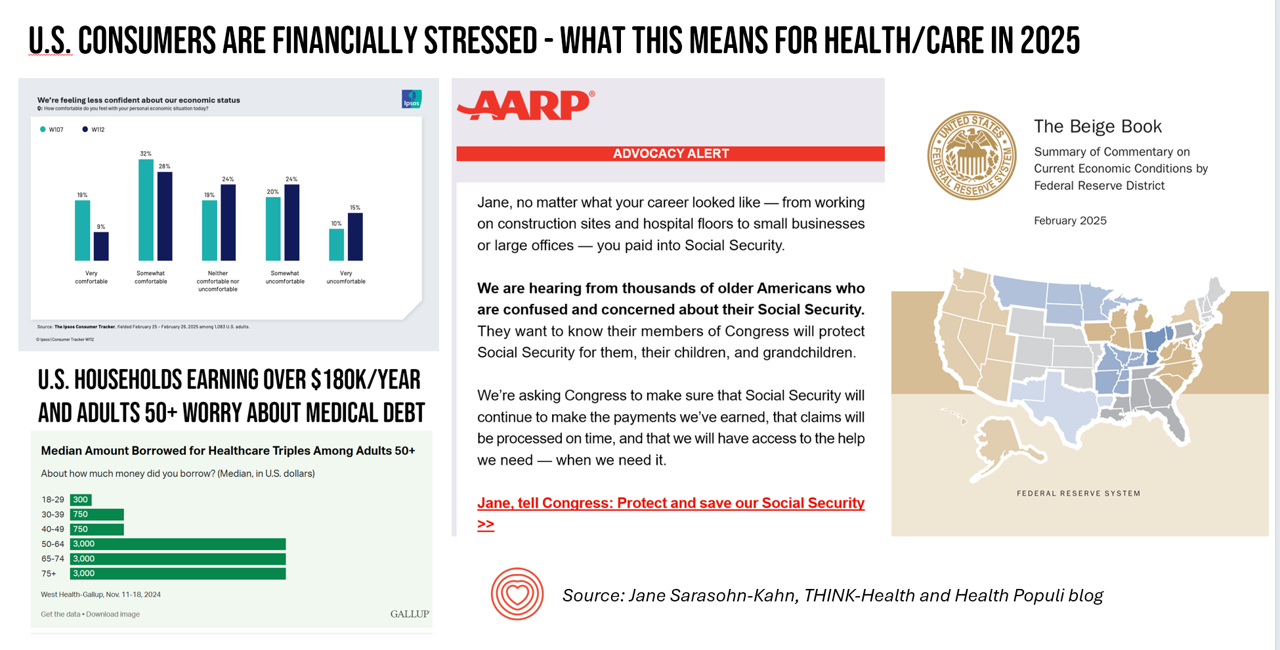

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

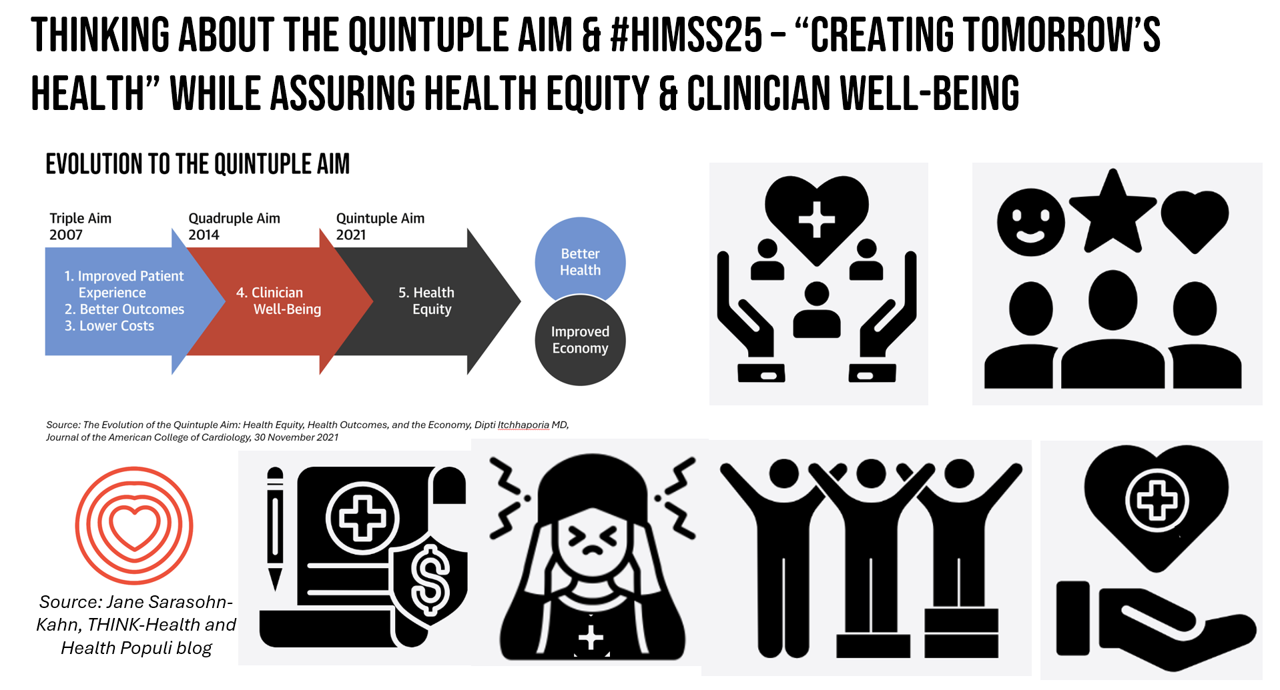

Think Quintuple Aim This Week at #HIMSS25

As HIMSS 2025, the largest annual conference on health information and innovation meets up in Las Vegas this week, we can peek into what’s on the organization’s CEO’s mind leading up to the meeting in this conversation between Hal Wolf, CEO of HIMSS, and Gil Bashe, Managing Director of FINN Partners. If you are unfamiliar with HIMSS, Hal explains in the discussion that HIMSS’s four focuses are digital health transformation, the deployment and utilization of AI as a tool, cybersecurity to protect peoples’ personal information and its use, and, workforce development. I have my own research agenda(s) underneath these themes

Improve Sleep, Improve the World and Health: ResMed’s Look at Global Sleep Trends

The world would be a better place if we had more, and better quality sleep. That’s the hopeful conclusion from the fifth annual Global Sleep Survey from ResMed. ResMed’s global reach with the sleeping public enabled the company to access the perspectives of over 30,000 respondents in 13 markets, finding that one in 3 people have trouble falling or staying asleep 3 or more times a week. We now live in “a world struggling with poor sleep” — “a world without rest,” ResMed coins our sleepless situation. The irony is that most people believe

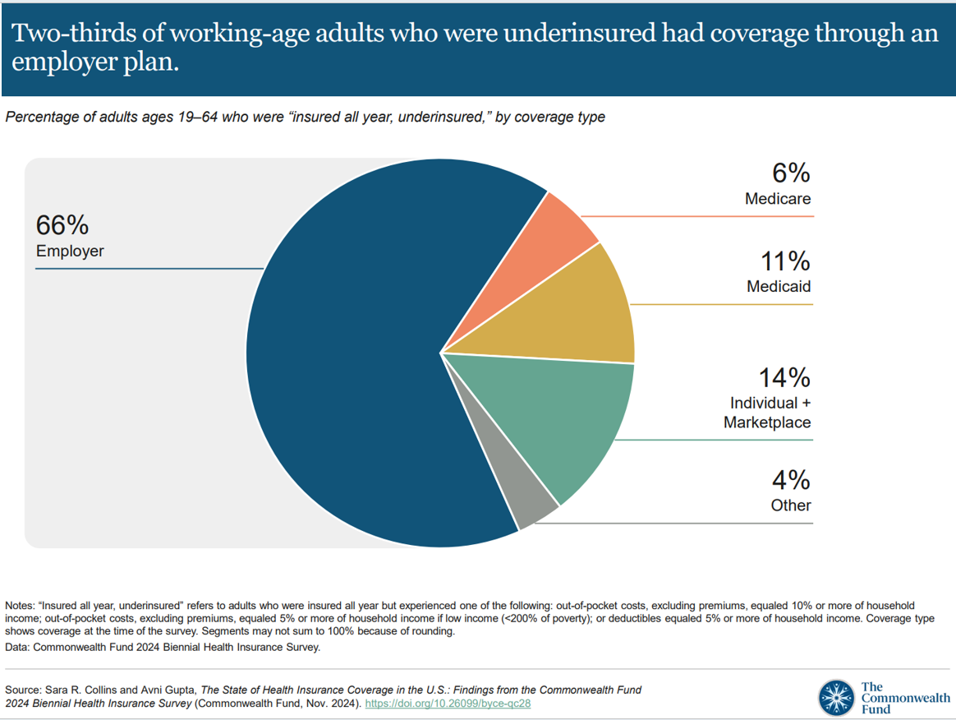

Workers Feel “Stuck,” Under-Insured, Financially Stressed, and Neglecting Mental Health

“It’s the economy stupid,” Jennifer Tescher, CEO of the Financial Health Network, titles her latest column in Forbes. Published two weeks after the 2024 U.S. elections, Jennifer’s assertion sums up what, ex post facto, we know about what most inspired American voters at the polls in November 2024: the economy, economics, inflation, the costs of daily living….pick your noun, but it’s all about those Benjamins right now for mainstream American consumers across many demographic cuts. With that realization, we must remind ourselves as we enter a new year under a second-term President Trump that health care spending for everyday people

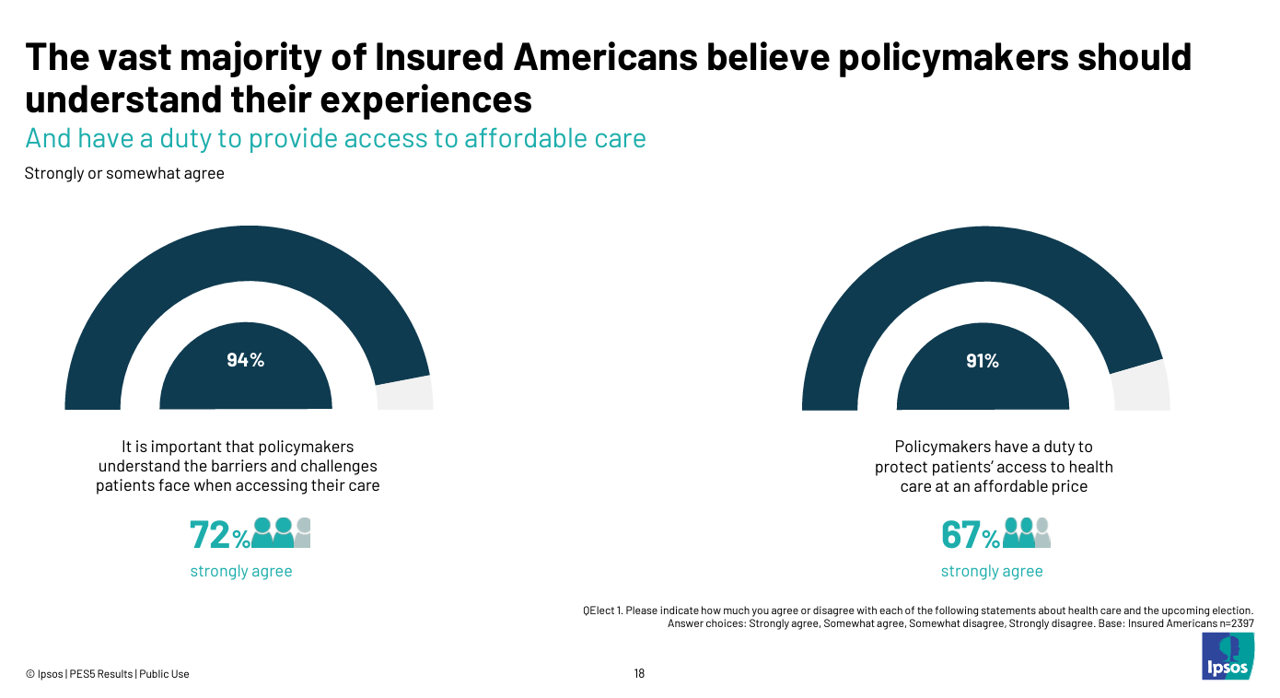

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

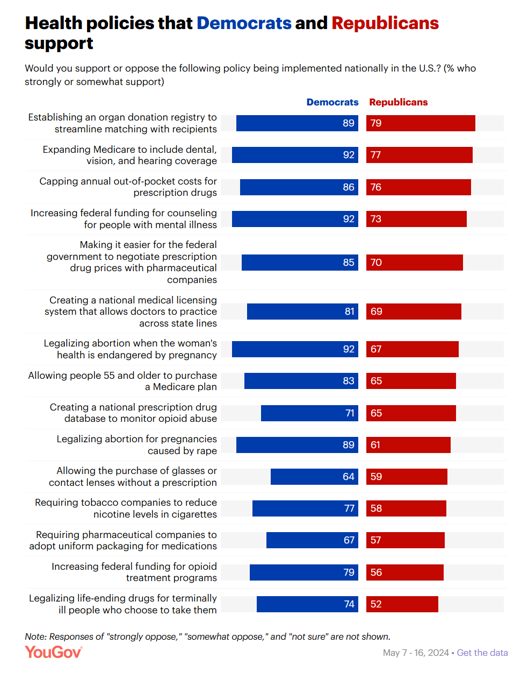

Where Democrats and Republicans Agree on Health Care Policies – From Medicare and Prescription Drugs to Gun Safety

In a super-divided electorate like the U.S. with about 60 days leading up to the 2024 Elections, we might assume there are no “purple” areas of agreement between the Red (Republicans) and the Blue (Democrats) thinking in PANTONE color politics. Surprisingly, there are many health policies on which Democrats and Republicans concur, as found in a series of YouGov polls conducted in May 2024. YouGov fielded the health policies poll in five waves online, each among roughly 1,100 U.S. adults in May 2004. This bar chart summarizes health

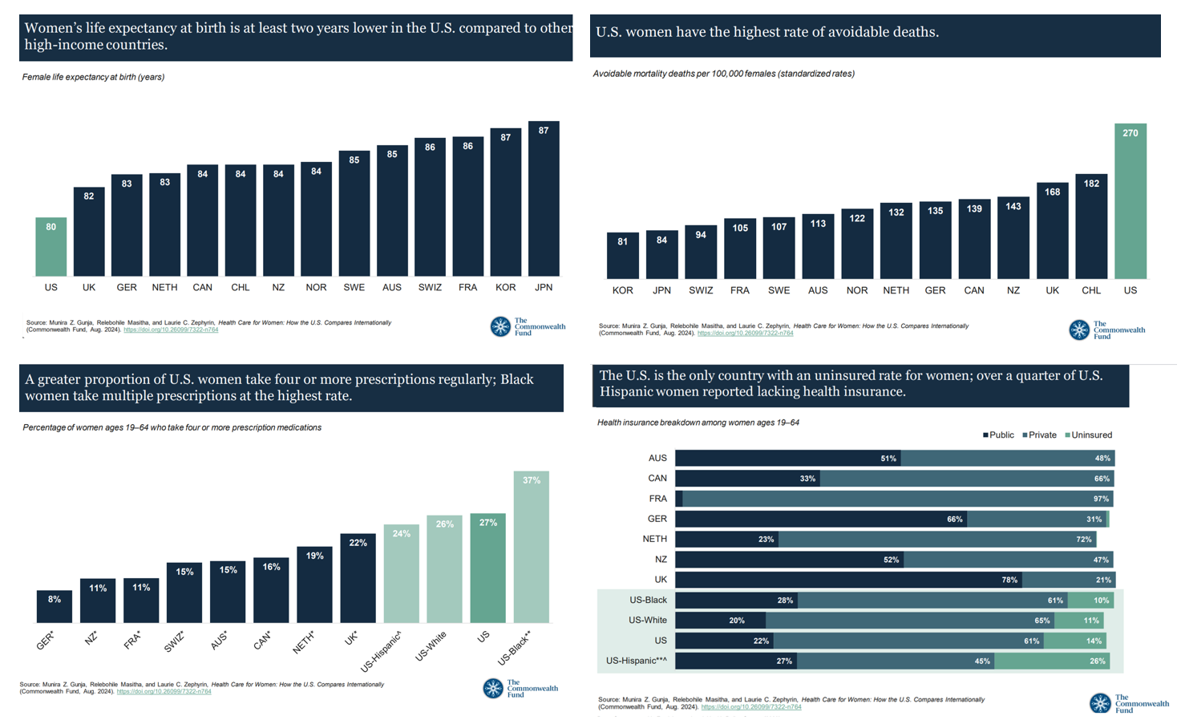

Women’s Health Outcomes in the U.S.: Spending More, Getting (Way) Less – 4 Charts from The Commonwealth Fund

Women in the U.S. have lower life expectancy, greater risks of heart disease, and more likely to face medical bills and self-rationing due to costs, we learn in the latest look into Health Care for Women: How the U.S. Compares Internationally from The Commonwealth Fund. The Fund identified four key conclusions in this global study: Mortality, shown in the first chart which illustrates women in the U.S. having the lowest life expectancy of 80 years versus women in other high-income countries; Health status, with women in the U.S. more likely to consume multiple prescription

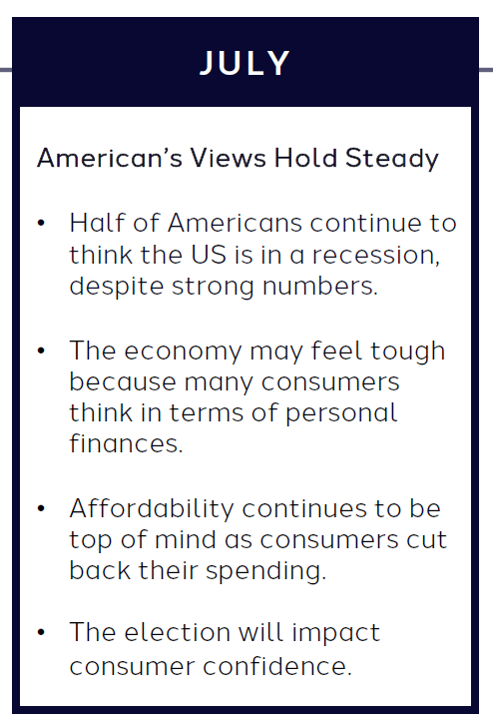

What the “Vibe-Cession” Means for Health Care in the U.S. – Spending is Personal

People living in the U.S. continue to feel a “vibe-cession” malaise, based on the American Mindset July 2024 update from Dentsu’s Consumer Navigator research. Notwithstanding generally good news about the American macroeconomy — in terms of growth, downward ticking inflation, and expected interest rate relief come September from the Federal Reserve — one in two Americans still thinks the country is in a recession. And this context is important for consumer’s personal spending on health care, fitness, and wellness, because, as Dentsu puts it, “consumers think in terms of personal finances.” As

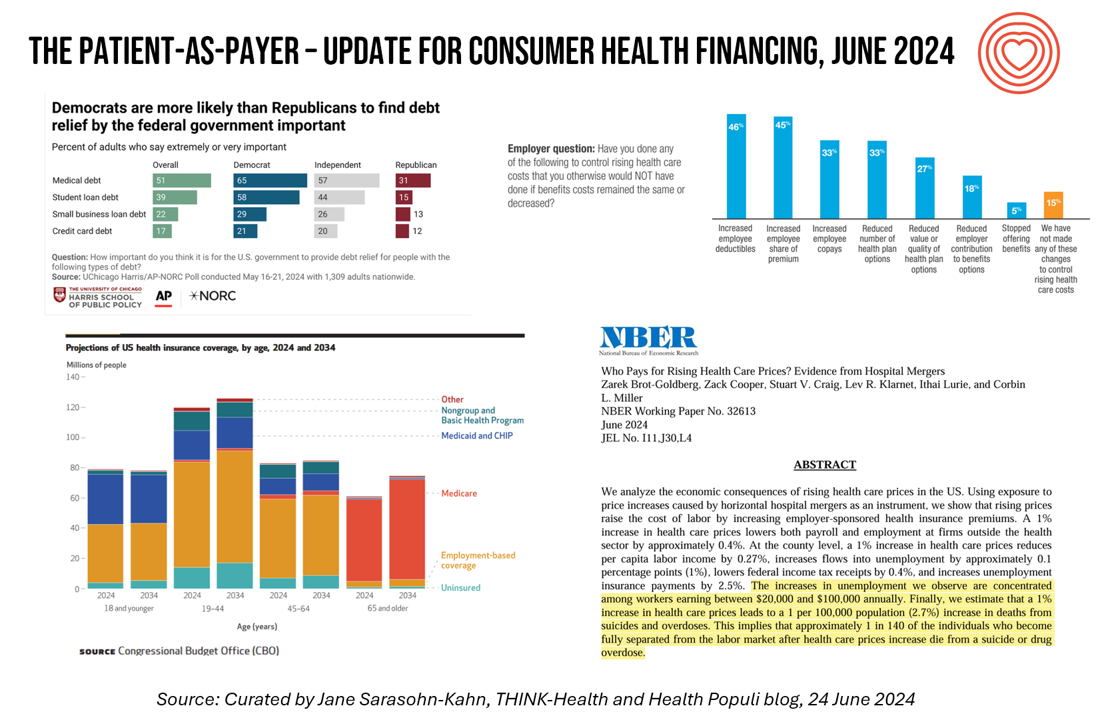

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

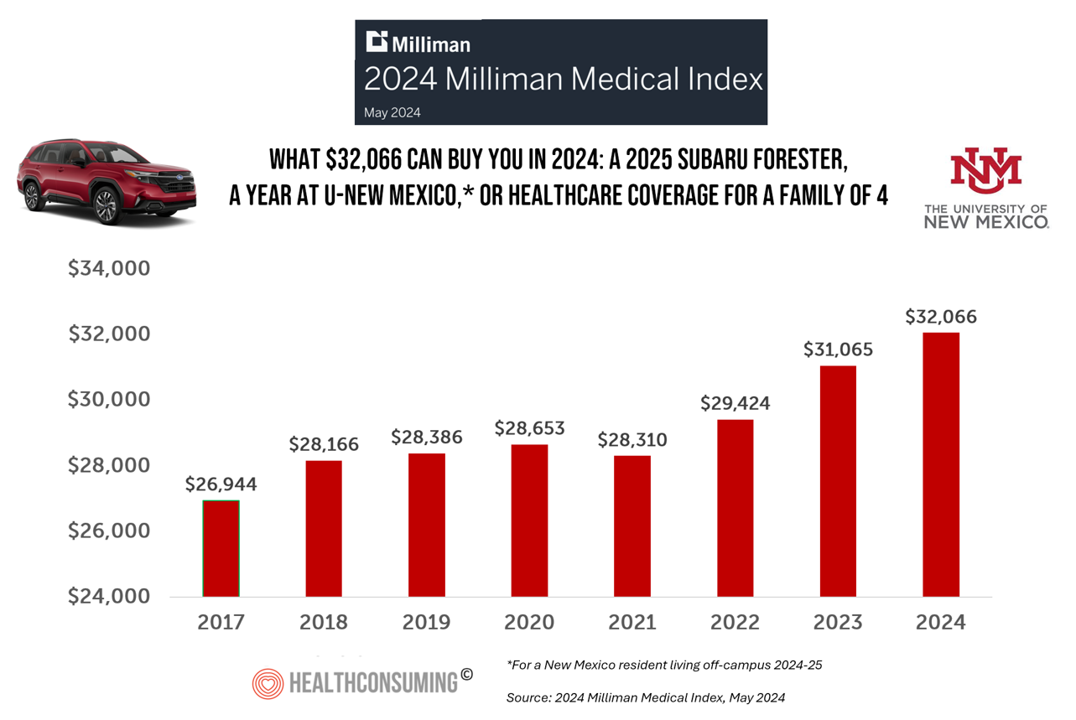

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a