Are We Liberated Yet? Tariffs Can Impact Financial Health (Riffing on MoneyLion’s Health Is Wealth Report)

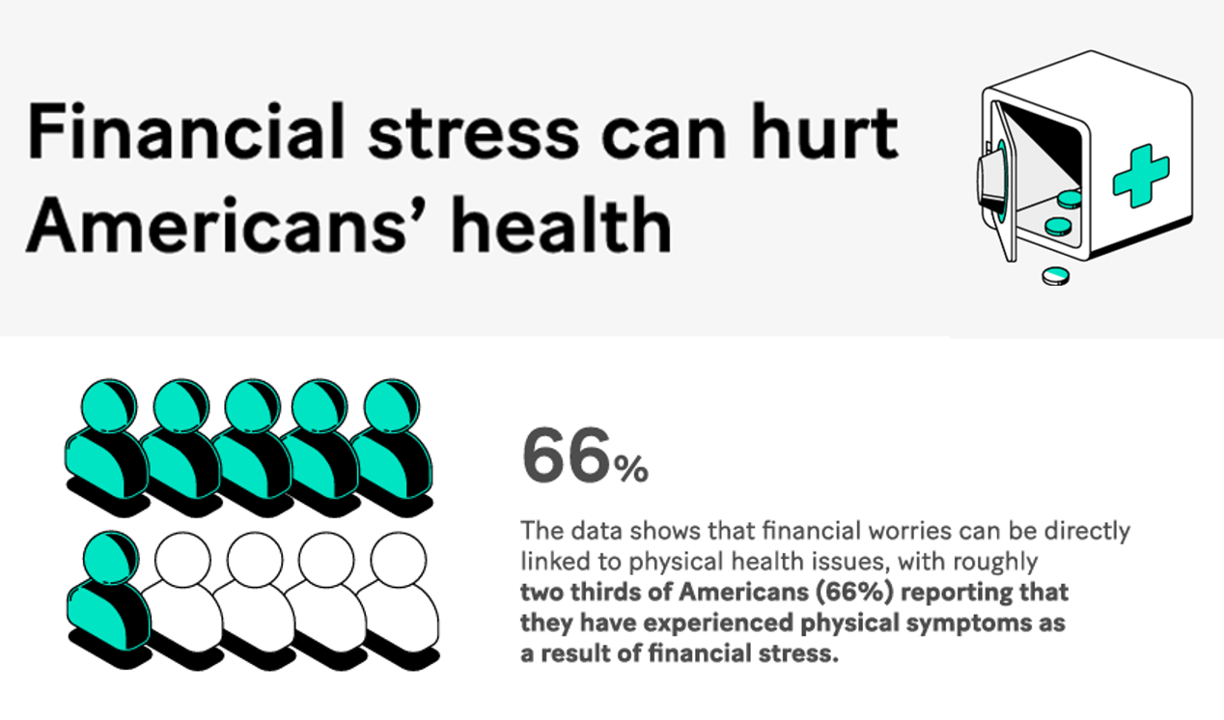

Americans’ financial health was already stressing consumers out leading up to Liberation Day, April 2nd, when President Trump announced tariffs on dozens of countries with whom the U.S. buys and sells goods. A new report from MoneyLion and Mastercard called Health is Wealth is well-timed for today’s Health Populi blog. The study was fielded by The Harris Poll online among 2,092 U.S. adults 18 and older between February 28 and March 4, 2025, so it was completed a month before the tariffs came to hit peoples’ 401(k) savings and employers’ company stock market caps.

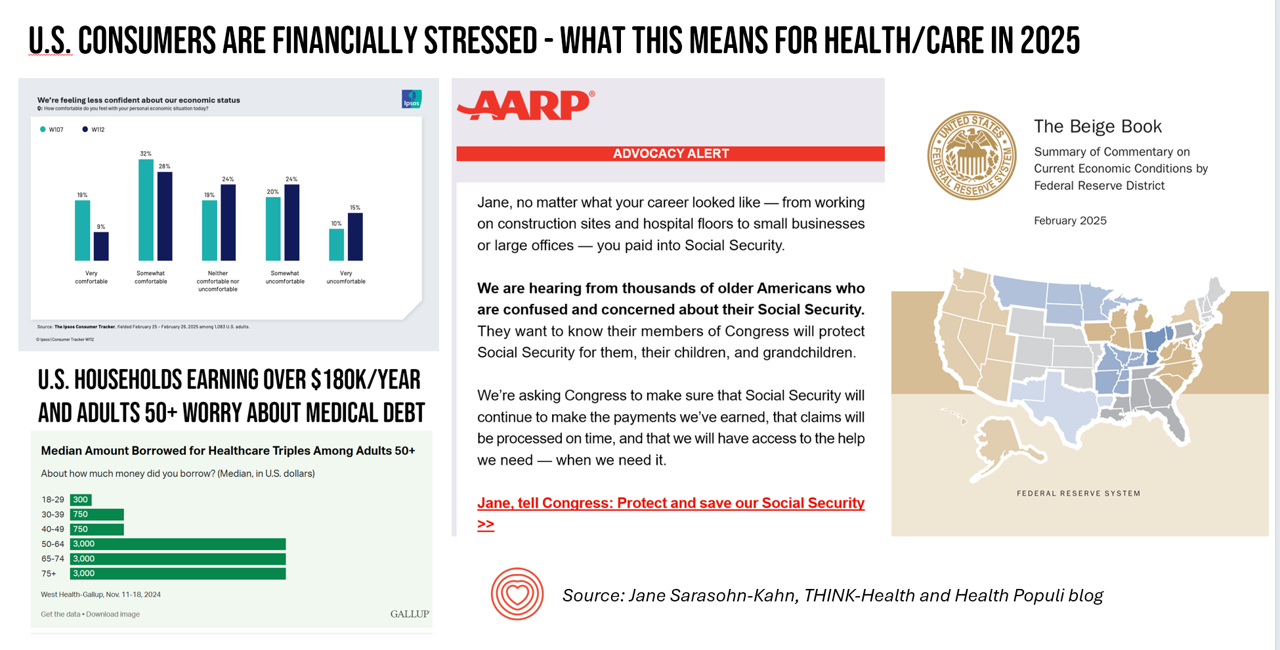

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

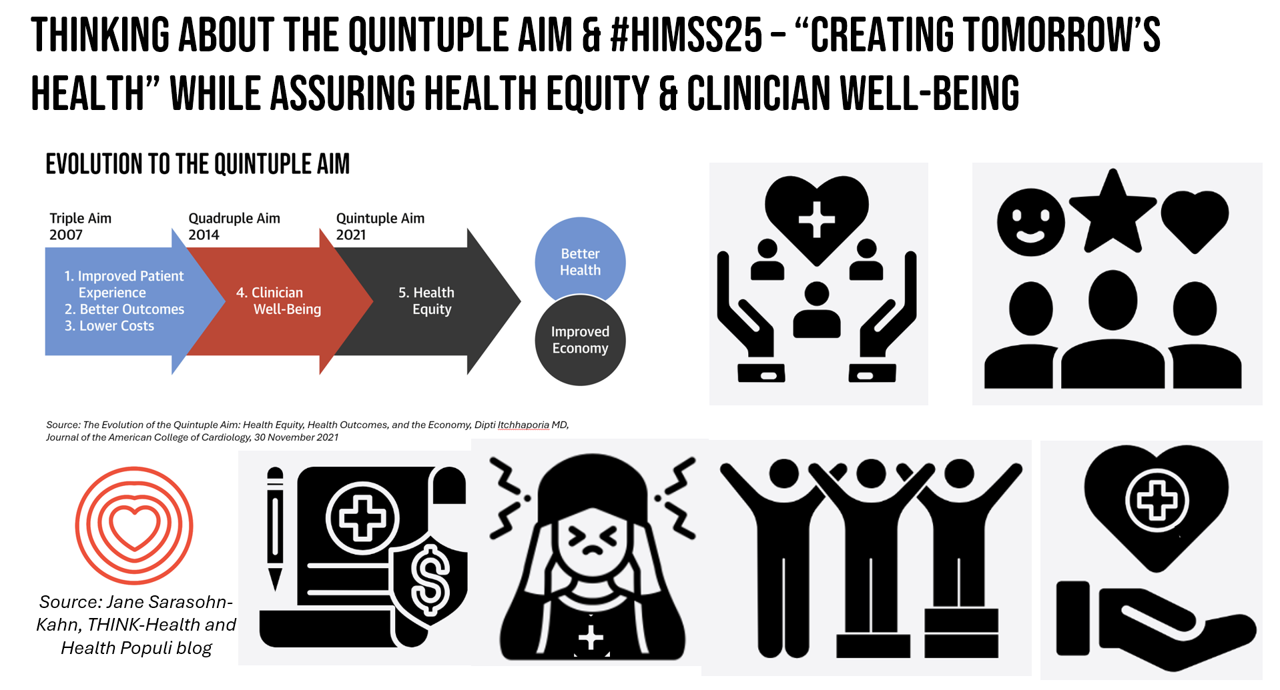

Think Quintuple Aim This Week at #HIMSS25

As HIMSS 2025, the largest annual conference on health information and innovation meets up in Las Vegas this week, we can peek into what’s on the organization’s CEO’s mind leading up to the meeting in this conversation between Hal Wolf, CEO of HIMSS, and Gil Bashe, Managing Director of FINN Partners. If you are unfamiliar with HIMSS, Hal explains in the discussion that HIMSS’s four focuses are digital health transformation, the deployment and utilization of AI as a tool, cybersecurity to protect peoples’ personal information and its use, and, workforce development. I have my own research agenda(s) underneath these themes

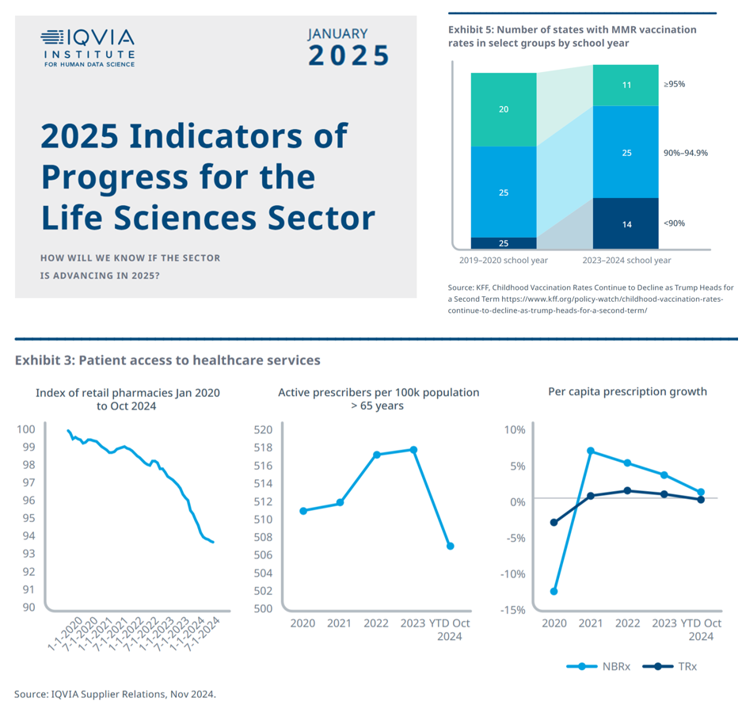

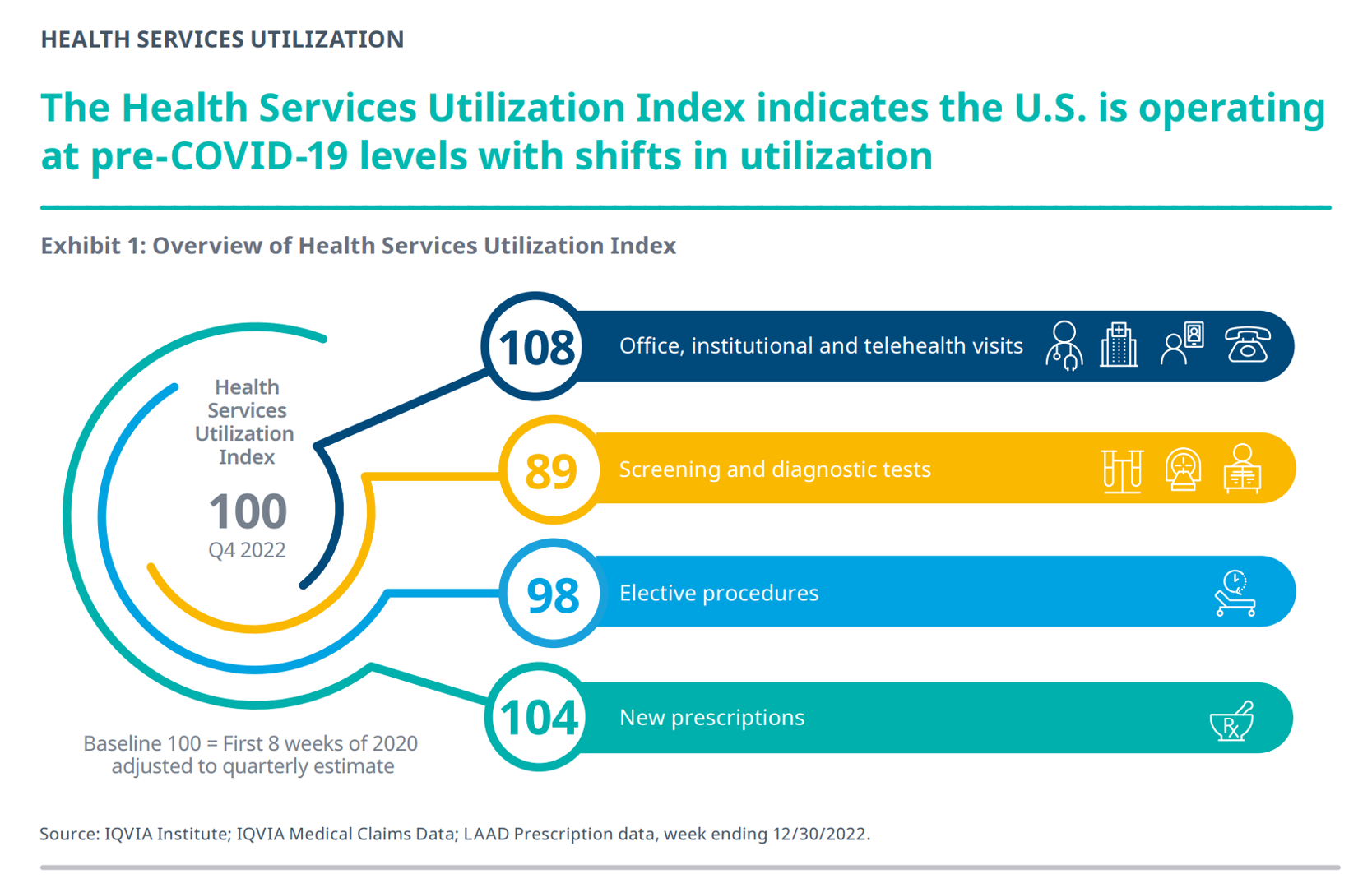

Measuring Progress for Life Sciences: Trust, Patient Access, and Prevention at a Fork in the Road of Public Health

How will we know if the life sciences sector is advancing in 2025? This is the question asked at the start of the report, a Research Brief: 2025 Indicators of Progress for the Life Sciences Sector, from the IQVIA Institute for Human Data Science (IQVIA). To answer that question, IQVIA identified ten indicators for this 2025 profile on the life sciences sector. I selected four key data points for this discussion which provide particularly informative insights for my advisory work right now at the intersection of health, people/consumers, and technology: Trust for/with/in life science

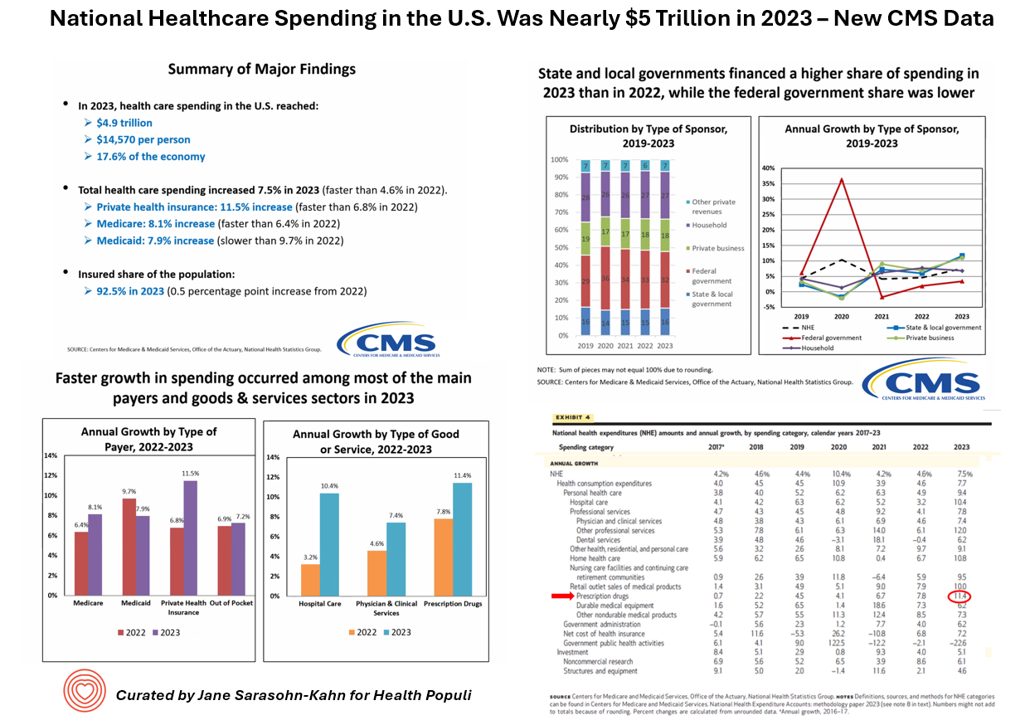

National Healthcare Spending in the U.S. Was Nearly $5 Trillion (with a “T”) in 2023 – New Data from CMS

What would $5 trillion be valued around the world or on the stock market? The economy of Germany was gauged around $5 trillion in 2024. India could be the world’s 3rd largest economy by 2026 valued at $5 trillion. Nvidia could be a $5 trillion company in 2025, as could Amazon. But today we report out the latest data from the Centers for Medicare and Medicaid Services (CMS) that national health spending in America reached $4.9 trillion in 2023. The full report on national health expenditures (NHE) in the U.S. was published today in Health Affairs, which came off embargo

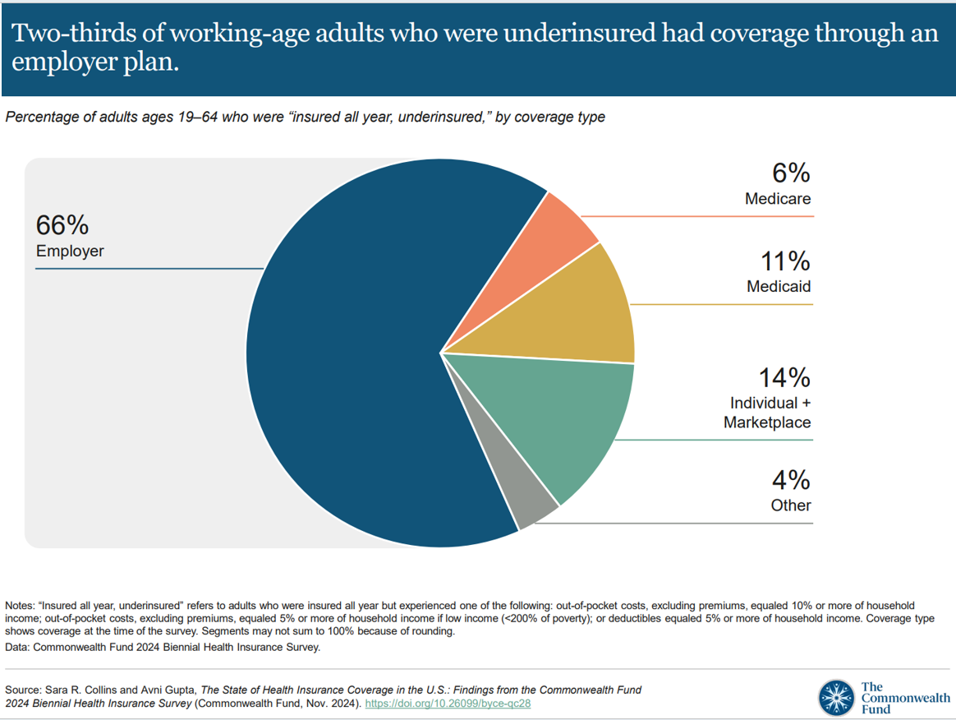

Workers Feel “Stuck,” Under-Insured, Financially Stressed, and Neglecting Mental Health

“It’s the economy stupid,” Jennifer Tescher, CEO of the Financial Health Network, titles her latest column in Forbes. Published two weeks after the 2024 U.S. elections, Jennifer’s assertion sums up what, ex post facto, we know about what most inspired American voters at the polls in November 2024: the economy, economics, inflation, the costs of daily living….pick your noun, but it’s all about those Benjamins right now for mainstream American consumers across many demographic cuts. With that realization, we must remind ourselves as we enter a new year under a second-term President Trump that health care spending for everyday people

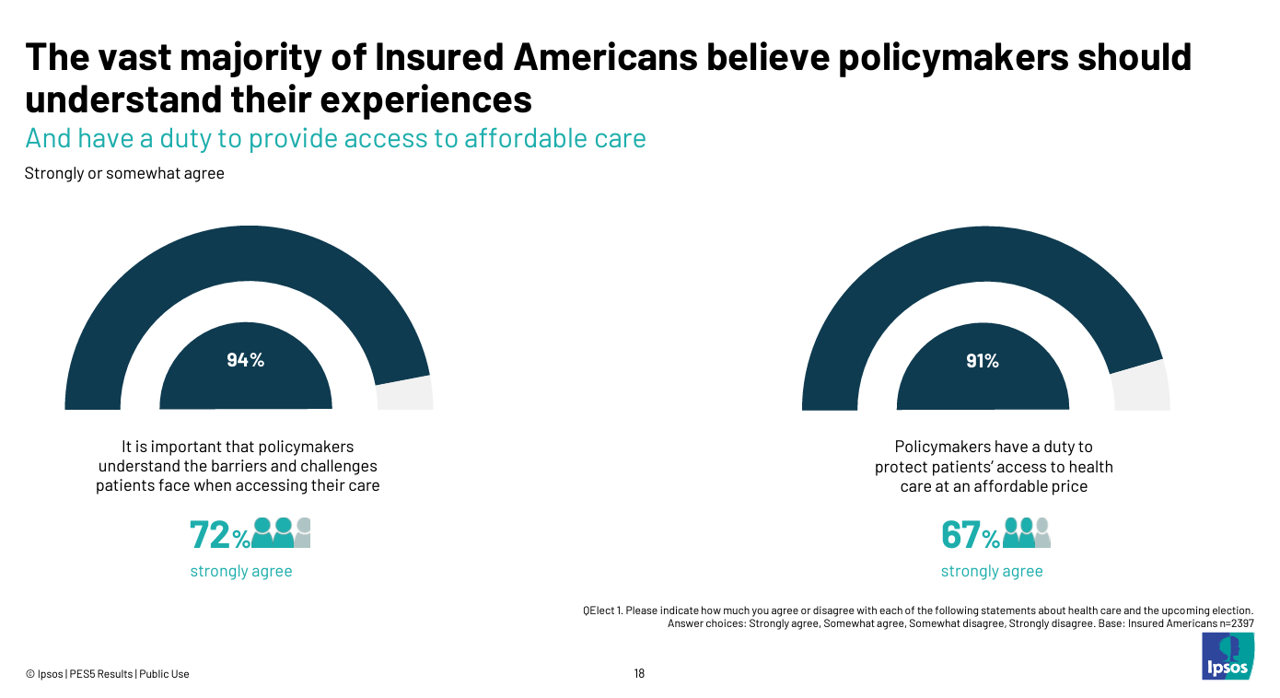

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

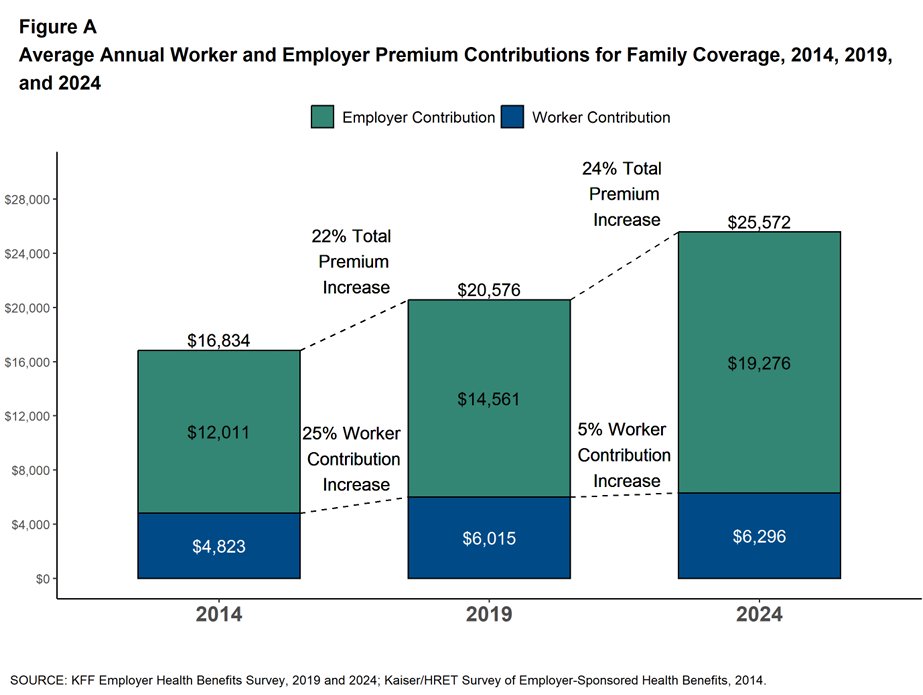

The Health Insurance Premium for a Family Averages $25,572 in 2024 – KFF’s Annual Update on Employer-Sponsored Benefits

The premium for employer-sponsored health plans grew by 6-7% between 2023 and 2024, according to the report on Employer Health Benefits 2024 Annual Survey from the Kaiser Family Foundation, KFF’s 26th annual study into U.S. companies’ spending on workers’ health care. In 2024 the average annual health insurance premium for family coverage is $25,572, split by 75% covered by the employer (just over $19,000) and 25% borne by the employee ($6,296), shown in the first chart from the report. The nearly $26K family premium is the average across all plan types in the

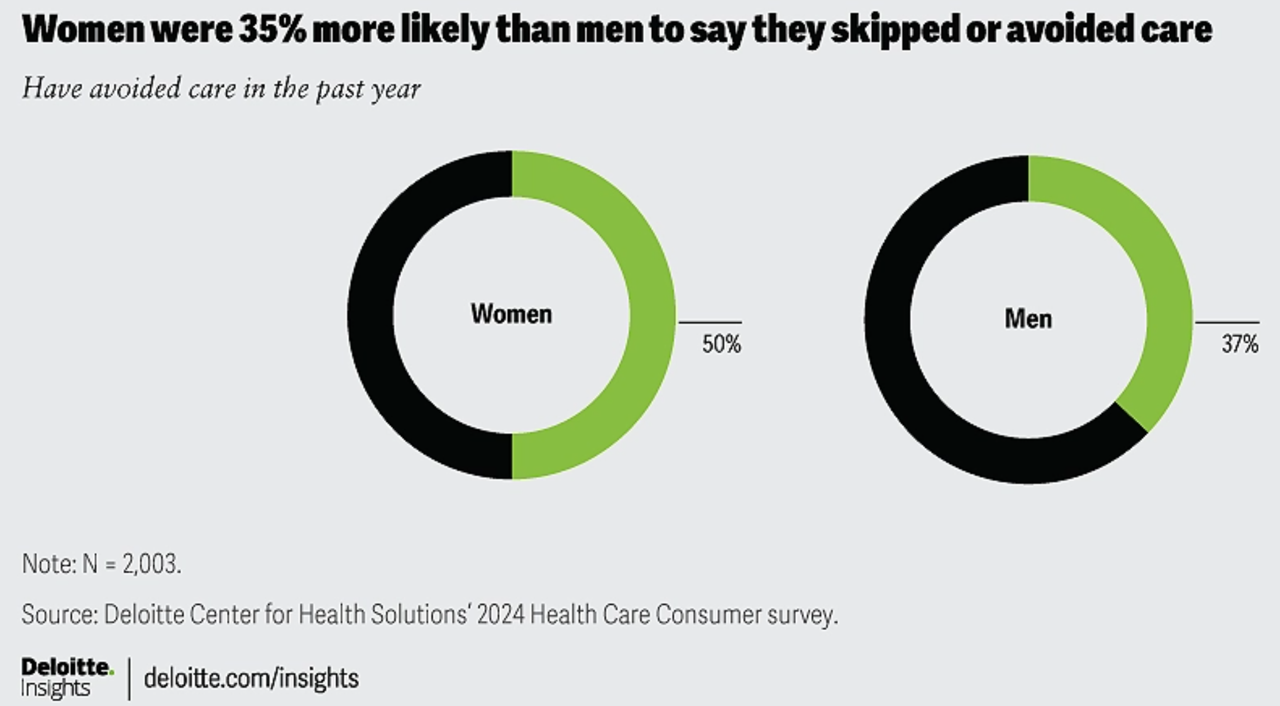

1 in 2 U.S. Women (“The Bedrock of Society”) Self-Ration Care – the Latest Deloitte Findings

Women in the U.S. are more likely to avoid care than men in America, Deloitte found in the consulting firm’s latest survey on consumers and health care. Deloitte coins this phenomenon as a “triple-threat” that women face in the U.S. health care environment, the 3 “threats” being, Affordability, Access, and, Prior experience — that is the health disparity among women who have seen personal mis-diagnosis, bias, or treatment that hasn’t been consistent with current protocols and practices. The data come out of Deloitte’s fielding of the U.S. consumer survey in February and March, 2024.

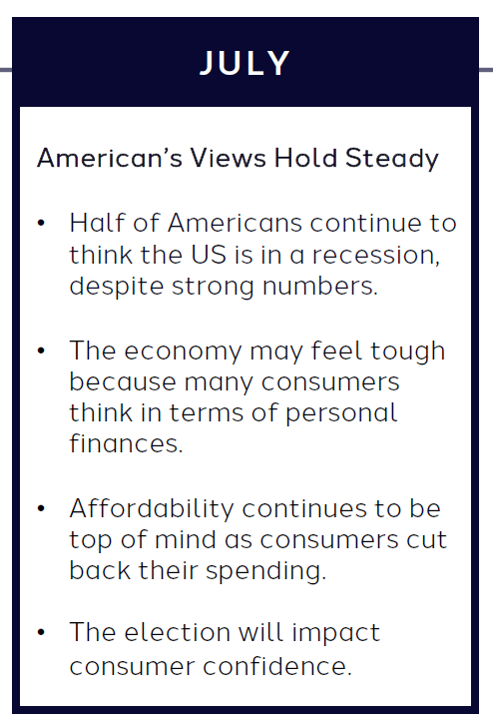

What the “Vibe-Cession” Means for Health Care in the U.S. – Spending is Personal

People living in the U.S. continue to feel a “vibe-cession” malaise, based on the American Mindset July 2024 update from Dentsu’s Consumer Navigator research. Notwithstanding generally good news about the American macroeconomy — in terms of growth, downward ticking inflation, and expected interest rate relief come September from the Federal Reserve — one in two Americans still thinks the country is in a recession. And this context is important for consumer’s personal spending on health care, fitness, and wellness, because, as Dentsu puts it, “consumers think in terms of personal finances.” As

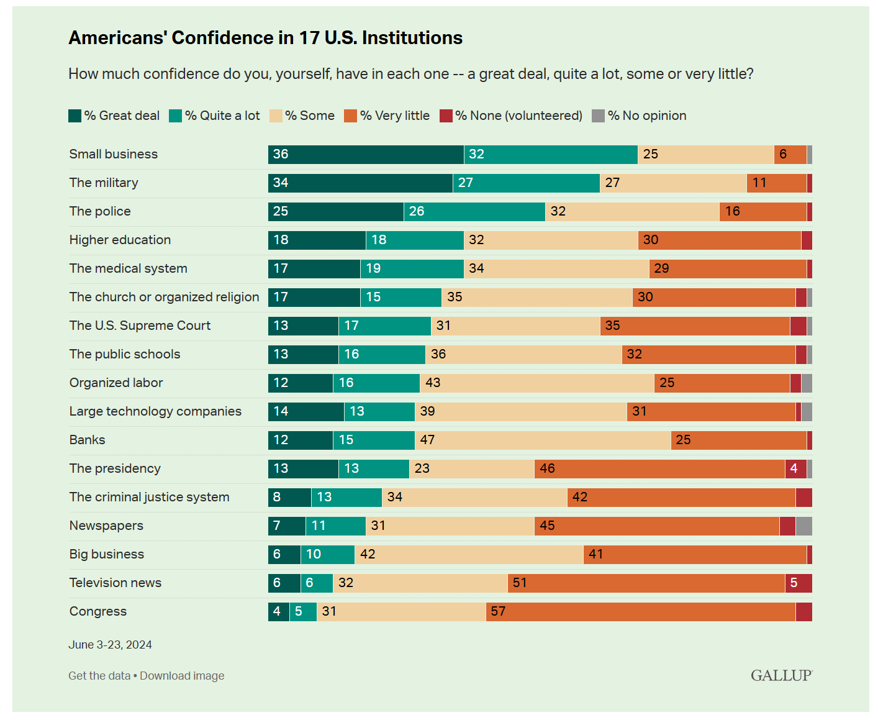

Trust in Institutions Among Americans: Small Biz, the Military and Police More than the Medical System

Two-thirds of Americans have a lot of confidence in small business in the U.S. In second place, 61% of people in the U.S. have confidence in the military, followed by 51% with the police. The Gallup Poll on Americans’ confidence in 17 U.S. institutions is out today, reflecting a snapshot of U.S. adults’ views on the organizations that touch their daily lives. And health care doesn’t fare too well in this latest read. Only 36% of Americans have confidence in the U.S. medical system, tied with peoples’ feelings of lack of confidence

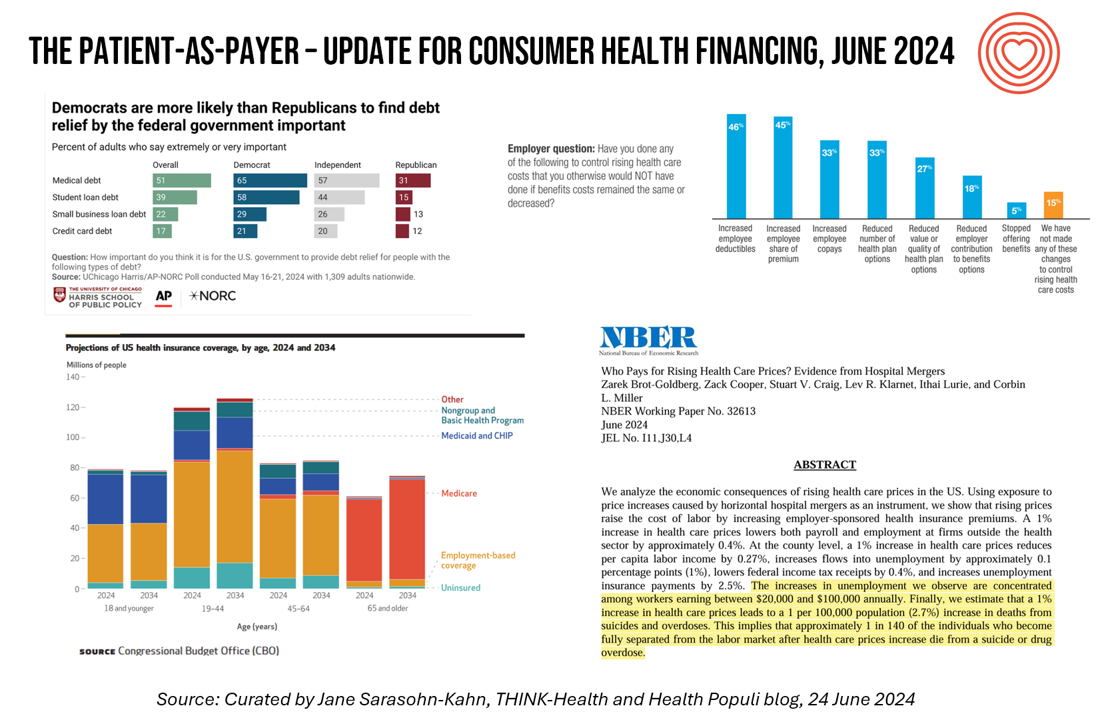

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

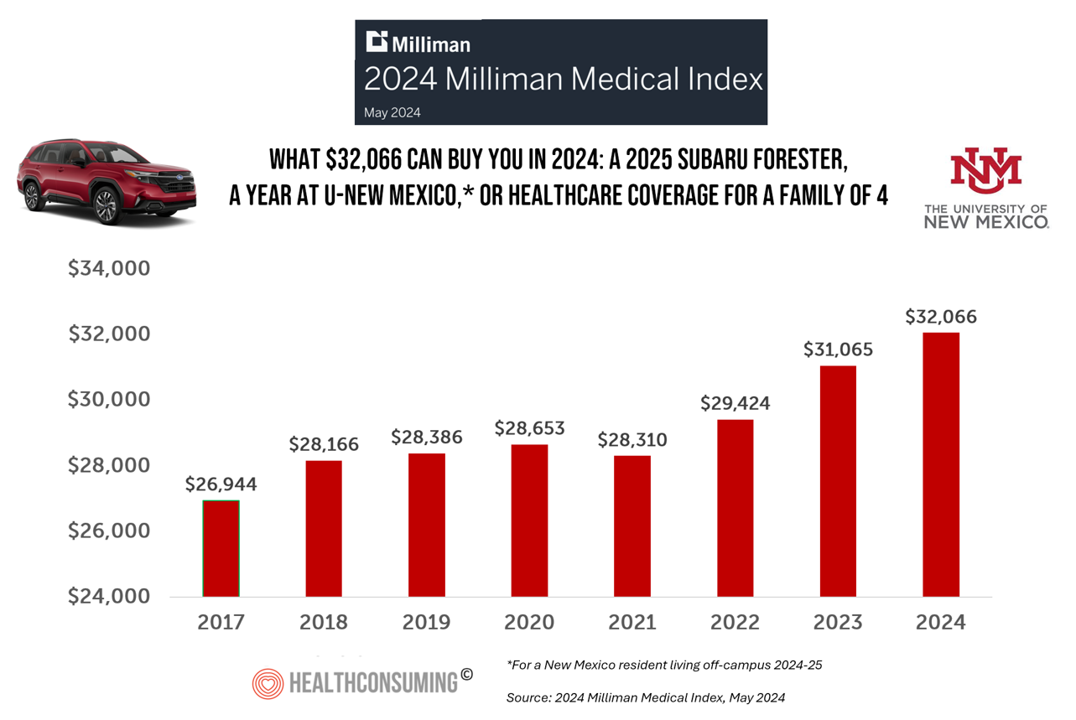

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

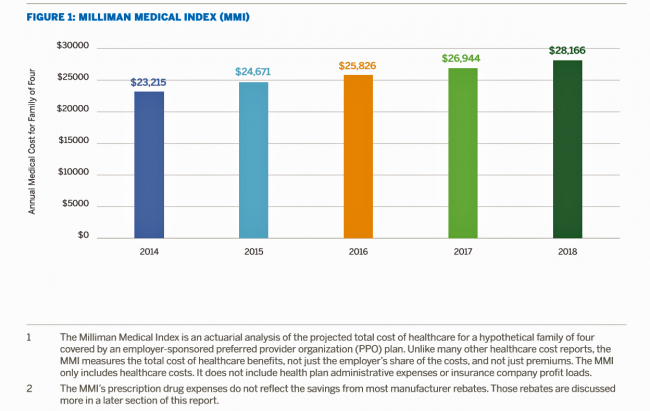

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

The Thematic Roadmap for AHIP 2024: What the Health Insurance Conference Will Cover

Health insurance plans make mainstream media news every week, whether coverage deals with the cost of a plan, the cost of out-of-network care, prior authorizations, or cybersecurity and ransomware attacks, among other front-page issues. This week, AHIP (the acronym for the industry association of America’s Health Insurance Plans) is convening in Las Vegas for its largest annual 2024 meeting. We expect at least 2,400 attendees registered for the meeting, and they’ll not just be representing the health insurance industry itself; folks will attend #AHIP2024 from other industry segments including pharmaceuticals, technology, hospitals and health systems, and the investment and financial services

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

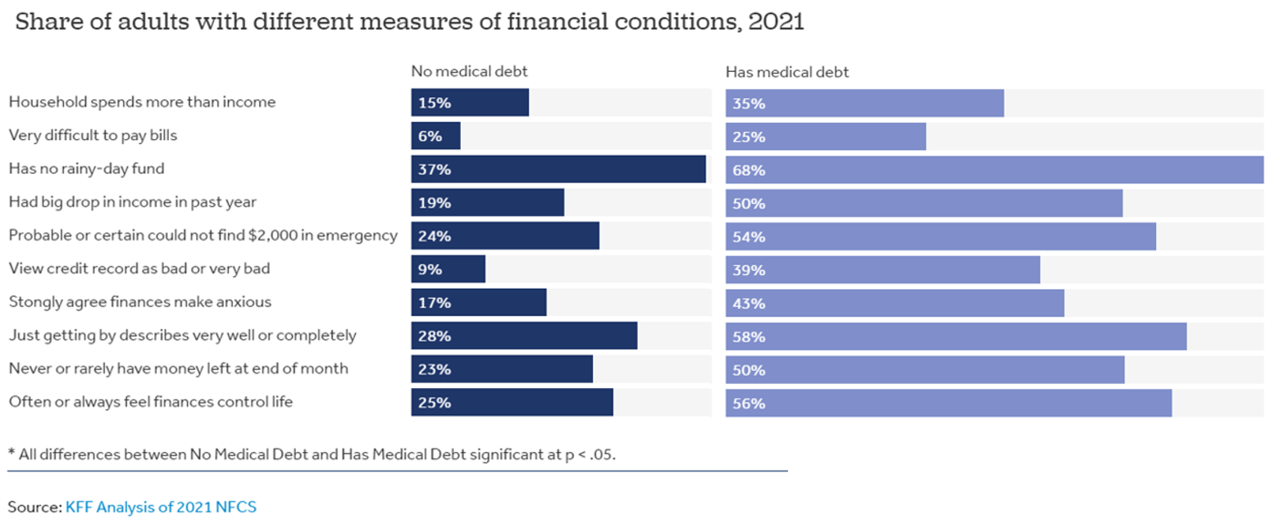

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

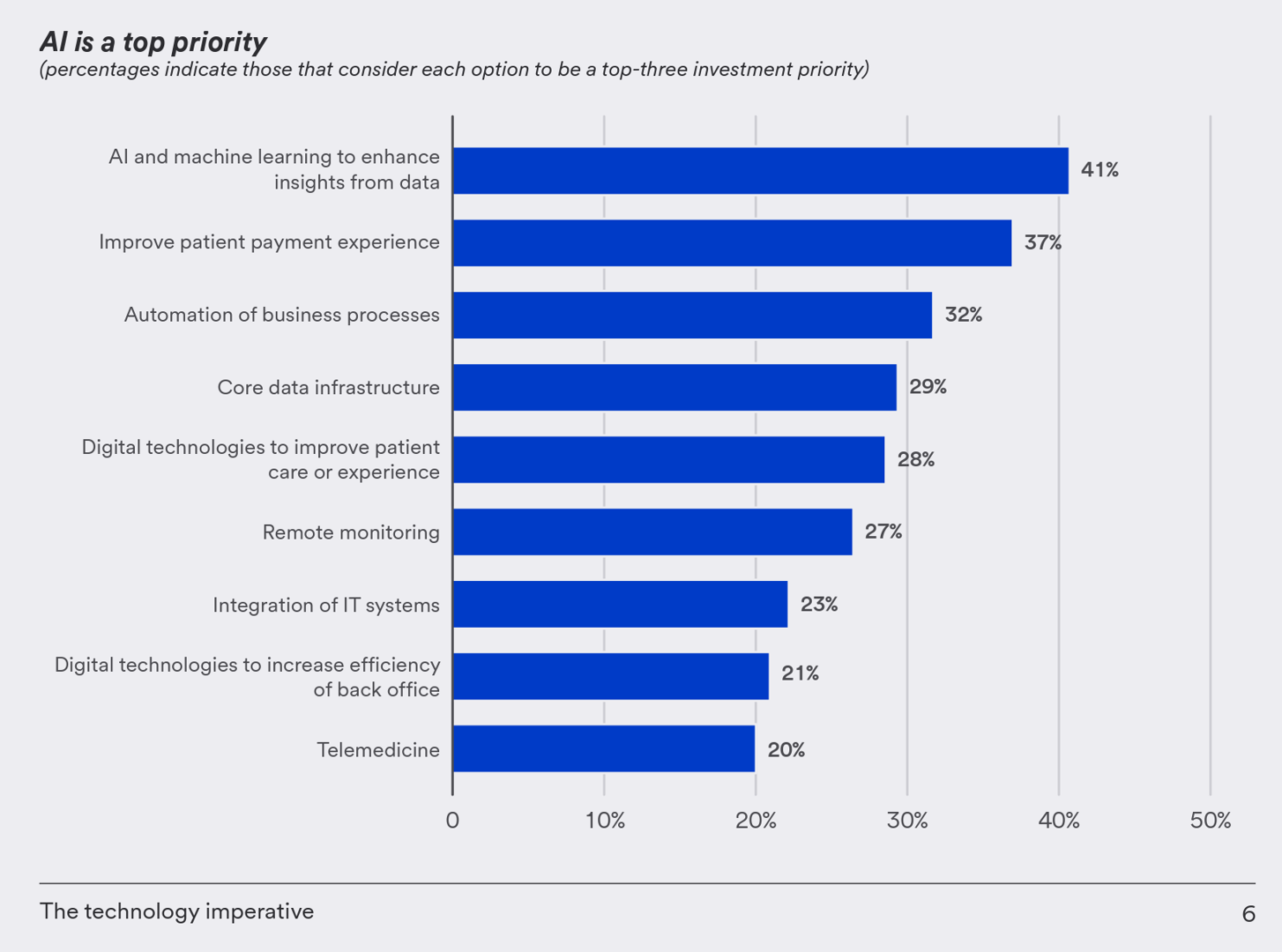

Health Care Finance Leaders Look to Cut Costs and Improve Patients’ Financial Experience — Think AI and Venmo

One half-of health care financial leaders plan to invest in technology to cut costs — and most believe that AI has the potential to re-define the entire finance function as they look to Leading the transformation, a study conducted by U.S. Bank among U.S. health finance leaders thinking about emerging technologies. U.S. Bank fielded a survey among 200 senior health care financial leaders in the U.S., 30% of whom were group CFOs, 20% regional/divisional CFOs, 25% senior managers, and the remaining various flavors of financial managers. All respondents were responsible for at least $100

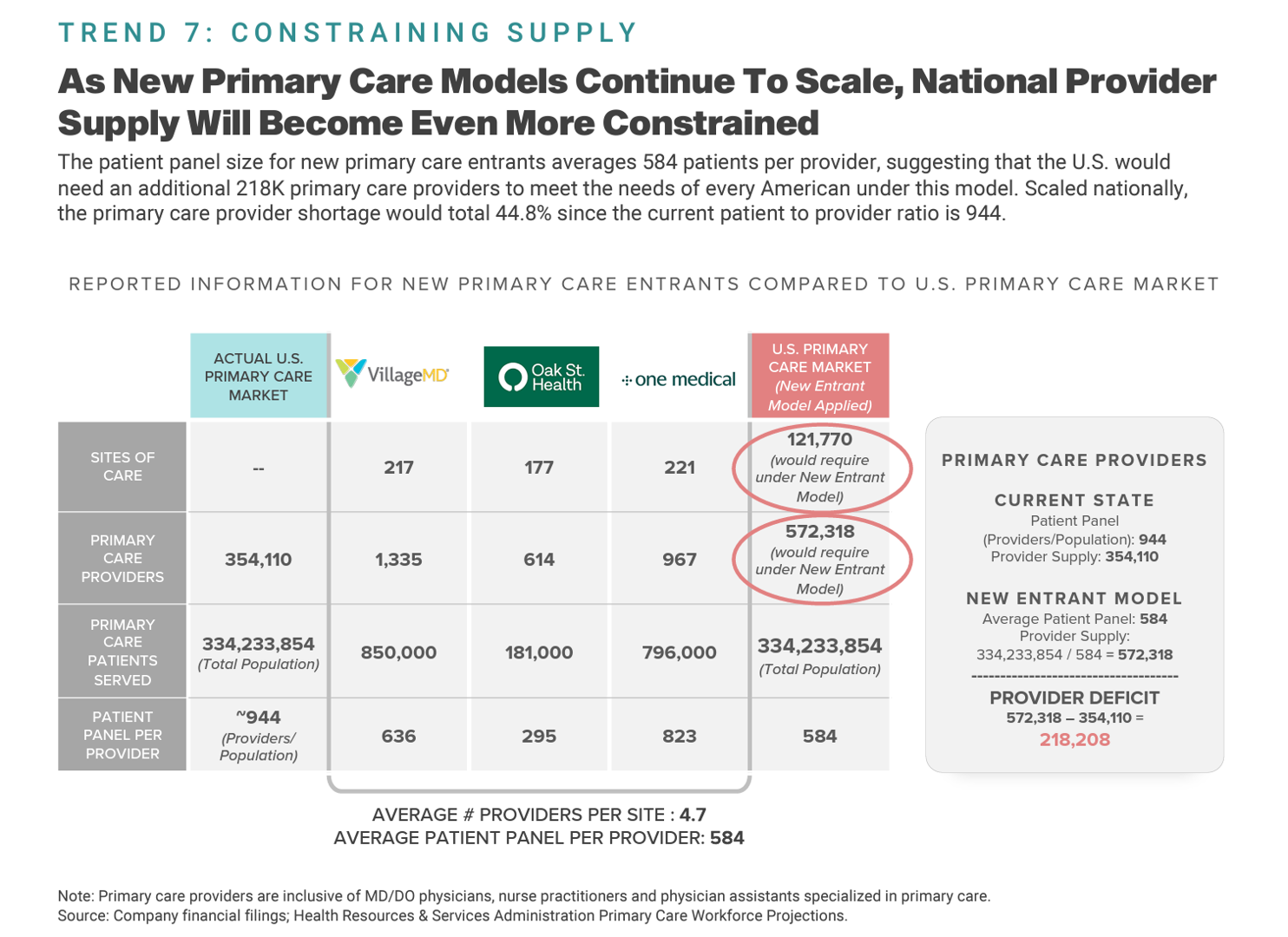

The 2023 Health Economy – The Evolving Primary Care and Retail Health Convergence Through Trilliant Health’s Lens

In U.S. health care’s negative-sum game, stakeholders who survive and win that game will have to deliver value-for-money, we learn from Trilliant Health’s 2023 Trends Shaping the Health Economy Report. “Report” is one word for this nearly 150-page compendium of health care data that is an encyclopedic treasure trove for health service researchers, marketers, strategists, journalists, and those keen to explore questions about the current state of health care in America. As Sanjula Jain points out in the Report’s press release, the publication resembles another huge report many of us appreciated for

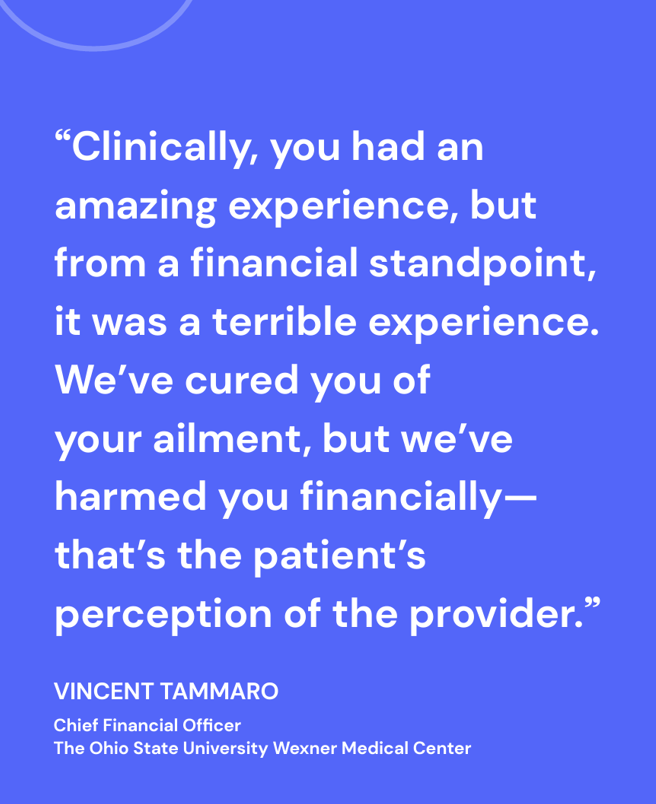

The Healthcare Financial Experience is a Stressful One: the Convergence of our Medical, Retail, and Financial Lives

One in two consumers in the U.S. feel their well-being or healing was negatively impacted by difficulty paying for their medical care. Welcome to the convergence of patients’ health care life with financial and retail lives, we learn from the 2024 Healthcare Financial Experience Study from Cedar. And that patient’s positive clinical experience can absolutely reverse the consumer’s perception of the provider, noted by this quote from OSU’s Chief Financial Officer Vincent Tammaro: “We’ve cured you of your ailment, but we’ve harmed you financially.” That’s a form of financial toxicity that

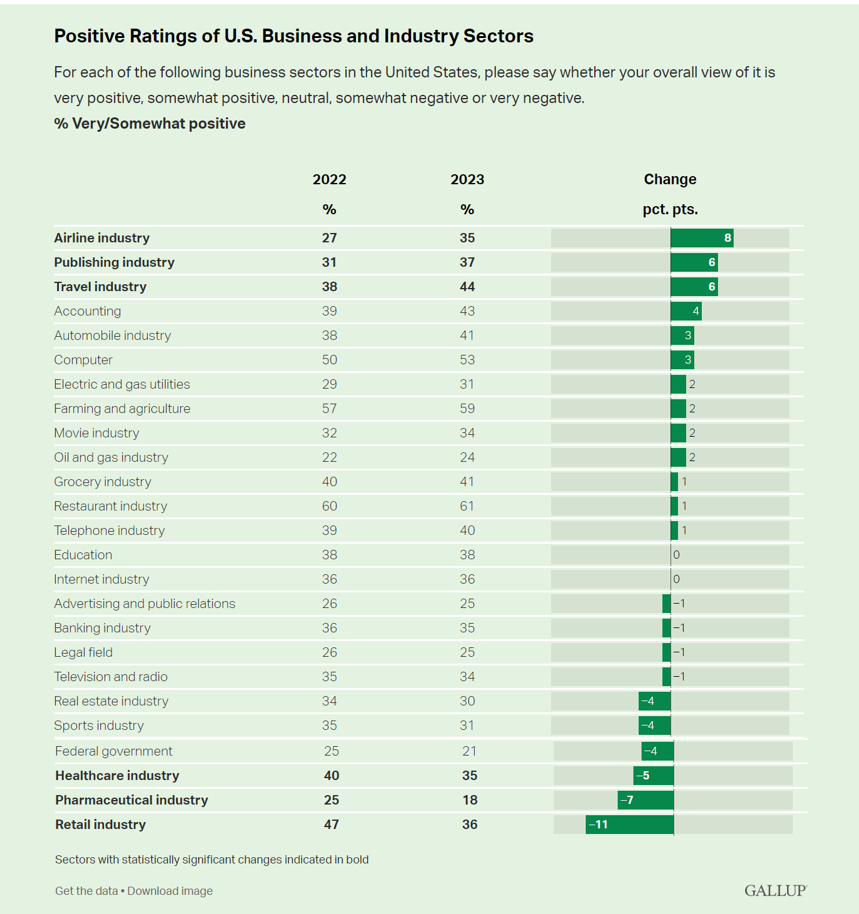

Slip Slidin’ Away: the Reputations of Pharma and Healthcare in the U.S. Decline in the Latest Gallup Poll

Oh, how quickly people forget…and slow to forgive. U.S. consumers’ positive views for healthcare, pharma and retail have significantly fallen in just one year, the latest annual Gallup poll of industry rankings in America found as of August 2023. This stat for the pharma industry was the lowest Gallup ever recorded for the sector since 2001. I can’t help hearing Paul Simon’s lyrics to Slip Slidin’ Away….”you know the nearer your destination, the more you’re slip slidin’ away” when it comes to health citizens’ perceptions of pharma and the healthcare

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

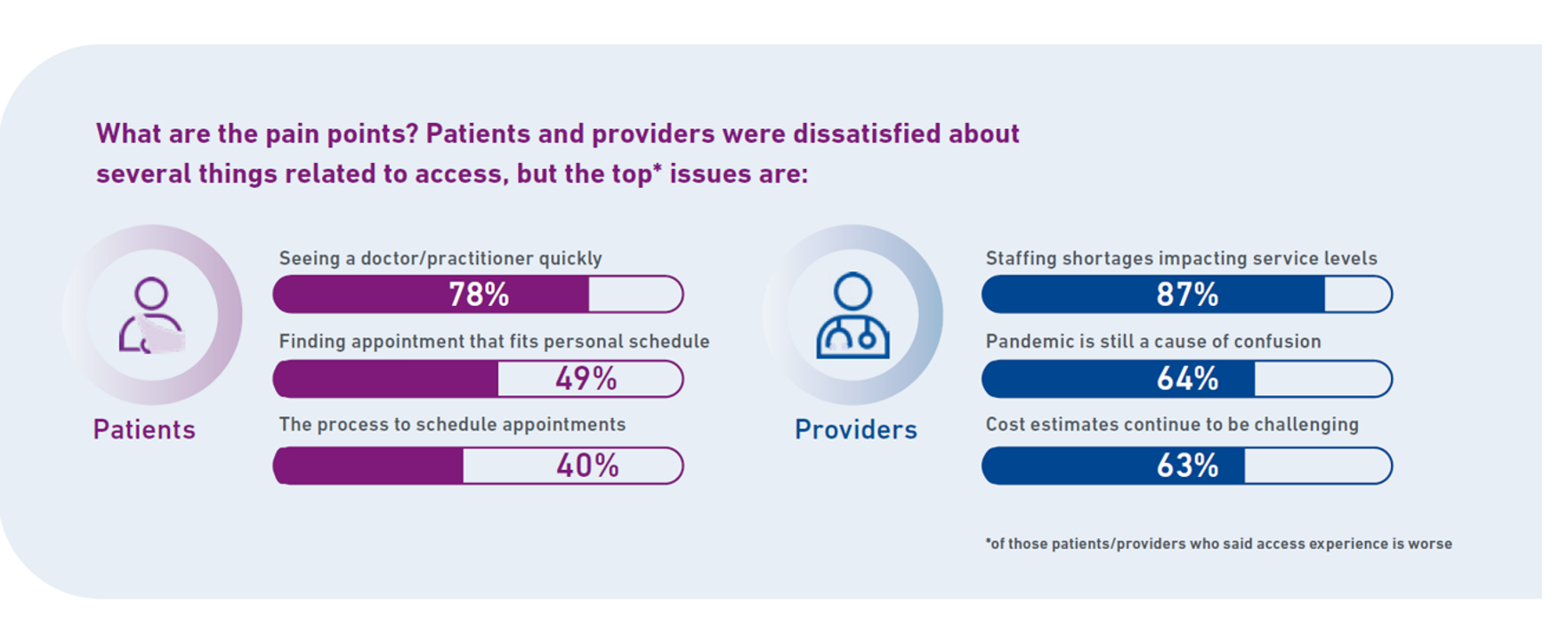

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

A Public Health Wake-Up Call: Reading Between the Lines in IQVIA’s 2023 Use of Medicines Report

Reviewing the annual 2023 report from the IQVIA Institute for Human Data Science discussing The Use of Medicines in the U.S. is always a detailed, deep, and insightful dive into the state of prescription drugs. It’s a volume speaking volumes on the current picture of prescribed meds, spending and revenues, health care utilization trends, and a forecast looking out to 2027. In my read of this year’s review, I see a flashing light for U.S. health care: “Wake up, public health!” I’ve pulled out a few of the data points that speak to me about population health, prevention and early

Quick, Accessible, Inexpensive Health Care – A Retail Health Update from Amazon and Dollar General

Two announcements this week add important initiatives to patients’ growing choices that speak to their consumer-sides’ sense of value and personal healthcare cost-containment: Amazon launched RxPass, a generic medicines subscription service; and, Dollar General promoted its mobile health service powered by DocGo on demand for health visits, “right outside the store.” These two programs come from outside of the legacy health care system of so-called incumbents — hospitals, health systems, health insurance — leveraging two brand-names beloved to many consumers for convenience, price transparency, and sheer cost. First, check out Amazon Pharmacy’s RxPass. Amazon

The Patient as Prescription Drug Payer – The GoodRx Playbook

Patients have more financial skin-in-their-healthcare-games facing high-deductibles and direct out-of-pocket costs for medical bills…including prescription drugs. I collaborated with GoodRx on a “yellow paper” discussing The Health Consumers as Payer, with implications and calls-to-action for pharma and life science companies. You can download the paper at this link. The report is intended to be a playbook for understanding patients’ growing role as consumers and health care payers, providing insights into peoples’ home economic mindsets and how these impact a patient’s adherence to medication based on cost and perceived value. With inflation facing household

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

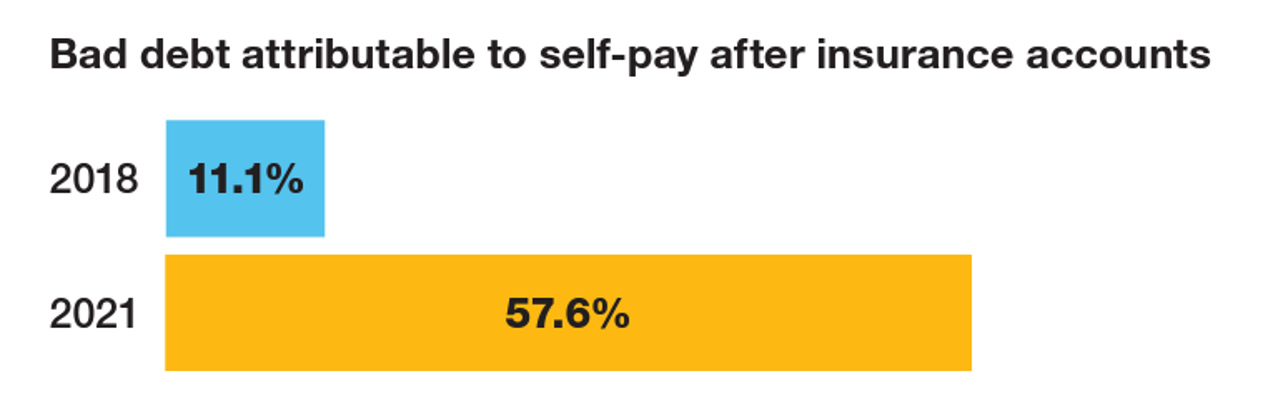

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

The Retail Health Battle Royale, Day 5 – Consumer Demands For a Health/Care Ecosystem (and What We Can Learn from Costco’s $1.50 Hot Dog)

In another factor to add into the retail health landscape, Dollar General (DG) the 80-year old retailer known for selling low-priced fast-moving consumer goods in peoples’ neighborhoods appointed a healthcare advisory panel this week. DG has been exploring its health-and-wellness offerings and has enlisted four physicians to advise the company’s strategy. One of the advisors, Dr. Von Nguyen, is the Clinical Lead of Public and Population Health at Google….tying back to yesterday’s post on Tech Giants in Healthcare. Just about one year ago, DG appointed the company’s first Chief Medical Officer, which I covered here in

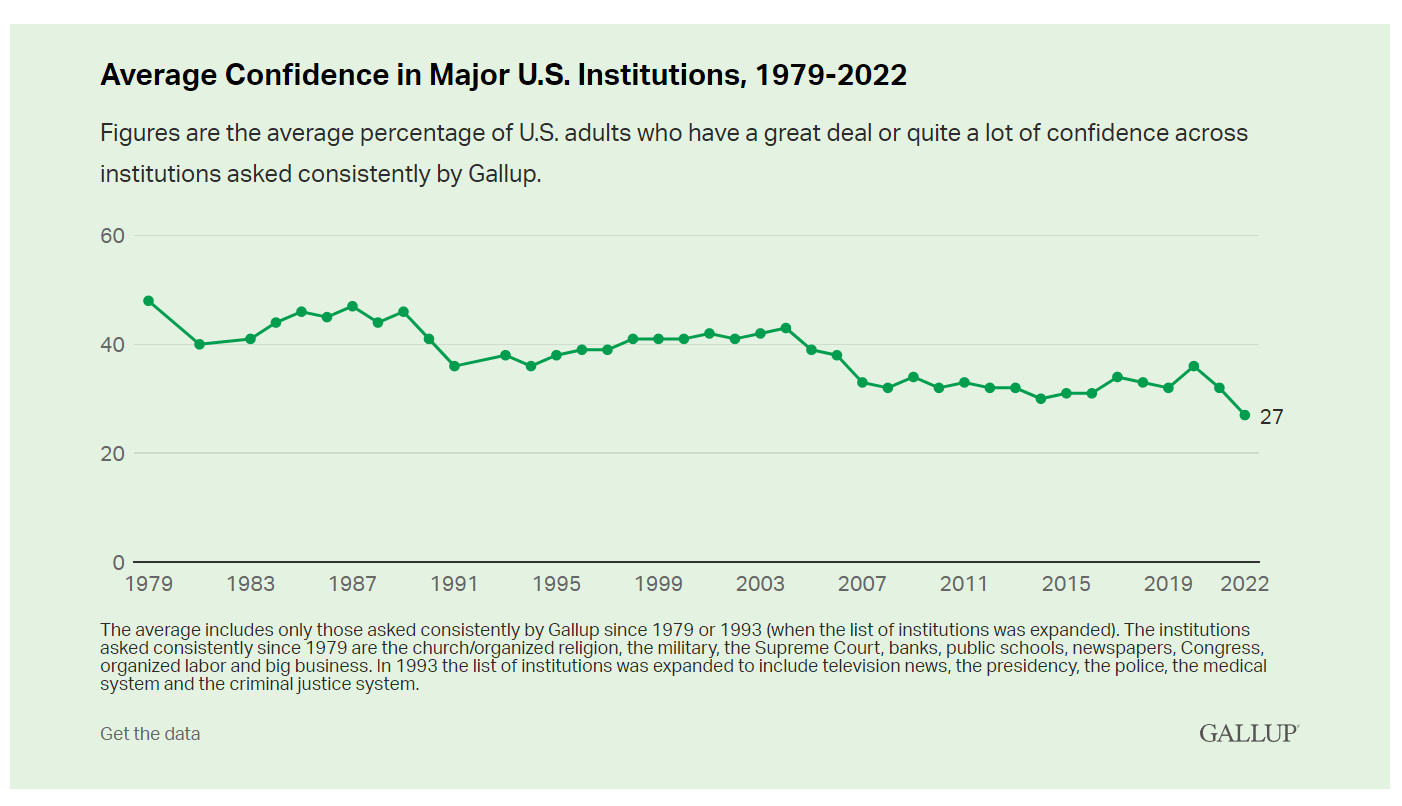

More Americans Trust Small Biz and the Military than the Medical System, Gallup Finds

The most trusted institutions in the U.S. are small business and the military, the only two sectors in which a majority of Americans have confidence. Americans’ trust in institutions hit new historic lows in 2022, Gallup found in its latest poll of U.S. sentiment across all major sectors. Today, more Americans have faith in the police than in the medical system, according to a Gallup poll finding that Confidence in U.S. Institutions Down; Average at New Low. published this week of Independence Day 2022. Confidence runs from a higher of 68% for

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

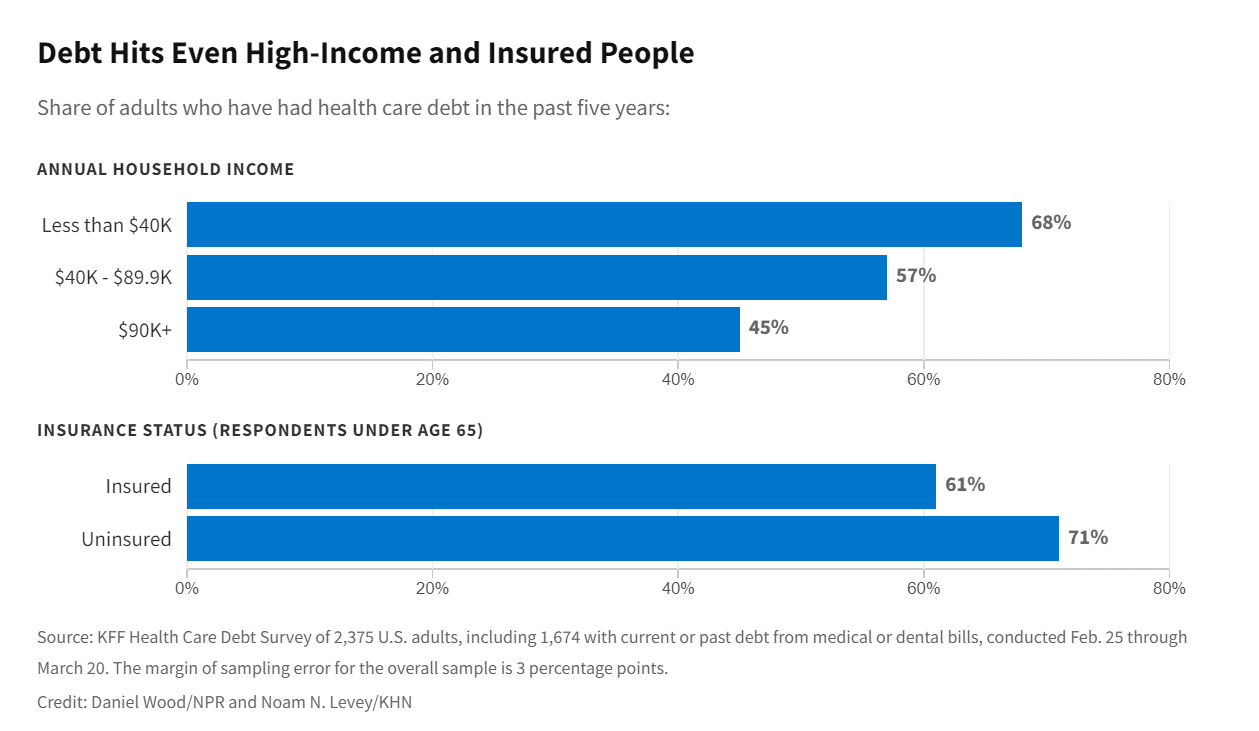

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Add on top of these significant stressors the need to deal with medical bills, which is another source of stress for millions of patients in America. I appreciated the opportunity to share my perspectives on “The Patient As the Payer: How the Pandemic, Inflation, and Anxiety are Reshaping Consumers” in a webinar hosted by CarePayment on 25 May 2022. In this

Aflac Finds Health Care and Financial Stress will “Dampen 2021 Holiday Magic” in U.S. Households

Most U.S. householders that experienced COVID-19 expect their 2021 December holidays will be impacted in terms of reducing their holiday gift or decor spending, canceling holiday travel plans to see family or friends, or canceling holiday events, according to the 2021 Aflac Health Care Issues Survey. Aflac polled 1,003 U.S. adults in September 2021 to gauge Americans’ financial health perspectives approaching the end of Year 2 of the COVID-19 pandemic in America. Families with children feel particularly strapped for the 2021 holiday season: while they will be less likely to reduce holiday spending, one-half are concerned about medical expenses compared with

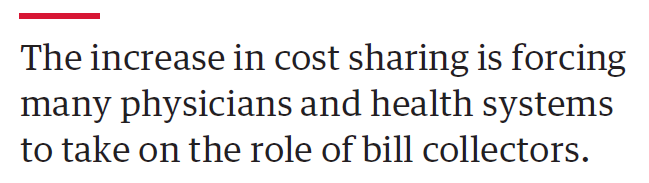

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

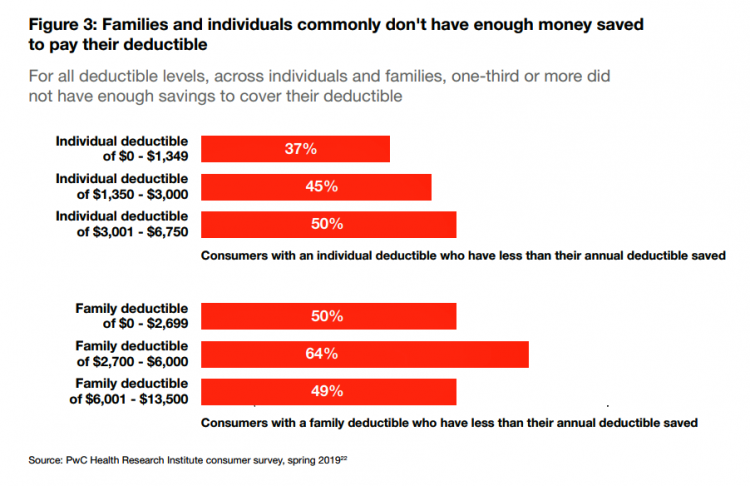

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

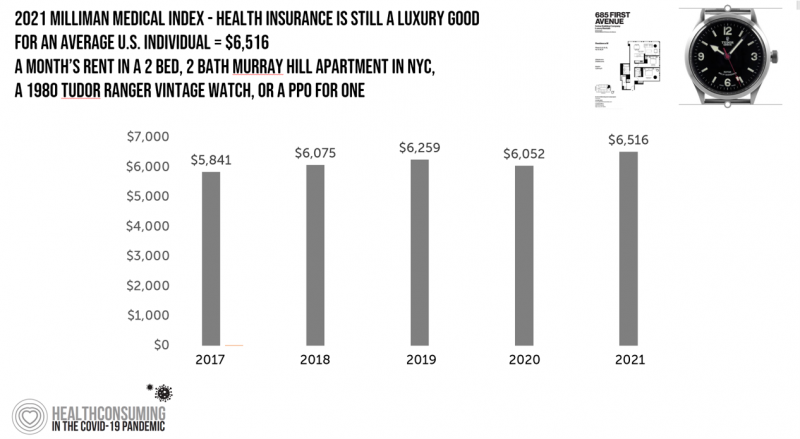

The Cost of Health Care for a Family of 4 in America Will Reach $28,256 in 2021

The good news for health care costs for a family of four in America is that they fell, for the first time in like, ever, in 2020. But like a déjà vu all over again, annual health care costs for a family of four enrolled in a PPO will climb to over $28,000 in 2021, based on the latest 2021 Milliman Medical Index (MMI). The first chart shows how health care costs declined in our Year of COVID, 2020, by over $1,000 for that hypothetical U.S. family. But costs rise with a statistical vengeance this year, by nearly $2,200 per family–about

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

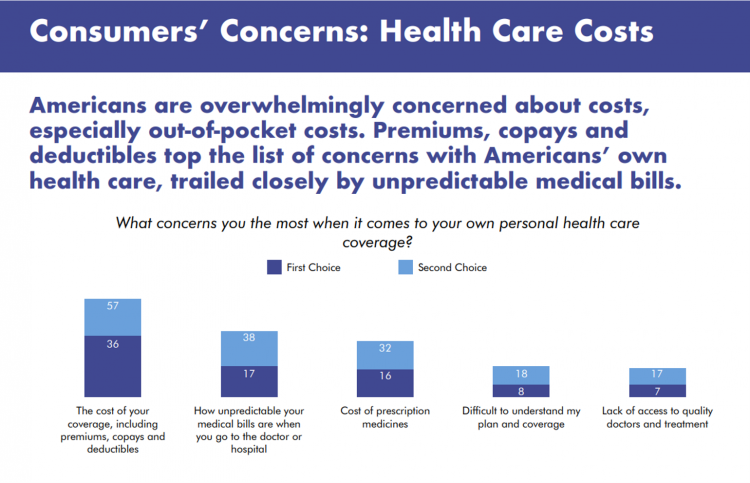

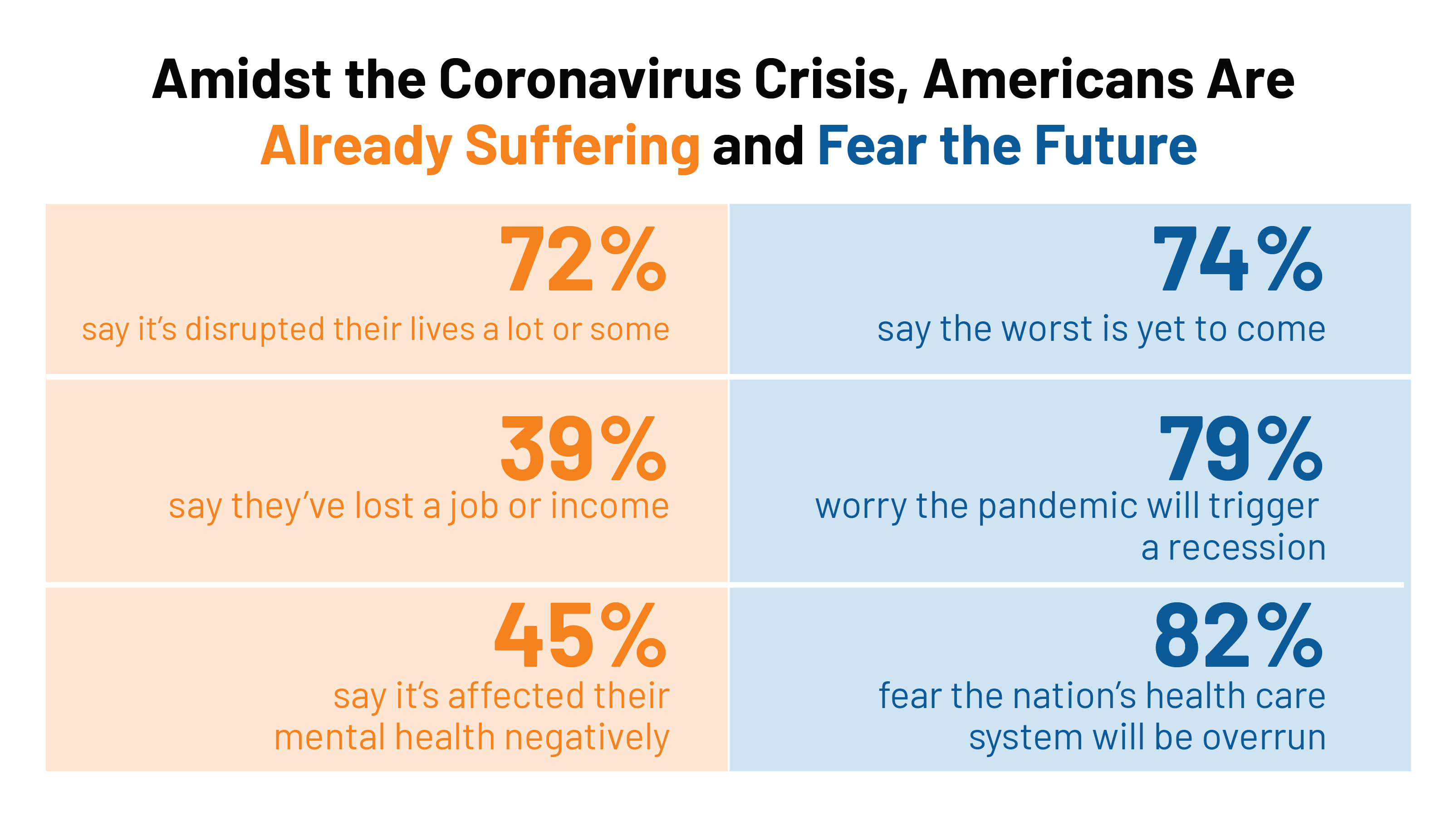

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

The Digital Consumer, Increasingly Connected to Health Devices; Parks Associates Kicking Off #CES2021

In 2020, the COVID-19 pandemic drove U.S. consumers to increase spending on electronics, notably laptops, smartphones, and desktop computers. But the coronavirus era also saw broadband households spending more on connecting health devices, with 42% of U.S. consumers owning digital health tech compared with 33% in 2015, according to research discussed in Supporting Today’s Connected Consumer from Parks Associates. developed for Sutherland, the digital transformation company. Consumer electronics purchase growth was, “likely driven by new social distancing guidelines brought on by COVID-19, which requires many individuals to work and attend school from home. Among the 26% of US broadband households

U.S. Health Consumers’ Growing Financial Pressures, From COVID to Cancer

Before the coronavirus pandemic, patients had been transforming into health care payors, bearing high deductibles, greater out of pocket costs, and financial risk shifting to them for medical spending. In the wake of COVID-19, we see health consumers-as-payors impacted by the pandemic, as well as for existing diagnoses and chronic care management. There is weakening in U.S. consumers’ overall household finances, the latest report from the U.S. Bureau of Economic Analysis (BEA) asserted (published 25 November 2020). In John Leer’s look into the BEA report in Morning Consult, he wrote, “Decreases in income, the expiration of unemployment benefits and increased

COVID-19 Has Accelerated Consumers’ Interest in Healthy Home Tech

One in two U.S. adults say their concerns about personal health and wellness increased in the past year: in particular, stress and anxiety, and sleep and eating habits. Despite spending more time at home due to the COVID-19 pandemic, few people believe they live in a “healthy home.” The vast majority of consumers are concerned about some aspect of their home’s health, like air or water quality, according to Healthy Home Technologies , a report published in October 2020 by the Consumer Technology Association (CTA), convener of the annual CES. For the research, CES interviewed 1,500 U.S. adults in late

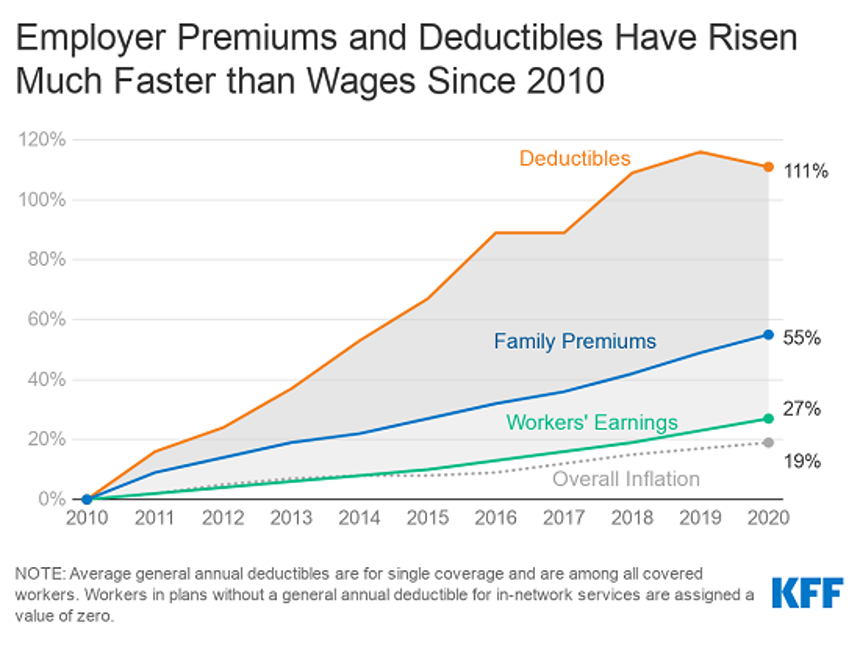

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

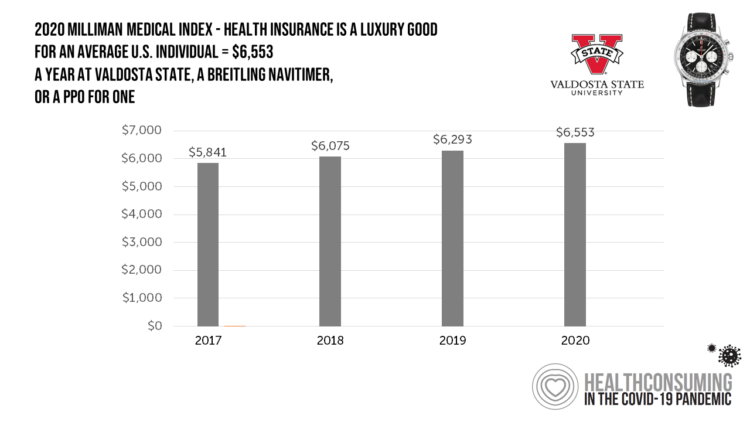

What $6,553 Buys You in America: A Luxury Watch, a Year at Valdosta State, or a PPO for One – the 2020 Milliman Medical Index

Imagine this: you find yourself with $6,553 in your pocket and you can pick one of the following: A new 2020 Breitling Navitimer watch; A year’s in-state tuition at Valdosta State University; or, A PPO for an average individual. Welcome to the annual Milliman Medical Index (MMI), which gauges the yearly price of an employer-sponsored preferred-provider organization (PPO) health insurance plan for a hypothetical American family and an N of 1 employee. That is a 4.1% increase from the 2019 estimate, about twice the rate of U.S. gross domestic product growth, Milliman points out in its report. Milliman bases

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

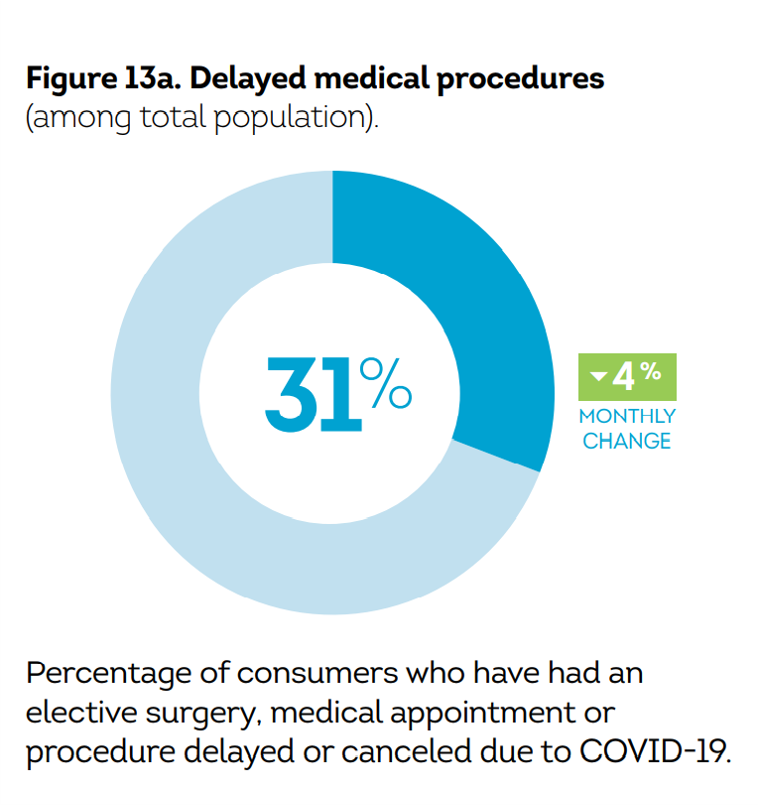

The Patient-as-Payor in the Coronavirus Pandemic

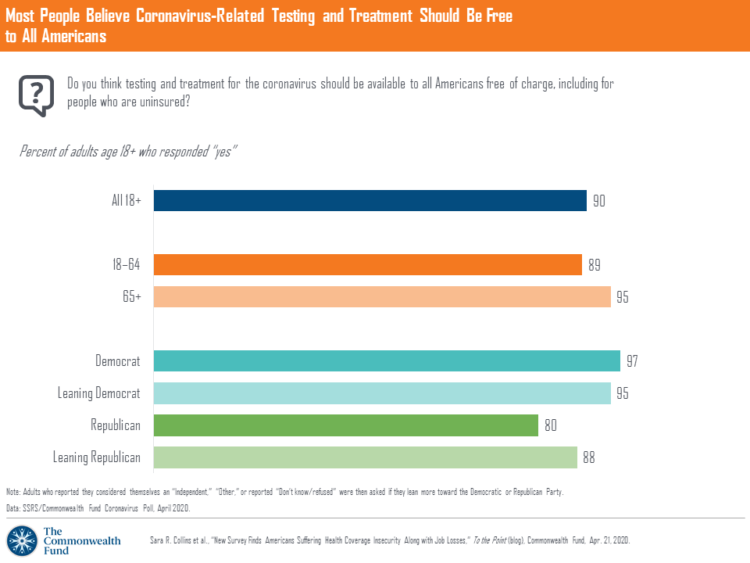

One in three working age people in the U.S. lost their job as a response to the COVID-19 pandemic, some of whom lost health insurance and others anxious their health coverage will be threatened, revealed in a survey from The Commonwealth Fund published on April 21, 2020. 2 in 5 people in America who are dealing with job insecurity are also health insurance insecure, the study found, as shown in the pie chart. The Commonwealth Fund commissioned the poll among 1,001 U.S. adults 18 to 64 years of age between 8-13 April 2020. Nearly all Americans believe the dots of

Wistful Thinking: The National Health Spending Forecast In a Land Without COVID-19

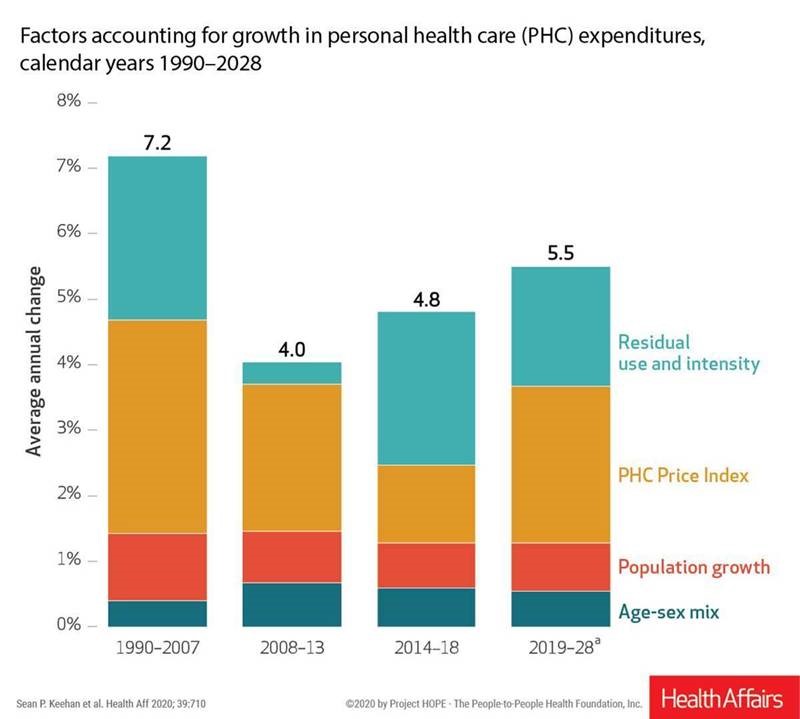

U.S. health care spending will grow to 20% of the national economy by 2028, forecasted in projections pre-published in the April 2020 issue of Health Affairs, National Health Expenditure (NHE) Projections. 2019-28: Expected Rebound in Prices Drives Rising Spending Growth. NHE will grow 5.4% in the decade, the model expects. But…what a difference a pandemic could make on this forecast. This year, NHE will be $3.8 trillion, growing to $6.2 trillion in 2028. Hospital care spending, the largest single component in national health spending, is estimated at $1.3 trillion in 2020. These projections are based on “current law,” the team

In the US COVID-19 Pandemic, A Tension Between the Fiscal and the Physical

“Act fast and do whatever it takes,” insists the second half of the title of a new eBook with contributions from forty leading economists from around the world. The first half of the title is, Mitigating the COVID Economic Crisis. The book is discussed in a World Economic Forum essay discussing the economists’ consensus to “act fast.” As the U.S. curve adds new American patients testing positive for the coronavirus, the book and essay illustrate the tension between health consumer versus the health citizen in the U.S. For clinical context, as I write this post on 24th March 2020, today’s U.S.

Waking Up a Health Consumer in the COVID-19 Era

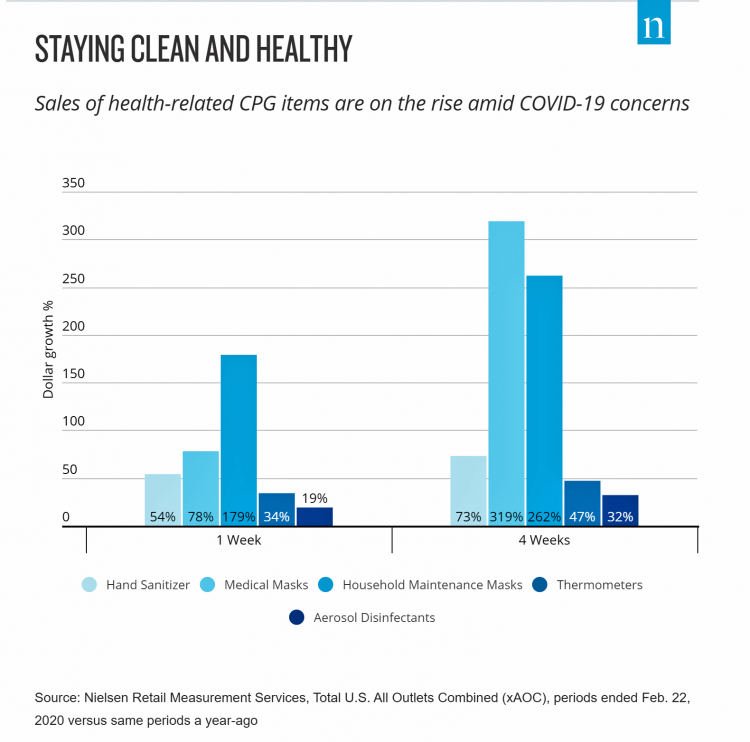

With President Trump’s somber speech from the Oval Office last night, we wake up on 12th March 2020 to a ban on most travel from Europe to the U.S., recommendations for hygiene, and call to come together in America. His remarks focused largely on an immigration and travel policy versus science, triaging, testing and treatment of the virus itself. Here is a link to the President’s full remarks from the White House website, presented at about 9 pm on 11 March 2020. Over the past week, I’ve culled several studies and resources to divine a profile of the U.S. consumer

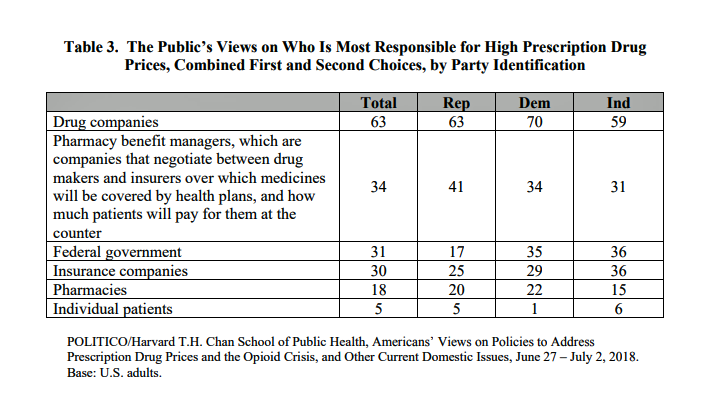

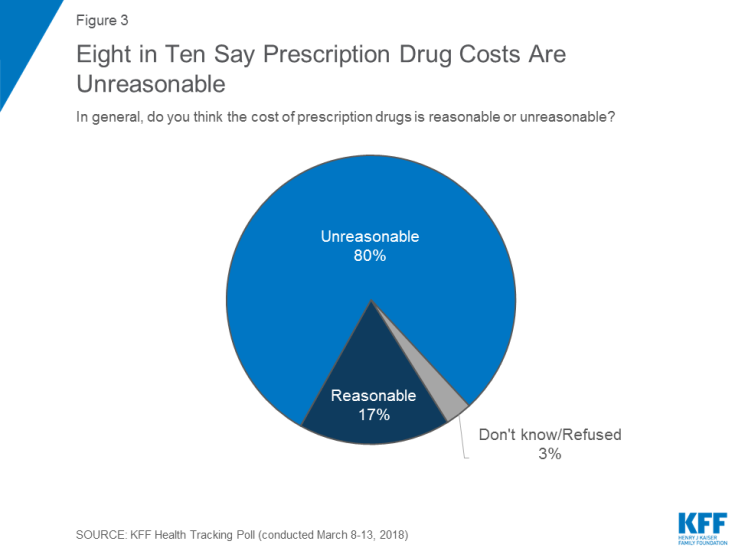

Americans’ Top 2 Priorities for President Trump and Congress Are To Lower Health Care and Rx Costs

Health care pocketbook issues rank first and second place for Americans in these months leading up to the 2020 Presidential election, according to research from POLITICO and the Harvard Chan School of Public Health published on 19th February 2020. This poll underscores that whether Democrat or Republican, these are the top two domestic priorities among Americans above all other issues polled including immigration, trade agreements, infrastructure and regulations. The point that Robert Blendon, Harvard’s long-time health care pollster, notes is that, “Even among Democrats, the top issues…(are) not the big system reform debates…They’re worried about their own lives, their own

Living in Digital Healthcare Times – Kicking off #DigitalHealthCES & #CES2020

Today is Day 1 of two Media Days at #CES2020 in Las Vegas, kicking off this manic week of the Consumer Electronics Show at the Mandalay Bay convention center. For several years, I’ve convened with journalists and industry analysts from around the world for these two days before the “official” opening of CES to hear the latest news from some of the largest tech-focused companies on Earth. Announcements come from across industry sector — from automotive and transportation, telecoms, consumer goods, entertainment, social media, travel, and retail…with platform technologies playing a role including but not limited to AI, AR/VR/XR (the

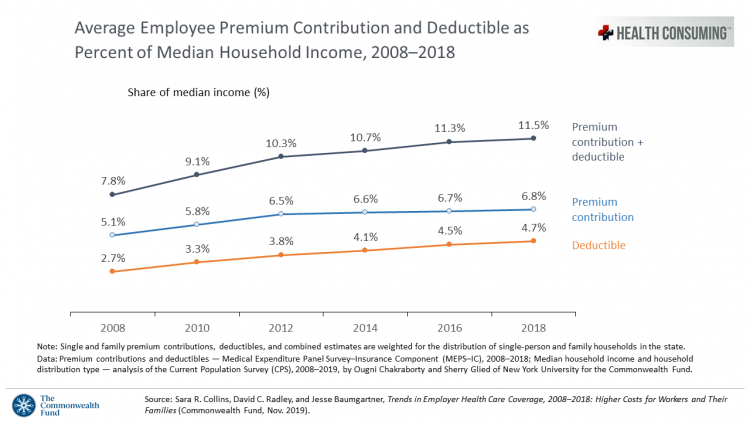

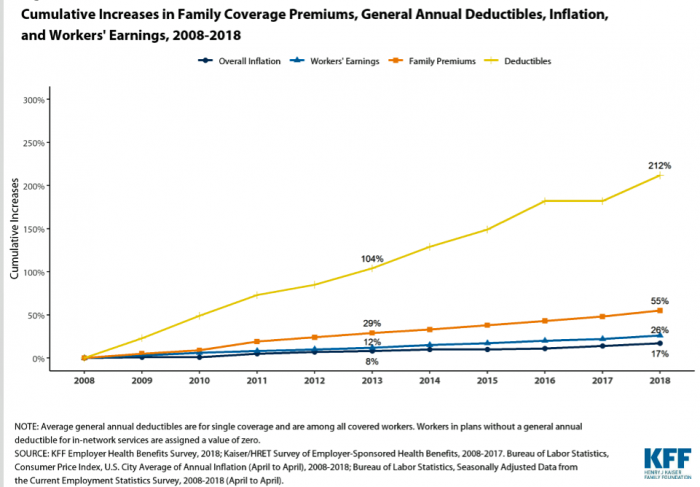

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Despite Greater Digital Health Engagement, Americans Have Worse Health and Financial Outcomes Than Other Nations’ Health Citizens

The idea of health care consumerism isn’t just an American discussion, Deloitte points out in its 2019 global survey of healthcare consumers report, A consumer-centered future of health. The driving forces shaping health and health care around the world are re-shaping health care financing and delivery around the world, and especially considering the growing role of patients in self-care — in terms of financing, clinical decision making and care-flows. With that said, Americans tend to be more healthcare-engaged than peer patients in Australia, Canada, Denmark, Germany, the Netherlands, Singapore, and the United Kingdom, Deloitte’s poll found. Some of the key behaviors

Hospitals Suffer Decline in Consumer Satisfaction

While customer satisfaction with health insurance plans slightly increased between 2018 and 2019, patient satisfaction with hospitals fell in all three settings where care is delivered — inpatient, outpatient, and the emergency room, according to the 2018-2019 ACSI Finance, Insurance and Health Care Report. ACSI polls about 300,000 U.S. consumers each year to gauge satisfaction with over 400 companies in 46 industries. For historic trends, you can check out my coverage of the 2014 version of this study here in Health Populi. The 2019 ACSI report bundles finance/banks, insurance (property/casualty, life and health) and hospitals together in one document. Health

More Evidence of Self-Rationing as Patients Morph into Healthcare Payors

Several new studies reveal that more patients are feeling and living out their role as health care payors as medical spending vies with other household line items. This role of patient-as-the-payor crosses consumers’ ages and demographics, and is heating up health care as the top political issue for the 2020 elections at both Federal and State levels. In research from HealthPocket, 2 in 5 Americans said they needed to reduce other household expenses to be able to afford their monthly insurance premiums. Four in ten consumers said their monthly health insurance premiums were increasing. One in four people in the

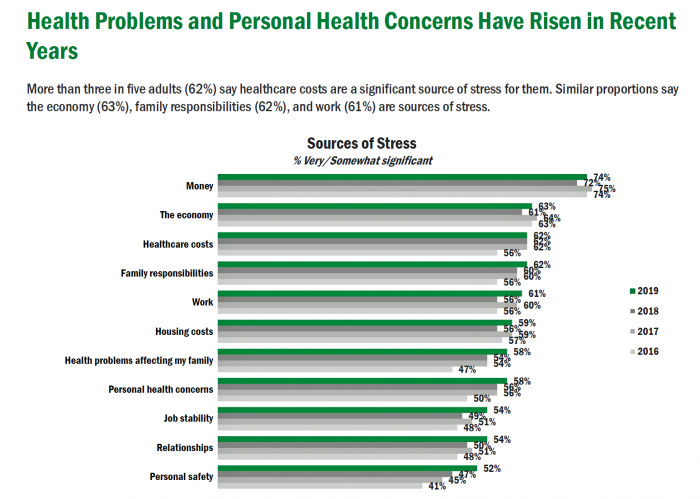

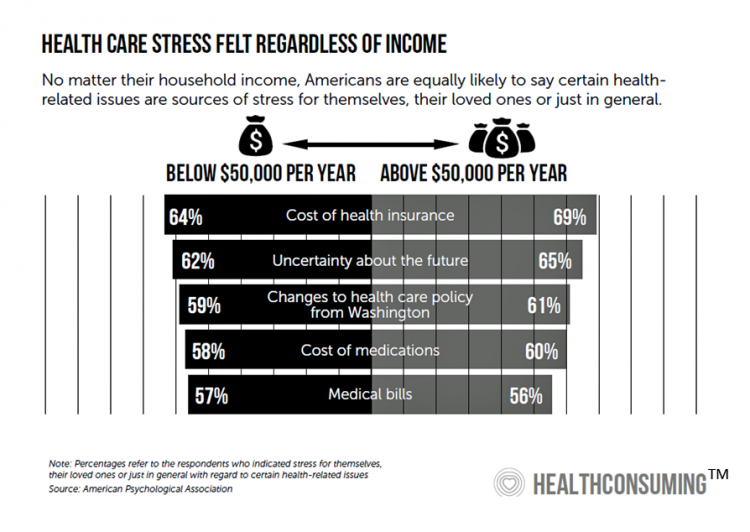

Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

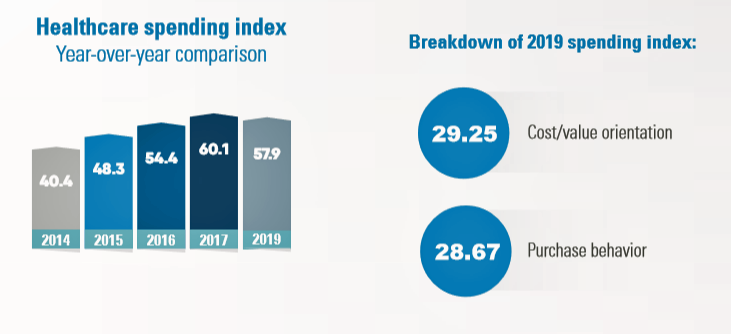

Health Consumer Behaviors in the U.S. Stall, Alegeus Finds in the 2019 Index

In the U.S., the theory of and rationale behind consumer-directed health has been that if you give a patient more financial skin-in-the-game — that is, to compel people to spend more out-of-pocket on health care — you will motivate that patient to don the hat of a consumer — to mindfully research, shop around, and purchase health care in a rational way, benefit from lower-cost and high-quality healthcare services. For years, Alegeus found that patients were indeed growing those consumer health muscles to save and shop for health care. In 2019, it appears that patients have backslid, according to the

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

How Can Patients Be Health Consumers in an Un-Transparent World?

That question in the title of this post is begged in the annual 2019 consumer survey released this week from UnitedHealthcare (UHC). UHC gauges peoples’ views on health care, insurance, and costs in its yearly research. This year, transparency and health literacy challenges top the findings. When the three in ten folks do shop, four in ten people used the internet or mobile apps to do so — a dramatic increase from 2012. Shopping is most commonly done among Millennials, one-half of whom shop for health care services. Of people who have used digital tools for health care shopping, 8

Talking “HealthConsuming” on the MM&M Podcast

Marc Iskowitz, Executive Editor of MM&M, warmly welcomed me to the Haymarket Media soundproof studio in New York City yesterday. We’d been trying to schedule meeting up to do a live podcast since February, and we finally got our mutual acts together on 6th August 2019. Here’s a link to the 30-minute conversation, where Marc combed through the over 500 endnotes from HealthConsuming‘s appendix to explore the patient as the new health care payor, the Amazon prime-ing of people, and prospects for social determinants of health to bolster medicines “beyond the pill.” https://www.pscp.tv/MMMnews/1eaJbvgovBYJX Thanks for listening — and if you

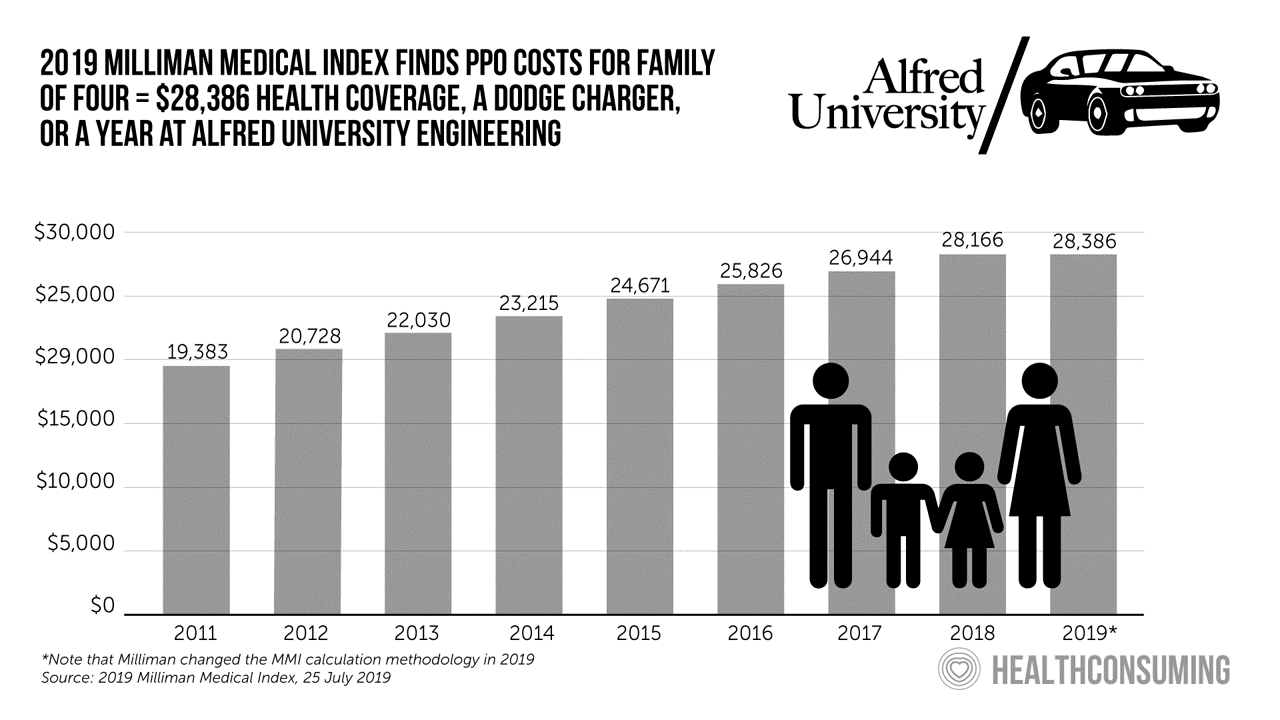

Milliman Finds PPO for Family of 4 in 2019 Will Cost $28,386

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI). Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University. The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years. The key points of the report are that:

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

On Amazon Prime Day, What Could Health Care Look Like?

Today is July 15, and my email in-box is flooded with all flavors of Amazon Prime’d stories in newsletters and product info from ecommerce sites — even those outside of Amazon from beauty retailers, electronics channels, and grocery stores. So I ask on what will probably be among the top ecommerce revenue generating days of all time: “What could health care look like when Amazon Prime’d?” I ask and answer this in my book, HealthConsuming, as chapter 3. For context, this chapter follows two that explain how patients in the U.S. have been morphing into health consumers based on how health

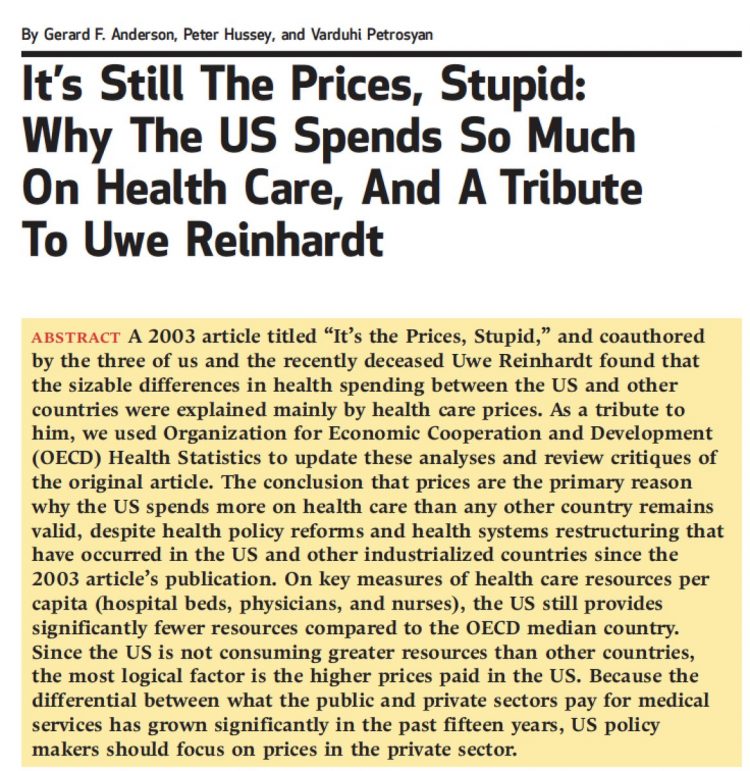

Retail Pricing in U.S. Health Care? Why Transparency Is Hard to Do

“It’s the prices stupid,” Uwe Reinhardt and Gerard Anderson and colleagues asserted in the title their seminal Health Affairs manifesto on U.S. healthcare spending. Sixteen years later, yesterday on 8th July 2019, a Federal U.S. judge blocked, in the literal last-minute, a DHHS order mandating prescription drug companies to publish “retail prices” of medicines in direct-to-consumer TV ads. I was getting this post on transparency together just before that announcement hit the press, so this post would have had a different nuance yesterday compared with today. And that’s how health care politics and economics in America roll these days. Welcome to

Health Care and the Democratic Debates – Round 2 – Battle Royale for M4All vs Medicare for All Who Want It – What It Means for Industry

Looking at this photo of the 2020 Democratic Party Presidential candidate debater line-up might give you a déjà vu feeling, a repeat of the night-before debate. But this was Round 2 of the debate, with ten more White House aspirants sharing views — sometimes sparring — on issues of immigration, economic justice, climate change, and once again health care playing a starring role from the start of the two-hour event. The line-up from left to write included: Marianne Williamson. author and spiritual advisor John Hickenlooper, former Governor of Colorado Andrew Yang. tech company executive Pete Buttigieg, Mayor of South Bend,

Health Care and the Democratic Debates – Part 1 – Medicare For All, Rx Prices, Guns and Mental Health

Twenty Democratic Presidential candidates each have a handful of minutes to make their case for scoring the 2020 nomination, “debating” last night and tonight on major issues facing the United States. I watched every minute, iPad at the ready, taking detailed notes during the 120 minutes of political discourse conducted at breakneck speed. Lester Holt, Savannah Guthrie, and Jose Diaz-Balart asked the ten candidates questions covering guns, butter (the economy), immigration, climate change, and of course, health care — what I’m focusing on in this post, the first of two-debate-days-in-a-row. The first ten of twenty candidates in this debate were,

Healthcare Costs Inspire Employer Activism and Employee Dissatisfaction – What PwC Found Behind the Numbers

In the U.S. each year between 2006 and 2016, employees’ healthcare cost sharing grew 4.5%. In that decade, Americans’ median wages rose 1.8% a year, PwC notes in their annual report, Medical cost trend: Behind the numbers 2020 from the firm’s Health Research Institute. Medical cost trend is the projected percent growth in healthcare costs over a year based on an equivalent benefit package from one year to the next. As the first chart shows, trend will grow 6% from 2019 to 2020. This is an increase of 0.3 percentage points up from 5.7% for 2019, which was flat from

Prescription Drug Costs In America Through the Patient Lens, via IQVIA, GoodRx and a New $2 Million Therapy

Americans consumed 17.6 prescriptions per person in 2018, two in three of which treated chronic conditions. Welcome to Medicine Use and Spending in the U.S. , the annual review of prescription drug supply, demand and Rx pricing dynamics from the IQVIA Institute for Human Data Science. In a call with analysts this week in which I participated, the Institute’s Executive Director Murray Aitken discussed the report which looks back at 2018 and forward to 2023 with scenarios about what the U.S. prescription drug market might look like five years from now. The report is organized into four sections: medical use

Assessing the GAO’s Report on Single-Payer Healthcare in America: Let’s Re-Imagine Workflow

Calls for universal health care, some under the banner of Medicare for All,” are growing among some policy makers and presidential candidates looking to run in 2020. As a response, the Chairman of the House Budget Committee in the U.S. Congress, Rep. John Yarmuth (D-Ky.), asked the Congressional Budget Office (CBO) to develop a report outlining definitions and concepts for a single-payer health care system in the U.S. The result of this ask is the report, Key Design Components and Considerations for Establishing a Single-Payer Health Care System, published on 1st May by the CBO. The report provides

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

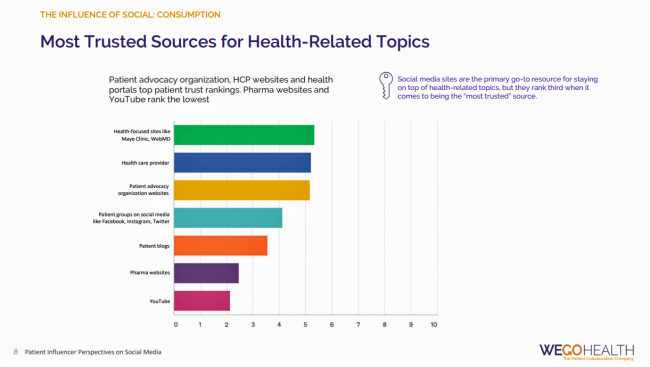

Listen Up, Healthcare: Hear The Patient’s Voice!

Consider the voice of a patient before the advent of the Internet in the digital 1.0 world, and then the proliferation of social networks in v 2.0. One patient could talk with another over their proverbial neighborhood fence, a concerned parent at the PTA meeting with others dealing with a children’s health issue, or a recovering alcoholic testifying in person at an AA session. Today, the voice of the patient is magnified one-to-many, omnichannel and multi-platform — via video, blogs, podcasts, social networks, listservs….and, yes, still in live forums like AA meetings, church basements, Y-spaces, and the Frazzled Cafe meet-ups

Health/Care Everywhere – Re-Imagining Healthcare at ATA 2019

“ATA” is the new three-letter acronym for the American Telemedicine Association, meeting today through Tuesday at the Convention Center in New Orleans. Ann Mond Johnson assumed the helm of CEO of ATA in 2018, and she’s issued a call-to-action across the health/care ecosystem for a delivery system upgrade. Her interview here in HealthLeaders speaks to her vision, recognizing, “It’s just stunning that there’s such a lag between what is possible in telehealth and what is actually happening.” I’m so keen on telehealth, I’m personally participating in three sessions at #ATA19. On Monday 15th April (US Tax Day, which is relevant

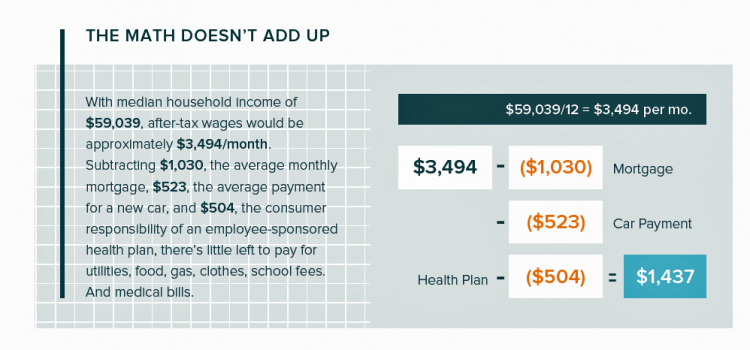

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

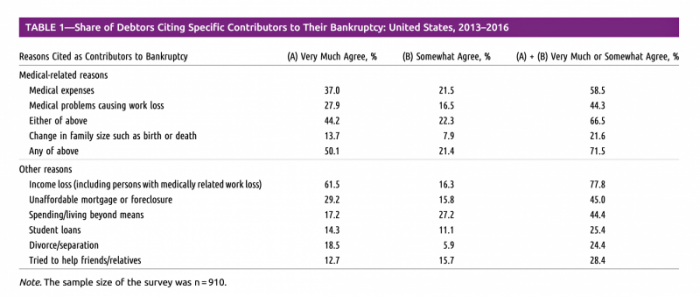

Medical Issues Are Still The #1 Contributor to Bankruptcy in the U.S., An AJPH Study Asserts

Medical costs in America are still the top contributor to personal bankruptcy in the U.S., a risk factor in two-thirds of bankruptcies filed between 2013 and 2016. That’s a sad fiscal fact, especially as more Americans gained access to health insurance under the Affordable Care Act, according to a study published this month in the American Journal of Public Health (AJPA). Between 2013 and 2016, about 530,000 bankruptcies were filed among U.S. families each year associated with medical reasons, illustrated in Table 1 from the study. The report, Medical Bankruptcy: Still Common Despite the Affordable Care Act, updates research from 2007 which

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

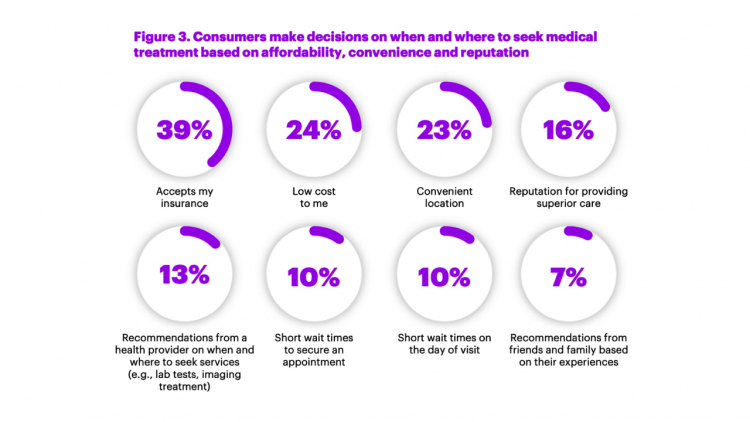

Cost and Convenience Underpin Patient Demands As Health Consumers

Across generations, from younger to older patients, cost, transparency and convenience drive consumer satisfaction, Accenture’s latest health consumer survey found. I had the opportunity to brainstorm the study’s findings in real-time on the day of survey launch, 12 February, with Dr. Kaveh Safavi, Brian Kalis, and Jenn Francis at HIMSS19. Our starting point was the tipping-point statistic that over 50% of people in the U.S. have chosen to use a non-traditional health care setting. Those non-traditional sites of care include walk-in and retail clinics, outpatient surgery centers, virtual health (whether on the phone, on video or via mobile apps), on-demand services,

Telehealth and Virtual Care Are Melting Into “Just” Health Care at HIMSS19

Just as we experienced “e-business” departments blurring into ecommerce and everyday business processes, so is “telehealth” morphing into, simply, health care delivery as one of many channels and platforms. Telehealth and virtual care are key education topics and exhibitor presences at HIMSS19. Several factors underpin the adoption of telehealth in 2019: Consumers’ demand for accessible, lower-cost health care services as people face greater financial responsibility for paying the medical bill (via high-deductible health plans and greater out-of-pocket costs for co-payments) Some consumers’ lacking or losing health insurance as ACA coverage eroded in the past two years, resulting in these patients

HIMSS 2019: The Mainstreaming of Health IT, from Jim Cramer to Opioid Risk Scores

On January 10, 2019, Jim Cramer of CNBC’s Mad Money recommended that Apple buy Epic, a market leader in EHRs. At that moment in the Twitterverse, it occurred to me that health IT as a consumer-facing industry was beginning to mainstream in America. Cramer’s pronouncement led to a tweetstorm where hundreds of tweeters in and outside of health/care talked back and with Cramer. A few of my favorite comments were: “Jim Cramer needs a crash course in FHIR standards” from the wonkier section of peanut gallery. “They are not even in the same universe” among people dissing the idea in

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

The Consumer as Payor – Retail Health at CES 2019

All health/care is retail now in America. I say this as most people in the U.S. who have health insurance must take on a deductible of some amount, which compels that insured individual to spend the first dollar on medical services up until they meet their financial commitment. At that point, health insurance kicks in, and then the insured may have to spend additional funds on co-payments for general medicines and services, and coinsurance for specialty drugs like injectables and high-cost new therapies. The patient is a consumer is a payor, I asserted today during my talk on the expanding

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

While National Health Care Spending Growth Slowed in 2017, One Stakeholder’s Financial Burden Grew: The Consumer’s

National health care spending growth slowed in 2017 to the post-recession rate of 3.9%, down from 4.8% in 2016. Per person, spending on health care grew 3.2% to $10,739 in 2017, and the share of GDP spent on medical care held steady at 17.9%. Healthcare spending in America is a $3.5 trillion micro-economy…roughly the size of the entire GDP of Germany, and about $1 trillion greater than the entire economy of France. These annual numbers come out of the annual report from the Centers for Medicare and Medicaid Services, published yesterday in Health Affairs. Underneath these macro-health economic numbers is

Most Americans Want the Federal Government to Ensure Healthcare for All

Most people in the U.S. believe that the Federal government should ensure that their fellow Americans, a new Gallup Poll found. This sentiment has been relatively stable since 2000 except for two big outlying years: a spike of 69% in 2006, and a low-point in 2003 of 42%. In 2006, Medicare Part D launched, which may have boosted consumers’ faith in Federal healthcare programs. In contrast, in 2013 the Affordable Care Act was in implementation and consumer-adoption mode, accompanied by aggressive anti-“Obamacare” campaigns in mass media. That’s the top lighter green line in the first chart. But while there’s majority support

As Workers’ Healthcare Costs Increase, Employers Look to Telehealth and Wearable Tech to Manage Cost & Health Risks

Family premiums for health insurance received at the workplace grew 5% in 2018: to $19,616, according to the 2018 KFF Employer Health Benefits Survey released today by the Kaiser Family Foundation (KFF). These two trends combine for a 212% increase in workers’ deductibles in the past decade. This is about eight times the growth of workers’ wages in the U.S. in the same period. Thus, the main takeaway from the study, KFF President and CEO Drew Altman noted, is that rising health care costs absolutely remain a burden for employers — but a bigger problem for workers in America. Given that

Retail Tomorrow, Today: A Smart Grocery Cart and Digital Samples For Paleo-Eating Moms

In our Amazon-Primed world, the future of retail is not ten years from now; it’s “tomorrow.” So GMDC, the association of retailers and brands who supply them, has formed a program called Retail Tomorrow to turbocharge the supply side with consumers who are already demanding convenience, immediate (or “soon”) gratification, and health where she/he “is.” That’s personalization, and that’s where retail health can and is making a difference in Everyday Peoples’ lives. In our DIY culture, we’re pumping our own petrol, making our own airline and hospitality reservations (from Expedia to Airbnb), trading stocks online, and cooking at home enabled by

Self-Care is Healthcare for Everyday People

Patients are the new healthcare payors, and as such, taking on the role of health consumers. In fact, health and wellness consumers have existed since a person purchased the first toothpaste, aspirin, heating pad, and moisturizing cream at retail. Or consulted with their neighborhood herbalista, homeopathic practitioner, therapeutic masseuse, or skin aesthetician. Today, the health and wellness consumer can DIY all of these things at home through a huge array of products available in pharmacies, supermarkets, Big Box stores, cosmetic superstores, convenience and dollar stores, and other retail channels – increasingly, online (THINK, of course, of Amazon — more on

Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. Who’s responsible? Nearly all Americans (86% net responsible) first blame health insurance companies, followed by hospitals (82%). Fewer U.S. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). Most of the surprise bills were for charges associated with a physician’s service or lab test. Most surprise charges were not due to the service being excluded from a health plans provider network. The poll was conducted among 1,002 U.S. adults 18 and over

“Lower Prescription Drug Prices” – A Tri-Partisan Call Across America

There’s growing evidence that a majority of U.S. voters, across the three-party landscape, agree on two healthcare issues this year: coverage of pre-existing conditions, and lowering the consumer-facing costs of prescription drugs. A new poll jointly conducted by Politico and the Harvard Chan School of Public Health bolsters my read on the latter issue – prescription drug pricing, which has become a mass popular culture union. There may be no other issue on voters’ collective minds for the 2018 mid-term election that so unites American voters than the demand for lower-cost medicines. This is directly relates to consumers’ tri-party

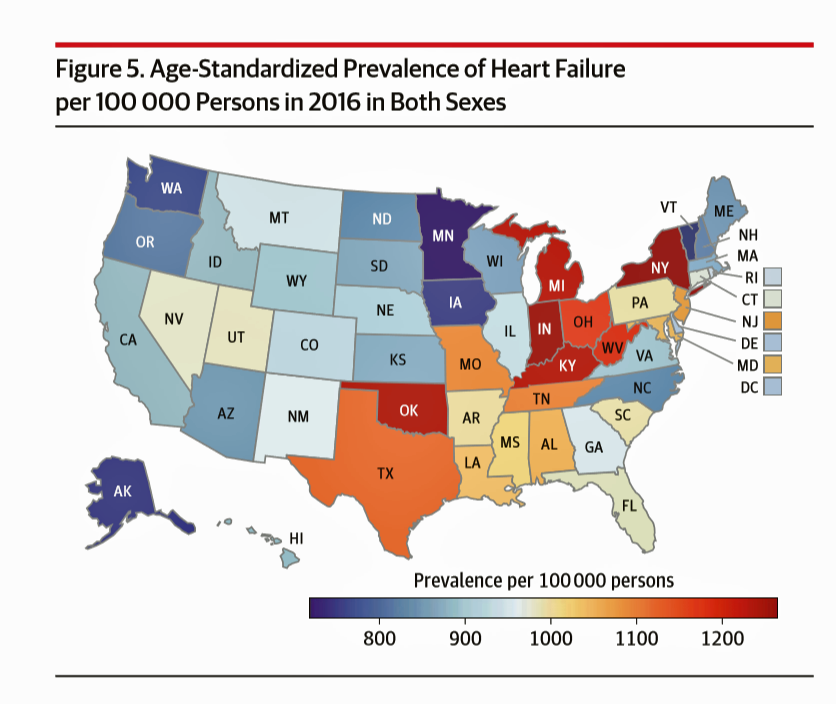

Heart Disease in America: Zip Code Determines Cardiovascular Disease-Destiny

If you live in one of nine U.S. states, your chances of having heart disease are greater than living in the 41 others. This geography-as-destiny for heart conditions is examined in The Burden of Cardiovascular Diseases Among US States, 1990-2016 published in JAMA Cardiology. Researchers analyzed data on cardiovascular disease mortality, nonfatal health outcomes, and risk factors by age, sex, and year from 1990 to 2016 for the U.S. population. The outcome used to measure health by state was cardiovascular disease disability-adjusted life-years, or DALYs (FYI, “DALYs” are a commonly used metric in health economics research). Pennsylvania While overall cardiovascular

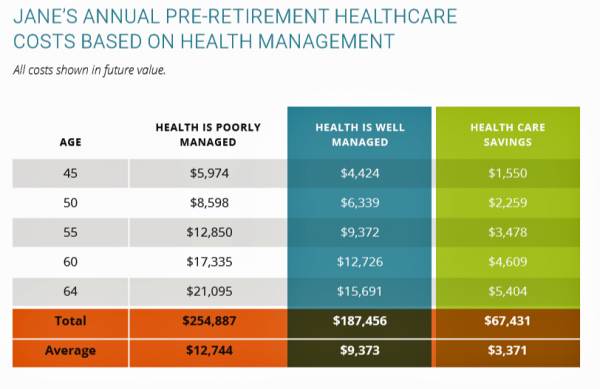

How Taking Care of Your Health Boosts Savings Accounts

It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated. But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries. How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans. This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services. The chart illustrates three

Design, Empathy and Ethics Come to Healthcare: HXD

Design-thinking has come to health/care, finally, and Amy Cueva has been beating this drum for a very long time. I’m delighted to be in her collegial circle, speaking at the conference about the evolving healthcare consumer who’s financially strapped, stressed-out, and Amazon Primed for customer service. I’m blogging live while attending HXD 2018 in Cambridge, MA, the health/care design conference convened by Mad*Pow, 26th and 27th June 2018. Today was Day 1 and I want to recap my learnings and share with you. Amy, Founder and Chief Experience Office of Mad*Pow, kicked off the conference with context-setting and inspiration. Design

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

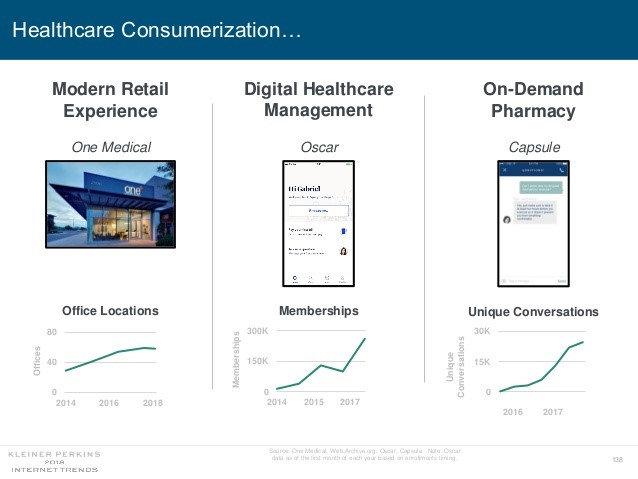

Mary Meeker on Healthcare in 2018: Connectivity, Consumerization, and Costs

Health care features prominently in the nearly-300 slides curated by Mary Meeker in her always- informative report on Internet Trends 2018. Meeker, of Kleiner Perkins, released the report as usual at the Code Conference, held this year on 30 May 2018 in Silicon Valley. I’ve mined Meeker’s report for several years here on Health Populi: 2017 – Digital healthcare at the inflection point, via Mary Meeker 2015 – Musings with Mary Meeker on the digital/health nexus 2014 – Healthcare at an inflection point: digital trends via Mary Meeker 2013 – The role of internet technologies in reducing healthcare costs – Meeker

Health Care for a Typical Working Family of Four in America Will Cost $28,166 in 2018

What could $28,166 buy you in 2018? A new car? A year of your child’s college education? A plot of land for your retirement home? Or a year of healthcare for a family of four? Welcome to this year’s edition of the Milliman Medical Index (MMI), one of the most important forecasts of the year in the world of the Health Populi blog and THINK-Health universe. That’s because we’re in the business of thinking about the future of health and health care through the health economics lens; the MMI is a key component of our ongoing environmental analysis of the

The Gap Between the Trump Administration’s Promise of Reducing Rx Costs for Consumers and What People Really Want

This is what happened to pharma stock prices on Friday after President Trump and Secretary of Health and Human Services Alex Azar outlined their new policies focusing on prescription drug prices. The graph is the Nasdaq U.S. Smart Pharmaceuticals Index (NQSSPH) from May 11, 2018, the date when POTUS and Secretary Azar made their announcement. What this upward driving curve indicates, from the start of stock trading in the morning until the ring of the closing bell, is that the pharma industry players, both manufacturers and PBMs, were quite delighted with what they heard. The blueprint for restructuring the prescription drug industry,

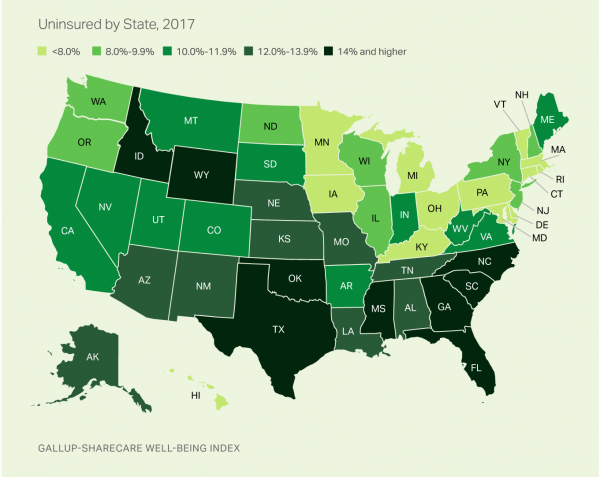

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

Universal Health Care and Financial Inclusion – Two Sides of the Wellness Coin

Two weeks in a row, The Economist, the news magazine headquartered in London, included two special reports stapled into the middle of the magazines. Universal health care was covered in a section on 28 April 2018, and coverage on financial inclusion was bundled into the 5th May edition. While The Economist’s editors may not have intended for these two reports to reinforce each other, my lens on health and healthcare immediately, and appreciatively, connected the dots between healthcare coverage and financial wellness. The Economist, not known for left-leaning political tendencies whatsoever, lays its bias down on the cover of the section here: universal healthcare

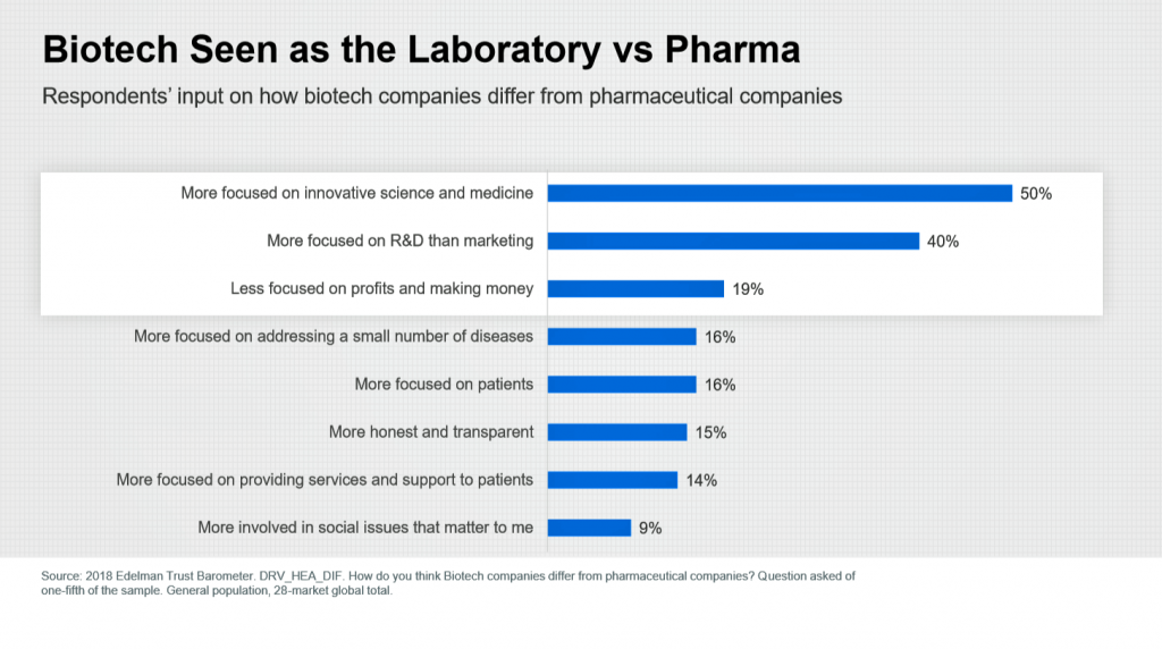

Americans’ Trust in the Healthcare System Low Compared to Rest-of-World’s Health Citizens

In the U.S., trust in the healthcare industry declined by 9 percentage points in just one year, declining from 62% of people trusting — that’s roughly two-thirds of Americans — down to 53% — closer to one-half of the population. I covered the launch of the 2018 Edelman Trust Barometer across all industries here in Health Populi in January 2018, when this year’s annual report was presented at the World Economic Forum in Davos as it is each year. The Edelman team shared this detailed data on the healthcare sector with me this week, for which I am grateful. Check

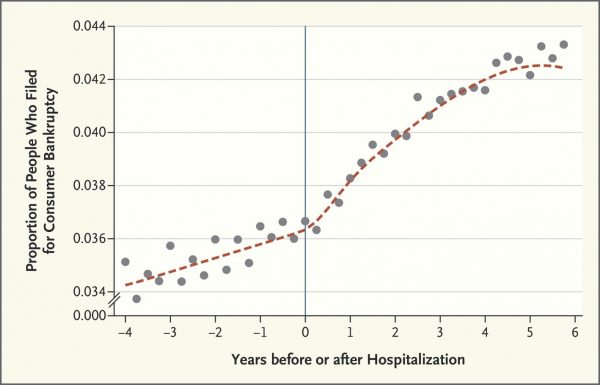

The New Financial Toxicity in Health Care: The Cost of Hospitalization

In healthcare, we use the word “toxicity” when it comes to taking a new medicine, especially a strong therapy to cure cancer. That prescription may be toxic as a harmful side effect on our journey to getting well. The concept of “financial toxicity” for cancer patients was raised by concerned clinicians at Sloane-Kettering Medical Center, who discussed the topic on 60 Minutes in 2014 and have published papers on the issue. Beyond strong medicines, a new financial toxicity has emerged for patients due to hospital inpatient admissions. A new article in the New England Journal of Medicine studies Myth and

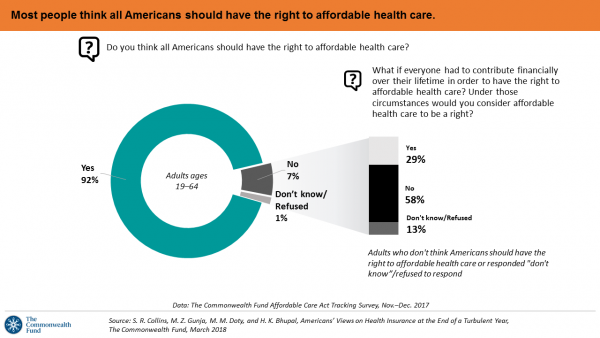

Majority Rules? The Right to Affordable Health Care is A Right for All Americans

If we’re playing a game of “majority rules,” then everyone in America would have the right to affordable health care, according to a new poll from The Commonwealth Fund. The report is aptly titled, Americans’ Views on Health Insurance at the End of a Turbulent Year. The Fund surveyed 2,410 U.S. adults, age 19 to 64, by phone in November and December 2017. This is the sixth survey conducted by the Fund to track Americans’ views of the Affordable Care Act; the first survey was fielded in mid-to-fall 2013. 9 in 10 working-age adults say “yes” indeed, my fellow Americans

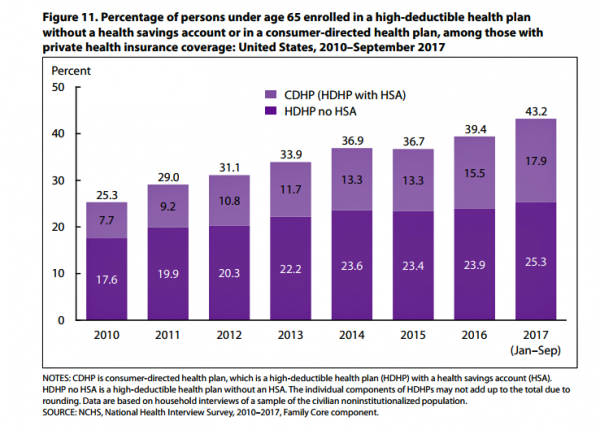

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for