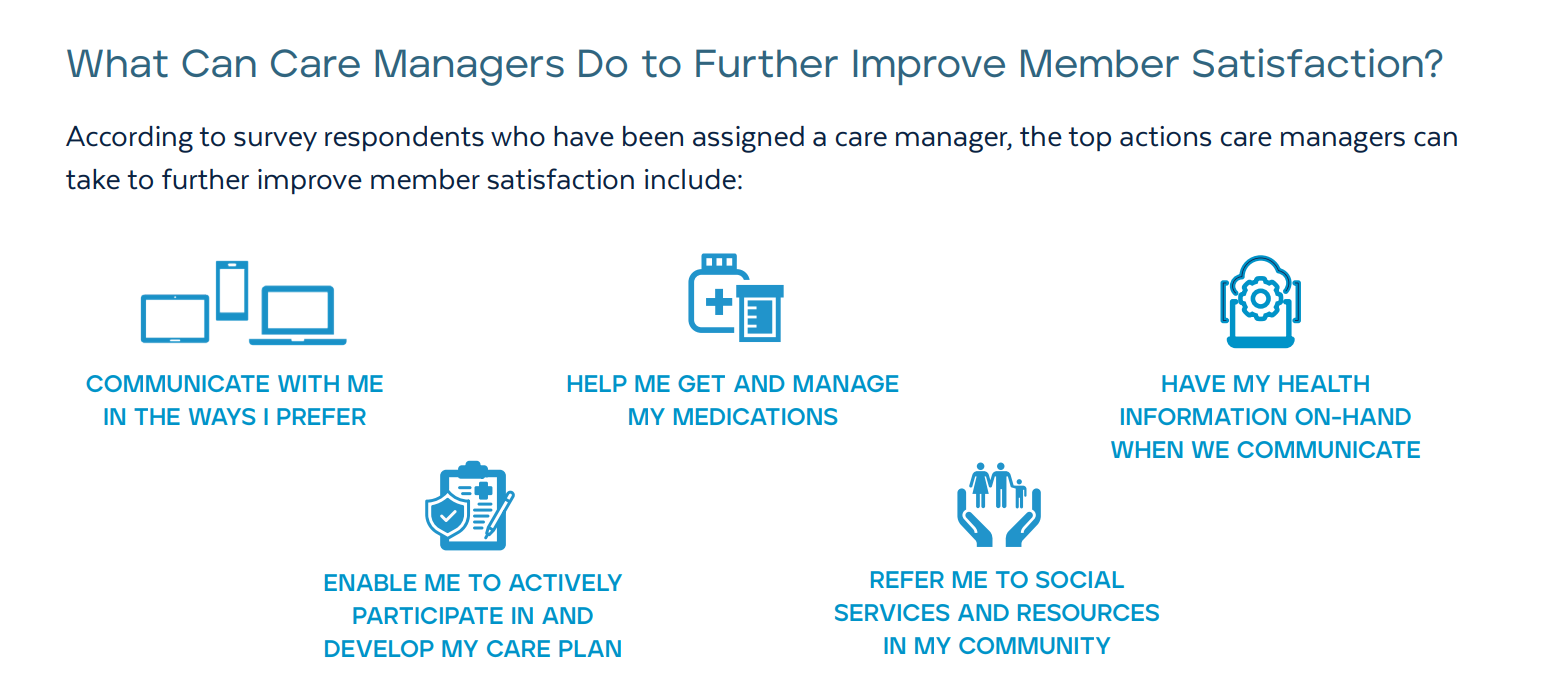

Personalizing Health Means Personalizing Health Insurance for Patient-Members – Learning from HealthEdge

As patients assume more financial skin in their personal healthcare, they take on the role of demanding consumer, or “impatient patients.” HealthEdge’s latest research into health consumers’ perspectives finds peoples’ satisfaction with their health insurance plans lacking, with members seeking easier access their personal health information, high levels of service, and rewards for healthy behaviors. Health plans would also boost consumers’ satisfaction by channeling patients’ access to the kinds of medical providers that align with consumers’ preferences and personal values, and by personalizing information to steer people toward lower-cost care.

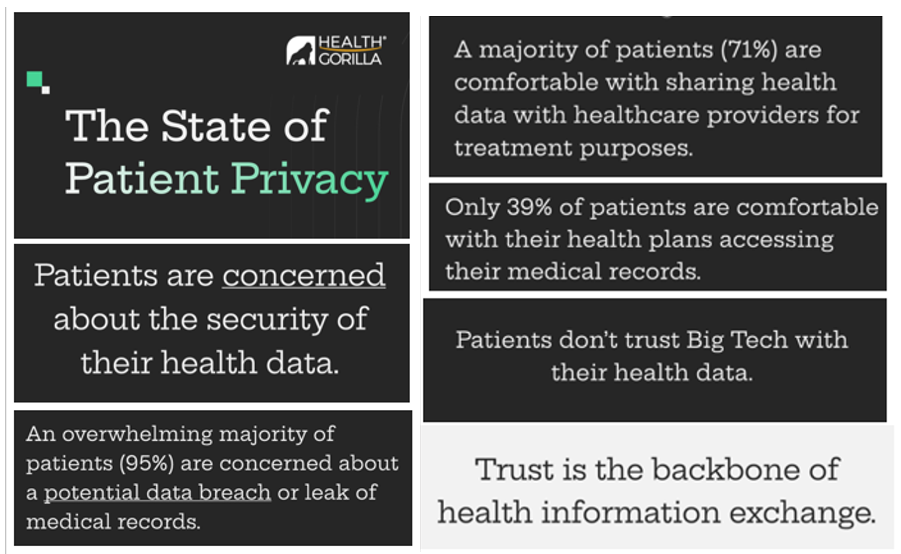

Patients Don’t Trust Big Tech with Personal Health Information Much Preferring Healthcare Providers as Data Stewards

Nearly all patients are concerned about their medical records getting leaked or breached, which is The State of Patient Privacy, the title of a consumer study from Health Gorilla with a headline finding that “Patients don’t trust Big Tech with their health data.” With trust the “backbone” of health information exchange, Health Gorilla calls out, we have to face a big challenge here as health care enters its own sort of industrial revolution embedded AI and data analytics across the health/care ecosystem. How to re-build trust with the very technology that can help health care,

To Avert a GLP-1 Cost Tsunami, Add Lifestyle Interventions: Learning from Virta Health

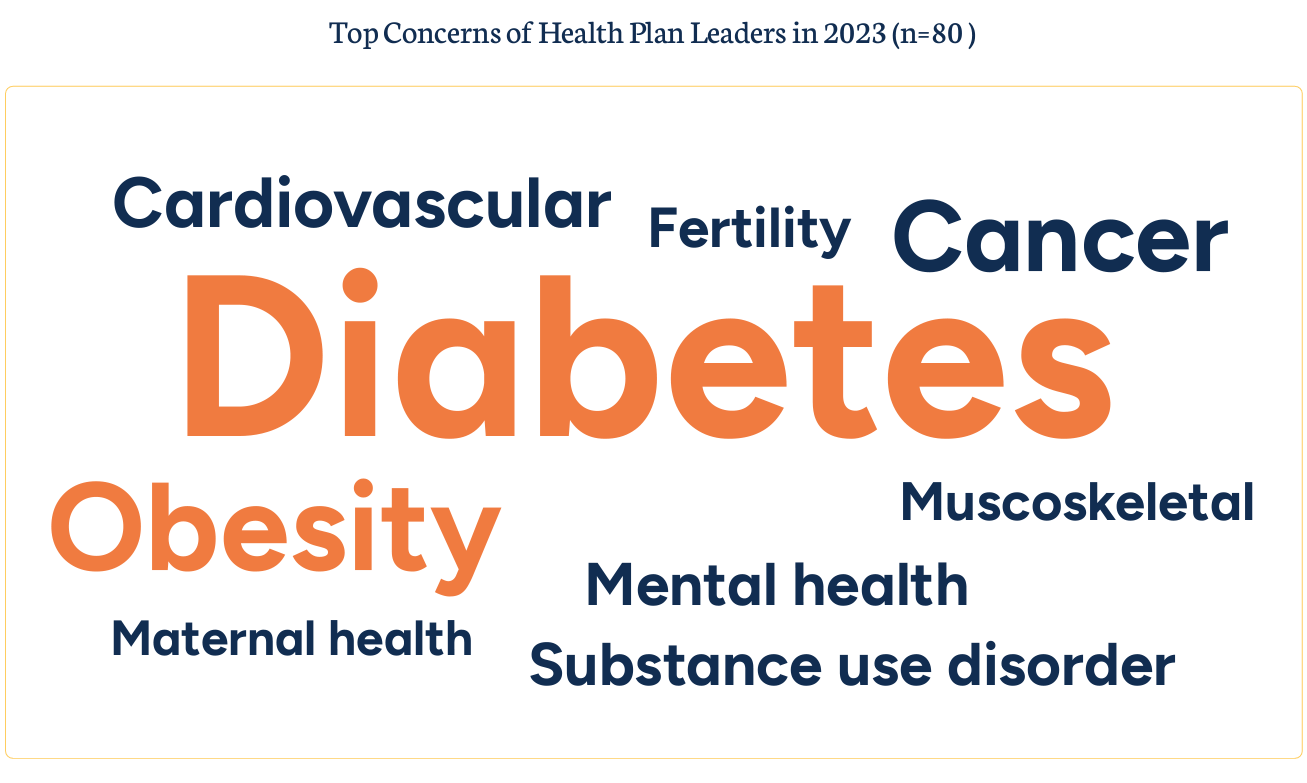

With consumer and prescriber interest in GLP-1 receptor agonist drugs “soaring,” health plan managers have a new source of financial stress and clinical questions on their to-do list. A team of Virta Health leaders held a webinar on 13th July 2023 to explain the results of a study the company just completed assessing health plan execs’ current views on Ozempic and other GLP-1 medicines with a view on both clinical outcomes and cost implications for this growing category of drugs that address diabetes and obesity. Indeed, diabetes and obesity are top health concerns among the

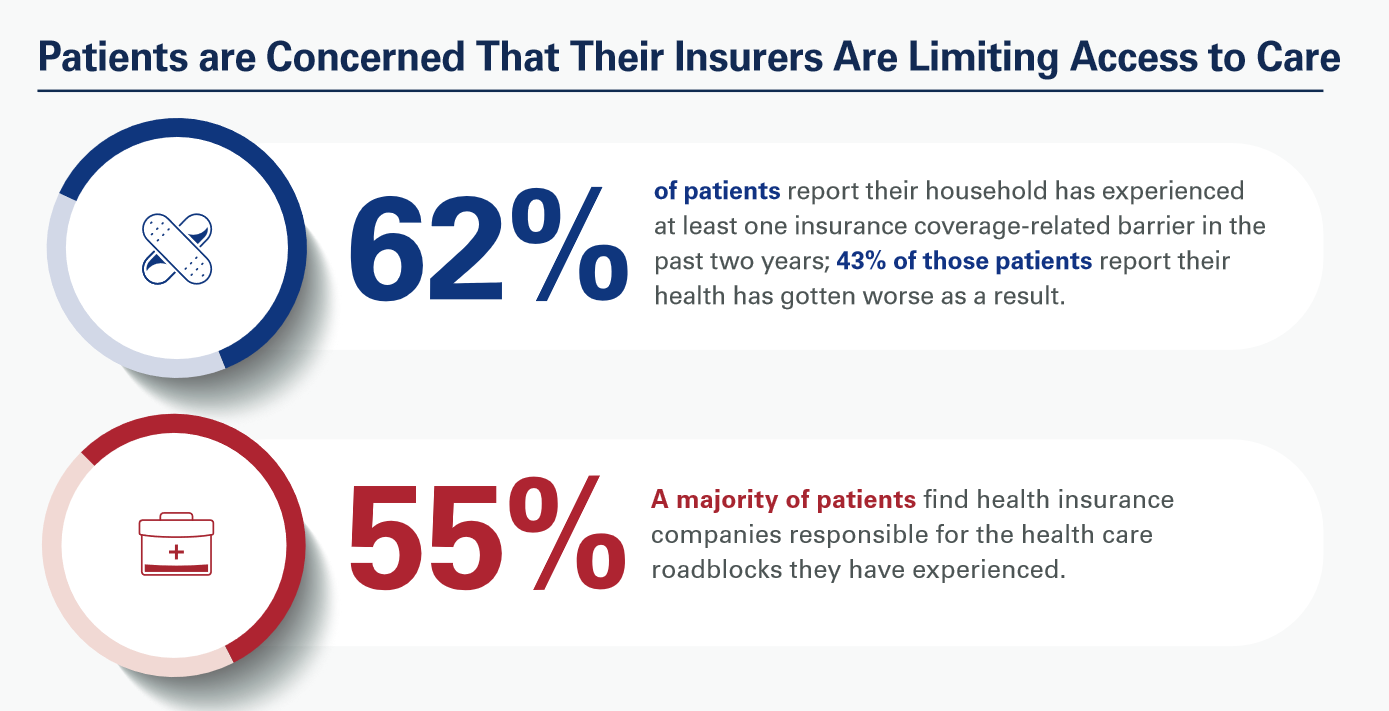

Patients, Nurses and Doctors Blame Health Insurers for Increasing Costs and Barriers to Care

Most patients, nurses and doctors believe that health insurance plans reduce access to health care which contributes to clinician burnout and increases costs, based on three surveys conducted by Morning Consult for the American Hospital Association (AHA). Most patients have experienced at least one health insurance related barrier in the past two years, and 4 in 10 of those people said their health got worse as a result of that care-barrier. “These surveys bear out what we’ve heard for years — certain insurance companies’ policies and practices are reducing health care access and making

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

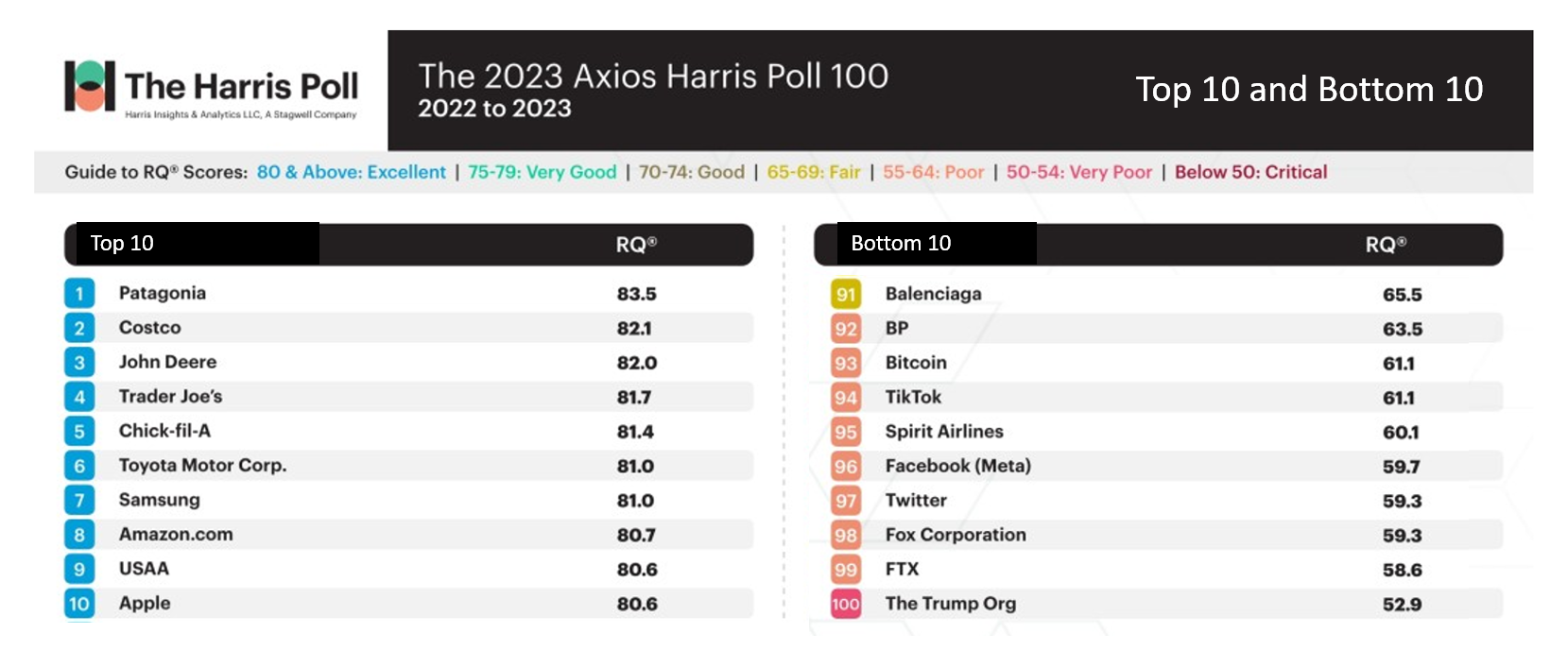

Searching for Health/Care Touchpoints in the 2023 Axios Harris Poll 100

Patagonia, Costco, John Deere, and Trader Joe’s are loved; Twitter, Fox Corp., FTX and The Trump Organization? Not so much. Welcome to 2023 Axios Harris Poll 100 list of companies U.S. consumers rate from excellent in terms of reputation to very poor and, one in particular, “critical.” Exploring the list, we can find insights into consumers’ preferred touchpoints for health, health care, and well-being curated in their daily lives. In this, today’s, Health Populi blog, I consider The 2023 Axios Harris Poll 100 reputation rankings in light of what we learned from the Morning Consult Most Trusted Brands 2023 study

Food Is Medicine, Especially When You Are Hungry – The American Heart Association‘s FIM Initiative

Food is a basic need, fundamental to our lives and well-being. And for millions of people around the world, and innumerable health citizens in the U.S., food security is part of daily life in 2023. Furthermore, as the U.S. Congress faces voting on the debt ceiling, the issue of SNAP benefits for nutritional assistance (aka “food stamps”) has been identified as a negotiating line-item by certain Federal budget-cut minded folks. That’s why the Food Is Medicine Initiative, launched collaboratively between the American Heart Association and The Rockefeller Foundation, is so timely and welcome. “The vision for

Don’t Mess with Medicare and Medicaid, Washington: They Remain Popular with Americans Across Party ID

A majority of the U.S. public does not want politicians to “up-end” government-funded health programs, according to the Kaiser Family Foundation’s March 2023 Health Tracking Poll. Social Security, Medicare, and Medicaid all garner most partisans’ support whether identifying as Democrat, Independent, or Republican, KFF found in their monthly poll of U.S. voters ages 18 and over. The survey was conducted online and by telephone among 1,271 U.S. adults between March 14-23, 2023. Among all the important findings in this well-timed poll, I’ll point to the issue of public

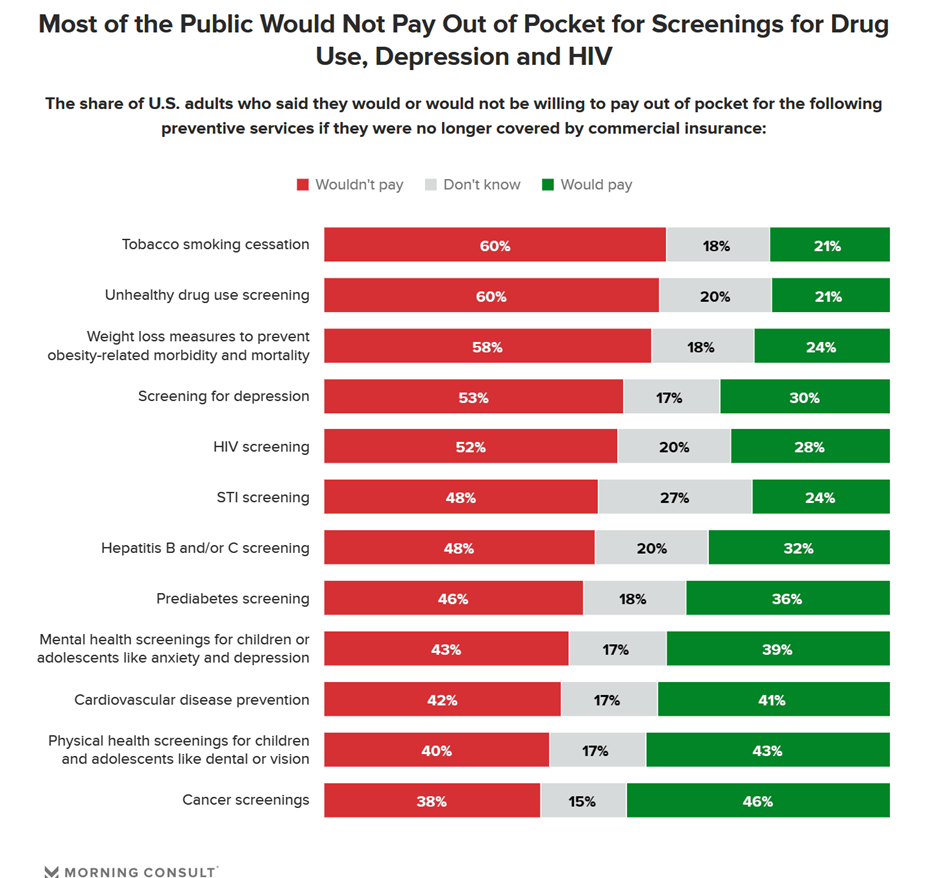

The Patient Is Still the Payor – And May Skip Paying for Prevention (Eyes on the ACA & Texas)

Many health citizens in the U.S. would likely skip receiving preventive health care services if the Affordable Care Act’s (ACA) coverage for them goes away, a Morning Consult survey found. The first chart illustrates the top-line of this research: that most U.S. adults would not pay out of pocket for several preventive services including tobacco cessation, drug use screening, weight loss measures to prevent obesity-related illnesses, as well as screening for depression or HIV. One of the key benefits embedded in the ACA was “free” without co-pay shares for preventive care. These

When Household Economics Blur with Health, Technology and Trust – Health Populi’s 2023 TrendCast

People are sick of being sick, the New York Times tells us. “Which virus is it?” the title of the article updating the winter 2022-23 sick-season asked. Entering 2023, U.S. health citizens face physical, financial, and mental health challenges of a syndemic, inflation, and stress – all of which will shape peoples’ demand side for health care and digital technology, and a supply side of providers challenged by tech-enabled organizations with design and data chops. Start with pandemic ennui The universal state of well-being among us mere humans is pandemic ennui: call it languishing (as opposed to flourishing), burnout, or

Omnichannel, Hybrid Health Care Is Happening – Let’s Bake It with Access and Equity

In just the past few months, we’ve seen the launch of Amazon Care, Instacart adding medical deliveries, and The Villages senior community welcoming virtual care to their homes. Welcome to the growing ecosystem of hybrid health care, anywhere and everywhere. In my latest post on the Medecision portal, I discuss the phenomenon and examples of early models, focusing in on Evernorth, a Cigna company. As we add new so-called “digital front doors” to health care delivery, we should be mindful to design in access and equity and avoid further fragmentation of an already-fragmented

Thinking Value-Based Health Care at HLTH 2022 – A Call-to-Action

The cost of health insurance for a worker who buys into a health plan at work in 2022 reached $22,463 for their family. The average monthly mortgage payment was $1,759 in mid-2022. “When housing and health both rank as basic needs in Maslow’s hierarchy, what’s a health system to do?” I ask in an essay published today on Crossover Health’s website titled Value-Based Care: Driving a Social Contract of Trust and Health. The answer: embrace value-based care. Warren Buffett wrote Berkshire Hathaway shareholders in 2008, asserting that, “Price is what you pay. Value

How Will the “New” Health Economy Fare in a Macro-Economic Downturn?

What happens to a health care ecosystem when the volume of patients and revenues they generate decline? Add to that scenario a growing consensus for a likely recession in 2023. How would that further impact the micro-economy of health care? A report from Trilliant on the 2022 Trends Shaping the Health Economy helps to inform our response to that question. Start with Sanjula Jain’s bottom-line: that every health care stakeholder will be impacted by reduced yield. That’s the fewer patients, less revenue prediction, based on Trilliant’s 13 trends re-shaping the U.S. health

Home Is Where the Health Is: An Update on Connectivity, Food, and Retail

Virtually every closed-door meeting I have had in the U.S. with a client group in the past several months has had a line item on the agenda to brainstorm the impact and opportunity of care-at-home, hospital-to-home, or Care Everywhere. This has happened across many stakeholders in the evolving health/care ecosystem of suppliers, including hospital systems, health plans, grocery chains, retail pharmacy, consumer technology, digital health and tech-enabled providers, pharma and medical supply companies. On October 10, Dr. Robert Pearl, former CEO of The Permanente Medical Group, published a provocative post on Forbes noting that Amazon, CVS, Walmart Are Playing Healthcare’s

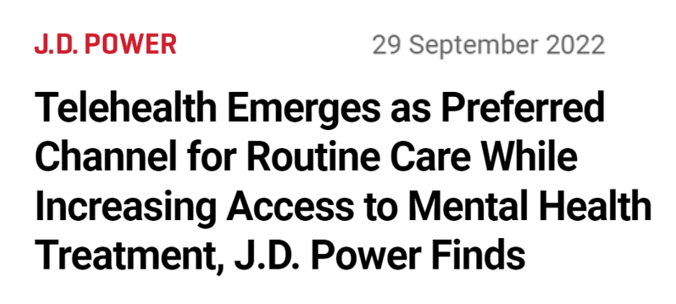

Telehealth-As-Healthcare Is a Mainstream Expectation Among Consumers, J.D. Power Finds

Telehealth has increased access to mental health services, I’ve highlighted this Mental Illness Awareness Week here in Health Populi. But telehealth has also emerged as a preferred channel for routine health care services, we learn from J.D. Power’s 2022 Telehealth Satisfaction Study. Among people who had used virtual care in the past year, telehealth-as-healthcare is now part of mainstream Americans’ expectations as a normal part of their medical care. That’s because 9 in 10 users of telehealth in the U.S. would use virtual care to receive medical services in the future, J.D. Power found in

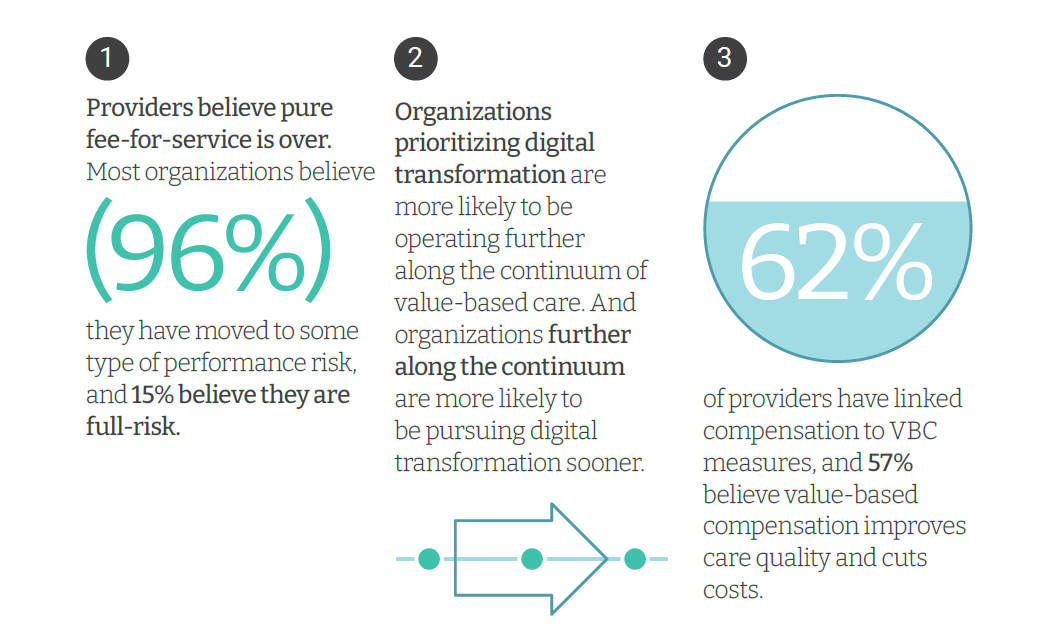

The Direct Link Between Value-Based Health Care, Digital Transformation and Social Determinants – Insights from Innovaccer and Morning Consult

Only 4% of health care payments in the U.S. are pure fee-for-service (FFS) these days. “The end of pure FFS is near,” according to The State and Science of Value-Based Care, a report-out of survey research from Innovaccer and Morning Consult. Innovaccer, a health cloud/data analytics company, worked with Morning Consult to do deep-dive interviews with 75 senior health care executives; research was conducted in November and December 2021, so these perspectives represent those of health system leaders at the start of 2022. The full report is worth your read; my focus in this Health

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

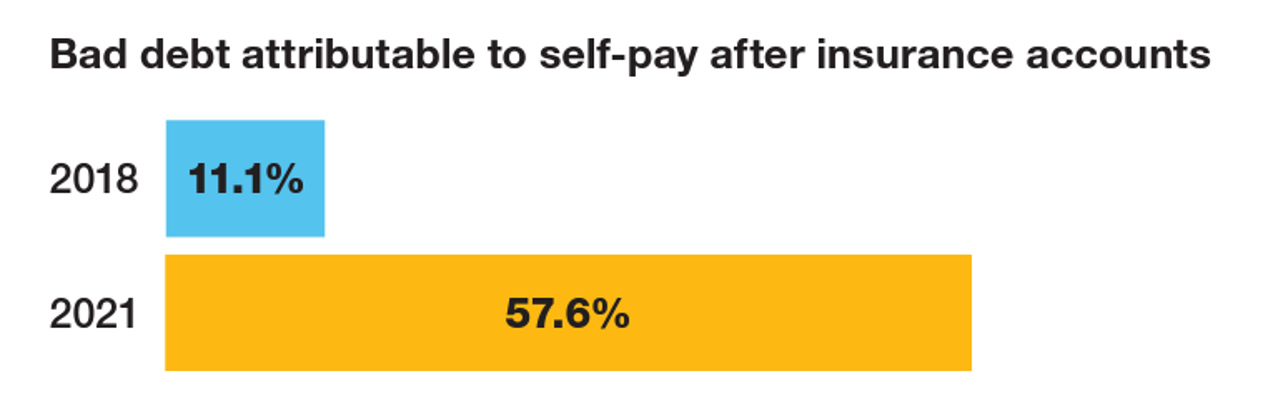

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

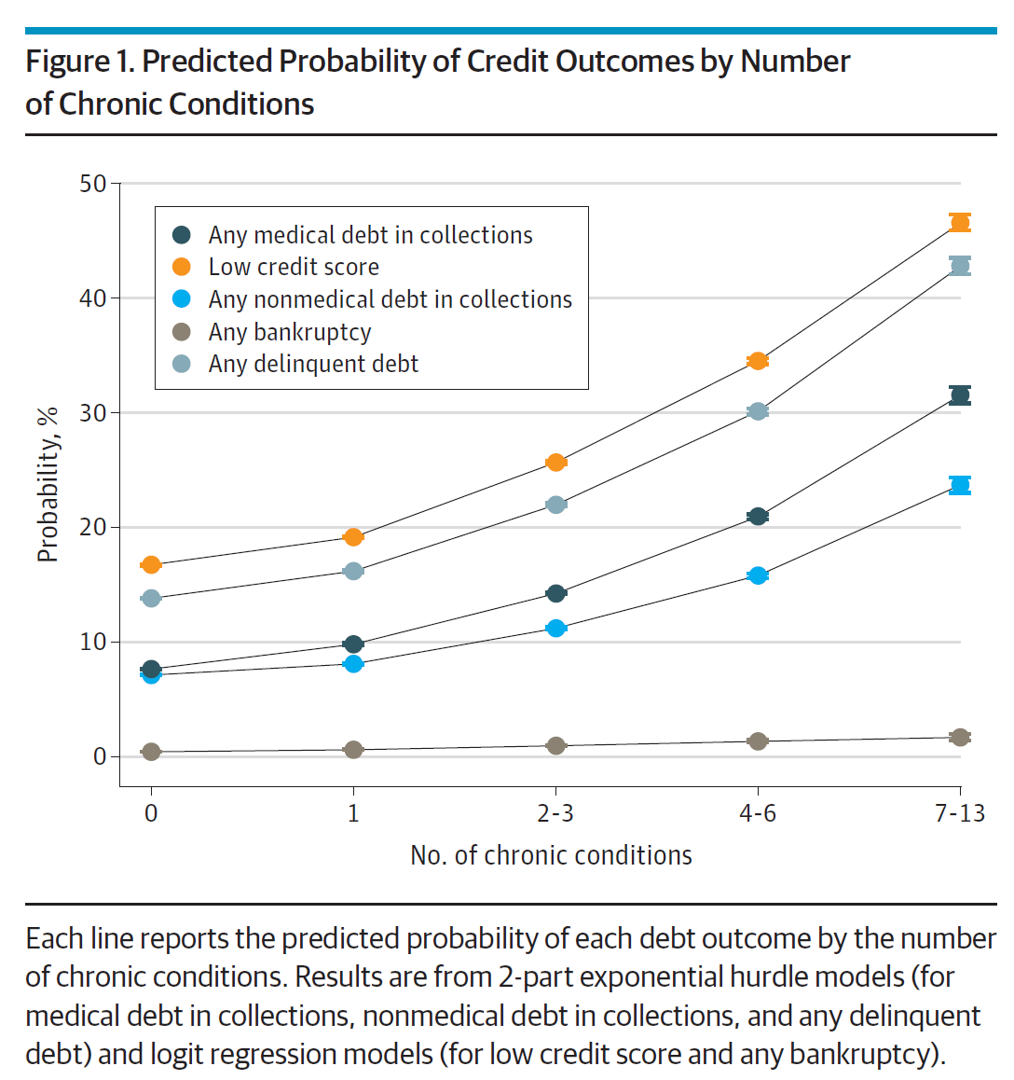

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

Partnering Up in the Health Care Ecosystem to Drive Transformation – for Organizations and Health Consumers Alike

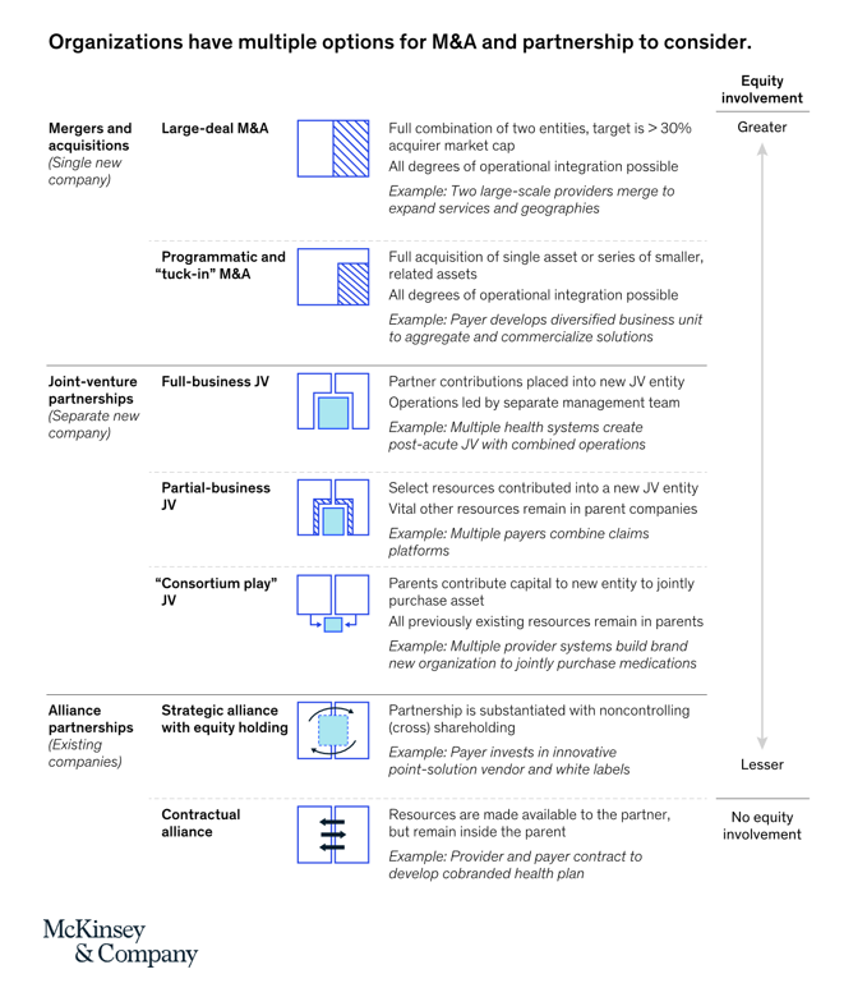

“Partnerships, including JVs and alliances with other healthcare organizations and with new entrants, are just one way to access new capabilities, unlock speed to market, and achieve capital, scale, and operational efficiencies” in health care transformations. “In an environment with continued competition for attractive assets and significant capital in play from institutional investors, these partnerships may also be the most accessible way for organizations to capture value in expanding healthcare services and technology value pools,” we learn in Overcoming the cost of healthcare transformation through partnerships from a team of health care folks with McKinsey & Company.

The Retail Health Battle Royale, Day 5 – Consumer Demands For a Health/Care Ecosystem (and What We Can Learn from Costco’s $1.50 Hot Dog)

In another factor to add into the retail health landscape, Dollar General (DG) the 80-year old retailer known for selling low-priced fast-moving consumer goods in peoples’ neighborhoods appointed a healthcare advisory panel this week. DG has been exploring its health-and-wellness offerings and has enlisted four physicians to advise the company’s strategy. One of the advisors, Dr. Von Nguyen, is the Clinical Lead of Public and Population Health at Google….tying back to yesterday’s post on Tech Giants in Healthcare. Just about one year ago, DG appointed the company’s first Chief Medical Officer, which I covered here in

The Retail Health Battle Royale in the U.S. – A Week-Long Brainstorm, Day 1 of 5

I’ve returned to the U.S. for a couple of months, having lived in and worked from Brussels, Belgium, since October 2021 (save for about ten days in March 2022). Work and life slow down in Europe in July and August, giving us the opportunity to return to our U.S. home base, reunite with friends and family, and re-join life and living this side of the Atlantic. The timing of my return to the U.S. coincides with a retail health hurricane of big announcements shaking up the health/care ecosystem. Among these events are Amazon’s plan to acquire One Medical, Apple’s publication of

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

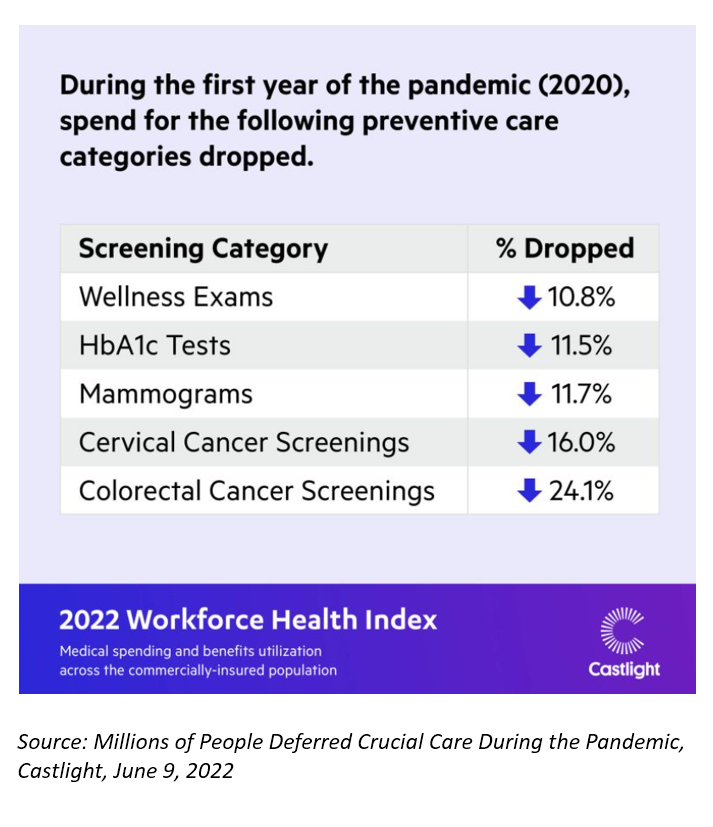

Use of Preventive Health Services Declined Among Commercially Insured People – With Big Differences in Telehealth for Non-White People, Castlight Finds

Declines in preventive care services like cancer screenings and blood glucose testing concern employers, whose continued to cover health insurance for employees during the pandemic. “As we enter the third year of the COVID-19 pandemic, employers continue to battle escalating clinical issues, including delayed care for chronic conditions, postponed preventive screenings, and the exponential increase in demand for behavioral health services,” the Chief Medical Officer for Castlight Health notes in an analysis of medical claims titled Millions of People Deferred Crucial Care During the Pandemic, published in June. The

The Evolution of a Patient Ambassador – Learning from Stacy Hurt

“I am a health care executive who happens to be a patient, caregiver, and advocate,” Stacy Hurt explained to me in a Zoom chat we shared on 31 May. I asked her to meet with me to discuss her professional news update: being appointed Parexel’s first Patient Ambassador. My Zoom invitation to Stacy was a very convenient excuse for me to catch up with a friend in the field: we have known each other since Stacy started to grow her health-social media presence on Twitter. And that involvement in

Jasper, Scaling a Human Touch for People Dealing with Cancer, Now With Walgreens

Each year, the first Sunday in June marks National Cancer Survivors Day. This year’s NCSD occurred two days ago on Sunday, 5th June. When you’re a cancer survivor, or happen to love one, every day is time to be grateful and celebrate that survival of someone who has come through a cancer journey. We all know (or are) people who have survived cancer. We know that the recipe for battling cancer goes beyond chemotherapy. We know of the resilience and grit required in the process: body, mind, and spirit. “Celebrate Life” is the mantra of NCSD, as this year’s campaign

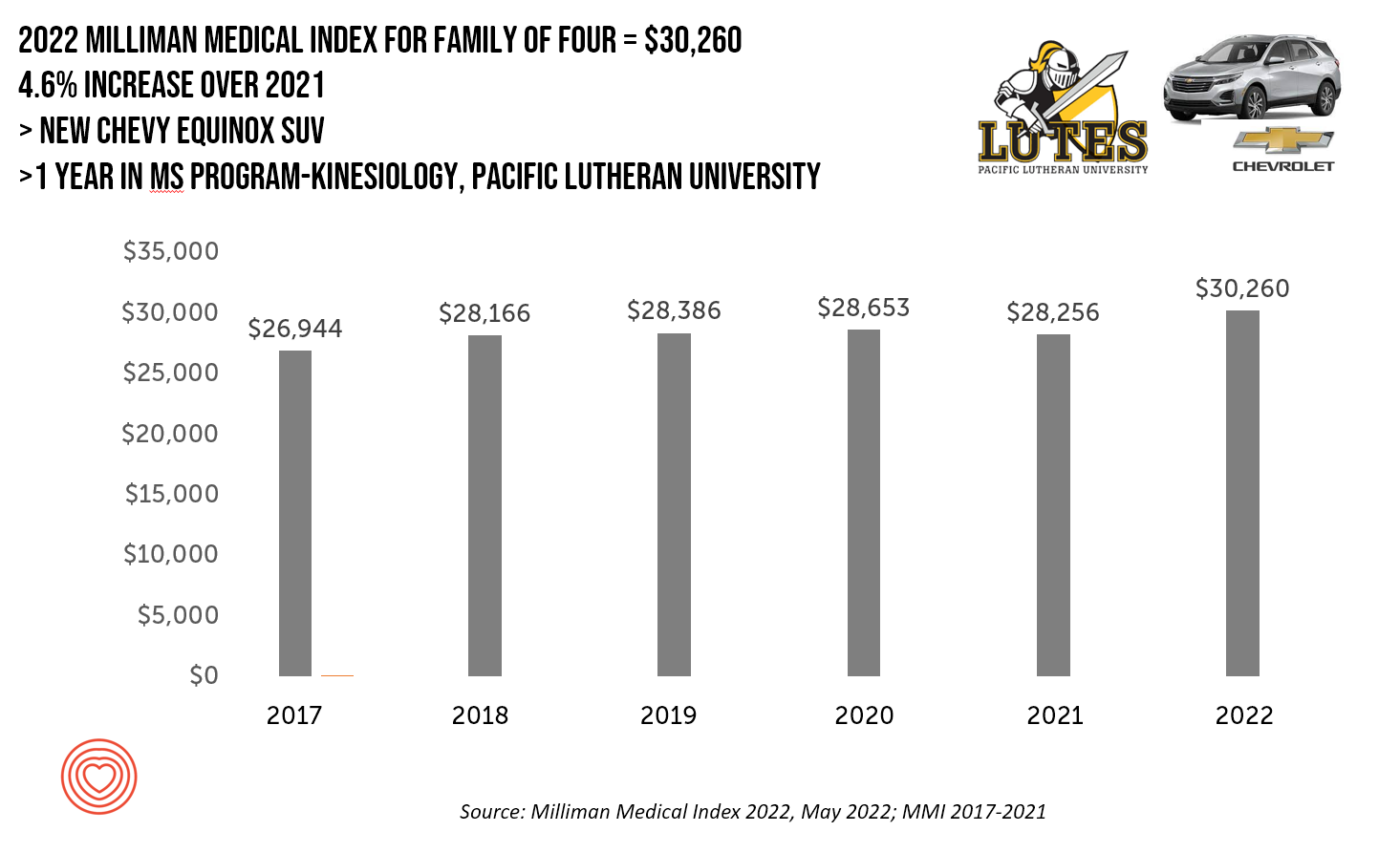

A New Chevy Equinox SUV, a Year in Grad School, or Health Care for Four – The 2022 Milliman Medical Index

A new Chevy Equinox SUV, a year in an MS program in kinesiology at Pacific Lutheran U., or health care for a family of four. At $30,260, you could pick one of these three options. Welcome to this year’s 2022 Milliman Medical Index, which annually calculates the health care costs for a median family of 4 in the U.S. I perennially select two alternative purchases for you to consider aligning with the MMI medical index. I have often picked a new car at list price and a year’s tuition at a U.S. institution of

The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Add on top of these significant stressors the need to deal with medical bills, which is another source of stress for millions of patients in America. I appreciated the opportunity to share my perspectives on “The Patient As the Payer: How the Pandemic, Inflation, and Anxiety are Reshaping Consumers” in a webinar hosted by CarePayment on 25 May 2022. In this

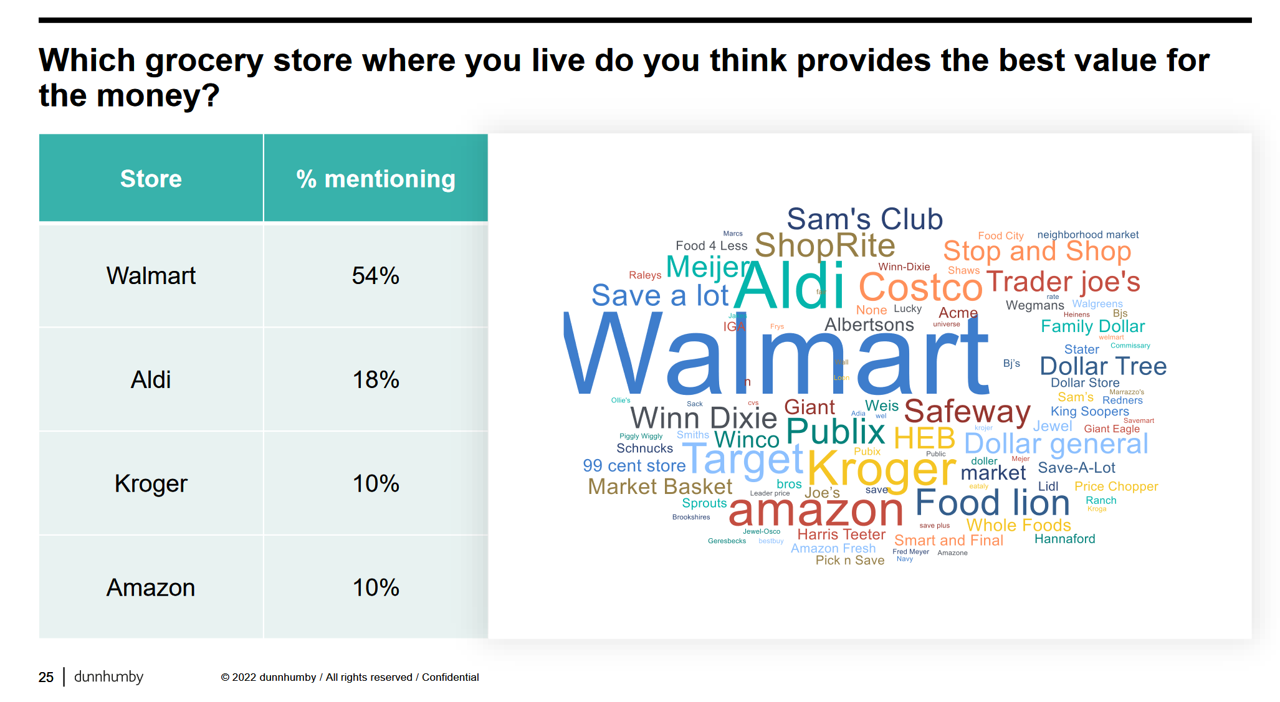

How the Pandemic, Inflation and Ukraine Are Re-Shaping Health Consumers – Learnings from dunnhumby

Too many dollars, stimulated by an influx of COVID-19 government stimulus, are chasing too few goods in economies around the world. Couple this will labor, material shortages, and disrupted supply chains, the exogenous shock of the Ukraine crisis amplifying cost increases and shortage driving higher prices for food and commodities, and global consumers are faced with strains in household budgets. This is impacting grocery stores and. through my lens, will impact health consumers’ spending, as well. In their discussion of Customer First Retailer Responses to Inflationary Times, dunnhumby, retail industry strategists, covered an update on inflation with the top-line that

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

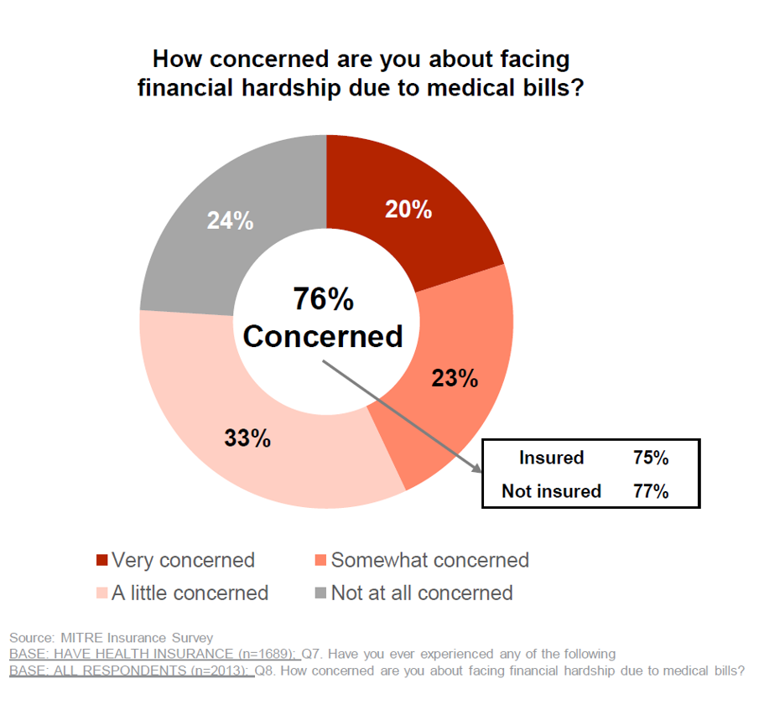

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care). But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today. “Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of

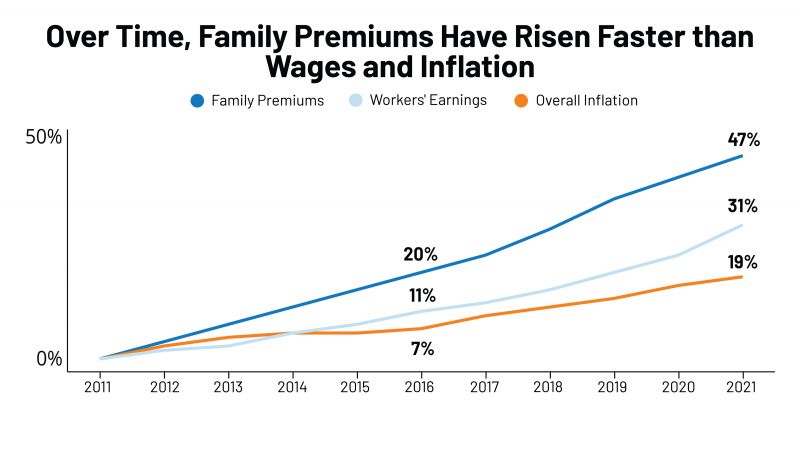

The Cost to Cover Health Insurance for a Family in America Is $22,221

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages. That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey. This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes. This 2021 update takes into account the impacts and influence of COVID-19 on workers’

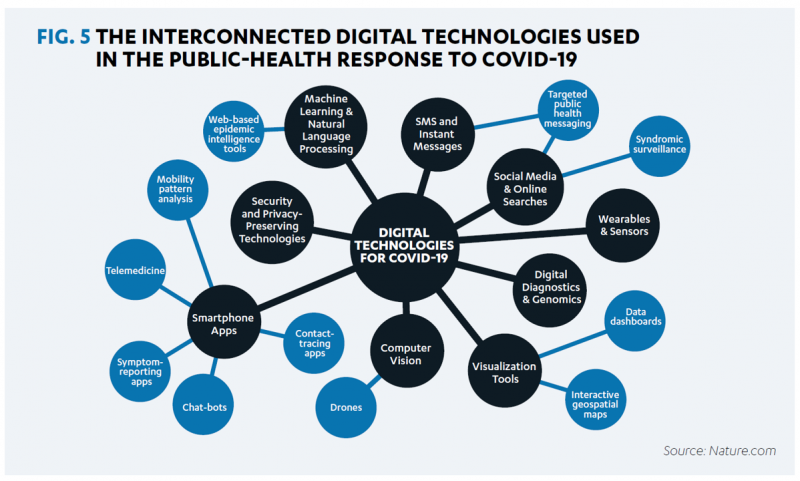

Designing Digital Health for Public Health Preparedness and Equity: the Consumer Tech Association Doubles Down

A coalition of health care providers, health plans, technology innovators, NGOs, and medical societies has come together as the Public Health Tech Initiative (PHTI), endorsed by the Consumer Technology Association (CTA) with the goal of advancing the use of trustworthy digital health to proactively meet the challenge of future public health emergencies….like pandemics. At the same time, CTA has published a paper on Advancing Health Equity Through Technology which complements and reinforces the PHTI announcement and objective. The paper that details the PHTI program, Using Heath Technology to Response to Public Health Emergencies, identifies the two focus areas: Digital health

Why CrossFit and 23andMe Are Moving from Health to Primary Care

As we see the medical and acute care sector moving toward health and wellness, there’s a sort of equal and opposite reaction moving from the other end of the continuum of health/care: that is, wellness and fitness companies blurring into health care. Let’s start with the news about CrossFit and 23andMe, then synthesize some key market forces that will help us anticipate more ecosystem change for 2022 and beyond. CrossFit announced the company’s launch of CrossFit Precision Care, described as primary care that provides personalized, data-driven services for “lifelong health,” according to the press release for the program. The service

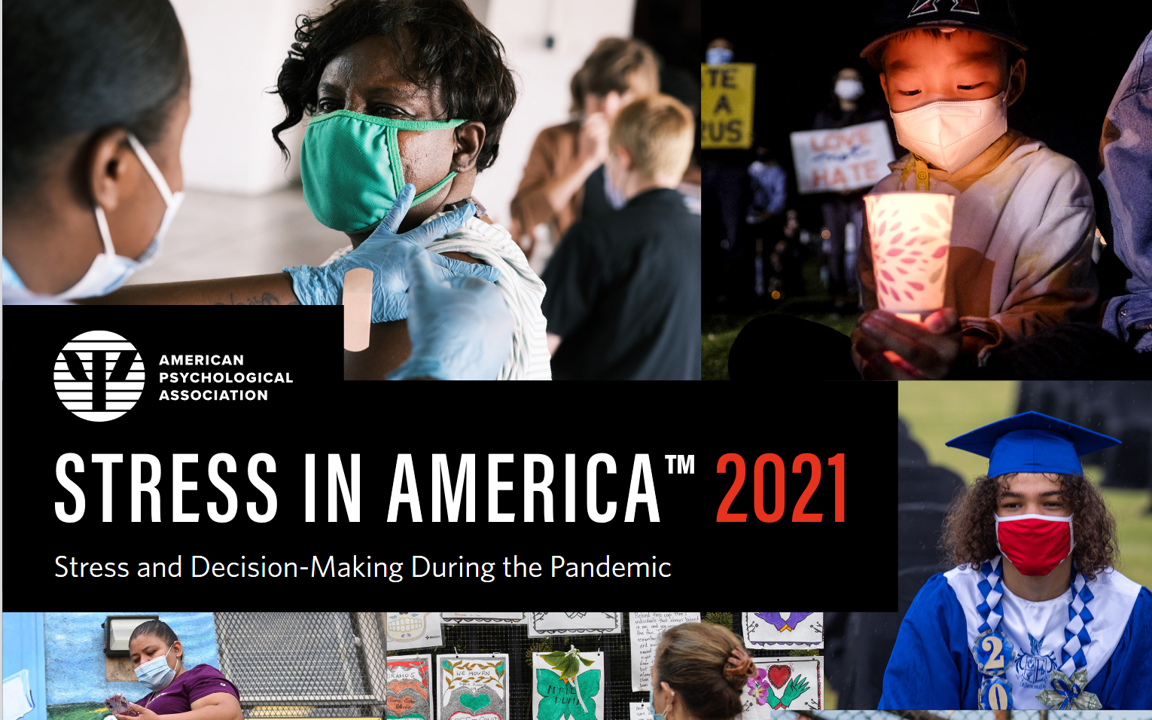

Still Struggling with Stress in America in 2021

“Americans remain in limbo between lives once lived and whatever the post-pandemic future holds,” the American Psychological Association observes in their latest read into Stress in America 2021, with this phase of the perennial study focused on Stress and Decision-Making During the Pandemic. The top-line: people face a daily web of risk assessment, up-ended routines, and endless news about the coronavirus locally and globally. While most people in the U.S. believe that “everything will work out” after the pandemic ends, the mental, emotional, and logistical daily distance between “now” and “then” brings uncertainty and indeed, prolonged stress. More Millennials, who

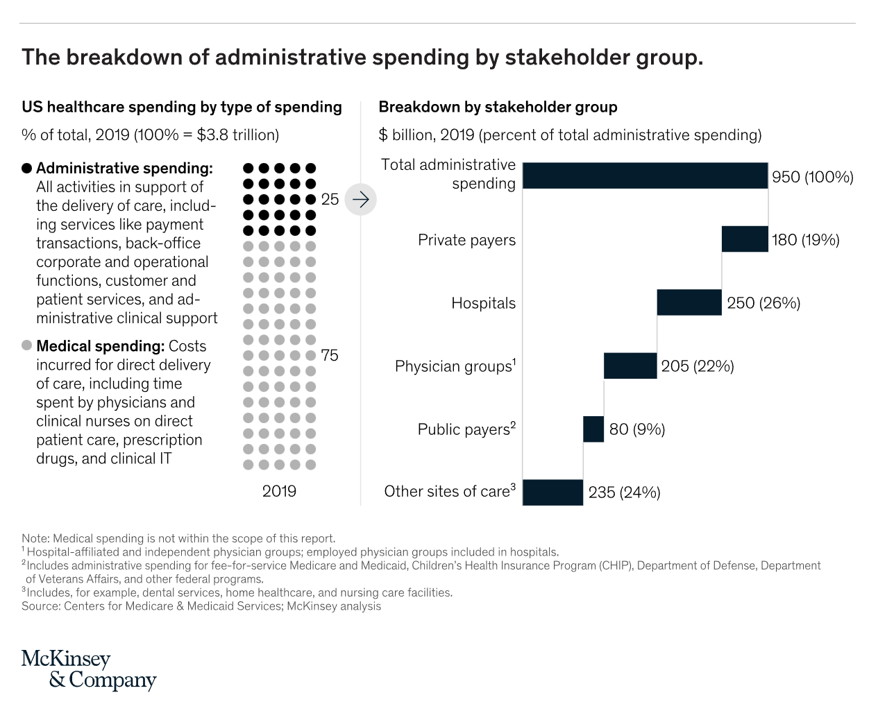

“Complexity is Profitable” in U.S. Healthcare – How to Save a Quarter-Trillion Dollars

In the U.S., “Health care is complicated because complexity is profitable.” So explain Bob Kocher, MD, and Anuraag Chigurupati, in a viewpoint on Economic Incentives for Administrative Simplification, published this week in JAMA. Dr. Kocher, a physician who is a venture capitalist, and Chigurupati, head of member experience at Devoted Health, explain the misaligned incentives that impede progress in reducing administrative spending. This essay joins two others in the October 20, 2021 issue of JAMA which highlight administrative spending in American health care: Administrative Simplification and the Potential for Saving a Quarter-Trillion Dollars in Health Care by Nikhil Sahni, Brandon

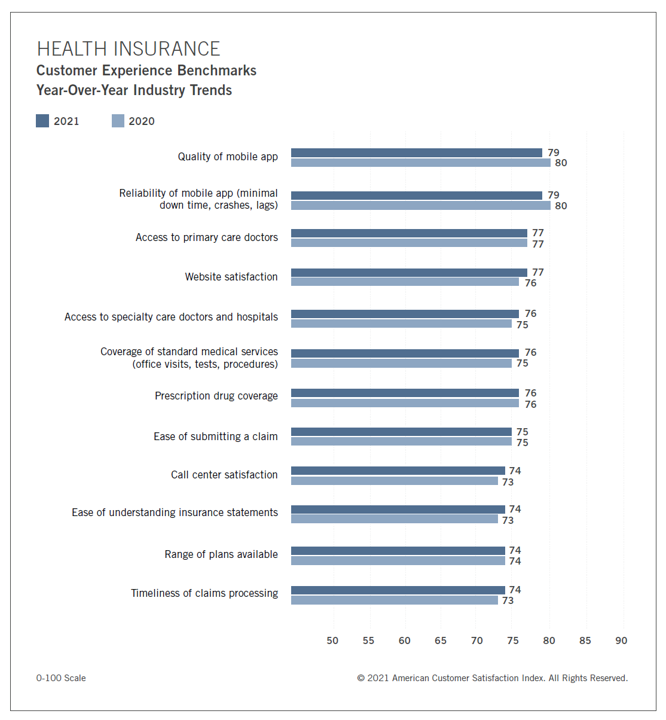

Health Plan Consumer Experience Scores Reflect Peoples’ Digital Transformation – ACSI Speaks

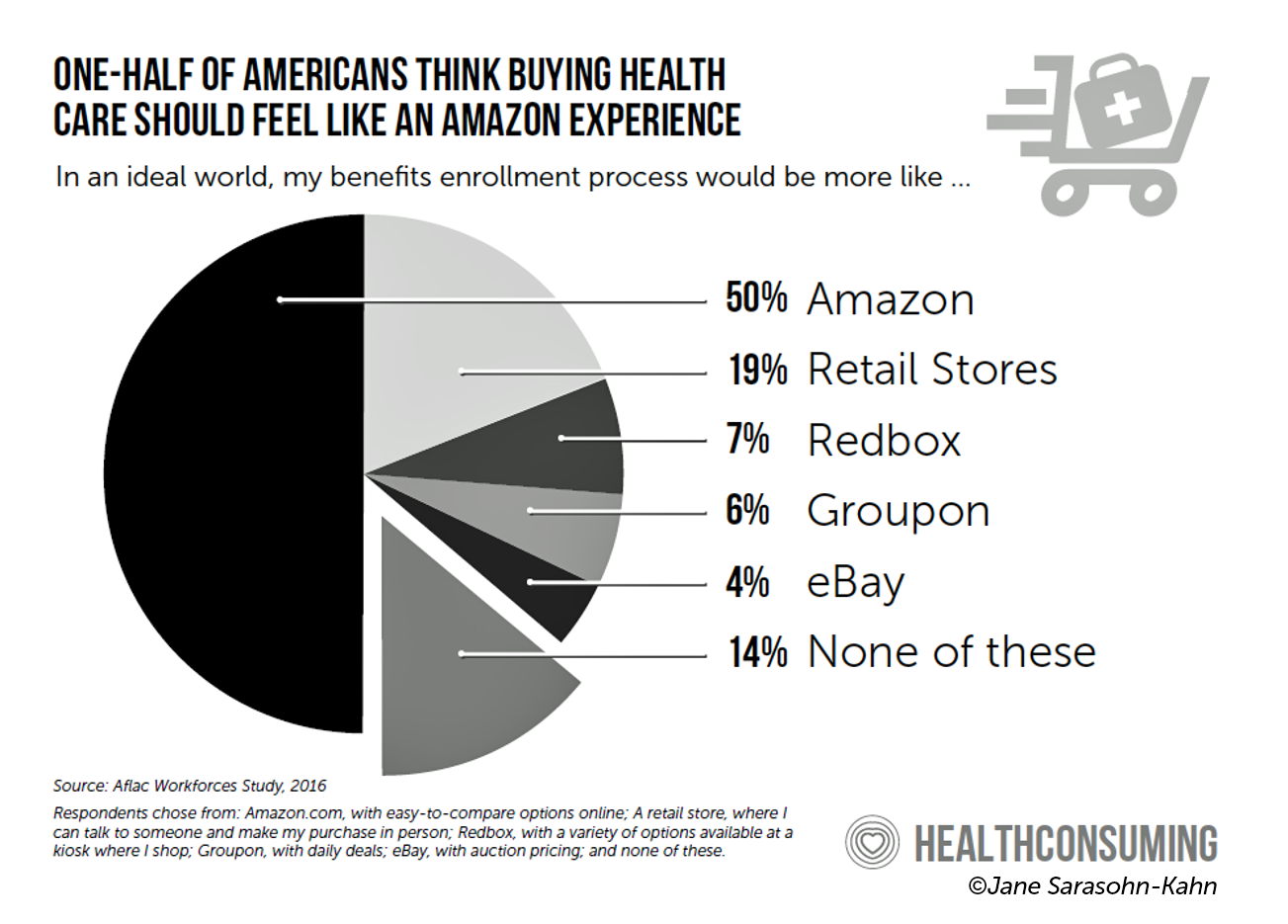

In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows. The American Customer Satisfaction Index Insurance and Health Care Study 2020-2021 published today, recognizing consumers’ value for the quality of health insurance companies’ mobile apps and reliability of those apps. Those digital health expectations surpass peoples’ benchmarks for accessing primary care doctors and specialty care doctors and hospitals, based on ACSI’s survey conducted among 12,274 customers via email. The study was fielded between October 2020 and September 2021. Year on year,

Be Mindful About What Makes Health at HLTH

“More than a year and a half into the COVID-19 outbreak, the recent spread of the highly transmissible delta variant in the United States has extended severe financial and health problems in the lives of many households across the country — disproportionately impacting people of color and people with low income,” reports Household Experiences in America During the Delta Variant Outbreak, a new analysis from the Robert Wood Johnson Foundation, NPR, and the Harvard Chan School of Public Health. As the HLTH conference convenes over 6,000 digital health innovators live, in person, in Boston in the wake of the delta

Consider Mental Health Equity on World Mental Health Day

COVID-19 exacted a toll on health citizens’ mental health, worsening a public health challenge that was already acute before the pandemic. It’s World Mental Health Day, an event marked by global and local stakeholders across the mental health ecosystem. On the global front, the World Health Organization (WHO) describes the universal phenomenon and burden of mental health on the Earth’s people… Nearly 1 billion people have a mental disorder Depression is a leading cause of disability worldwide, impacting about 5% of the world’s population People with severe mental disorders like schizophrenia tend to die as much as 20 years earlier

Pondering Prescription Drugs: Pricing Rx and Going Direct-to-Consumer

There is one health care public policy issue that unites U.S. voters across political party: that is the consumer-facing costs of prescription drugs. With the price of medicines in politicians’ and health citizens’ cross-hairs, the pharmaceutical and biotech industries have responded in many ways to the Rx pricing critiques from consumers (via, for example, Consumer Reports/Consumers Union and AARP), hospitals (through the American Hospital Association), and insurance companies (from AHIP, America’s Health Insurance Plans). The latest poll from the University of Chicago/Harris Public Policy and the Associate Press-NORC Center for Public Affairs Research quantifies the issue cross-party, finding that 74%

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

Regulation, Reimbursement, and Interoperability Block Health Systems’ Digital Transformation – The State of Healthcare in 2021 From HIMSS

There is no doubt that the COVID-19 pandemic motivated health care providers, payers, and patients to adopt digital tools and contact-less services, allowing people to deliver and receive medical care. Still, 18 months into the pandemic, now endemic and in its fourth wave of cases spiking around the world and in many parts of the U.S., some aspects of “digital transformation” seem not to have fully transformed American healthcare, we learn in HIMSS’s annual 2021 State of Healthcare Report. HIMSS collaborated with the organizations Trust Accenture, The Chartix Group, and ZS on this year’s research. Nine in ten clinicians have recommended

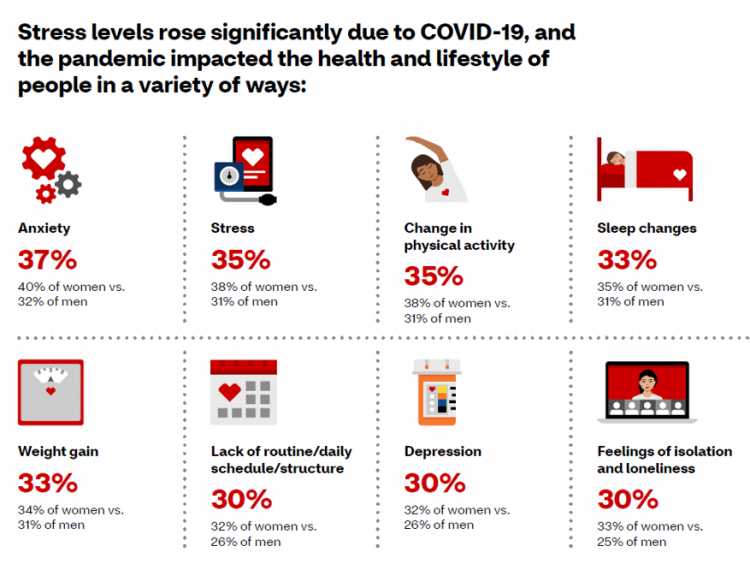

CVS Finds Differences in Mental and Behavioral Health Among Men Vs. Women in the Pandemic

As the COVID-19 pandemic shifts to a more endemic phase — becoming part of peoples’ everyday life for months to come — impacts on peoples’ mental health will persist, according to new research from CVS Health in the company’s annual Health Care Insights Study. CVS conducted the annual Health Care Insights Study among 1,000 U.S. adults in March 2021. To complement the consumer study, an additional survey was undertaken among 400 health care providers including primary care physicians and specialists, nurse practitioners, physician assistants, RNs and pharmacists. CVS has been tracking the growing trend of health care consumerism in the

Reimagining Life After the Pandemic – Seeking Health, Safety, Sustainability, and Trust

COVID-19 reshaped people around the world, one-half of whom are re-defining their personal purpose and life-goals. This sense of purpose extends to peoples’ willingness to buy or patronize companies who do not meet their needs for health, safety, sustainability and trust. For example, two in three of these people would switch travel brands if they felt health and safety weren’t up to par, discovered in Life Reimagined – Mapping the motivations that matter for today’s consumers, from Accenture’s Voices of Change series. In May 2021, Accenture polled over 25,000 consumers globally, in 22 countries, and found that one-half of people

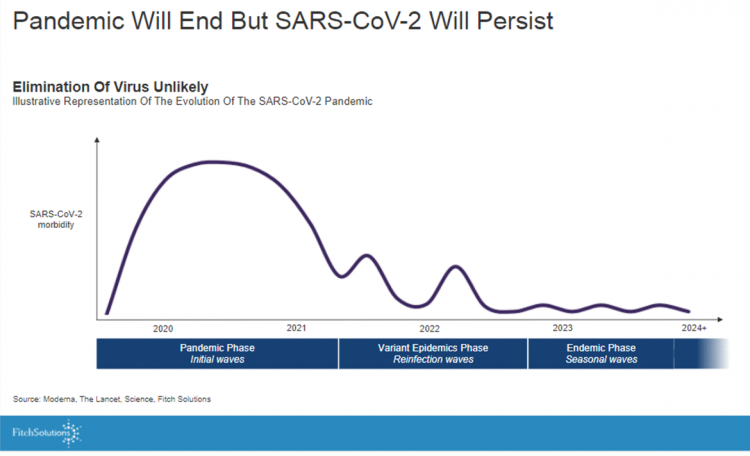

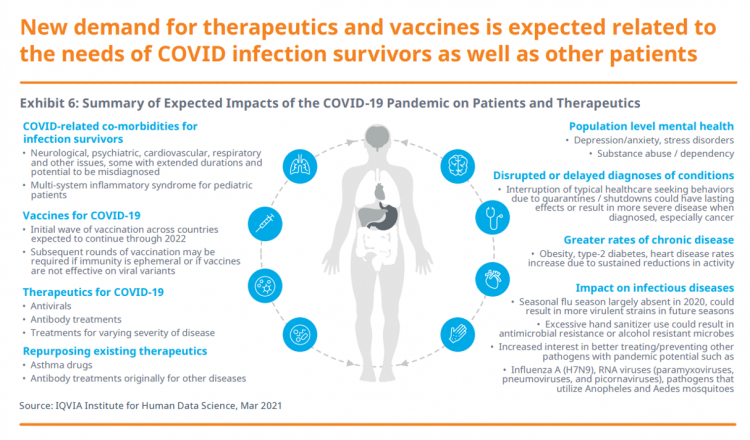

The Healthcare and Macro-Economic Impacts of Living with Endemic COVID – Listening to Fitch

Getting totally rid of the coronavirus isn’t likely, so we humans must accept the fact that SARS-CoV-2 will be endemic. The economic and healthcare system impacts of this were explored in the Post-Covid Healthcare Landscape, delivered by Fitch Solutions’ Jamie Davies and Beau Noafshar, leaders in the Pharmaceuticals, Healthcare, and Medical Devices groups. I welcomed the opportunity to learn from this team’s approach in weaving together the dynamic issues that help us to plan for the long-tail of COVID-19 and its impact on the economy and prospects for the health care industry and health citizens. The first graph illustrates the

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

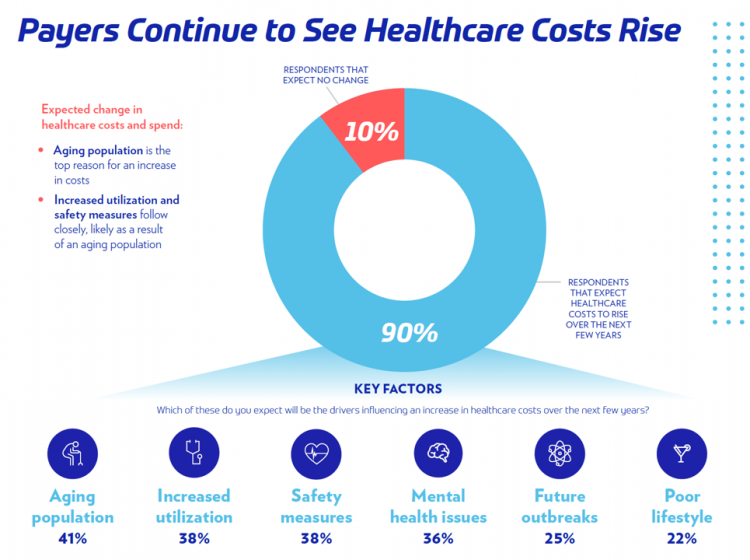

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

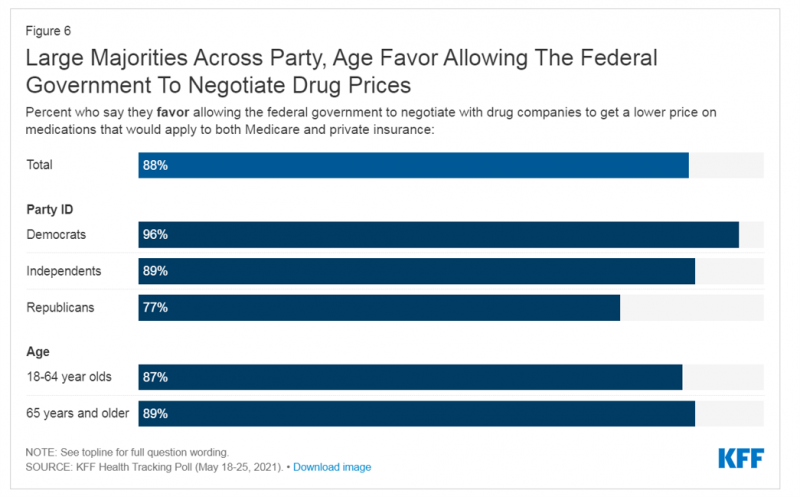

What Do Democrats and Republicans Agree On? Allowing Negotiations to Lower Rx Prices

People living in the U.S. have weathered over fifteen months of life-shifts for work, school, prayer, fitness, and social lives. So you might think that the most important public priority for Congress might have something to do with COVID-19, vaccines, or health insurance coverage. But across all priorities, it turns out that prescription drug costs rank higher in Americans’ minds than any other issue in the Kaiser Family Foundation Health Tracking Poll for May 2021. Two-thirds of U.S. adults said that allowing the federal government and private insurance plans to negotiate for lower prices on Rx drugs was their top

Wearables Are Good For Older People, Too — The Latest From Laurie Orlov

The COVID-19 pandemic accelerated a whole lot of digital transformation for people staying home. For digital natives, that wasn’t such an exogenous shock. For older people who are digital immigrants, they will remember their initial Zoom get-together’s with much-missed family, ordering groceries online in the first ecommerce purchase, and using telemedicine for the first time as a digital health front-door. Laurie Orlov, tech industry veteran, writer, speaker and elder care advocate, is the founder of the encyclopedic Aging and Health Technology Watch website. She takes this propitious moment to assess The Future of Wearables and Older Adult in a new report.

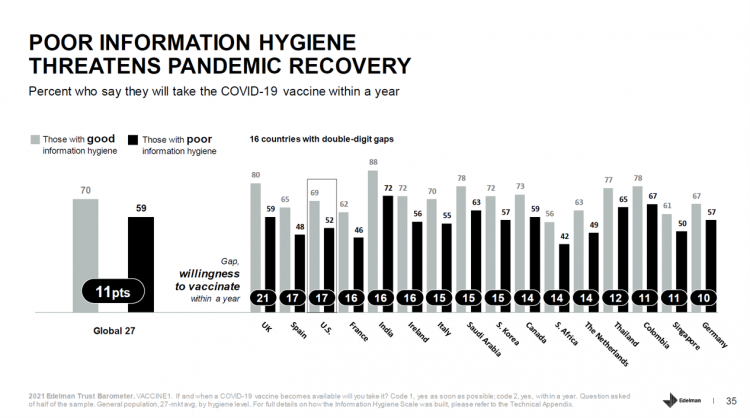

Healthcare, Heal Thyself! How the Industry Can and Should Play the Trust Card

The emergence of the COVID-19 vaccine “infodemic” has slowed the ability for nations around the world to emerge out of the public health crisis. Growing cynicism among some health citizens facing the politicization of public health tactics like vaccines and facial masks is what we’re talking about. At the root is peoples’ lack of trust across a range of information providers, including government, media, business, and even peers. The 2021 Edelman Trust Barometer spotlighted the infodemic and eroding trust in the U.S. in the voices of public health, the public sector, and media. This is a global challenge as well,

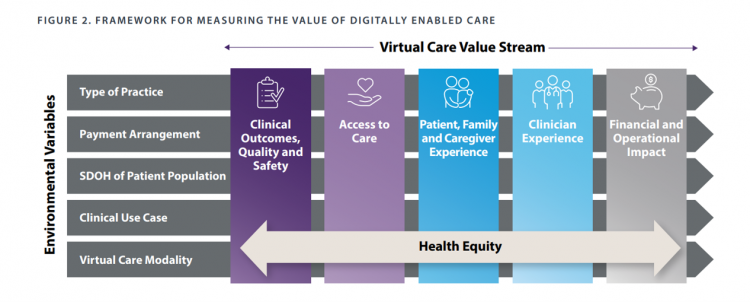

The ROI on Virtual Care – Thinking About Value and Future Prospects With the AMA

When a new technology or product starts to get used in a market, it follows a diffusion curve whose slope depends on the pace of adoption in that market. For telehealth, that S-curve has had a very long and fairly flat front-end of the “S” followed by a hockey stick trajectory in March and April 2020 as the COVID-19 pandemic was an exogenous shock to in-person health care delivery. The first chart from the CDC illustrates that dramatic growth in the use of telehealth ratcheting up since the first case of COVID-19 was diagnosed in the U.S. Virtual care has

Spending on Medicines In and Post-COVID Say a Lot About Patients and Larger Healthcare Trends – an IQVIA Update

Spending on medicines, globally, will rebound this year and rise above pre-pandemic levels through 2025. Between 2021 and 2025, the annual growth global growth rate for prescription drugs spending is expected to range from 3% to 6%, a $1.6 trillion bill for the worlds’s total Rx medicines market. That relatively low single-digit growth rate is tempered by savings from biosimilars and the loss of brand exclusivity (that is, more generics coming to market). On the faster-growth side, we can expect two big therapeutic areas to drive spending upward: oncology and immunology, projected to expand by 9% to 12% each year

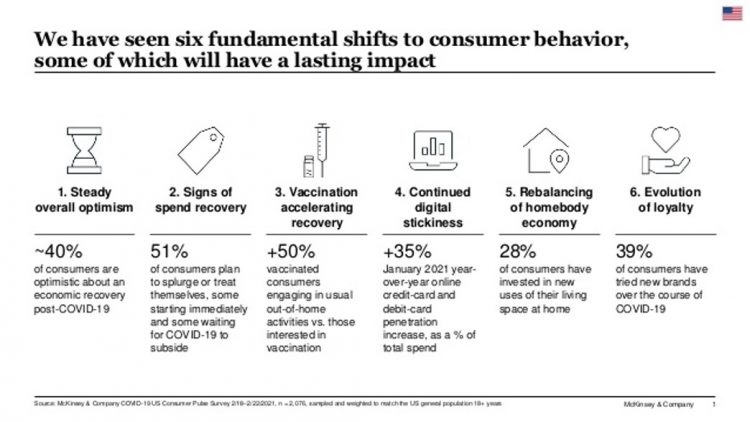

The Rise of the Homebody Economy and Healthcare to the Home

As the coronavirus crisis stretched from weeks into months, now over one year since being defined as a pandemic, U.S. consumers have made significant investments into their homes for working, educating students, cooking, and working out. Welcome to the “rebalancing of the homebody economy,” in the words of McKinsey, out with new data on consumer sentiment during the coronavirus crisis. The continued penetration of vaccines-into-arms in the U.S. is fanning optimism in terms of household economics, personal spending — especially on experiences that get folks “out” of the house. Still, the Homebody Economy will persist even post-COVID, with a growing

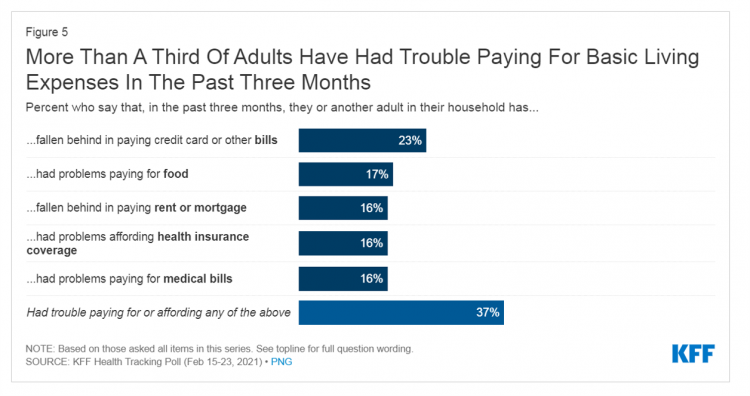

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

Our Homes Are Health Delivery Platforms – The New Home Health/Care at CES 2021

The coronavirus pandemic disrupted and re-shaped the annual CES across so many respects — the meeting of thousands making up the global consumer tech community “met” virtually, both keynote and education sessions were pre-recorded, and the lovely serendipity of learning and meeting new concepts and contacts wasn’t so straightforward. But for those of us working with and innovating solutions for health and health care, #CES2021 was baked with health goodness, in and beyond “digital health” categories. In my consumer-facing health care work, I’ve adopted the mantra that our homes are our health hubs. Reflecting on my many conversations during CES

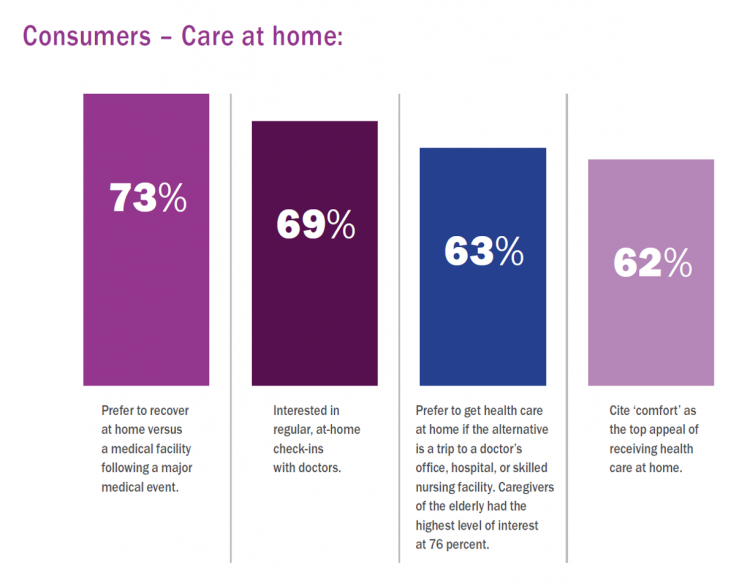

The Comforts of Home Drive Demand for Healthcare There

Two in three U.S. consumers skipped or delayed getting in-person medical care in 2020. One in 2 people had a telehealth visit int he last year. Most would use virtual care again. The coronavirus pandemic has mind-shifted how patients envision a health care visit. Today, most consumers prefer the idea of getting health care at home compared with going to a doctor’s office. Most Americans also like the idea of recovering at home instead of at a medical facility after a major medical event, according to the report, Health-at-Home 2020: The New Standard of Care Delivery from CareCentrix. COVID-19 has

The COVID-19 Era Has Grown Health Consumer Demand for Virtual Care

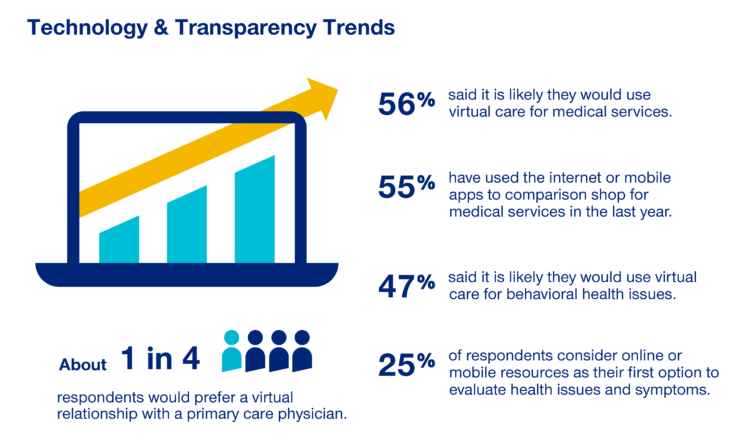

Over one-half of Americans would likely use virtual care for their healthcare services, and one in four people would actually prefer a virtual relationship with a primary care physician, according to the fifth annual 2020 Consumer Sentiment Survey from UnitedHealthcare. What a difference a pandemic can make in accelerating patients’ adoption of digital health tools. This survey was conducted in mid-September 2020, and so the results demonstrate U.S. health consumers’ growing digital health “muscles” in the form of demand and confidence in using virtual care. One in four people would consider online options as their first-line to evaluating personal health

Healthcare Costs, Access to Data, and Partnering With Providers: Patients’ Top User Experience Factors

As patients returned to in-person, brick-and-mortar health care settings after the first wave of COVID-19 pandemic, they re-enter the health care system with heightened consumer expectations, according to the Beryl Institute – Ipsos Px Pulse report, Consumer Perspectives on Patient Experience in the U.S. Ipsos conducted the survey research among 1,028 U.S. adults between 23 September and 5 October 2020 — giving consumers many months of living in the context of the coronavirus. This report is a must-read for people involved with patient and consumer health engagement in the U.S. and covers a range of issues. My focus in this

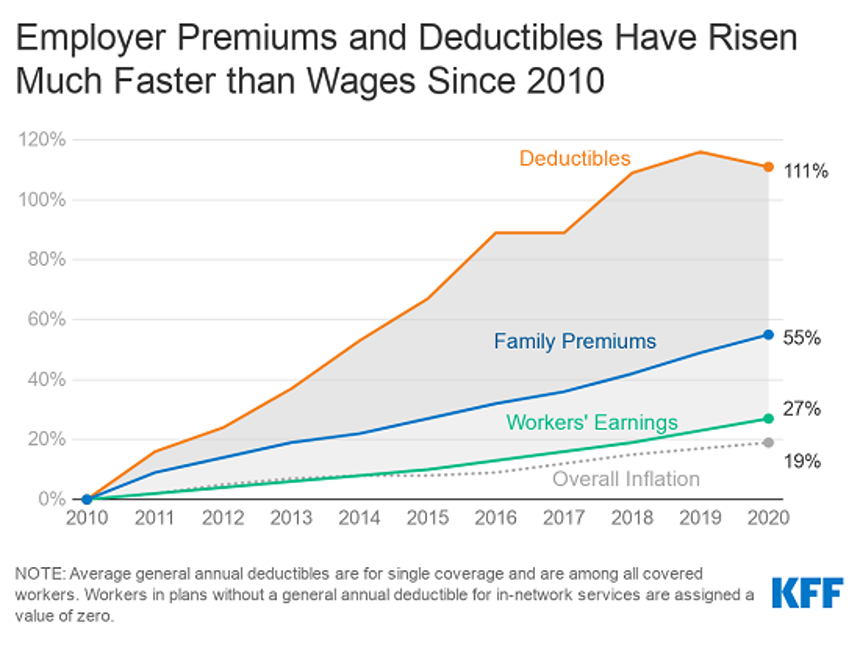

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

50 Days Before the U.S. Elections, Voters Say Health Care Costs and Access Top Their Health Concerns — More than COVID-19

The coronavirus pandemic has revealed deep cracks and inequities in U.S. health care in terms of exposure to COVID-19 and subsequent outcomes, with access to medical care and mortality rates negatively impacting people of color to a greater extent than White Americans. The pandemic has also led to economic decline that, seven weeks before the 2020 elections in America, is top-of-mind for health citizens with the virus-crisis itself receding to second place, according to the Kaiser Family Foundation September 2020 Health Tracking Poll. KFF polled 1,199 U.S. adults 18 years of age and older between August 28 and September 3,

Health Happens at Home: Lessons from the Parks Connected Health Summit

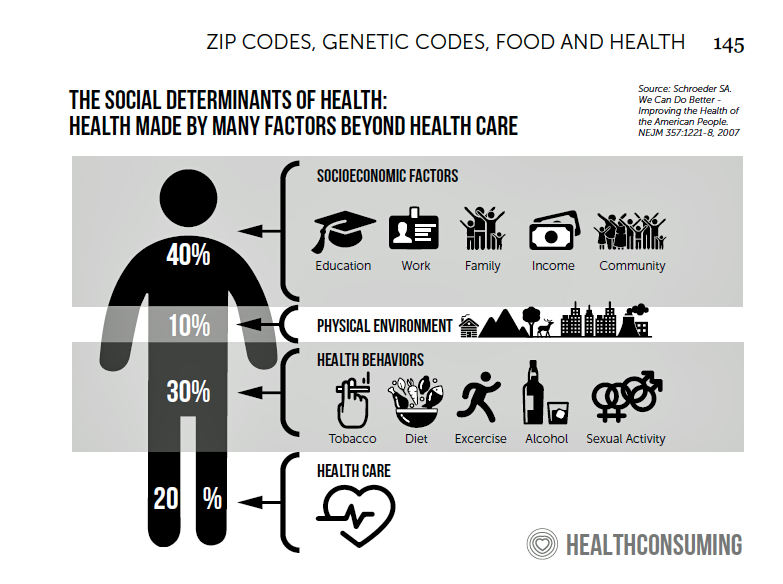

Home is where the health is, we know in the wake of the COVID-19 pandemic. To be sure, many of us who have been preaching that our ZIP codes are more impactful to our health than our genetic codes have known the evidence backing the social and behavioral determinants of health for a long time. This week, Parks Associates convened the Connected Health Summit, focused on the theme of consumer engagement and innovation. I attended all three days’ worth of sessions in this well-planned and -executed virtual meeting. In this post, I’ll weave my favorite themes of consumer health engagement

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for