Health Insurance Coverage Among Smaller U.S. Businesses Is Eroding: A Signal From JPMorganChase

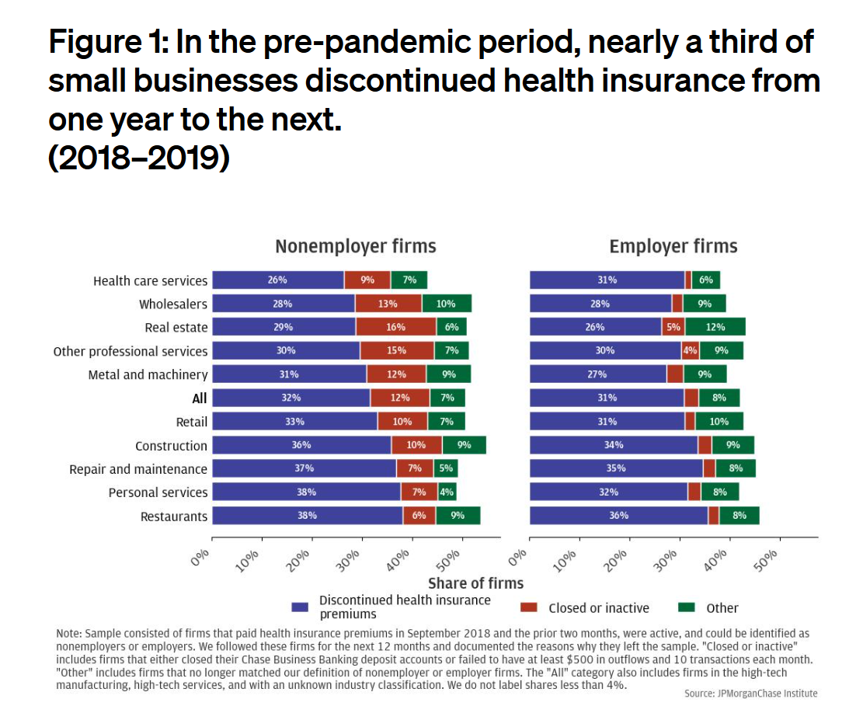

Working-age people in the U.S. depend on their employers to provide health insurance; just over one-half of people in America receive employer-sponsored health insurance. But a concerning signal has emerged that calls into question how sustainable the uniquely American employer-sponsored health plan model is: that is that one in 3 small businesses in the U.S. stopped covering health insurance after the worst of the pandemic health effects in 2023 as the companies payroll expenses continued to increase, a statistic raised in The consistency of health insurance coverage in small business: industry challenges and insights, a report from the JPMorganChase Institute

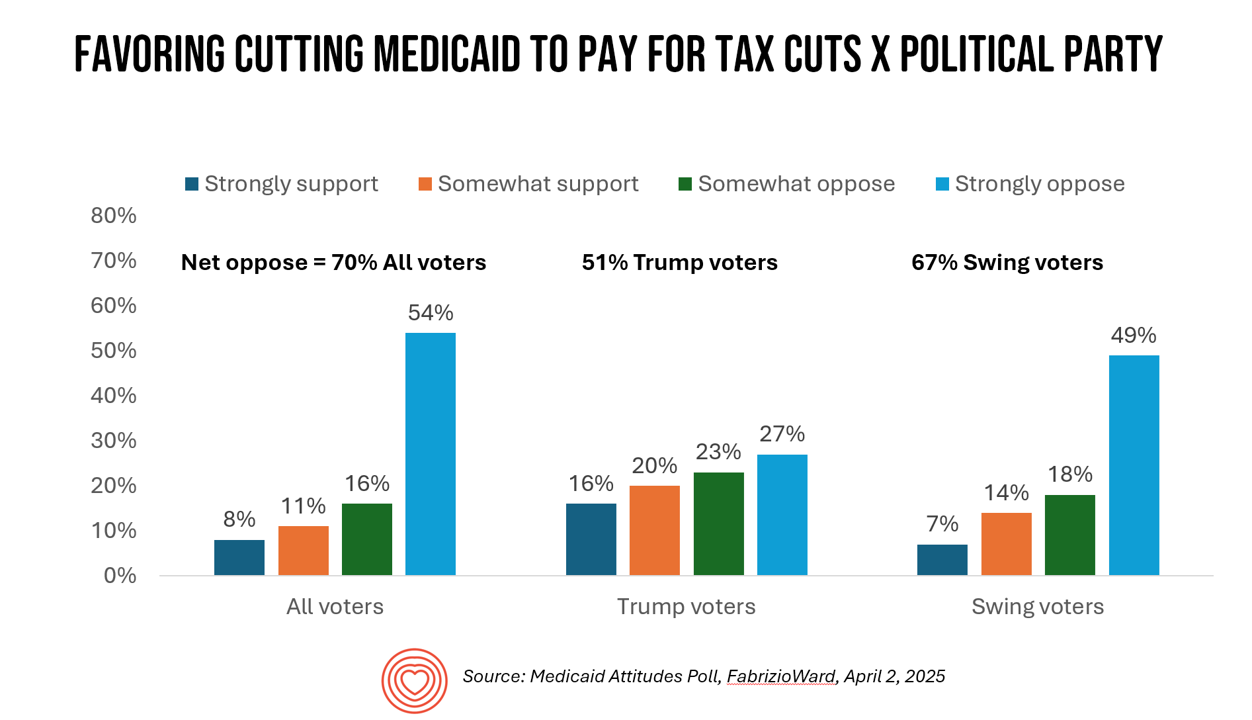

Most Americans Don’t Want to Cut Medicaid (Including Republicans)

With potential down-sizing of Medicaid on the short-term U.S. political horizon, a fascinating poll found that most people identifying as Republican would not favor cuts to Medicaid. What fascinates me about this survey, published earlier this week, is that it was conducted by FabrizioWard, a polling firm that has often been used by President Trump. The firm’s Bob Ward told POLITICO that, “There’s really not a political appetite out there to go after Medicaid to pay for tax cuts. Medicaid has touched so many families that people have made up their minds about what

Are We Liberated Yet? Tariffs Can Impact Financial Health (Riffing on MoneyLion’s Health Is Wealth Report)

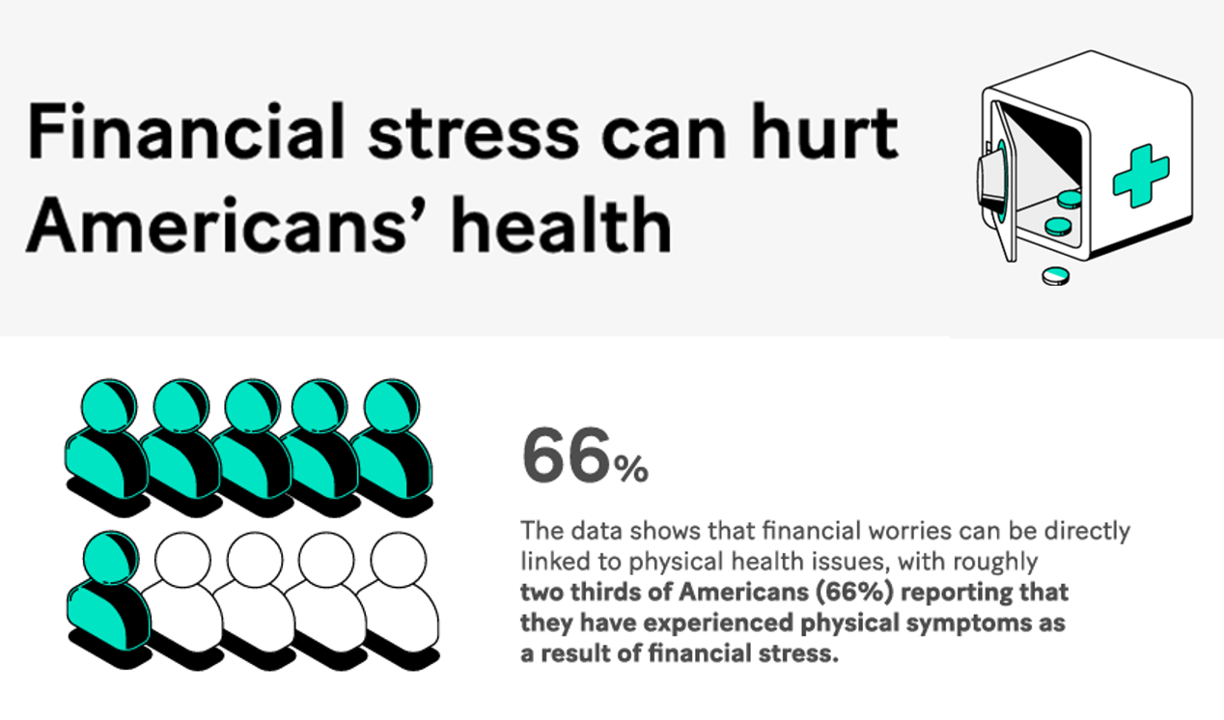

Americans’ financial health was already stressing consumers out leading up to Liberation Day, April 2nd, when President Trump announced tariffs on dozens of countries with whom the U.S. buys and sells goods. A new report from MoneyLion and Mastercard called Health is Wealth is well-timed for today’s Health Populi blog. The study was fielded by The Harris Poll online among 2,092 U.S. adults 18 and older between February 28 and March 4, 2025, so it was completed a month before the tariffs came to hit peoples’ 401(k) savings and employers’ company stock market caps.

What is a Consumer Health Company? Riffing Off of Deloitte’s Report on CHCs/A 2Q2025 Look at Self-Care Futures

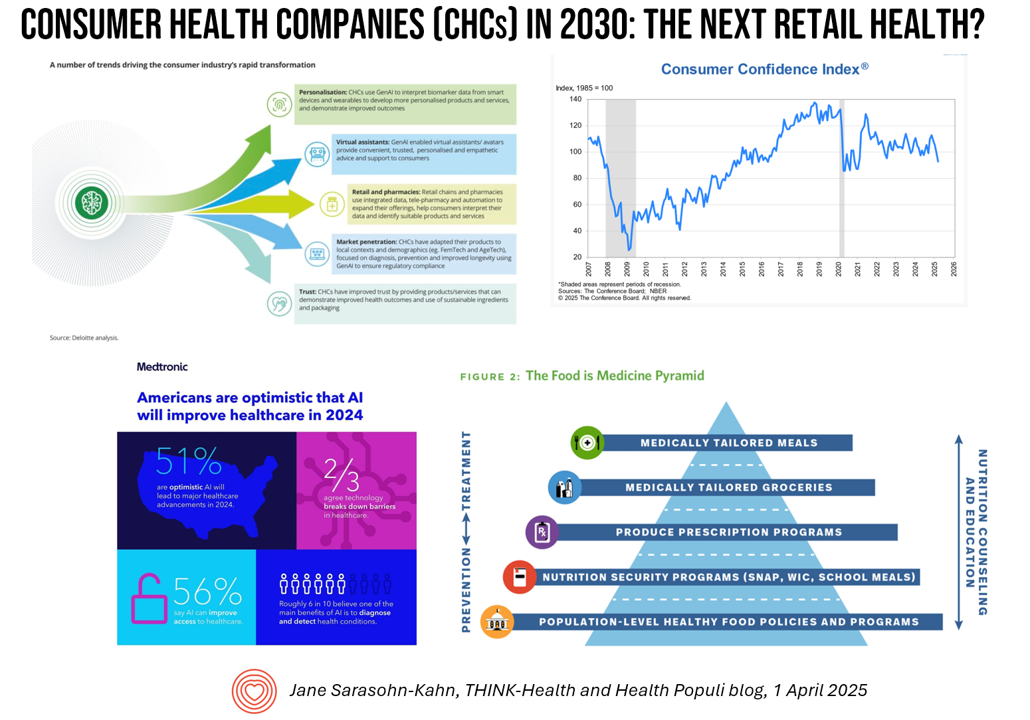

The health care landscape in 2030 will feature an expanded consumer health industry that will become, “an established branch of the health ecosystem focused on promoting health, preventing, disease, treating symptoms and extending healthy longevity,” according to a report published by Deloitte in September 2024, Accelerating the future: The rise of a dynamic consumer health market. While this report hit the virtual bookshelf about six months ago, I am revisiting it on this first day of the second quarter of 2025 because of its salience in this moment of uncertainties across our professional and personal lives — particularly related to

The Growth of DIY Digital Health – What’s Behind the Zeitgeist of Self-Reliance?

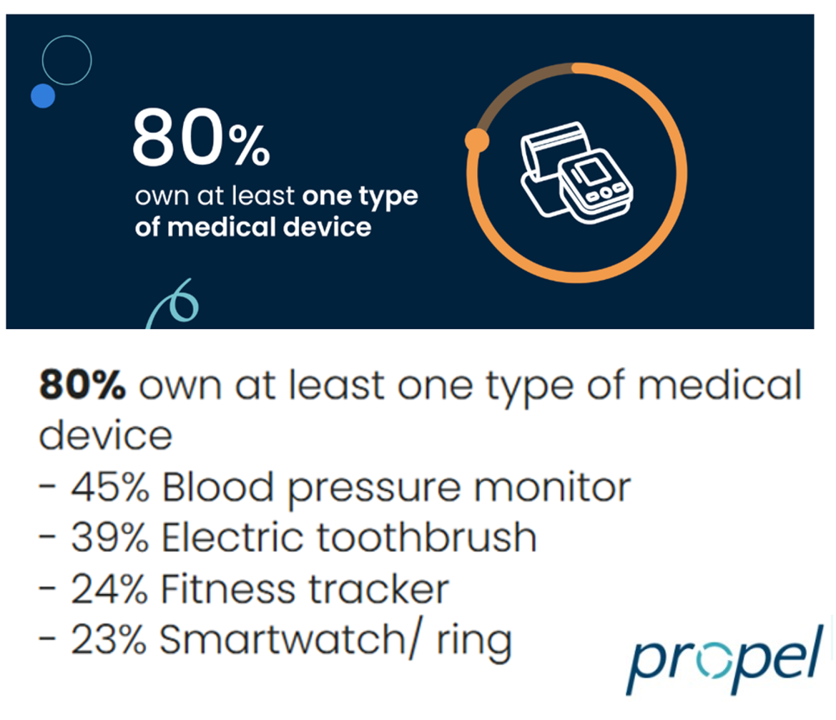

Most people in the U.S. use at least one medical device at home — likely a blood pressure monitor. used by nearly one-half of people based on a survey of 2,000 consumers conducted for Propel Software. The Propel study’s insights build on what we know is a growing ethos among health consumers seeking to take more control over their health care and the rising costs of medical bills and out-of-pocket expenses. That includes oral health and dental bills: 2 in 5 U.S. consumers use electric toothbrushes (a growing smart-device category at the

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

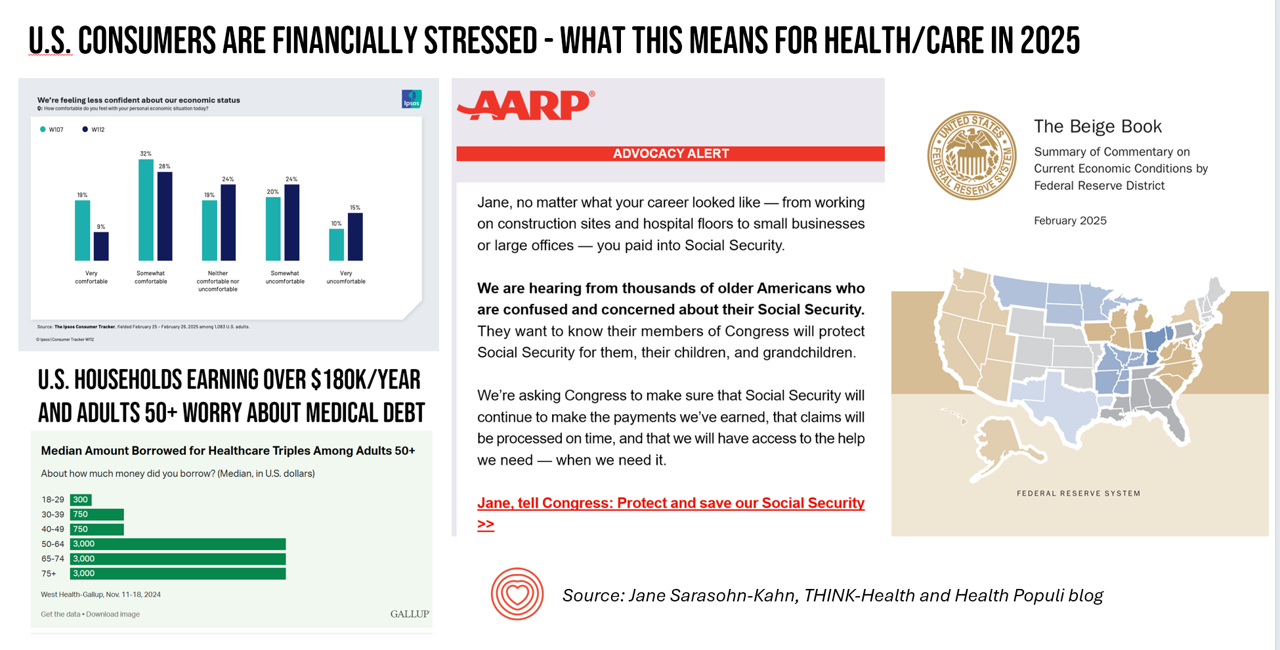

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

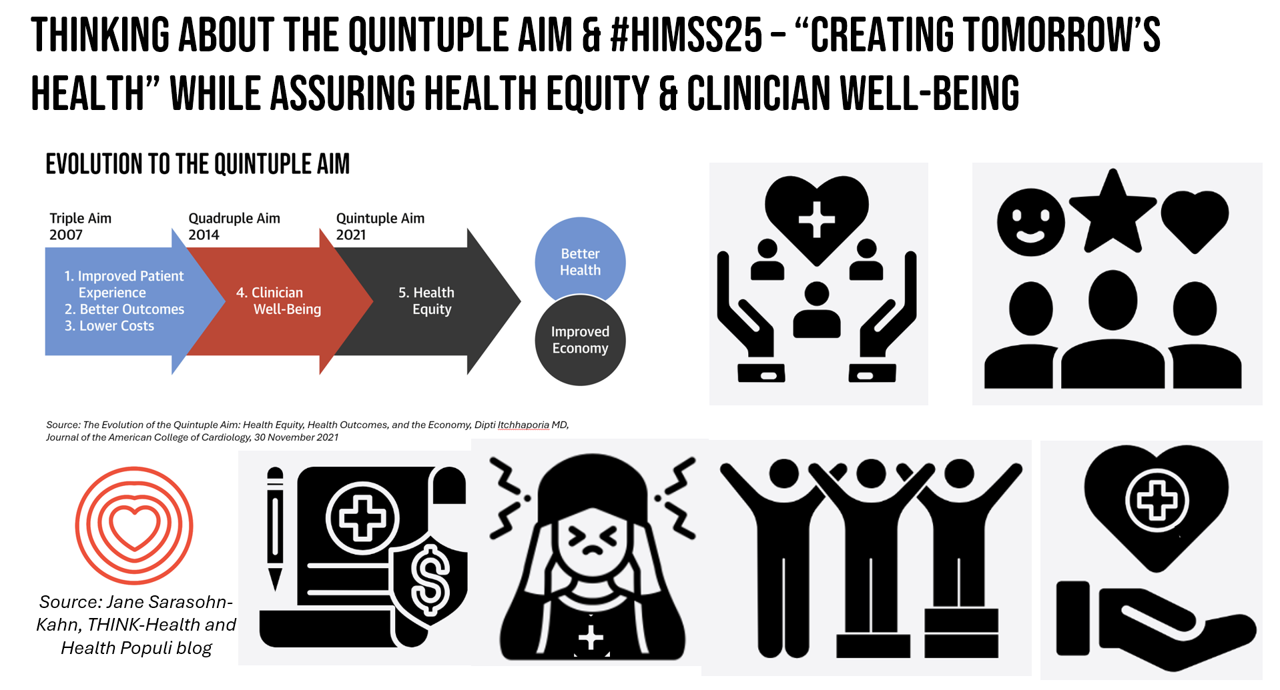

Think Quintuple Aim This Week at #HIMSS25

As HIMSS 2025, the largest annual conference on health information and innovation meets up in Las Vegas this week, we can peek into what’s on the organization’s CEO’s mind leading up to the meeting in this conversation between Hal Wolf, CEO of HIMSS, and Gil Bashe, Managing Director of FINN Partners. If you are unfamiliar with HIMSS, Hal explains in the discussion that HIMSS’s four focuses are digital health transformation, the deployment and utilization of AI as a tool, cybersecurity to protect peoples’ personal information and its use, and, workforce development. I have my own research agenda(s) underneath these themes

Improve Sleep, Improve the World and Health: ResMed’s Look at Global Sleep Trends

The world would be a better place if we had more, and better quality sleep. That’s the hopeful conclusion from the fifth annual Global Sleep Survey from ResMed. ResMed’s global reach with the sleeping public enabled the company to access the perspectives of over 30,000 respondents in 13 markets, finding that one in 3 people have trouble falling or staying asleep 3 or more times a week. We now live in “a world struggling with poor sleep” — “a world without rest,” ResMed coins our sleepless situation. The irony is that most people believe

Health/Care at Super Bowl LIX, GLP-1s, Kaiser and Tufts on Food-As-Medicine, and the RFK, Jr. Factor: A Health Consumer Check-In

In the wake of the always-creative ads for Super Bowl and last Sunday’s LIX bout, game-watchers got to see a plethora of commercials dedicated to the annual event’s major features: food and game-day eating. Oh, and what’s turned out to be the most controversial commercial, the one on GLP-1s from Hims & Hers. In that vein, and converging with many news and policy events, I’m trend-weaving the latest insights into that most consumer-facing of the social determinants of health: food, and in particular, health consumers viewing and adopting food as part of their health and well-being moves. First, to the

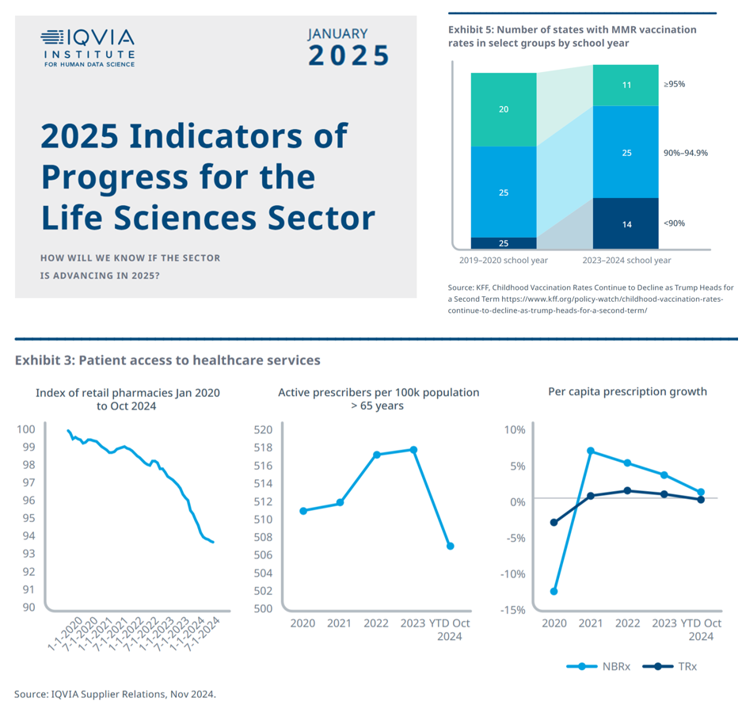

Measuring Progress for Life Sciences: Trust, Patient Access, and Prevention at a Fork in the Road of Public Health

How will we know if the life sciences sector is advancing in 2025? This is the question asked at the start of the report, a Research Brief: 2025 Indicators of Progress for the Life Sciences Sector, from the IQVIA Institute for Human Data Science (IQVIA). To answer that question, IQVIA identified ten indicators for this 2025 profile on the life sciences sector. I selected four key data points for this discussion which provide particularly informative insights for my advisory work right now at the intersection of health, people/consumers, and technology: Trust for/with/in life science

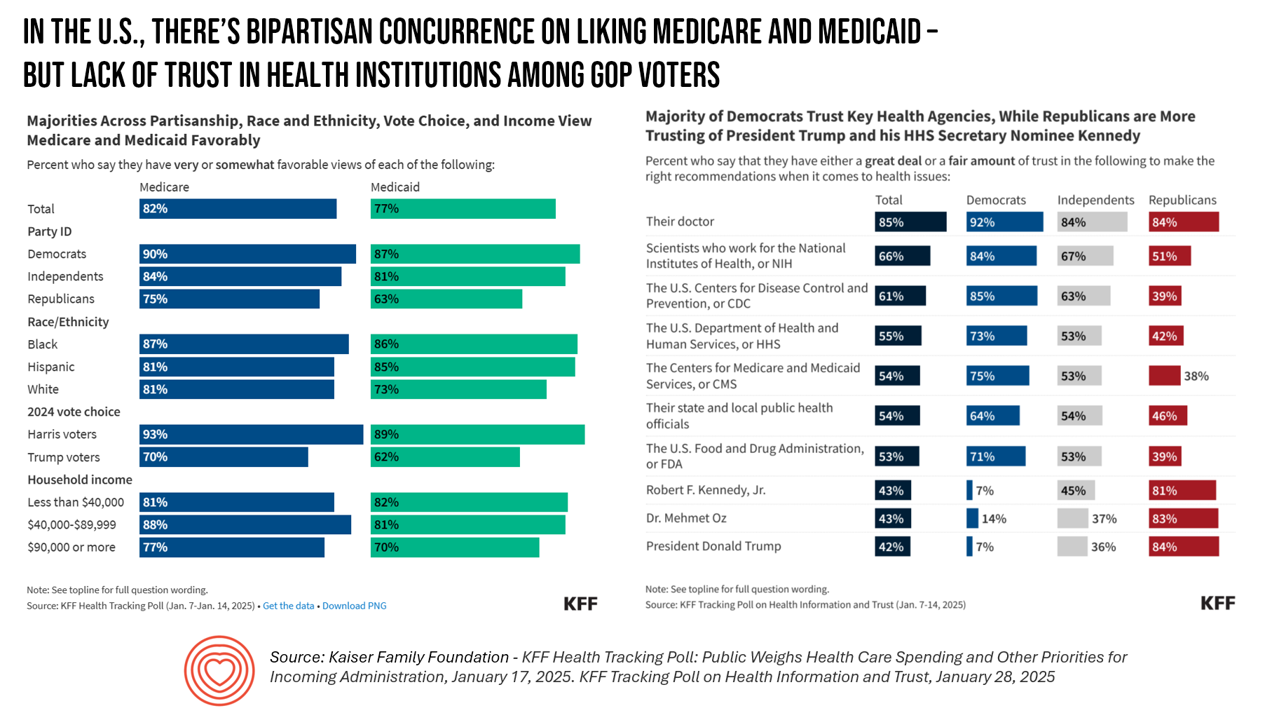

Some Bipartisan Concurrence on Health Care Issues in the U.S. – But Trust in Health Care Isn’t Bipartisan – KFF’s January 2025 Polls

Two polls from one poll source paint at once a bipartisan and bipolar picture of U.S. health citizens when it comes to health care issues versus health care institutions in America. The Kaiser Family Foundation has hit the 2025 health policy ground running in publishing the January 2025 Health Tracking Poll last week and a poll on health care trust and mis-information yesterday. First, the health tracking poll which finds some concurrence between Democrats and Republicans on several big issues facing Americans and various aspects of their health care. As

Trust and Grievance in 2025: The Edelman Trust Barometer on MLK Jr. Day Converging with the World Economic Forum Kick-Off and the Inauguration of the 47th U.S. President

At the start of each new year comes the World Economic Forum meet-up in Davos, Switzerland and with that conference start today, 20 January 2025, the publication of the Edelman Trust Barometer. Now in the study’s 25th annual edition, the Edelman Trust Barometer this year finds us, globally, in a Crisis of Grievance which is eroding trust. Edelman surveyed 1,150 residents (plus or minus) in each of 28 countries around the world, yielding over 33,000 citizens’ voices sharing perspectives on trust and institutions. Interviews were fielded from late October to mid-November 2024.

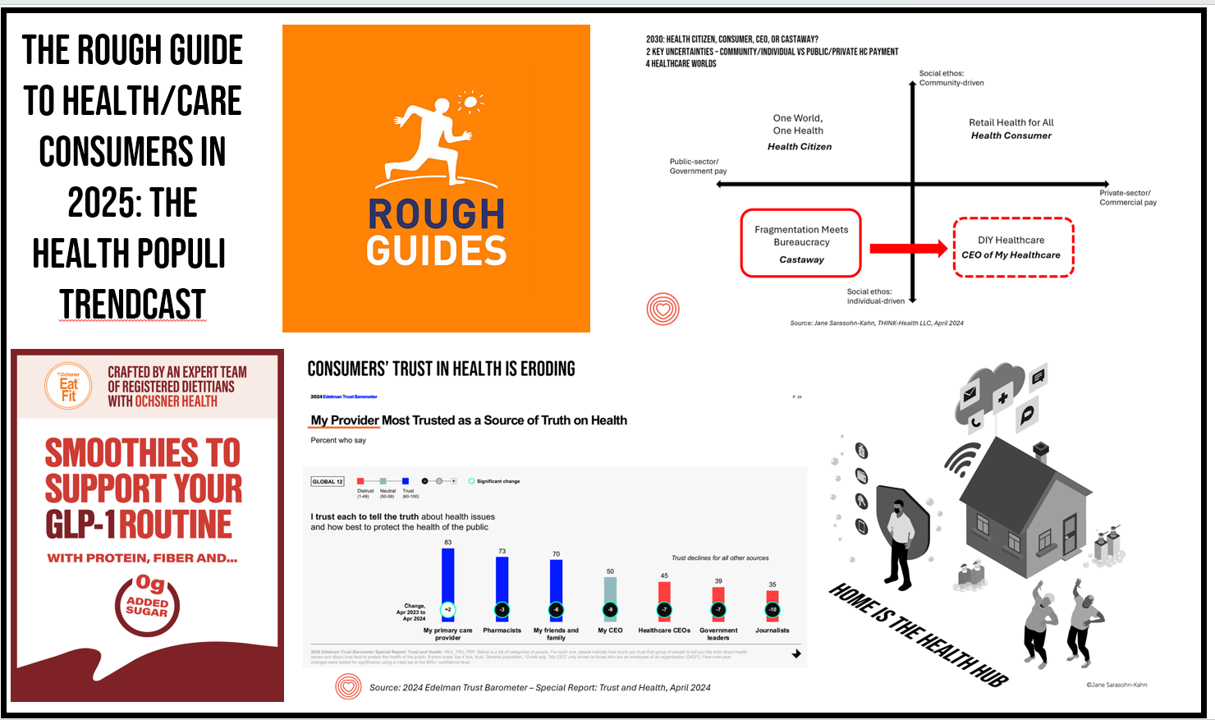

The Rough Guide to Health/Care Consumers in 2025: The 2025 Health Populi TrendCast

At this year-end time each year, my gift to Health Populi readers is an annual “TrendCast,” weaving together key data and stories at the convergence of people, health care, and technology with a look into the next 1-3 years. If you don’t know my work and “me,” my lens is through health economics broadly defined: I use a slash mark between “health” and “care” because of this orientation, which goes well beyond traditional measurement of how health care spending is included in a nation’s gross domestic product (GDP); I consider health across the many dimensions important to people, addressing physical,

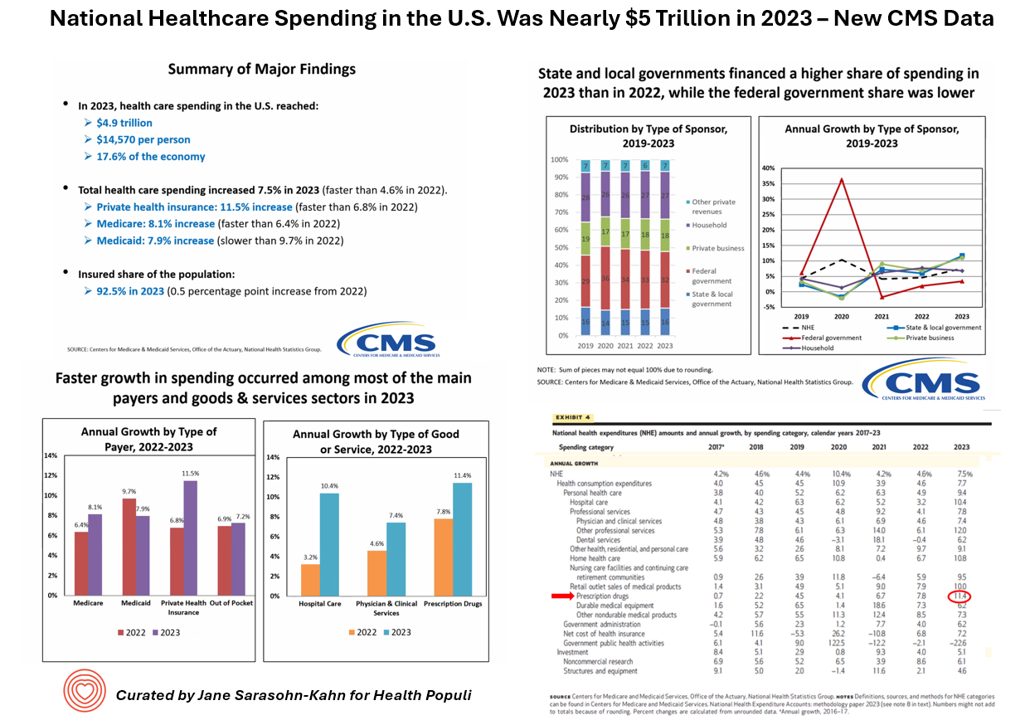

National Healthcare Spending in the U.S. Was Nearly $5 Trillion (with a “T”) in 2023 – New Data from CMS

What would $5 trillion be valued around the world or on the stock market? The economy of Germany was gauged around $5 trillion in 2024. India could be the world’s 3rd largest economy by 2026 valued at $5 trillion. Nvidia could be a $5 trillion company in 2025, as could Amazon. But today we report out the latest data from the Centers for Medicare and Medicaid Services (CMS) that national health spending in America reached $4.9 trillion in 2023. The full report on national health expenditures (NHE) in the U.S. was published today in Health Affairs, which came off embargo

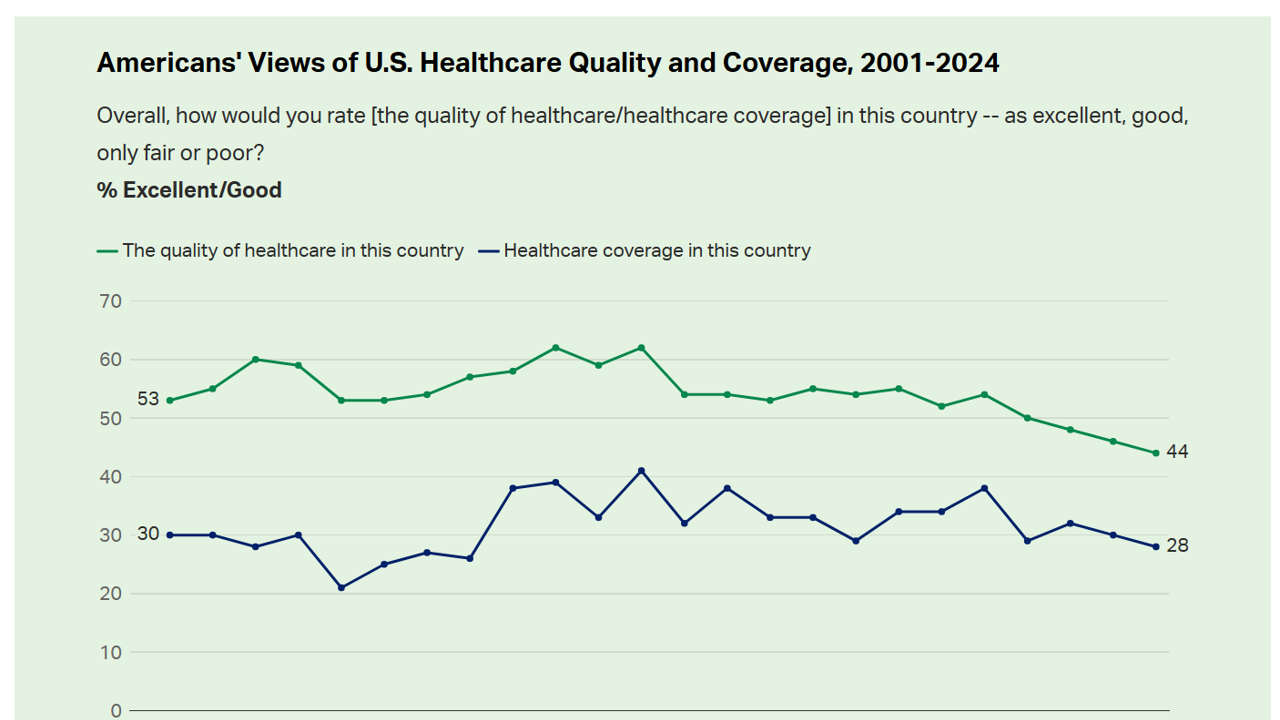

Americans’ Views on the Quality of Healthcare Fell to a Record Low — with Costs Ranking as the Most Urgent Problem for Health in the U.S.

Americans’ perception of the quality of health care in the U.S. fell to the lowest level since 2001, Gallup found in a poll of U.S. health citizens’ views on health care quality, published December 6, 2024. In 2024, only 44% of Americans said that the quality of health care int he U.S. was excellent or good — conversely, 56% of Americans though health care quality was only fair or poor. By political party, that included 50% of Democrats evaluating the quality of care highly compared with 42% of Republicans. Only 28% of people in

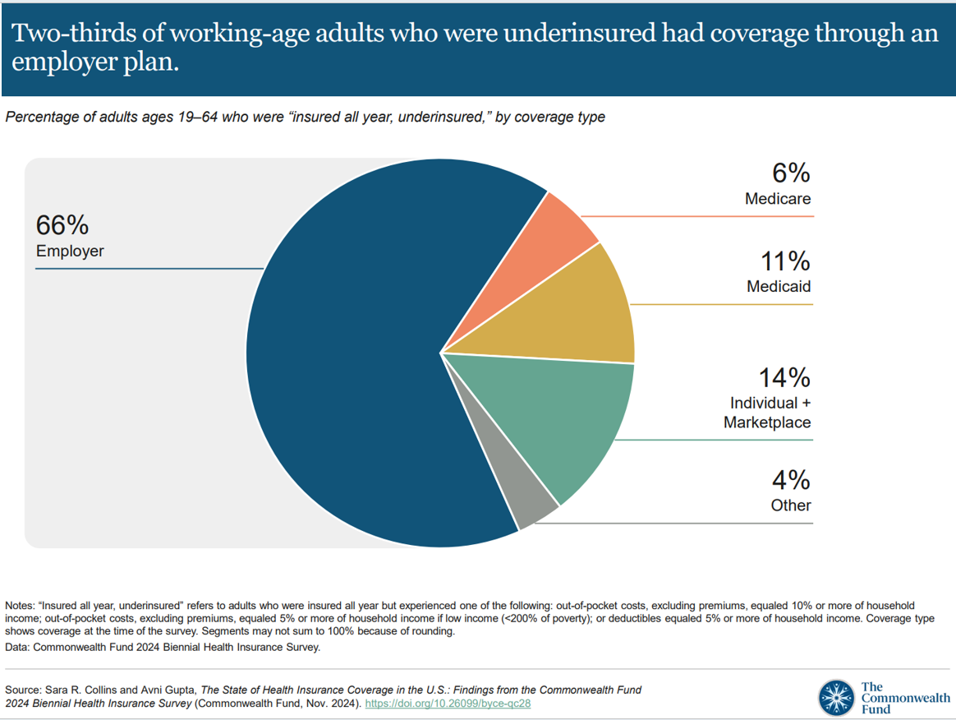

Workers Feel “Stuck,” Under-Insured, Financially Stressed, and Neglecting Mental Health

“It’s the economy stupid,” Jennifer Tescher, CEO of the Financial Health Network, titles her latest column in Forbes. Published two weeks after the 2024 U.S. elections, Jennifer’s assertion sums up what, ex post facto, we know about what most inspired American voters at the polls in November 2024: the economy, economics, inflation, the costs of daily living….pick your noun, but it’s all about those Benjamins right now for mainstream American consumers across many demographic cuts. With that realization, we must remind ourselves as we enter a new year under a second-term President Trump that health care spending for everyday people

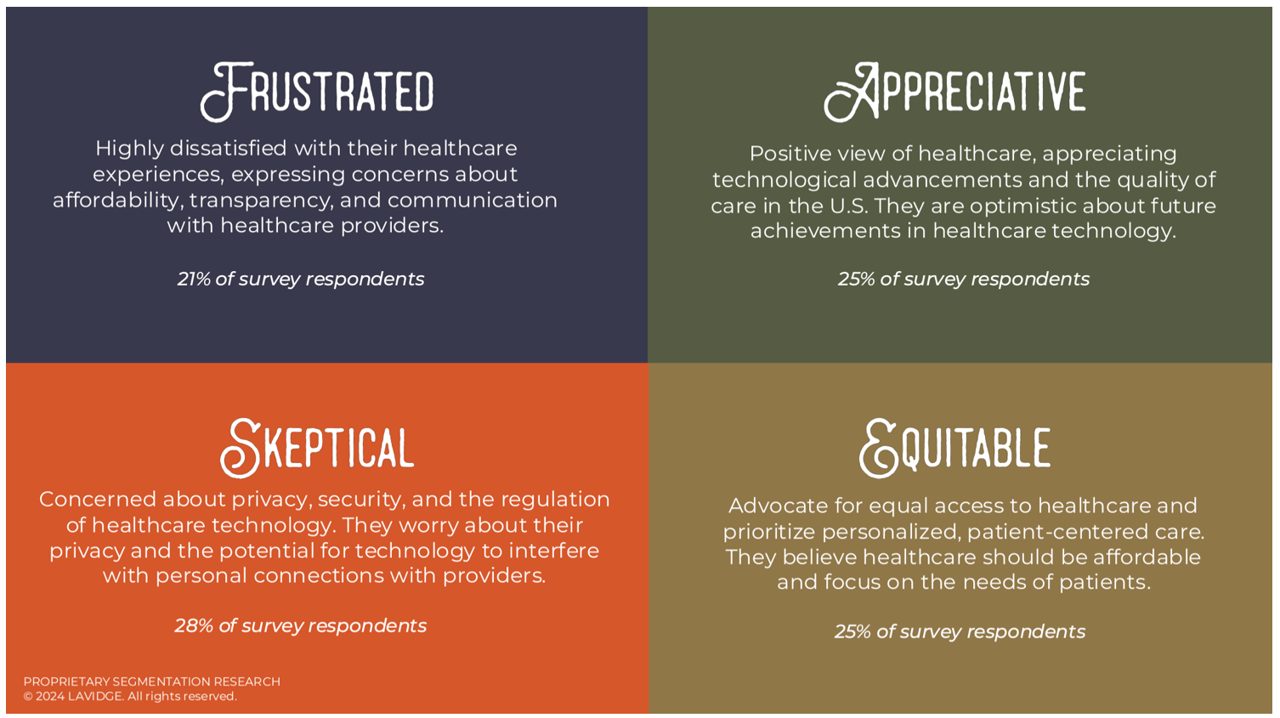

3 in 4 U.S. Patients Say the Healthcare System is Broken — But Technology Can Help

Patients “yearn” for personalized services and relationships in health care — optimistic that technology can help deliver on that hope — we learn in Healthcare’s Future: Balancing Progress and Perception, a health consumer survey report from Lavidge. Lavidge, a communications/PR/marketing consultancy, polled U.S. patients’ attitudes about health care and technology in June 2024, publishing the report earlier this month. Start with over-arching finding that, “Three out of four patients believe the U.S. healthcare system is broken and there is a strong sense of distrust,” Lavidge asserts right at the top of

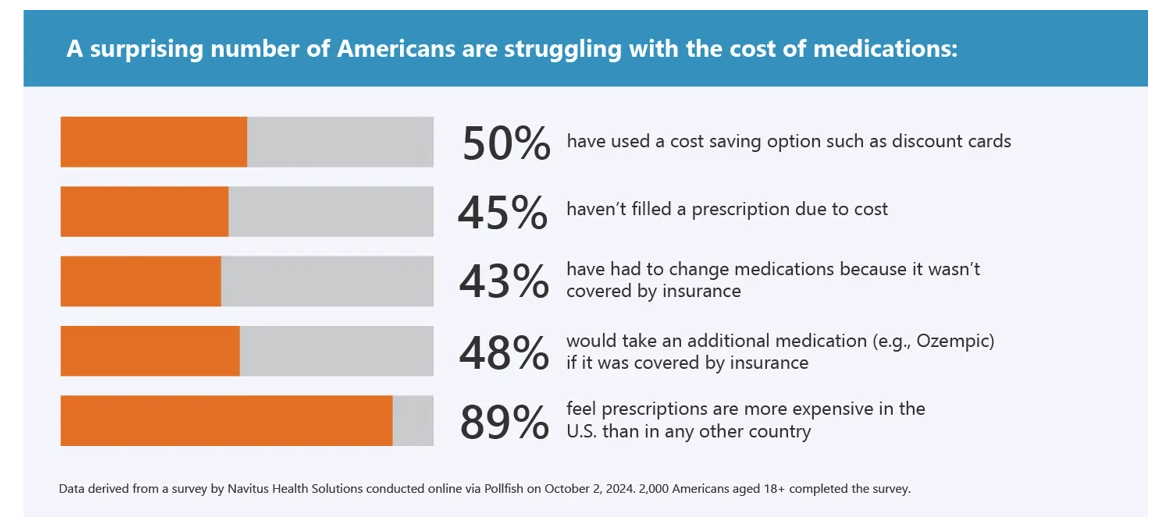

What Stays True for U.S. Health Care Post #Election2024 (1) – Consumers’ Dissatisfaction with Drug Prices

For health care, there are many uncertainties as we reflect, one week after the 2024 U.S. elections, on probably policy and market impacts that we can expect in 2025 and beyond. In today’s Health Populi post, I’ll reflect on the first of several certainties we-know-we-know about U.S. health citizens and key factors shaping the American health ecosystem. In this first of several posts on “What Stays True for U.S. Health Care Post #Election2024,” I’ll focus on U.S. consumer dissatisfaction with drug prices — across political party identification. Let’s set the context with data from a recently-published

Peace and Health: A Causal Relationship Explored in the AMA Journal of Ethics

“Peace and health are inextricably connected,” the Editors of the AMA Journal of Ethics introduce an issue of the journal devoted to Peace in Health Care published November 2024. In this timely journal issue, we can explore nearly one dozen essays exploring the interrelationship between peace and health in various clinical, care, and community settings — including hospice, maternal/child care, built environments, and adjacencies looking at the use of psychedelics and music for quieting one’s inner voices. You, the reader, will find your own favorite issues to explore based on your work, values, and interests.

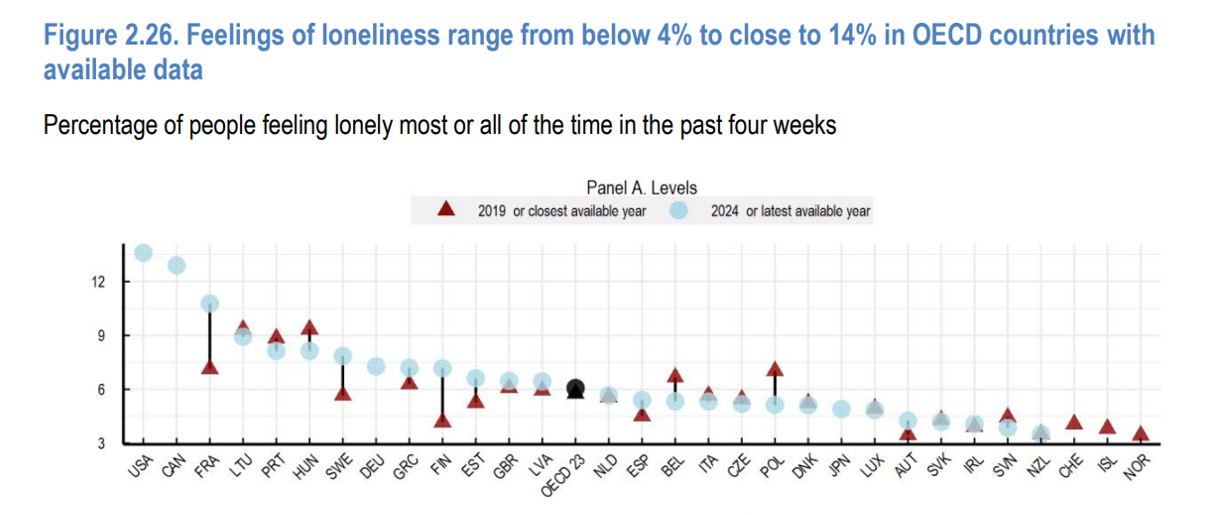

How’s Life? Around the World – In the U.S., It’s the Sadness That Stands Out

A new report from the OECD asks the question, “How’s Life?” with the tagline letting us know the plotline focuses on “well-being and resilience in times of crisis.” The Organization of Economic Cooperation and Development (OECD) has tracked the well-being of member nations for the past six years, taking a broad view on the definition of holistic health — including physical, mental, financial, and social aspects of people living in OECD countries. The first “How’s Life?” report was published at the height of the global financial crisis; the authors of this report introduce it saying that, “the

Doctors’ Recommendations Are Top Motivators for Consumers Who Buy Digital Health Devices: Trust and Health

Most consumers using digital health devices felt more trust in the technology when coupled with doctors’ office reviews — another lens on the importance of trust-equity between patients and physicians. This insight came out of a report on How Consumers Purchase, Use and Trust Medical Devices based on market research sponsored by Propel Software. For the study, Propel Software engaged Talker Research to conduct a survey among 2,000 U.S. adults in October 2024 to gauge peoples’ views on digital health tools, buying trends, and trust. Start with the rate of 1 in 4 Americans’ experience

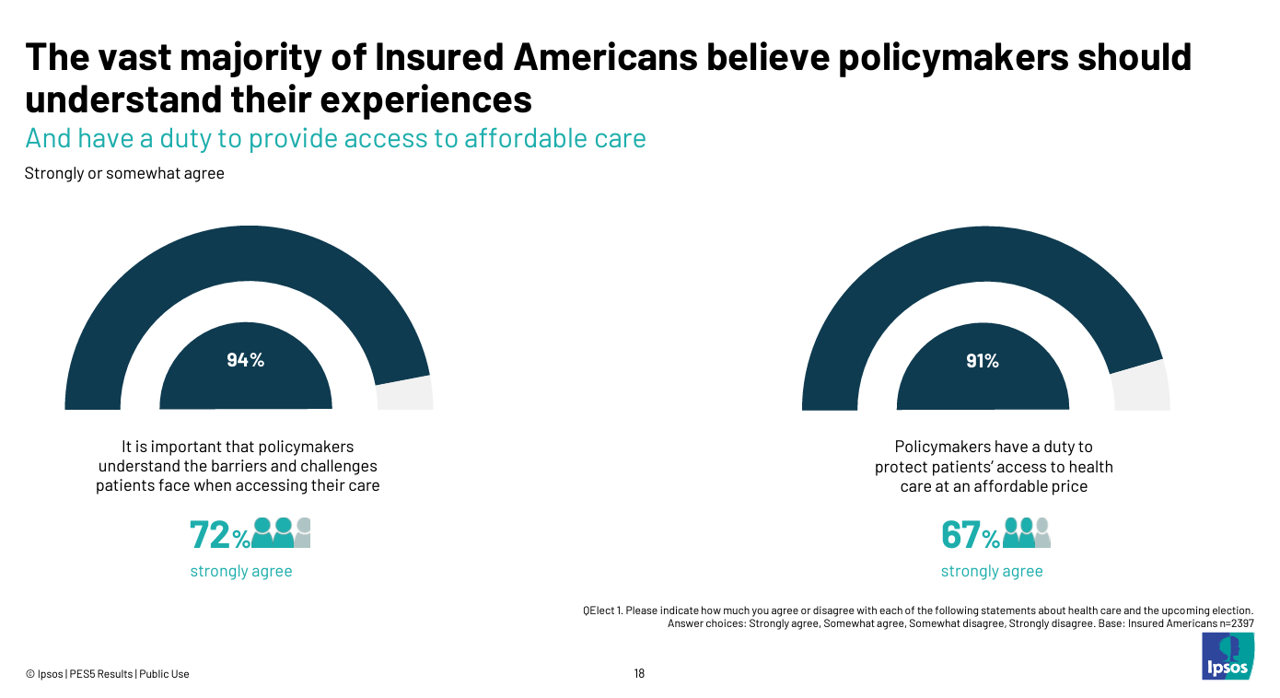

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

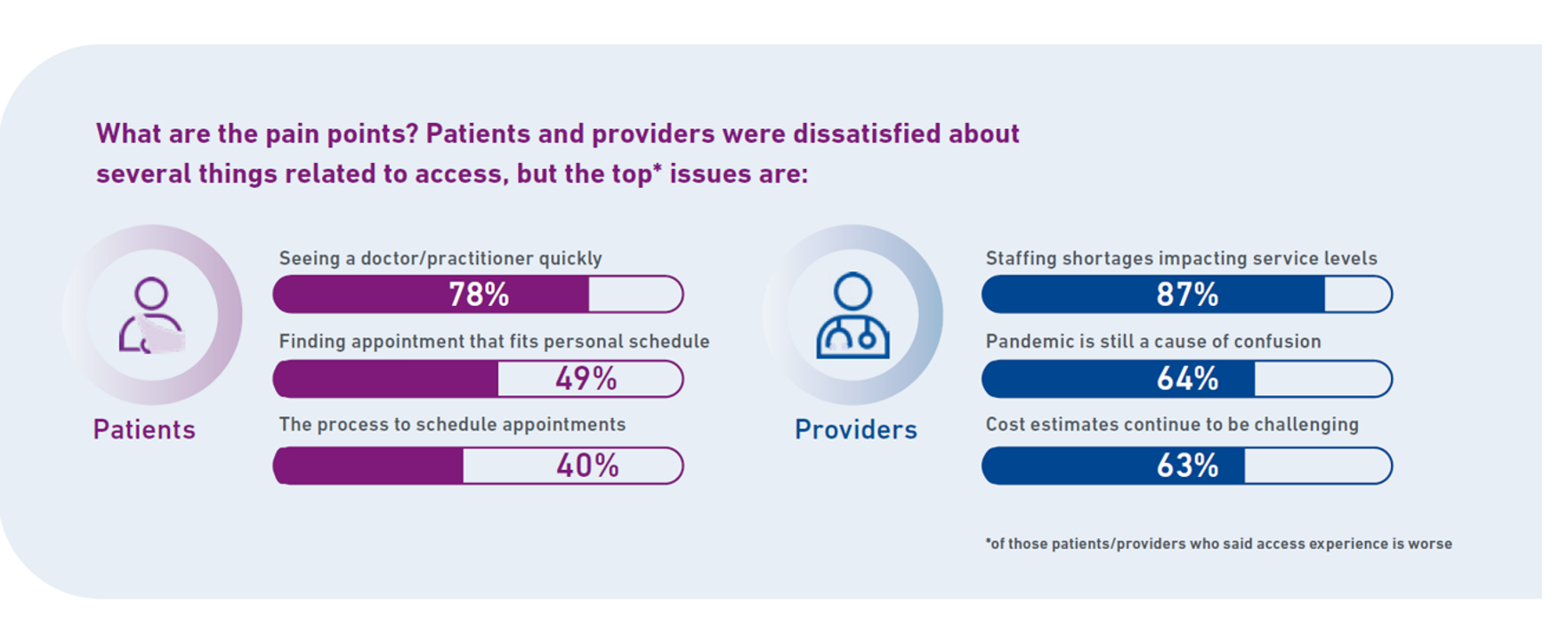

Closing the Chasm Between Patients and Clinicians With Digital Health Tools – Some Health Consumer Context for #HLTHUSA

As the annual HLTH conference convenes this week in Las Vegas, numerous reports have been published to coincide with the meeting updating various aspects of technology, health care, providers and patients. In this post, I’m weaving together several of the papers that speak to the intersection of health care, consumers, and technology – the sweet spot here on Health Populi. I hope to provide attendees of HLTH 2024 along with my readers who aren’t in Vegas useful context for assessing the new ideas and business model announcements as well as a practical summary for those of you in planning mode for

The Health Insurance Premium for a Family Averages $25,572 in 2024 – KFF’s Annual Update on Employer-Sponsored Benefits

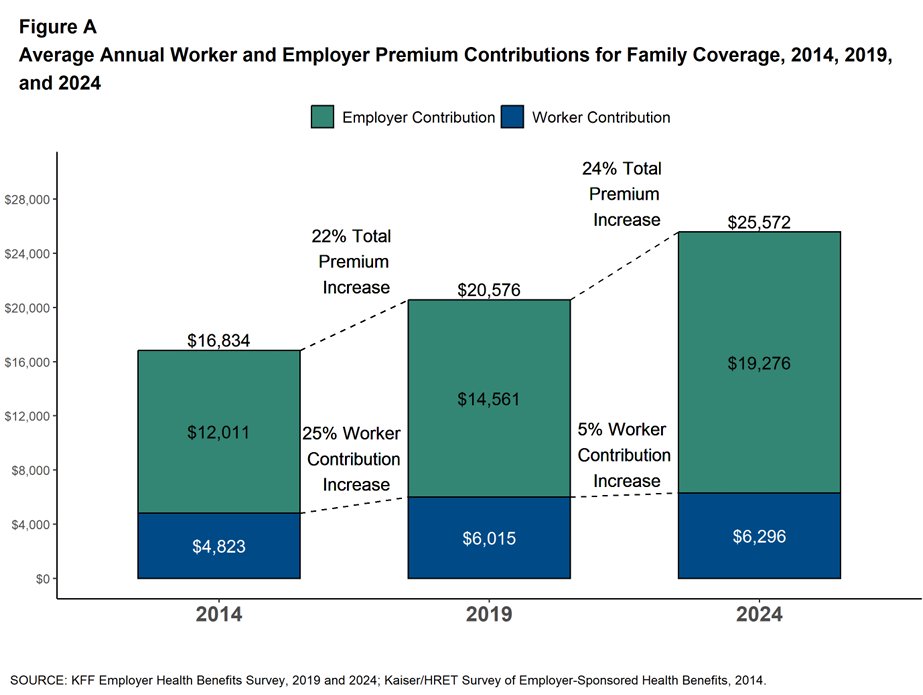

The premium for employer-sponsored health plans grew by 6-7% between 2023 and 2024, according to the report on Employer Health Benefits 2024 Annual Survey from the Kaiser Family Foundation, KFF’s 26th annual study into U.S. companies’ spending on workers’ health care. In 2024 the average annual health insurance premium for family coverage is $25,572, split by 75% covered by the employer (just over $19,000) and 25% borne by the employee ($6,296), shown in the first chart from the report. The nearly $26K family premium is the average across all plan types in the

Peoples’ Lack of Trust in Science Extends to Views on Food and Nutrition

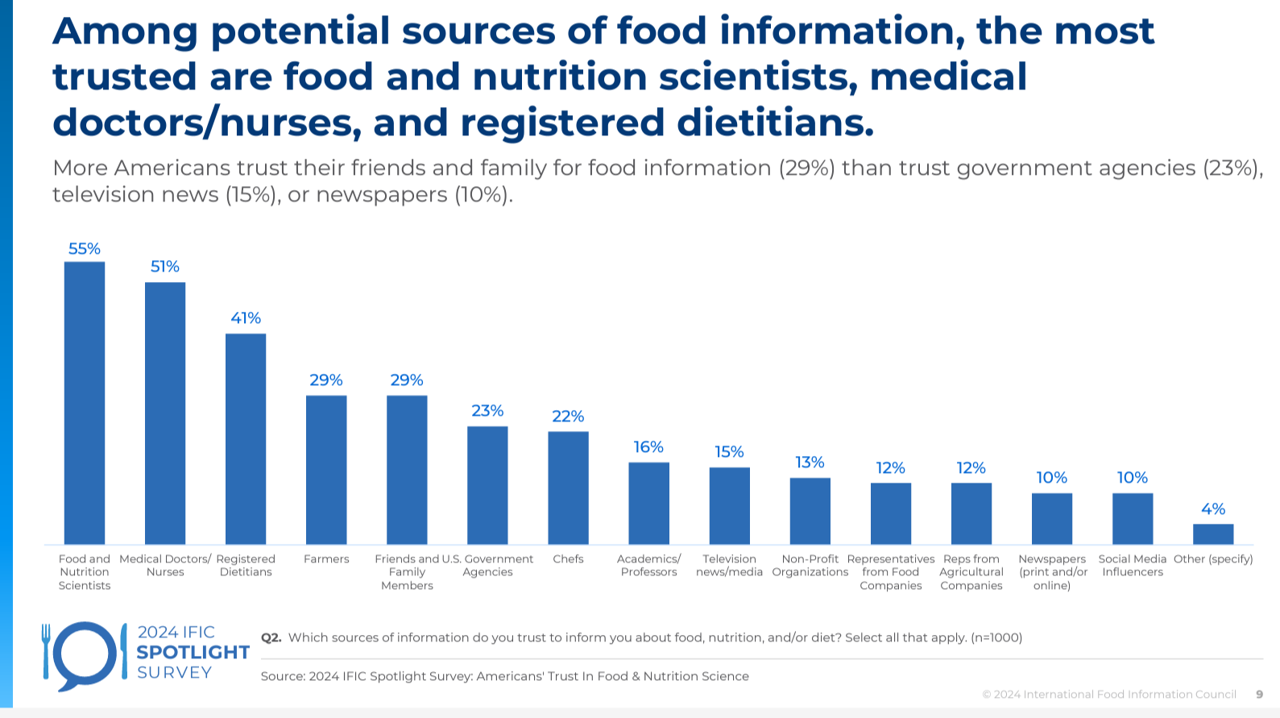

Only 2 in 5 people in the U.S. strongly trust science concerning food, nutrition, or diet, we learn from the 2024 IFIC Spotlight Survey: Americans’ Trust in Food & Nutrition Science, published in October. IFIC is the International Food Information Council, a non-profit organization with a mission of communicating science-based information about food safety, nutrition, and sustainable food systems. IFIC surveyed 1,000 U.S. adults online in July to gauge consumers’ views on food and science. The most-trusted sources of food information are the scientists involved in researching nutrition,

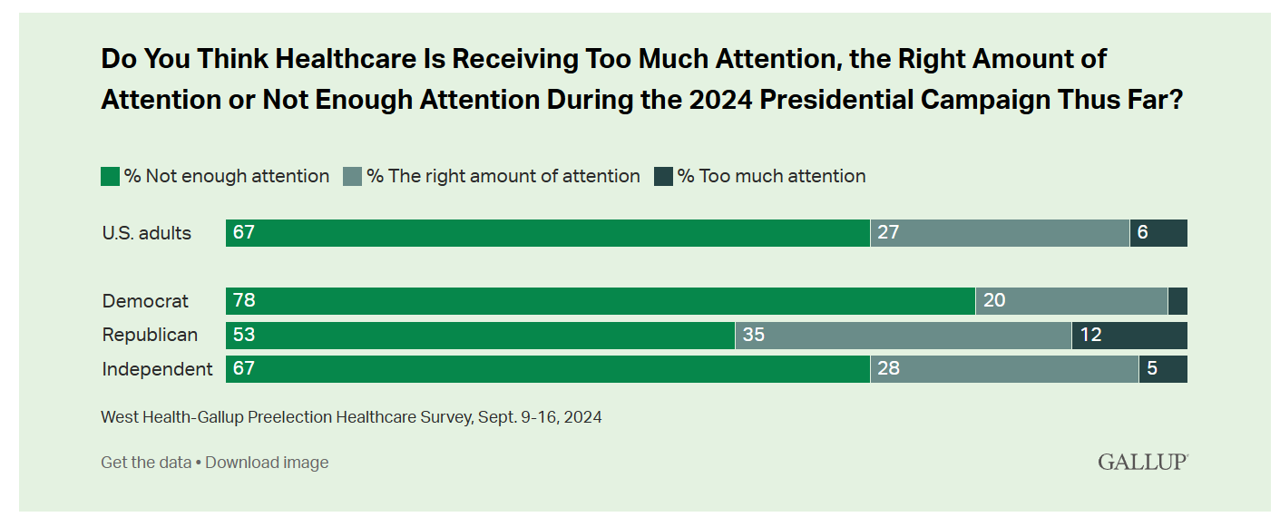

Americans Want More Health Care Issues Baked into the 2024 Elections – Gallup

Beyond women’s health and abortion politics, most Americans are looking for more health care baked into the 2024 Elections, based on a new poll from Gallup in collaboration with West Health. Two in three U.S. adults thought health care was not receiving enough attention during the 2024 Presidential campaign as of September 2024. This is a majority shared opinion for voters across the three party IDs in the U.S., shown in the first bar graph. The research polled 3,660 U.S. adults in September, about two-thirds before the presidential debate held September 10, and about one-third

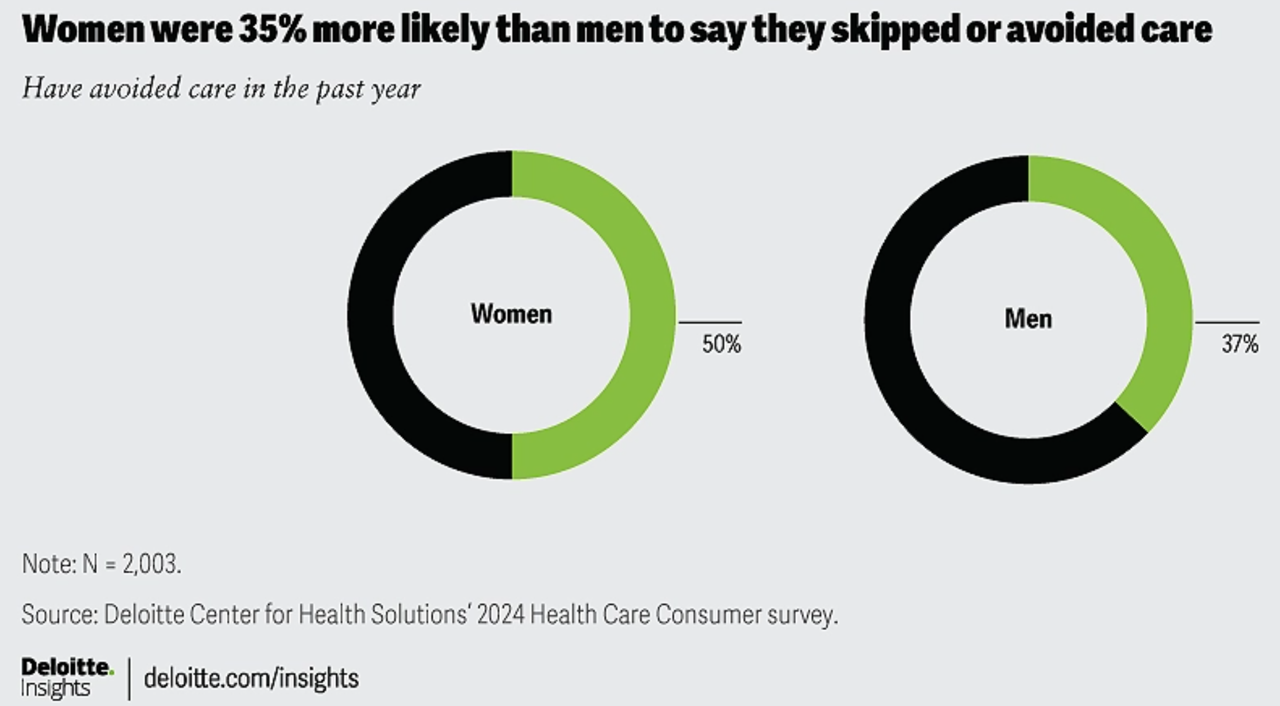

1 in 2 U.S. Women (“The Bedrock of Society”) Self-Ration Care – the Latest Deloitte Findings

Women in the U.S. are more likely to avoid care than men in America, Deloitte found in the consulting firm’s latest survey on consumers and health care. Deloitte coins this phenomenon as a “triple-threat” that women face in the U.S. health care environment, the 3 “threats” being, Affordability, Access, and, Prior experience — that is the health disparity among women who have seen personal mis-diagnosis, bias, or treatment that hasn’t been consistent with current protocols and practices. The data come out of Deloitte’s fielding of the U.S. consumer survey in February and March, 2024.

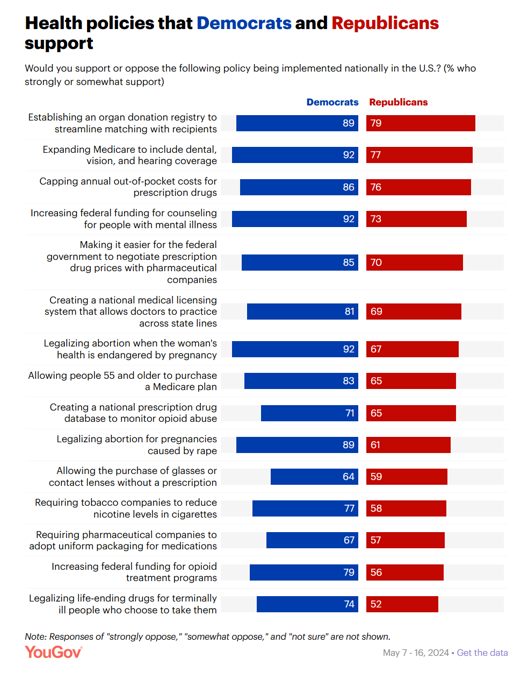

Where Democrats and Republicans Agree on Health Care Policies – From Medicare and Prescription Drugs to Gun Safety

In a super-divided electorate like the U.S. with about 60 days leading up to the 2024 Elections, we might assume there are no “purple” areas of agreement between the Red (Republicans) and the Blue (Democrats) thinking in PANTONE color politics. Surprisingly, there are many health policies on which Democrats and Republicans concur, as found in a series of YouGov polls conducted in May 2024. YouGov fielded the health policies poll in five waves online, each among roughly 1,100 U.S. adults in May 2004. This bar chart summarizes health

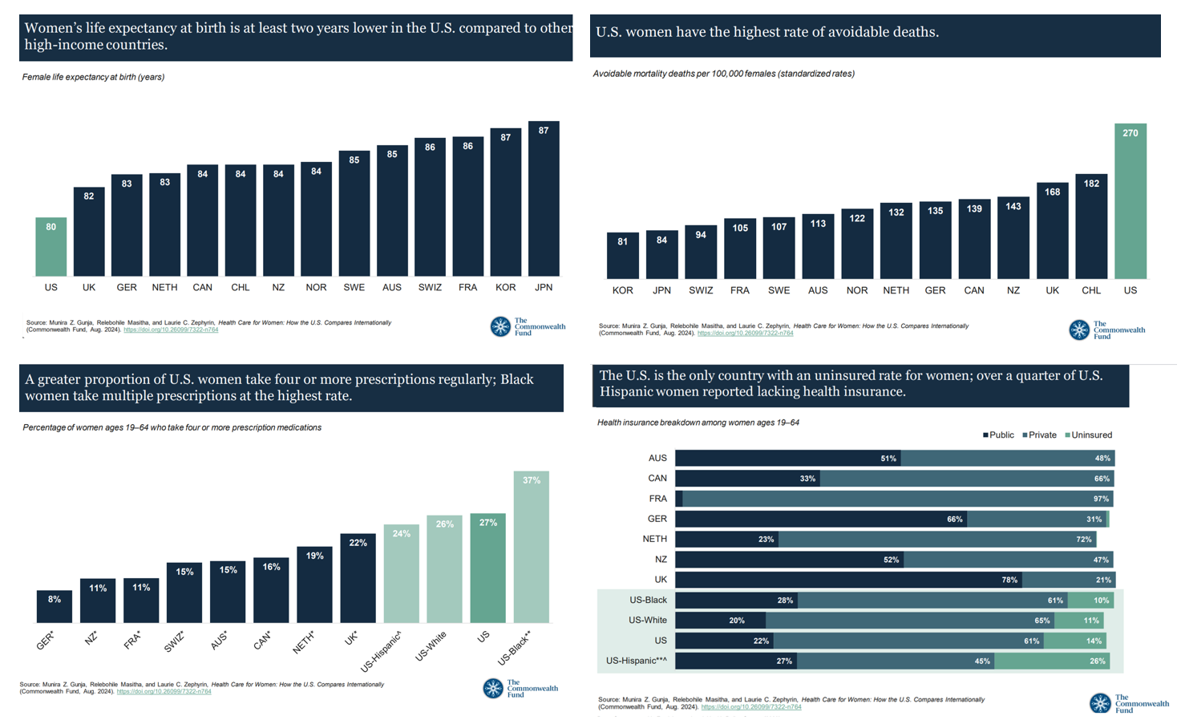

Women’s Health Outcomes in the U.S.: Spending More, Getting (Way) Less – 4 Charts from The Commonwealth Fund

Women in the U.S. have lower life expectancy, greater risks of heart disease, and more likely to face medical bills and self-rationing due to costs, we learn in the latest look into Health Care for Women: How the U.S. Compares Internationally from The Commonwealth Fund. The Fund identified four key conclusions in this global study: Mortality, shown in the first chart which illustrates women in the U.S. having the lowest life expectancy of 80 years versus women in other high-income countries; Health status, with women in the U.S. more likely to consume multiple prescription

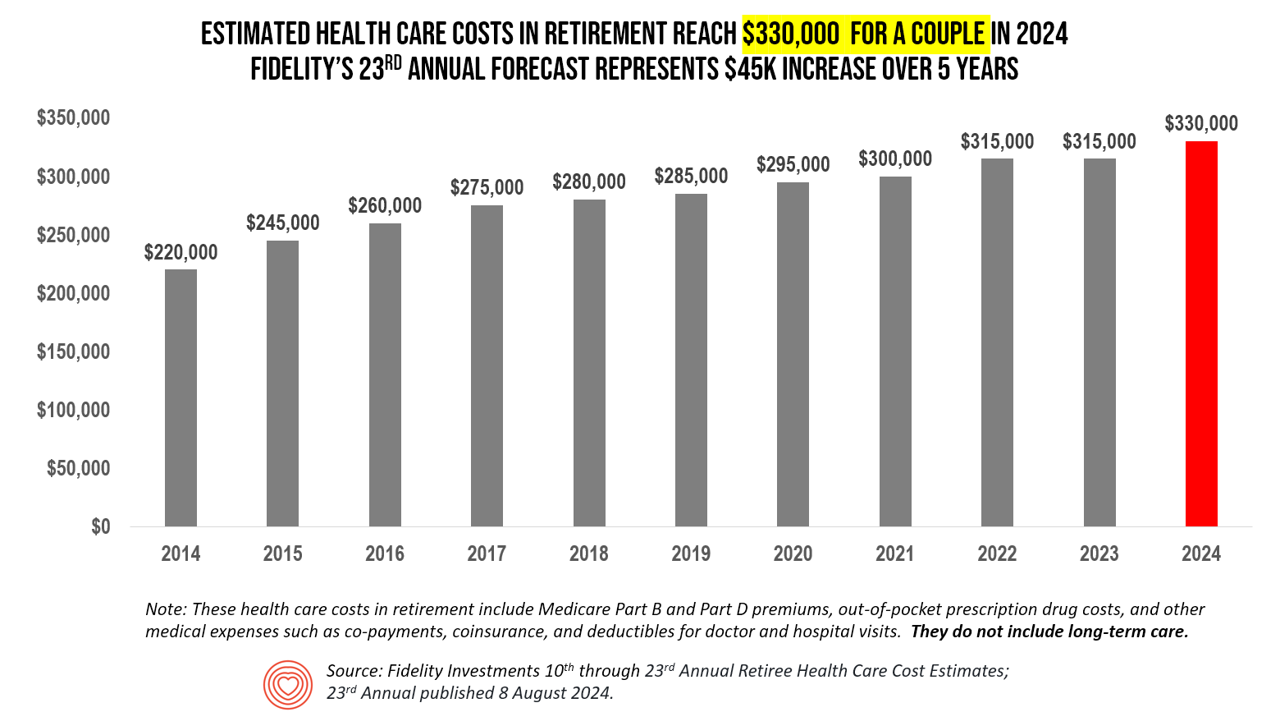

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

What the “Vibe-Cession” Means for Health Care in the U.S. – Spending is Personal

People living in the U.S. continue to feel a “vibe-cession” malaise, based on the American Mindset July 2024 update from Dentsu’s Consumer Navigator research. Notwithstanding generally good news about the American macroeconomy — in terms of growth, downward ticking inflation, and expected interest rate relief come September from the Federal Reserve — one in two Americans still thinks the country is in a recession. And this context is important for consumer’s personal spending on health care, fitness, and wellness, because, as Dentsu puts it, “consumers think in terms of personal finances.” As

Consumers Demand Foods That Are Healthy AND Delicious – and Some Health Equity Implications

The most common food-eating styles practiced by U.S. consumers are low sugar/diabetic diets, low-calorie, dairy-free, anti-inflammatory, and gluten-free, ccording to the Midyear Trends update from Datassential. In their update on the food trends entering the second half of 2024, Datassential offered several insights on consumers and food-as-medicine in a section called the Health Check-Up. These trends are shaping consumers’ food demands in both their grocery shopping preferences (for food consumed in the home) as well as their eating-out ordering strategies — where 35% of consumers want to see menu offerings with foods that are

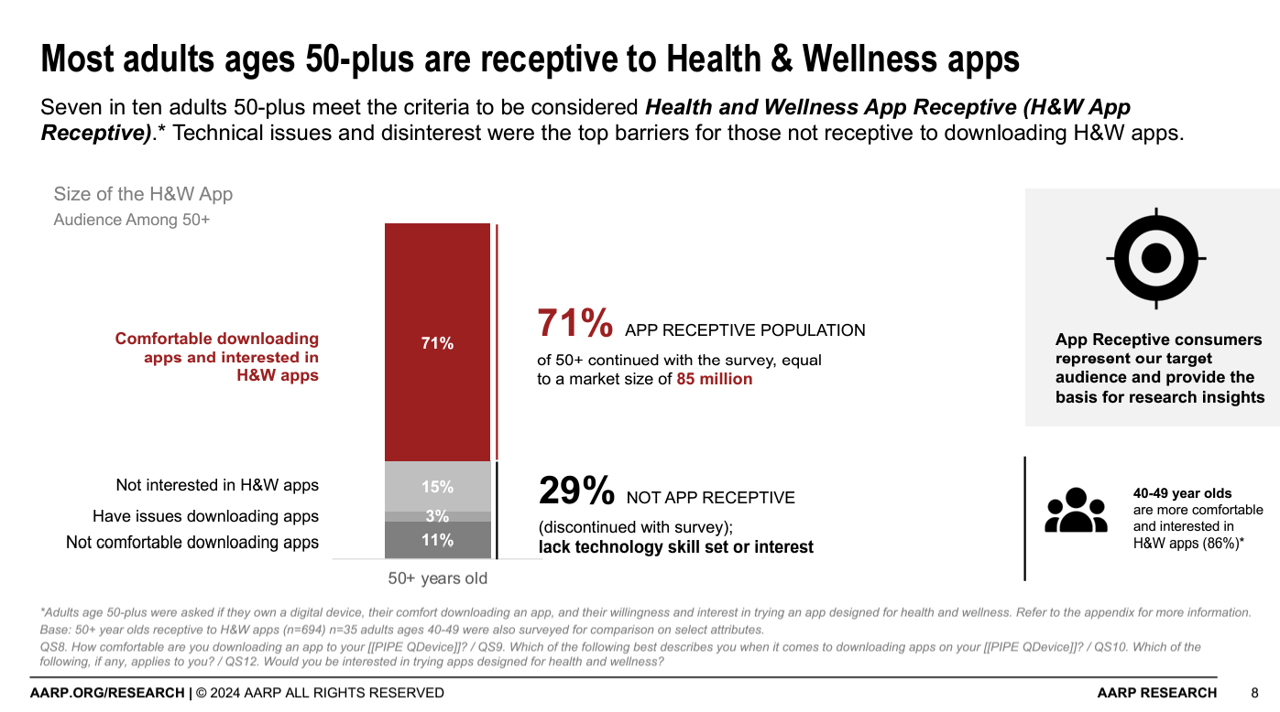

Older Americans Mostly Receptive to Apps for Health, but Chronically Ill People Could Use a Nudge (and a Payer)

AARP found that 7 in 10 people ages 50+ are “app-receptive” for health and wellness apps in Unlocking Health and Wellness Apps: Experiences of Adults Age 50-Plus, a summary of research conducted with U.S. consumers 50 and over from AARP. The methodology for this study included only older consumers who were comfortable in downloading apps to smartphones or tablets, and were willing to do so — whom AARP considered the target audience for this research. In addition, the respondents surveyed were also at least interested in trying apps designed for health and wellness, thus dubbed “health

“Listen to Me:” Personalization in Health Care Starts With Taking Patients’ Voices Seriously – the 15th Beryl Institute-Ipsos PX Pulse Survey

Patients’ experience with health care in the U.S. dropped to its lowest point over the past year, explained in the 15th release of The Beryl Institute – Ipsos PX Pulse survey. The study into U.S. adult consumers’ perspectives defined “patient experience” (PX) as, “The sum of all interactions, shaped by an organization’s culture, that influence patient perceptions across the continuum of care.” The survey was fielded by Ipsos among 1,018 U.S. adults in March 2024. Health care providers (and other industry stakeholders that go B2B or B2B2C (or P) are all thinking

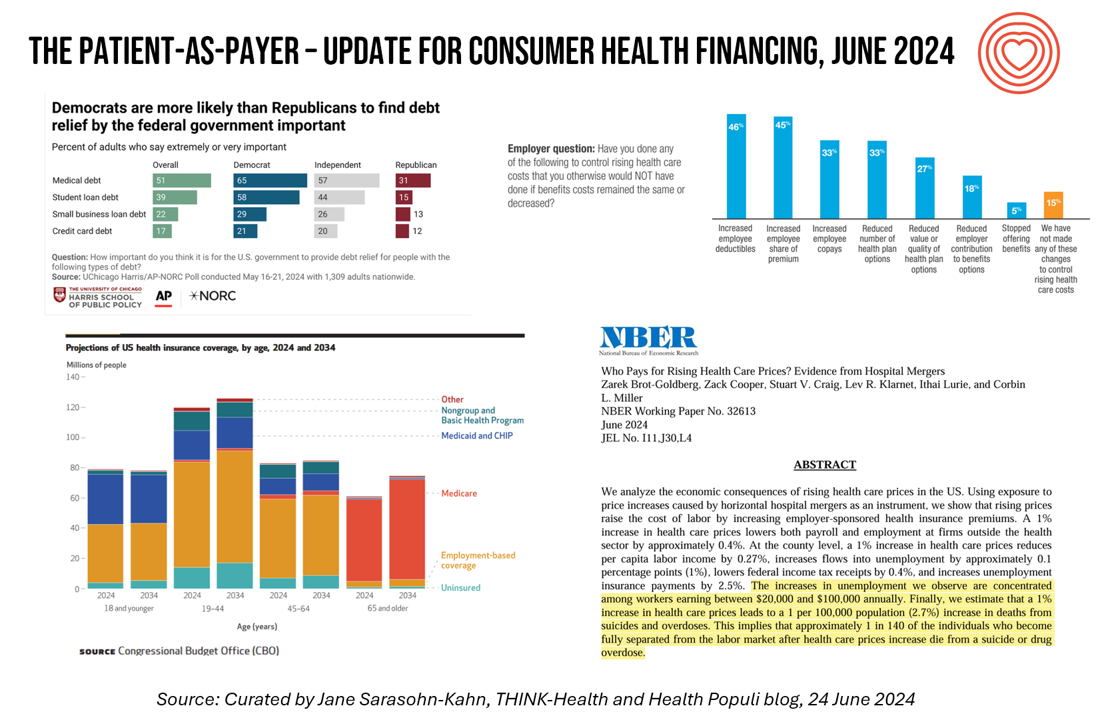

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

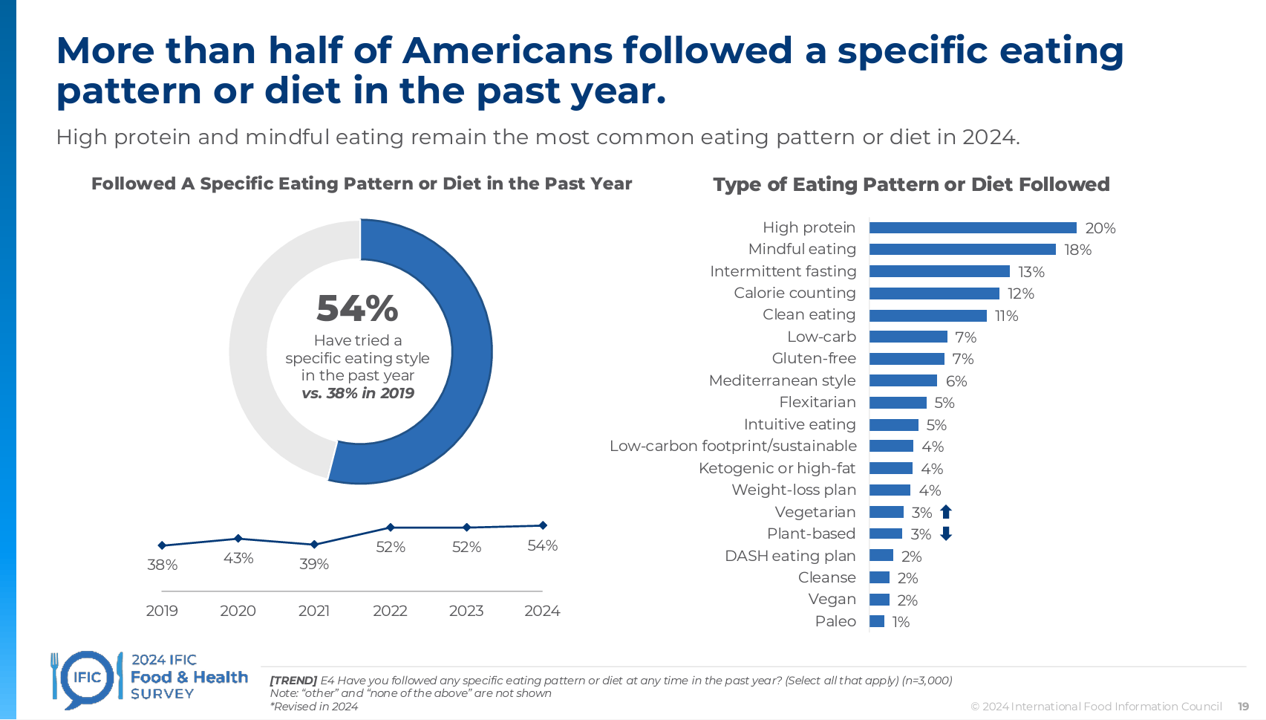

Most Americans Follow an Eating Pattern in Search of Energy, Protein, and Well-Being – With Growing Financial Stress: A Food as Medicine Update

Most Americans follow some kind of eating regime, seeking energy, more protein, and healthy aging, according to the annual 2024 Food & Health Survey published this week by the International Food Information Council (IFIC). But a person’s household finances play a direct role in their ability to balance healthful food purchases and healthy eating, IFIC learned. In this 19th annual fielding of this research, IFIC explored 3,000 U.S. consumers’ perspectives on diet and nutrition, trusted sources for food information, and new insights into peoples’ views on the GLP-1 weight-loss drugs and the growing sense

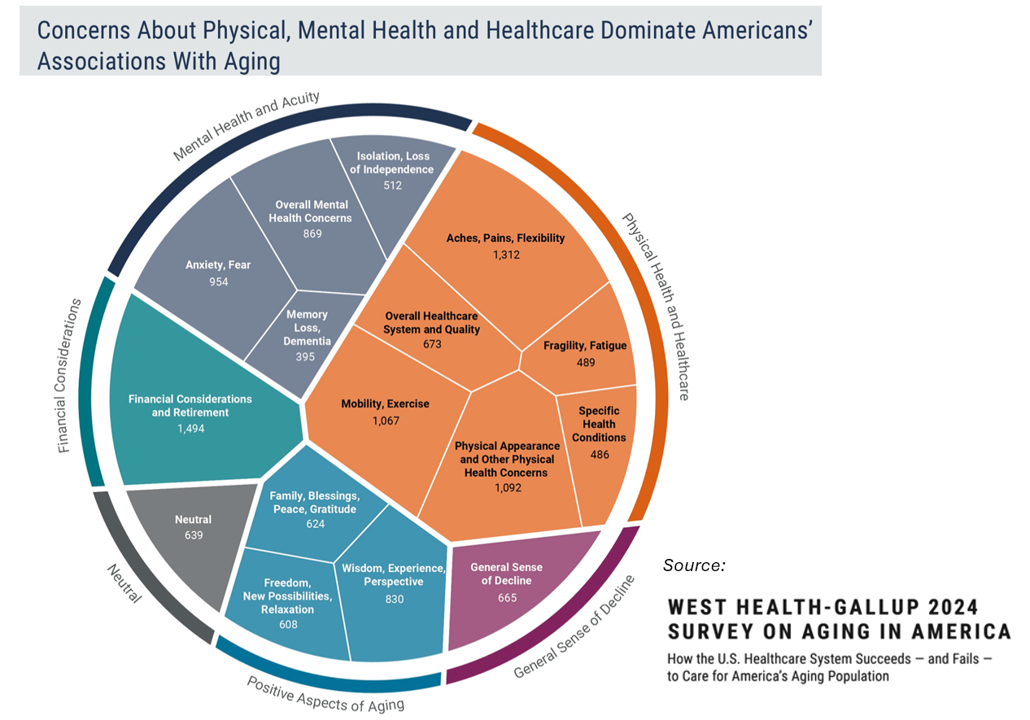

Most Americans, Both Younger and Older, Worry About the Future of Medicare and Social Security

You would assume that most people over 50 would be worried about the financial future of Medicare to cover health care as those middle-aged Americans age. But a surprising two-thirds of young Americans between 18 and 29, and 7 in 10 between 30 and 39 years of age, are concerned that Medicare’s solvency will worsen leading to their not being able to receive Medicare when eligible to receive it, discovered in the 2024 Healthcare in America Report from West Health and Gallup. This year’s research focused on aging in America, exploring areas of U.S. health care system successes as well

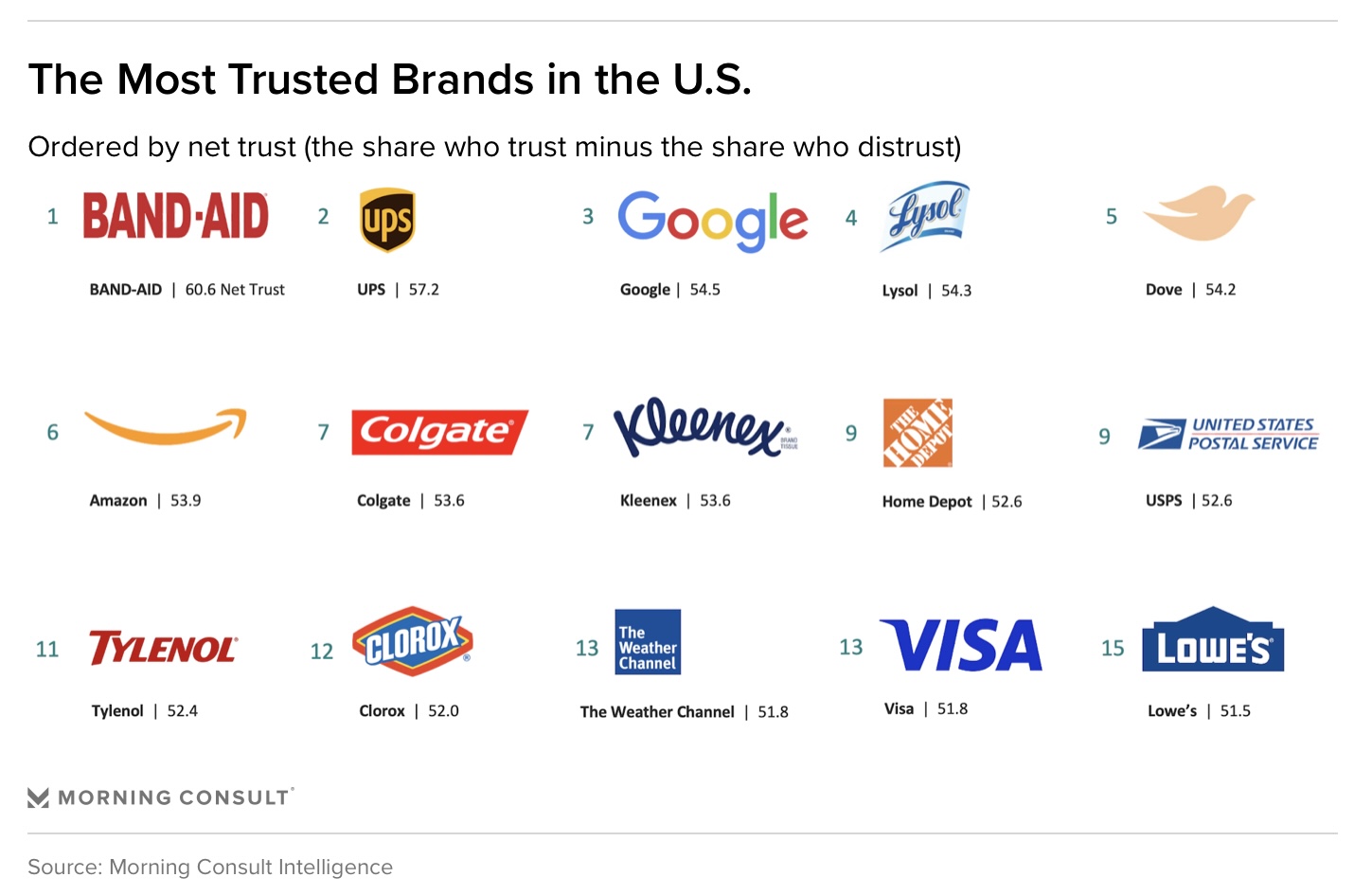

The Most Trusted Brands of 2024 Tell Us A Lot About Health Consumers

From bandages to home hygiene, OTC pain meds and DIY home projects, Morning Consult’s look into the most-trusted brands of 2024 give us insights into health consumers. I’ve been tracking this study since before the public health crisis of the coronavirus, and it always offers us a practical snapshot of the U.S. consumer’s current ethos on trusted companies helping people risk-manage daily living — and of course, find joy and satisfaction as well. In the top 15, we find self-care for health and well-being in many brands and products: we can call out Band-Aid, Dove, Colgate, Kleenex, and Tylenol. For

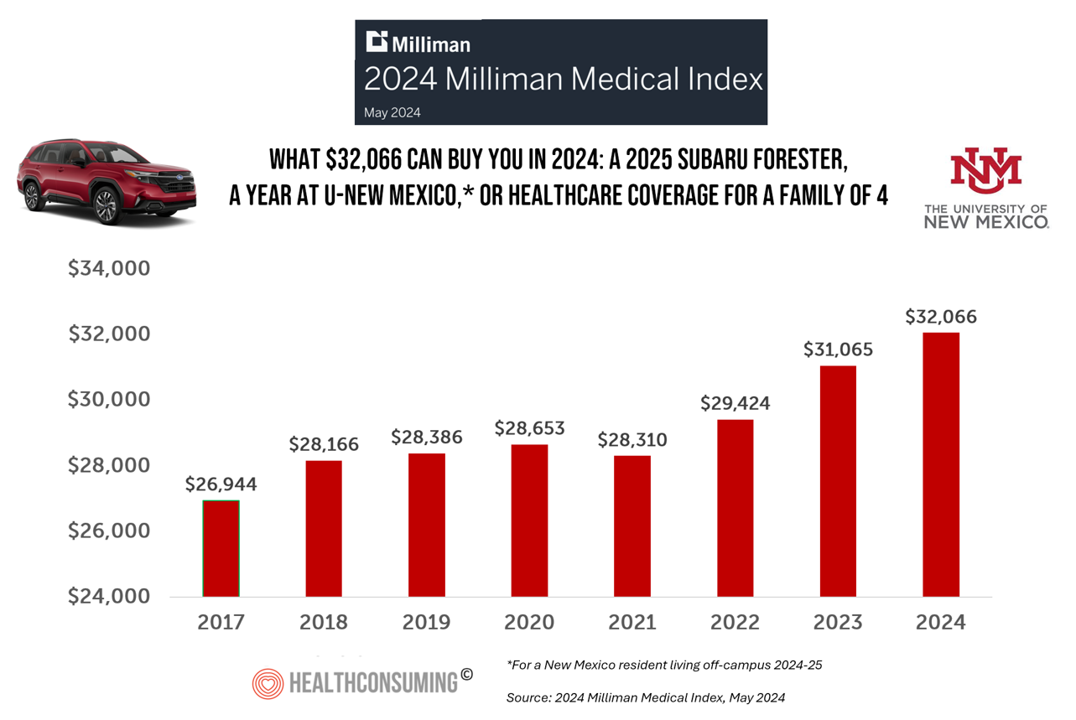

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

The Thematic Roadmap for AHIP 2024: What the Health Insurance Conference Will Cover

Health insurance plans make mainstream media news every week, whether coverage deals with the cost of a plan, the cost of out-of-network care, prior authorizations, or cybersecurity and ransomware attacks, among other front-page issues. This week, AHIP (the acronym for the industry association of America’s Health Insurance Plans) is convening in Las Vegas for its largest annual 2024 meeting. We expect at least 2,400 attendees registered for the meeting, and they’ll not just be representing the health insurance industry itself; folks will attend #AHIP2024 from other industry segments including pharmaceuticals, technology, hospitals and health systems, and the investment and financial services

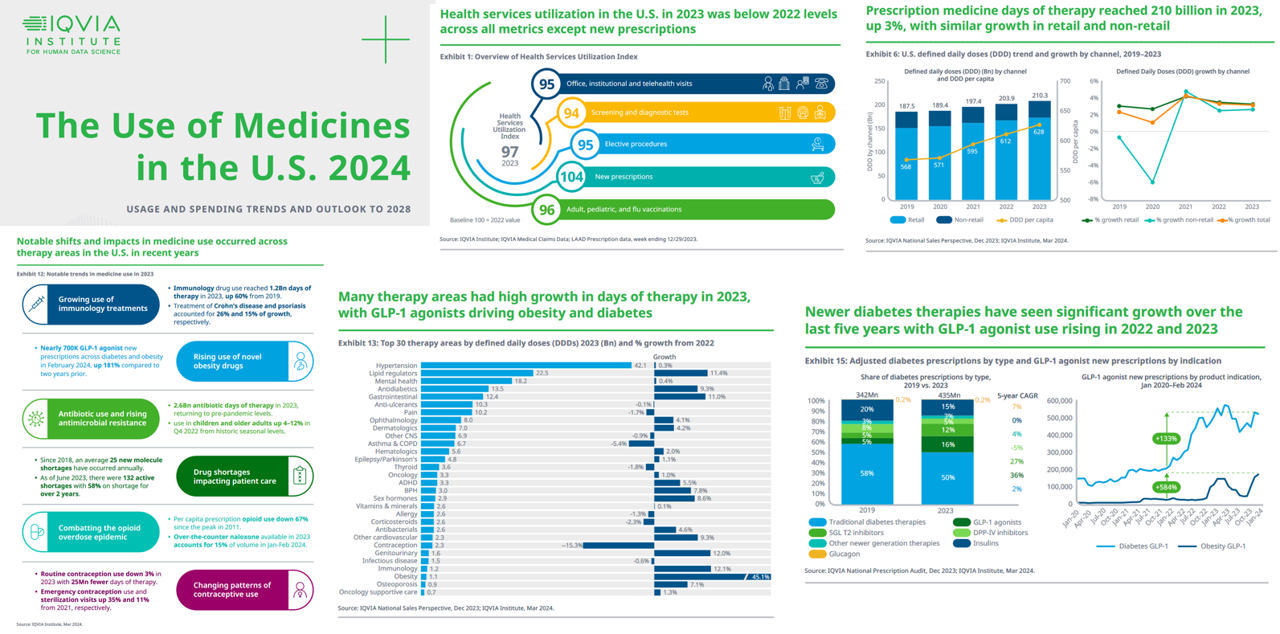

Prescriptions Are Up, Health Services Utilization Down, and GLP-1s Are a Major Growth Driver: IQVIA’s 2024 Update

In the past year, the growth of prescription drug utilization and spending has much to do with the use of GLP-1 agonists to treat diabetes and obesity, along with immunology therapy, and lipid meds, along with specialty medicines now accounting for over half of spending — up from 49% in 2018. This update comes from The Use of Medicines in the U.S. 2024 from the IQVIA Institute for Human Data Science. The annual report details trends in health services utilization, the use of prescription drugs, patient financing of those costs, the drivers underpinning the medicines spending, and an outlook to 2028.

Inflation, Health, and the American Consumer – “The Devil Wears Kirkland”

The Wall Street Journal reported yesterday that surging hospital prices are helping to keep inflation high. Hospital costs rose 7.7% last month, the highest increase in 13 years. This chart from WSJ’s reporting illustrates the >2x change in the CPI for hospitals vs the overall rate of price increases. Hospitals are not alone in price cliffs, with health insurance premiums spiking last year at the fastest rate in a decade, the Labor Statistics data showed. “For patients and their employers, the increases have meant higher health-insurance premiums, as well as limiting wage

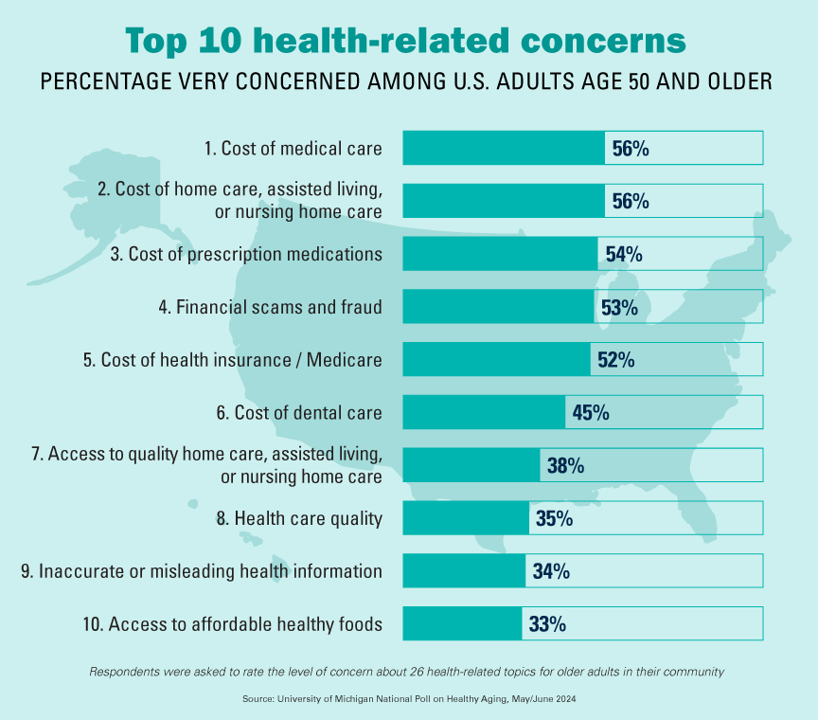

The Cost of Medical Care, Long-Term Care, and Prescription Drugs Top Older Americans’ Health-Related Concerns – With Social Security and Medicare Top of Mind

Among Americans 50 years of age and over, the top health-related concerns are Cost, Cost, and Cost — for medical services, for long-term and home care, and for prescription medications. Quality of care ranks lower as a concern versus the financial aspects of health care in America among people 50 years of age and older, as we learn what’s On Their Minds: Older Adults’ Top Health-Related Concerns from the University of Michigan Institute for Healthcare Policy and Innovation. AARP sponsors this study, which is published nearly every month of the year on the Michigan Medicine portal.

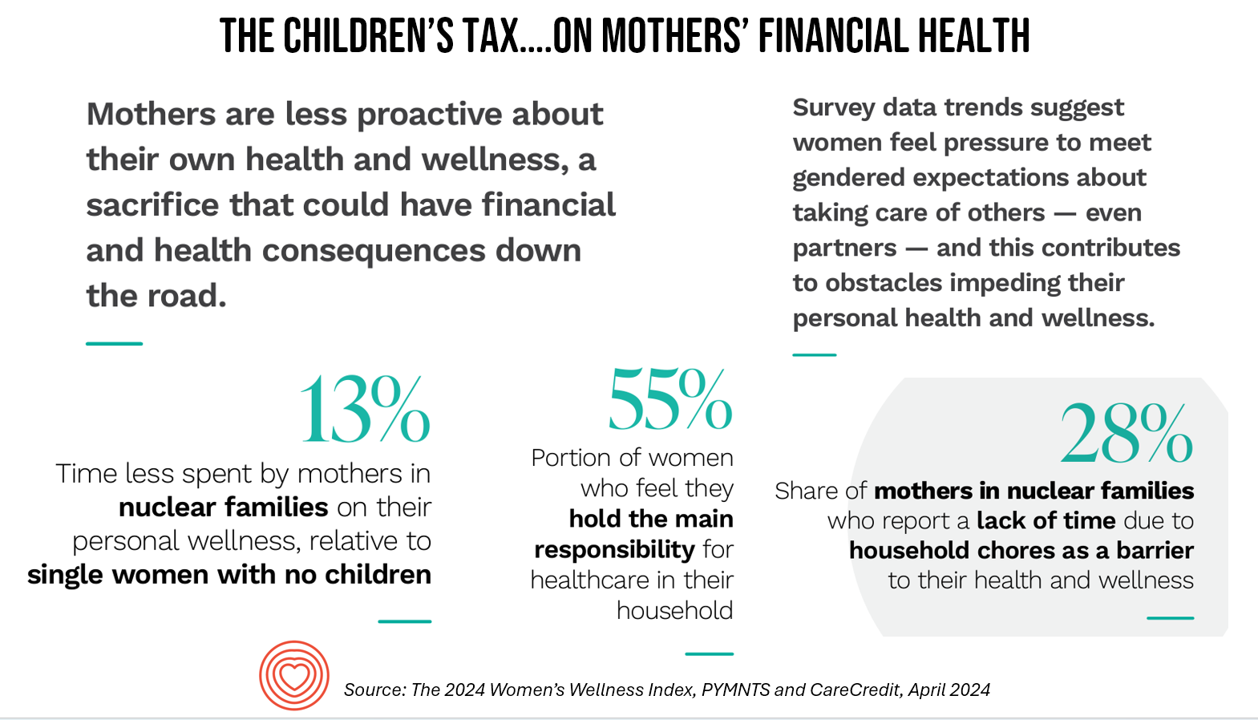

A Tax on Moms’ Financial and Physical Health – The 2024 Women’s Wellness Index

“Motherhood is the exquisite inconvenience of being another person’s everything” is a quote I turn to when I think about my own Mom and the remarkable women in my life raising children. With Mother’s Day soon approaching, the 2024 Women’s Wellness Index reminds us that the act of “being another person’s everything” has its cost. The Index, sponsored by PYMNTS in collaboration with CareCredit, was built on survey responses from 10,045 U.S. consumers fielded in November-December 2023. The study gauged women’s perspectives on finances, family, social life impacts on health and well-being. My key takeaway from

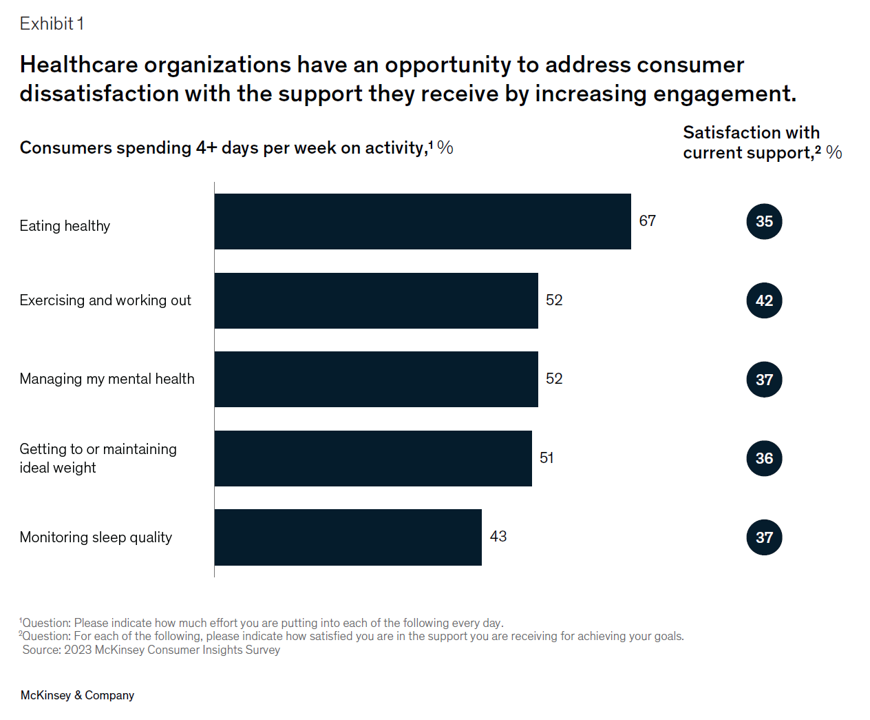

Leveraging Trust, Showing Humility: How Health Care Organizations Can Serve Consumers – A New Read from McKinsey

Three trends underpin health consumers’ evolving demands for service: spending more but getting less satisfaction and innovation; trusting health care with data but underwhelmed by the use of that personal information; and, growing “shopping” behavior seeking quality, availability, proximity, cost, and options across channels for health care. That’s the current read from McKinsey & Company’s team noting that Consumers rule: Driving healthcare growth with a consumer-led strategy. In this health consumer update, McKinsey spoke with three consumer marketing experts from other industries to learn best practices on how best to “be there”

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 2

This post follows up Part 1 of a two-part series I’ve prepared in advance of the AHIP 2024 conference where I’ll be brainstorming these scenarios with a panel of folks who know their stuff in technology, health care and hospital systems, retail health, and pharmacy, among other key issues. Now, let’s dive into the four alternative futures built off of our two driving forces we discussed in Part 1. The stories: 4 future health care worlds for 2030 My goal for this post and for the AHIP panel is to brainstorm what the person’s

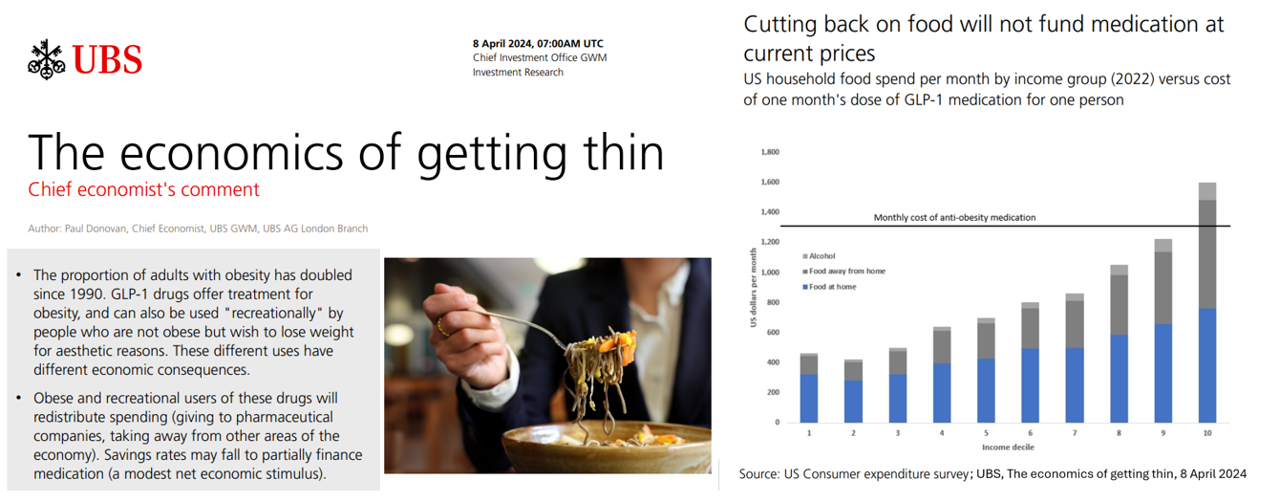

Considering Equity and Consumer Impacts of GLP-1 Drugs – A UBS Economist Weighs In

Since the introduction of GLP-1 drugs on the market, their use has split into two categories: for obesity and “recreationally,” according to the Chief Economist with UBS (formerly known as Union Bank of Switzerland). Paul Donovan, said economist, discusses The economics of getting thin in his regularly published comment blog. “These different uses have different economic consequences,” Donovan explains: Obese patients who use GLP-1s should become more productive employees, Donovan expects — less subject to prejudice, and less likely to be absent from work. While so-called recreational GLP-1 consumers may experience these

A Springtime Re-Set for Self-Care, From Fitness to Cozy Cardio: Peloton’s Latest Consumer Research

How many people do you know that don’t know their cholesterol or their BMI, their net worth or IQ, their credit score, astrological sign, or ancestry pie-chart? Chances are fewer and fewer as most people have gained access to medical records and lab test results on patient portals, calorie burns on smartwatches, credit scores via monthly credit card payments online, and completing spit tests from that popularly gifted Ancestry DNA test kits received during the holiday season. Meet “The Guy Who Didn’t Know His Cholesterol” conceived by Roz Chast,

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

The Self-Prescribing Consumer: DIY Comes to Prescriptions via GLP-1s, the OPill, and Dexcom’s CGM

Three major milestones marked March 2024 which compel us to note the growing role of patients-as-consumers — especially for self-prescribing medicines and medical devices. This wave of self-prescribed healthcare is characterized by three innovations: the Opill, GLP-1 receptor agonists, and Dexcom’s Continuous Glucose Monitoring (CGM) system that’s now available without a prescription. Together, these products reflect a shift in health care empowerment toward patients as consumers with greater autonomy over their health care when the products and services are accessible, affordable, and designed with the end-user central to the value proposition and care flows. Let’s take a look at each

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

The Economic Contours of the Change Healthcare Cyber Attack: Taking Stock So Far

On February 22, 2024, I went to a CVS Pharmacy-Inside-Target in my community to fill a prescription for benzonatate 200 mg capsules. I had caught a bad case of the flu the week before, and subsequently suffered a very long tail of a cough. That’s TMI for me to write about in the Health Populi blog, but this story has a current-events twist: the pharmacist could not electronically link with my insurance company to transact my payment. He tried a few work-flows, and ended up using a discount card which in the moment worked for us, and I paid the

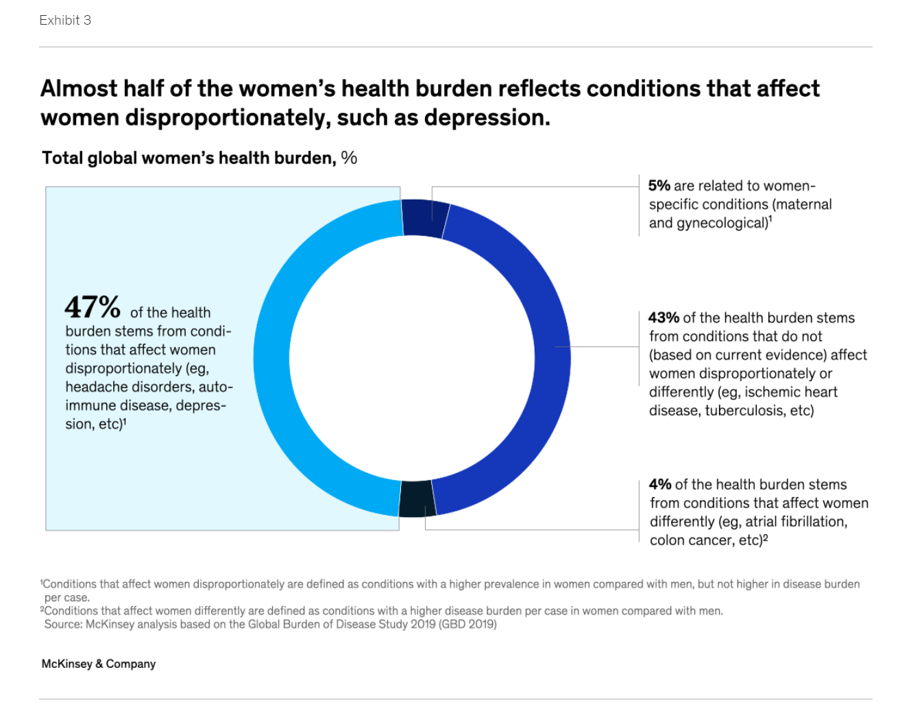

The Women’s Health Gap Is Especially Wide During Her Working Years – Learning from McKinsey, the World Economic Forum, and AARP in Women’s History Month

There’s a gender-health gap that hits women particularly hard when she is of working age — negatively impacting her own physical and financial health, along with that of the community and nation in which she lives. March being Women’s History Month, we’ve got a treasure-trove of reports to review — including several focusing on health. I’ll dive into two for this post, to focus in on the women’s health gap that’s especially wide during her working years. The reports cover research from the McKinsey Health Institute collaborating with the World Economic Forum on

A Health Consumer Bill of Rights: Assuring Affordability, Access, Autonomy, and Equity

Let’s put “health” back into the U.S. health care system. That’s the mantra coming out of this week’s annual Capitol Conference convened by the National Association of Benefits and Insurance Professionals (NABIP). (FYI you might know of NABIP by its former acronym, NAHU, the National Association of Health Underwriters). NABIP, whose members represent professionals in the health insurance benefits industry, drafted and adopted a new American Healthcare Consumer Bill of Rights launched at the meeting. While the digital health stakeholder community is convening this week at VIVE in Los Angeles to share innovations in health tech, NABIP

Americans Come Together in Worries About Medical Bills, the Cost of Health Care, and Prescription Drug Costs

In the U.S., national news media, Federal statistics, dozens of business leaders and the Federal Reserve Bank have been talking about an historically positive American economy on a macro level. But among individual residents of the U.S., there is still a negative feeling about the economy in a personal context, revealed in the Kaiser Family Foundation Health Tracking Poll for February 2024. I’ve selected three figures of data from the KFF’s Poll which make the point that in peoples’ negative feelings about the national economy, their personal feelings about medical costs rank high

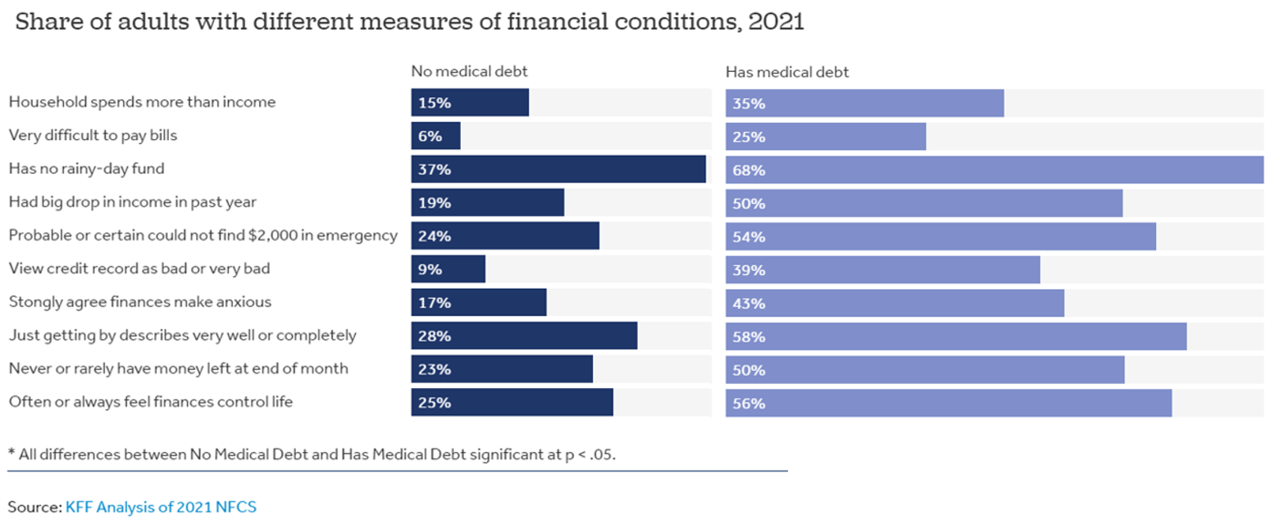

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

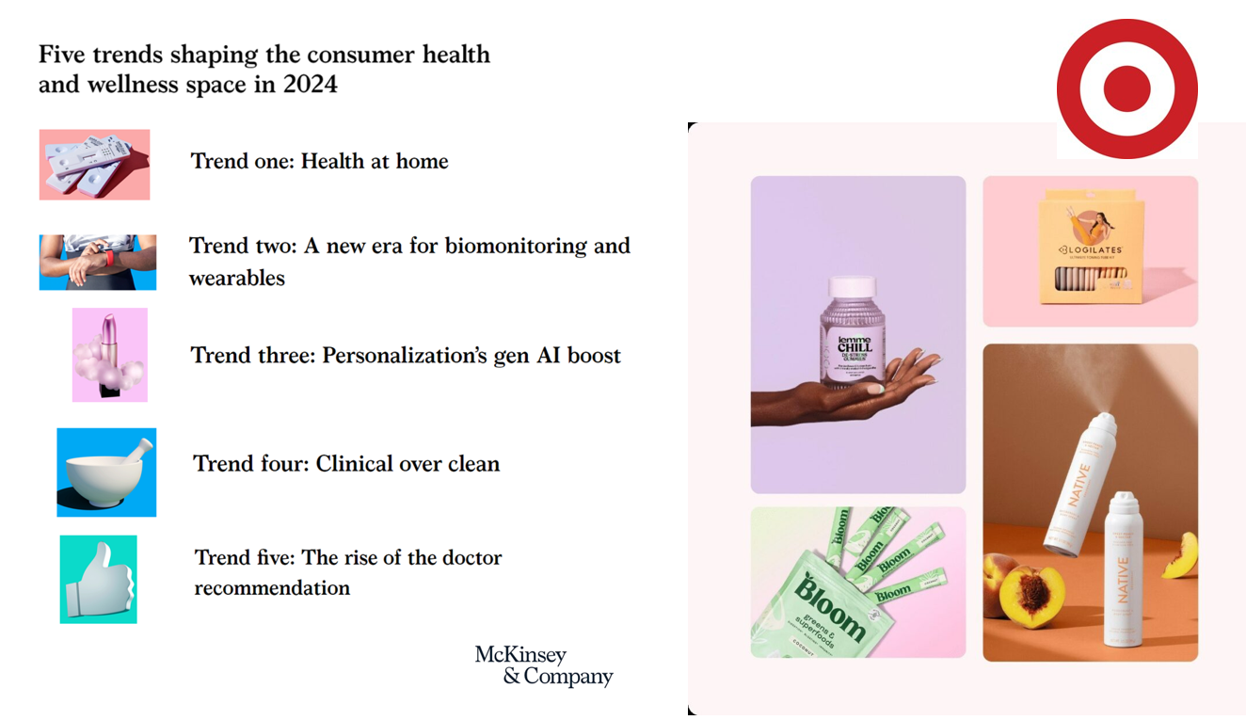

The Wellness Market Shaped by Health at Home, Wearable Tech, and Clinical Evidence – Thinking McKinsey and Target

Target announced that the retail chain would grow its aisles of wellness-oriented products by at least 1,000 SKUs. The products will span the store’s large footprint, going beyond health and beauty reaching into fashion, food, home hygiene and fitness. The title of the company’s press release about the program also included the fact that many of the products would be priced as low as $1.99. So financial wellness is also baked into the Target strategy. Globally, the wellness market is valued at a whopping $1.8 trillion according to a report published last week by McKinsey. McKinsey points to five trends

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

Inflation and the cost of health care top U.S. voters’ issues for 2024 elections

The cost of living ranks top in U.S. voters’ minds among many issues Americans are feeling and following in late 2023. A close second in line is affordability of health care, as consumers’ household budgets must make room for paying medical bills — with prescription drug costs also very important as a discussion topic for 2024 Presidential candidates, we learn from the latest KFF Health Tracking Poll published 1 December. The monthly study focused on U.S. voters’ top issues and perspectives on the health system and care approaching the new year of 2024. KFF fielded the study among 1,301 U.S.

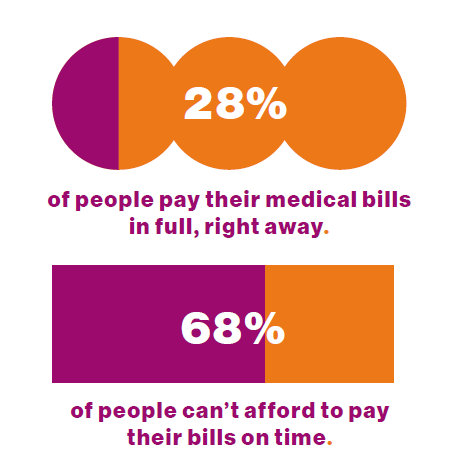

Healthcare Bills, Affordability, and Self-Rationing Care Will Continue to Challenge U.S. Health Consumers in 2024

Two-thirds of U.S. consumers say they can’t afford to pay their medical bills on-time, based on the 2023 Consumer Survey from Access One, a financial services company focused on healthcare payments. The report’s title page asks the question, “What options do consumers really want for paying healthcare expenses?” The survey report responds to that question, finding out that nearly one-half of patients have taken some kind of action to reduce their medical expenses. Furthermore, one-third of consumers are not confident they could pay a medical bill of $500 or more. Access One fielded

Everybody is Stressed in America, and It’s Not Good for Our Health: the 2023 Update from the American Psychological Association

The U.S. is “a nation recovering from collective trauma,” the according to the latest survey on Stress in America 2023 from the American Psychological Association (APA). The APA has been quantifying Stress in America since 2007; for context, at the end of that year The Great Recession kicked in, and in response President Obama’s team put together assistance to bolster the national economy, jobs, and health technology (codified in the American Recovery and Reinvestment Act). American health citizens are experiencing a deja vu in 2023 akin to their financial stress experienced in the APA 2008 Stress

How Ahold-Delhaize Connects the Grocery, Climate Change, ESG and Consumers’ Health

In the food sector, “the opportunity for us and the role that we play is to connect climate and health,” Daniella Vega of Ahold Delhaize told Valerio Baselli during the Morningstar Sustainable Investing Summit 2023. In a conversation discussing the importance of non-financial metrics in companies’ ESG efforts, Vega connected the dots between climate change, retail grocery, and consumers’ health and well-being. Vega is the Global Senior Vice President, Health & Sustainability, with Ahold Delhaize— one of the largest food retail companies in the world. Based in the Netherlands, the company operates mainly in

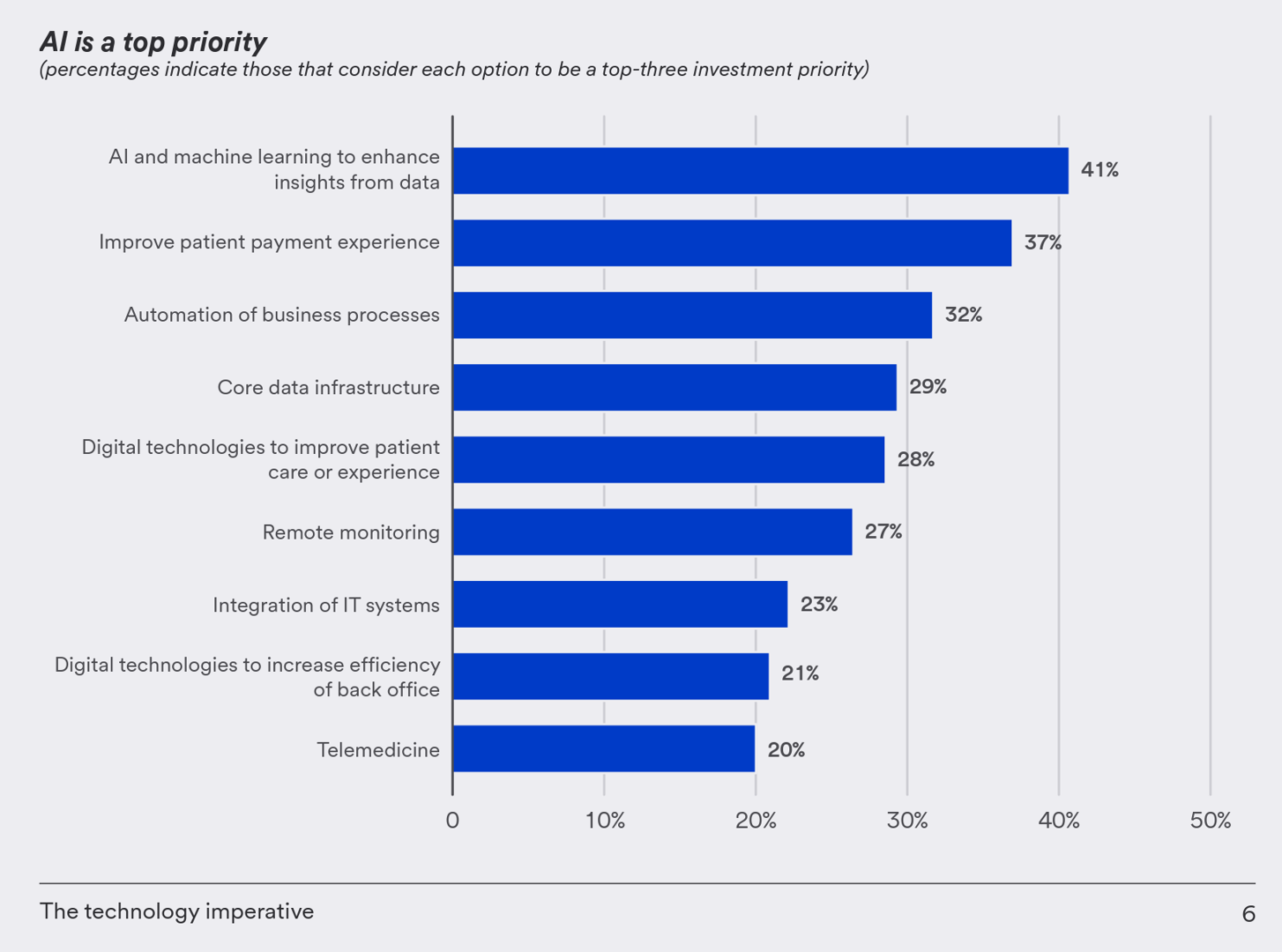

Health Care Finance Leaders Look to Cut Costs and Improve Patients’ Financial Experience — Think AI and Venmo

One half-of health care financial leaders plan to invest in technology to cut costs — and most believe that AI has the potential to re-define the entire finance function as they look to Leading the transformation, a study conducted by U.S. Bank among U.S. health finance leaders thinking about emerging technologies. U.S. Bank fielded a survey among 200 senior health care financial leaders in the U.S., 30% of whom were group CFOs, 20% regional/divisional CFOs, 25% senior managers, and the remaining various flavors of financial managers. All respondents were responsible for at least $100

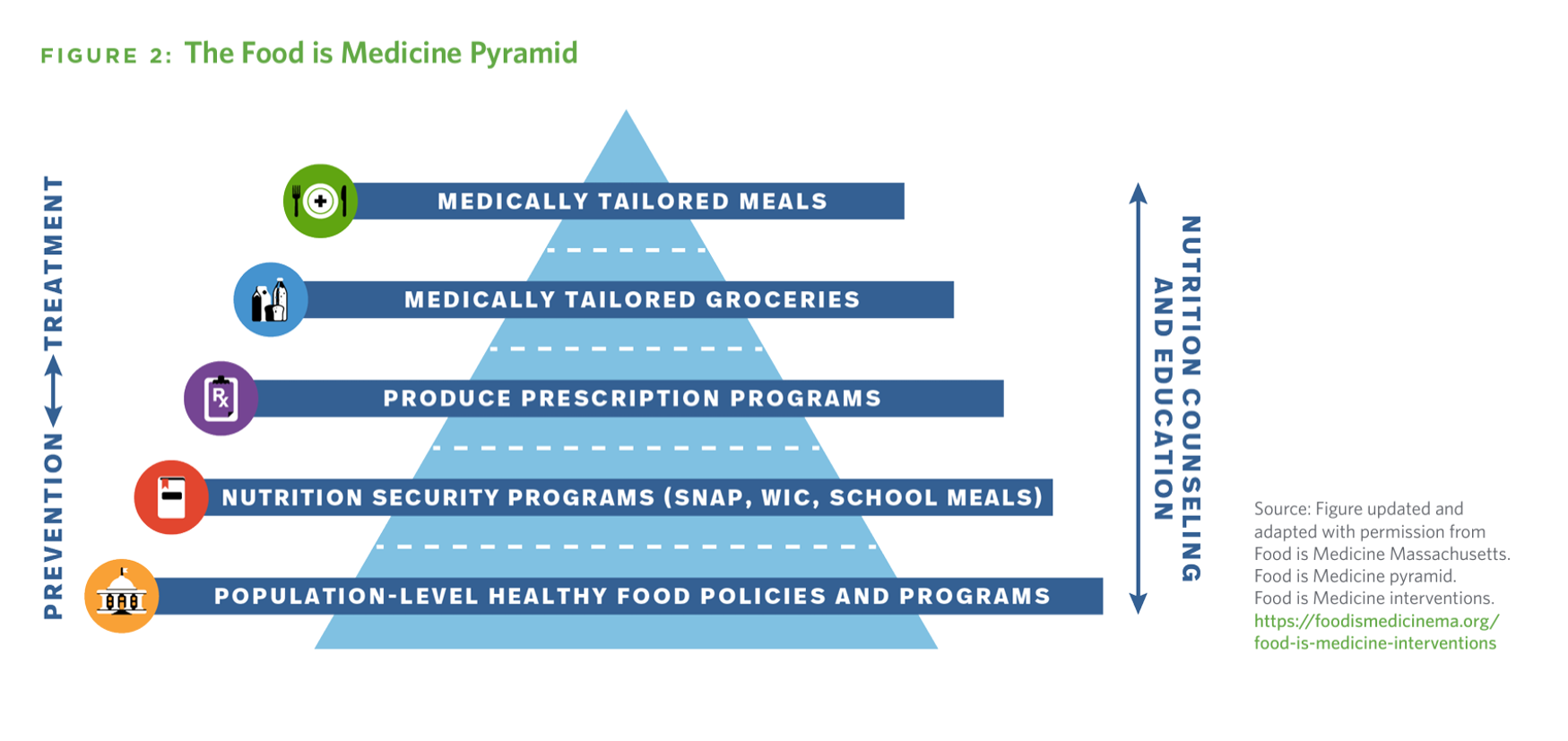

Food-As-Medicine Grows Its Cred Across the Health/Care and Retail Ecosystem

In the nation’s search for spending smarter on health care, the U.S. could save at least $13 billion a year through deploying medically-tailored meals for people enrolled in Medicare, Medicaid, and private insurance programs, according to the True Cost of Food, research published by the Tufts School of Nutrition Science and Policy collaborating with The Rockefeller Foundation. It’s been one year since the White House convened the Conference on Hunger, Nutrition, and Health, kicking off the Biden Administration’s national strategy to improve health citizens’ access to healthy food as a matter of public health and economic security.

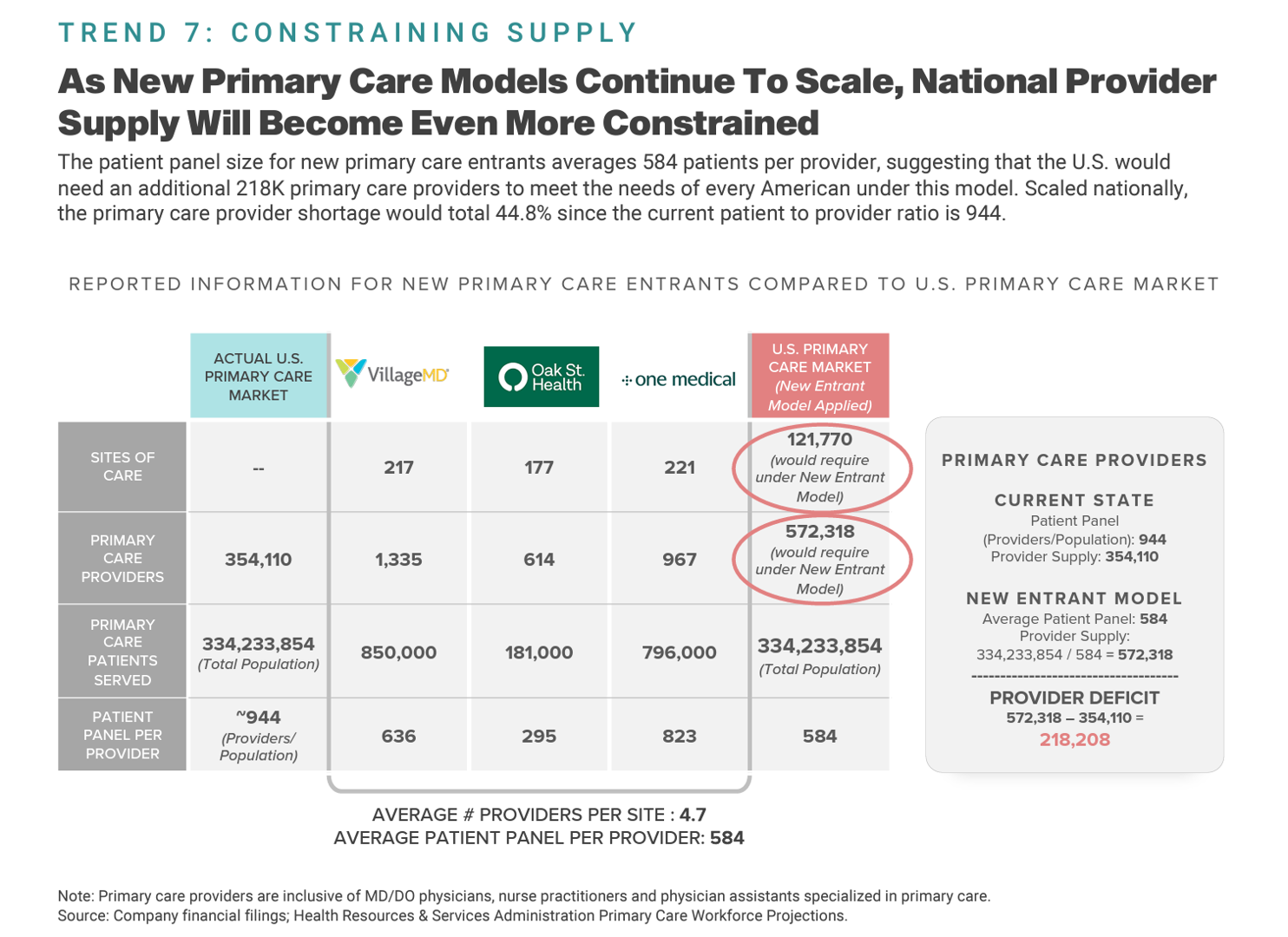

The 2023 Health Economy – The Evolving Primary Care and Retail Health Convergence Through Trilliant Health’s Lens

In U.S. health care’s negative-sum game, stakeholders who survive and win that game will have to deliver value-for-money, we learn from Trilliant Health’s 2023 Trends Shaping the Health Economy Report. “Report” is one word for this nearly 150-page compendium of health care data that is an encyclopedic treasure trove for health service researchers, marketers, strategists, journalists, and those keen to explore questions about the current state of health care in America. As Sanjula Jain points out in the Report’s press release, the publication resembles another huge report many of us appreciated for

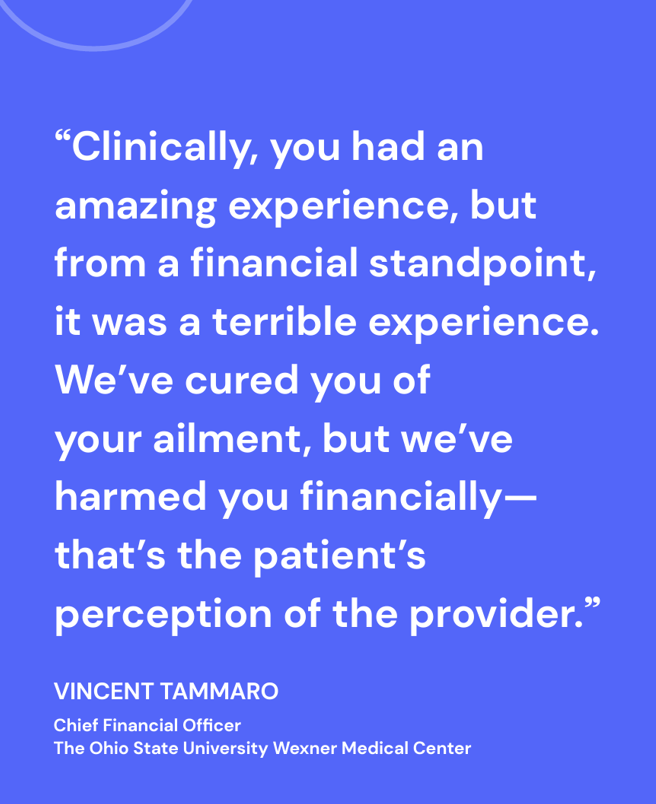

The Healthcare Financial Experience is a Stressful One: the Convergence of our Medical, Retail, and Financial Lives

One in two consumers in the U.S. feel their well-being or healing was negatively impacted by difficulty paying for their medical care. Welcome to the convergence of patients’ health care life with financial and retail lives, we learn from the 2024 Healthcare Financial Experience Study from Cedar. And that patient’s positive clinical experience can absolutely reverse the consumer’s perception of the provider, noted by this quote from OSU’s Chief Financial Officer Vincent Tammaro: “We’ve cured you of your ailment, but we’ve harmed you financially.” That’s a form of financial toxicity that

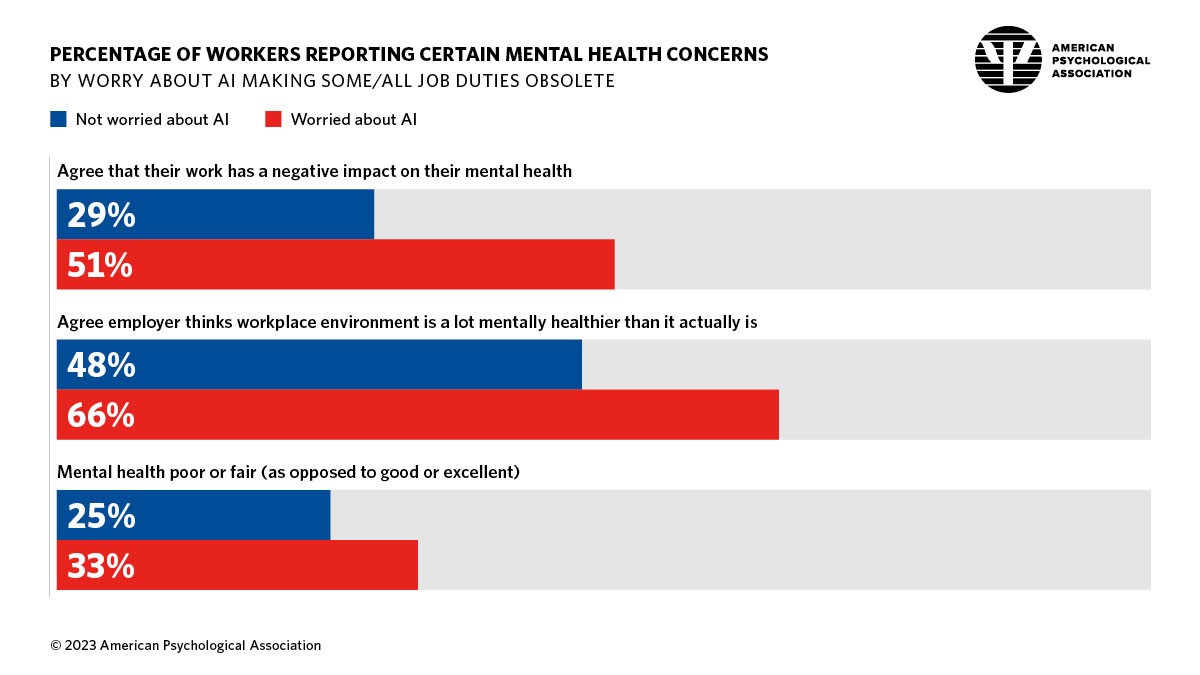

Working in America: AI Is the Next Major Job Stressor

Workers in America are worried about the potential impacts that artificial intelligence (AI) could have on the workplace and jobs, according to Work in America: Artificial Intelligence, Monitoring Technology and Psychological Well-Being, a study from the American Psychological Association (APA). For many years, we’ve been tracking APA’s Stress in America studies gauging Americans’ mental health before the pandemic and during the pandemic. To social and political stress, we must now add in another stressor to peoples’ daily lives: concerns about AI and the potential for it to make one’s job obsolete, with the subsequent

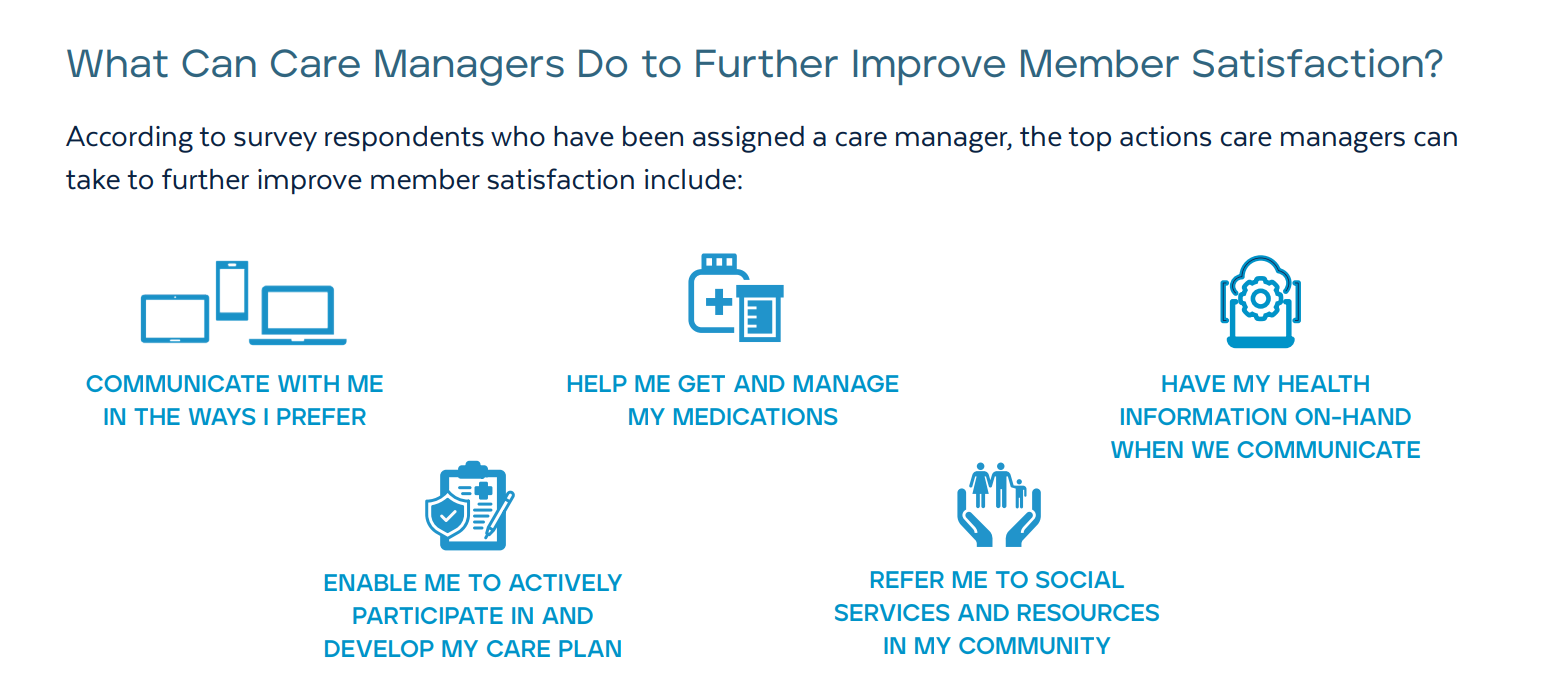

Personalizing Health Means Personalizing Health Insurance for Patient-Members – Learning from HealthEdge

As patients assume more financial skin in their personal healthcare, they take on the role of demanding consumer, or “impatient patients.” HealthEdge’s latest research into health consumers’ perspectives finds peoples’ satisfaction with their health insurance plans lacking, with members seeking easier access their personal health information, high levels of service, and rewards for healthy behaviors. Health plans would also boost consumers’ satisfaction by channeling patients’ access to the kinds of medical providers that align with consumers’ preferences and personal values, and by personalizing information to steer people toward lower-cost care.

A Tale of Barbie, Beyonce and Taylor, the Economy and the Gynecologist

This weekend’s Wall Street Journal Saturday/Sunday edition featured a big story on the economic force of women in the summer of 2023, termed “the women’s multiplier effect” — that women’s spending is a powerful force in the U.S. economy (and as it turns out, in Sweden’s economy as well). The article was titled, “Women Own This Summer. The Economy Proves It,” and featured a Photoshopped image in various shades of pink with Margot Robbie as Barbie in the center, flanked by Beyonce to the left and Taylor Swift to the right. I’m

GNC Offers “Free Healthcare” — Telehealth, Generic Meds, and Loyalty in the Retail Health Ecosystem

The retail health landscape continues to grow, now with GNC Health offering a new program featuring telehealth and “curated set” of 40+ generic prescription drugs commonly used in urgent care settings. The services are available to members of GNC’s new-and-improved loyalty program, GNC PRO Access, which is priced at a fixed fee of $39.99 for one year’s membership. This is available to consumers 18 years of age and older. “As a trusted brand in the health and wellness space, we are thrilled to expand our efforts in helping our customers Live Well by offering

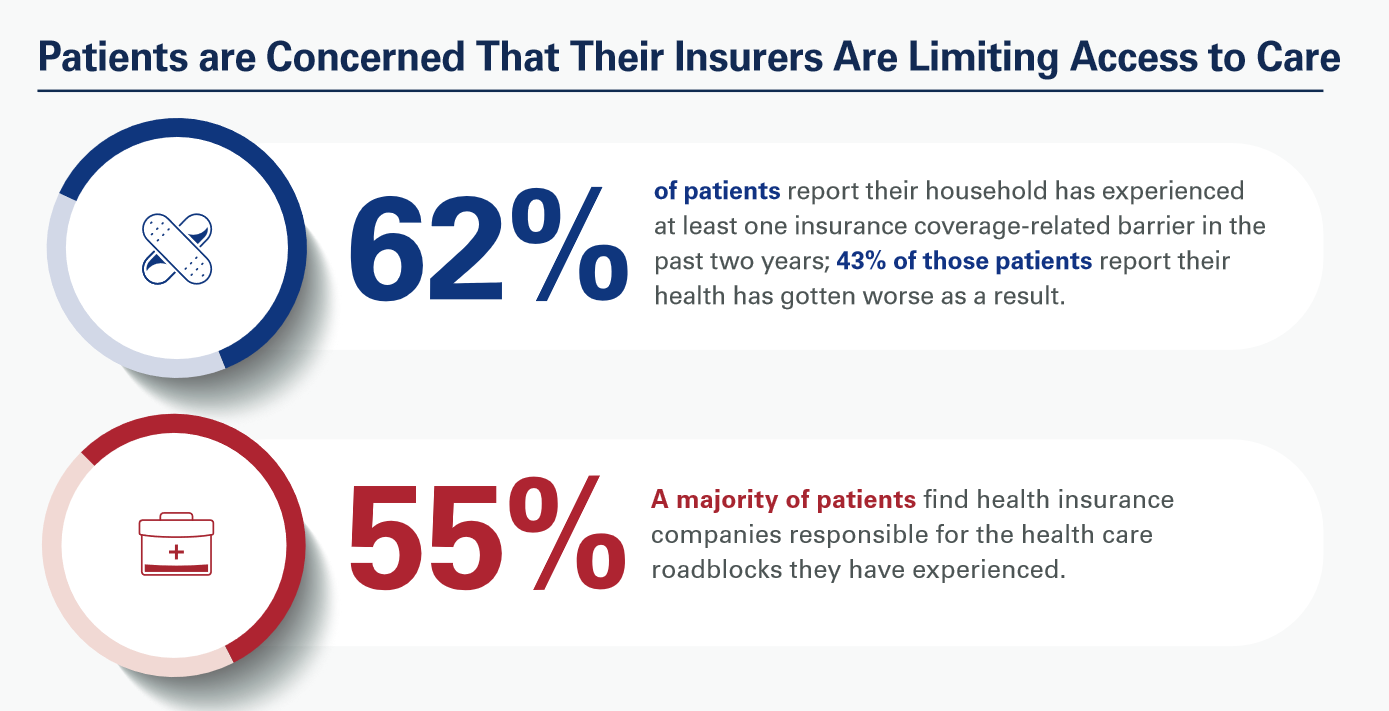

Patients, Nurses and Doctors Blame Health Insurers for Increasing Costs and Barriers to Care

Most patients, nurses and doctors believe that health insurance plans reduce access to health care which contributes to clinician burnout and increases costs, based on three surveys conducted by Morning Consult for the American Hospital Association (AHA). Most patients have experienced at least one health insurance related barrier in the past two years, and 4 in 10 of those people said their health got worse as a result of that care-barrier. “These surveys bear out what we’ve heard for years — certain insurance companies’ policies and practices are reducing health care access and making

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

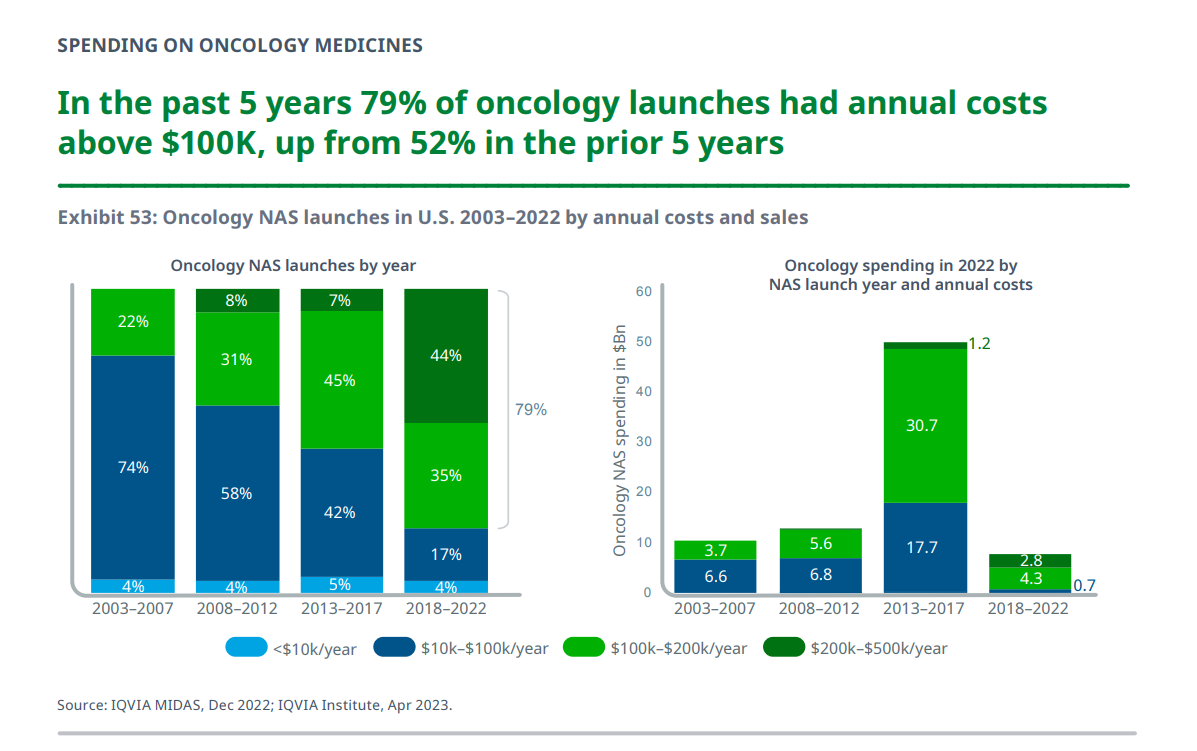

Consumers and Cancer: 3 Patient-Focused Charts From IQVIA on the State of the Oncology in 2023 – and Introducing CancerX

It’s time for the annual ASCO conference, currently convening the American Society for Clinical Oncology in Chicago. Starting 2nd June, there have been dozens of positive announcements updating research and therapies bringing hope to the 2 million new patients who will be diagnosed with cancer in the U.S. in 2023, and millions of more people worldwide. Just in time for #ASCO2023, the IQVIA Institute published their annual report on Global Oncology Trends 2023 – Outlook to 2027, an update featuring pipelines, therapy approvals, research updates, costs of oncology products, and patients.

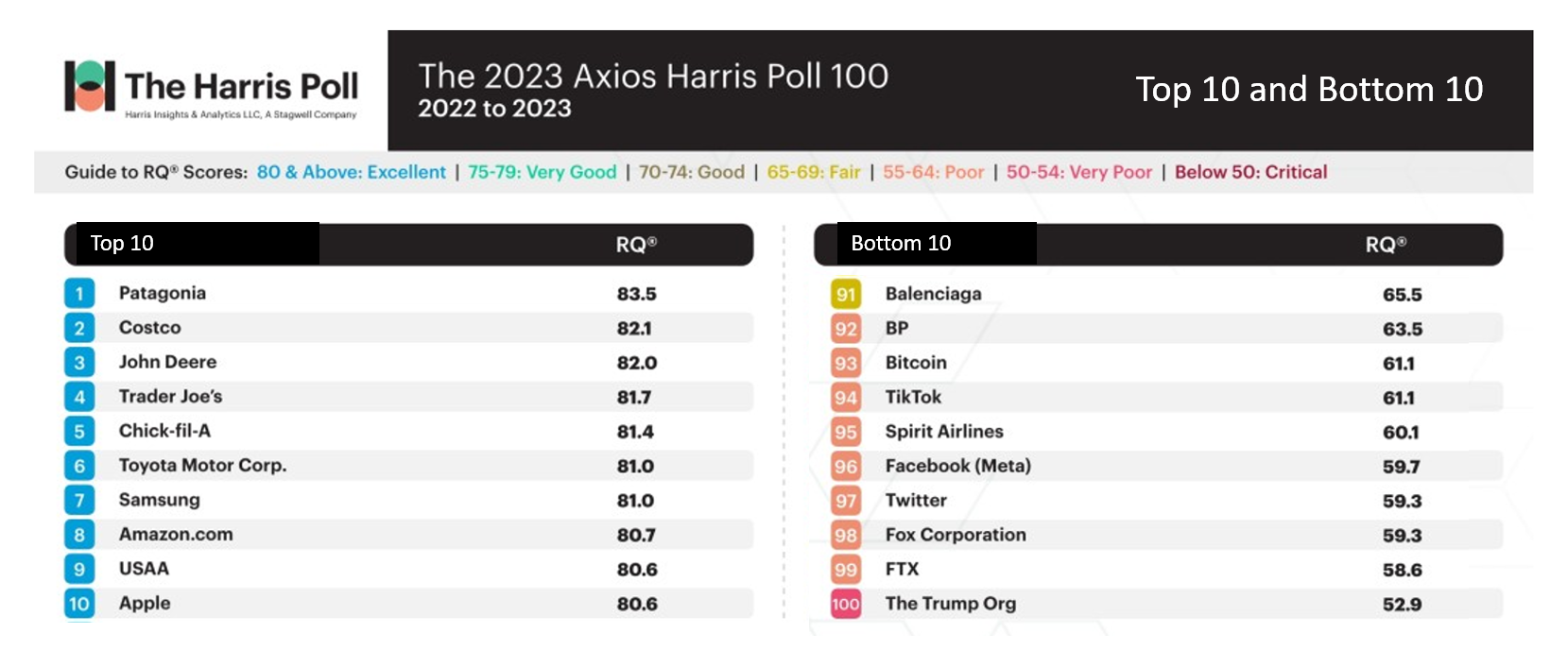

Searching for Health/Care Touchpoints in the 2023 Axios Harris Poll 100

Patagonia, Costco, John Deere, and Trader Joe’s are loved; Twitter, Fox Corp., FTX and The Trump Organization? Not so much. Welcome to 2023 Axios Harris Poll 100 list of companies U.S. consumers rate from excellent in terms of reputation to very poor and, one in particular, “critical.” Exploring the list, we can find insights into consumers’ preferred touchpoints for health, health care, and well-being curated in their daily lives. In this, today’s, Health Populi blog, I consider The 2023 Axios Harris Poll 100 reputation rankings in light of what we learned from the Morning Consult Most Trusted Brands 2023 study

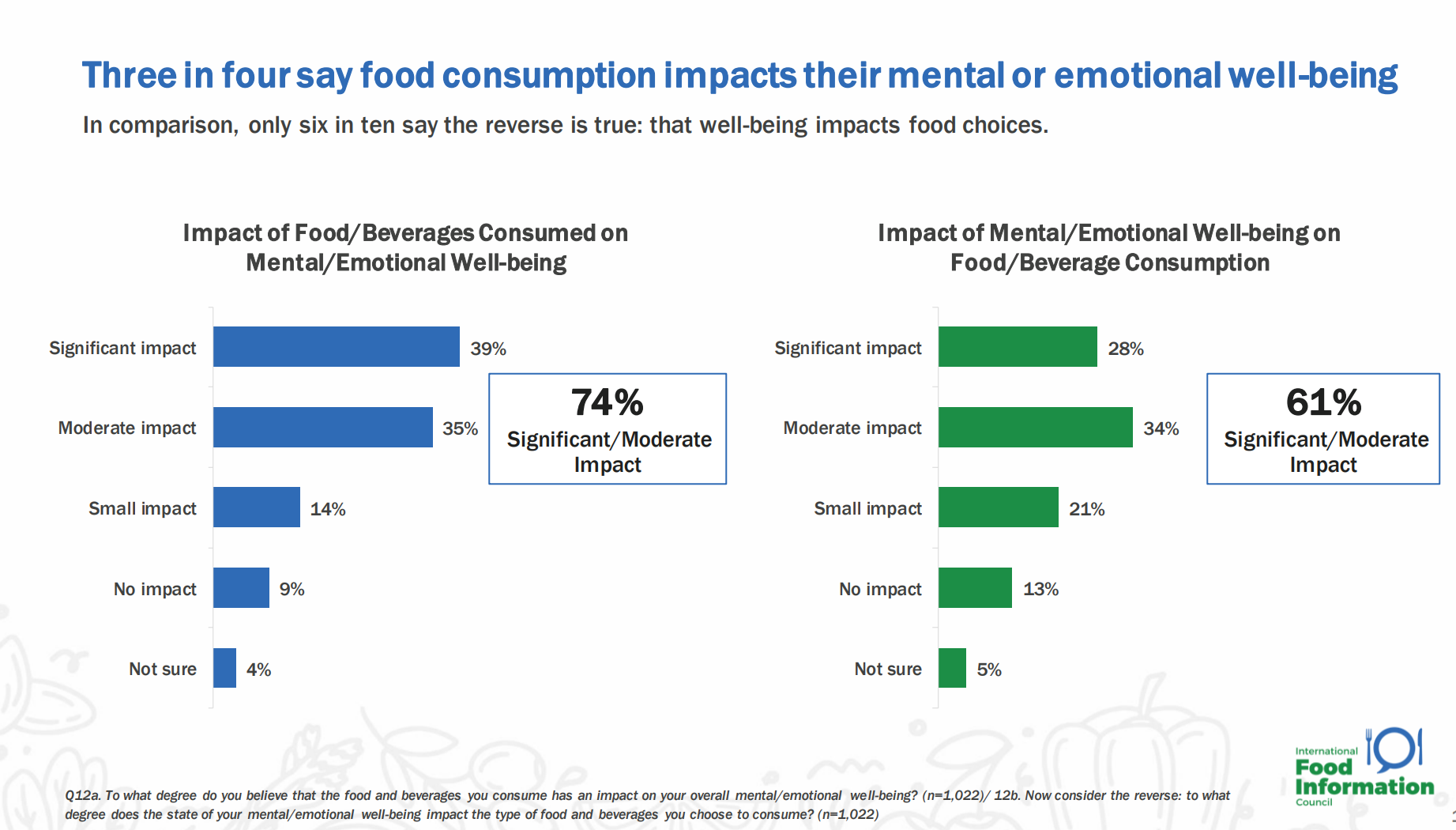

Our Mental and Emotional Health Are Interwoven With What We Eat and Drink – Chewing On the IFIC 2023 Food and Health Survey

As most Americans confess to feeling stressed over the past six months, peoples’ food and beverage choices have been intimately connected with their mental and emotional well-being, we learn from the 2023 Food & Health Survey from the International Food Information Council (IFIC). For this year’s study, IFIC commissioned Greenwald Research to conduct 1,022 interviews with adults between 18 and 80 years of age in April 2023. The research explored consumers’ perspectives on healthy food, the cost of food, approaches to self-care through food consumption, the growing role of social media in the food system, and the influence of sustainability

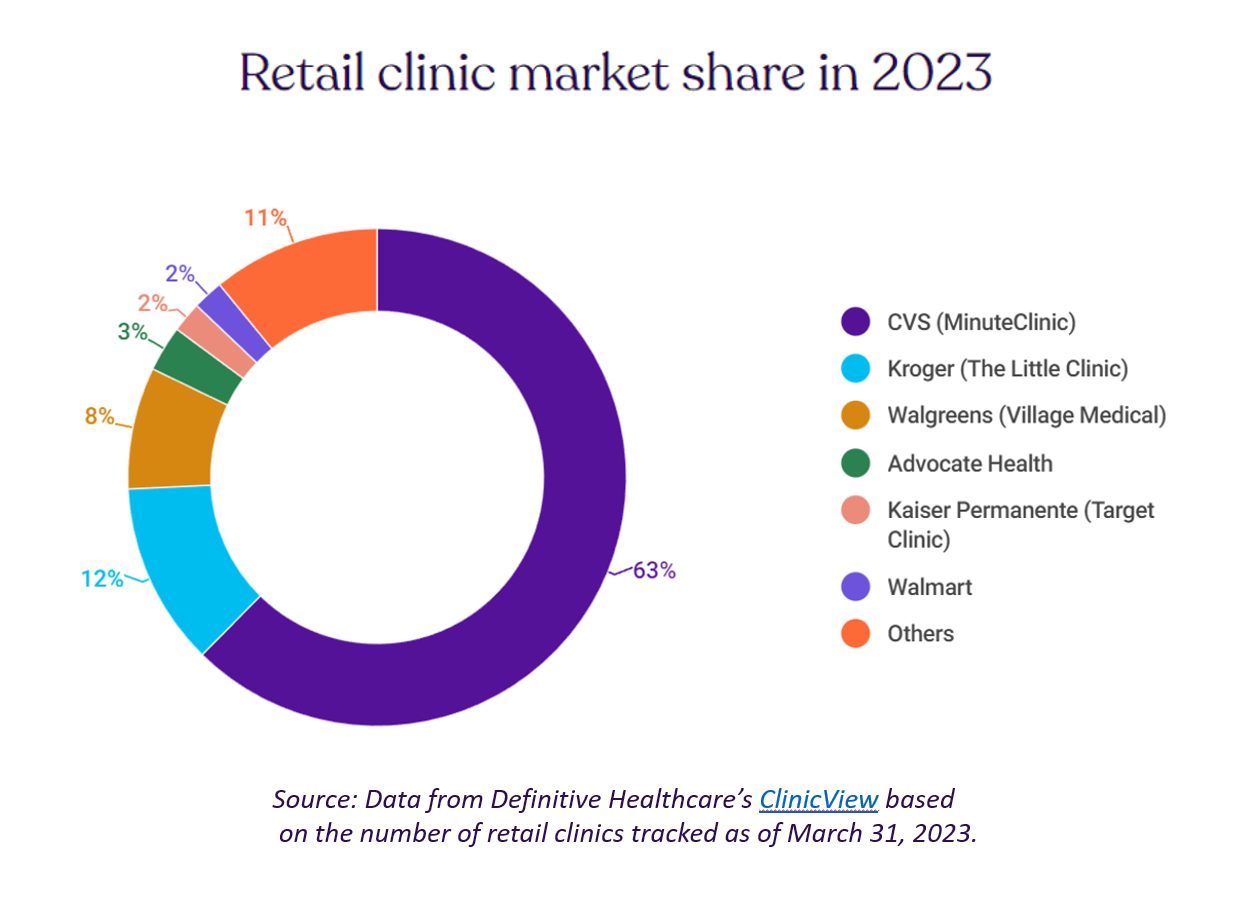

Retail Clinics’ Growing Role in Health Care and Prescription Drug Sales

“It seemed like an odd pairing: shampoo and a throat swab,” observes a new report on the growth of retail health from Definitive Healthcare. But retail clinics are no longer, as the paper explains, “an experiment of a few grocery stores….they’re becoming a major force in the U.S. healthcare system,” asserts the thesis of Retailers in healthcare: A catalyst for provider evolution. While the use of emergency departments fell by 1% in the past five years, the use of retail clinics expanded by 70%, Definitive Healthcare calculated. Most retail clinics are owned by

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

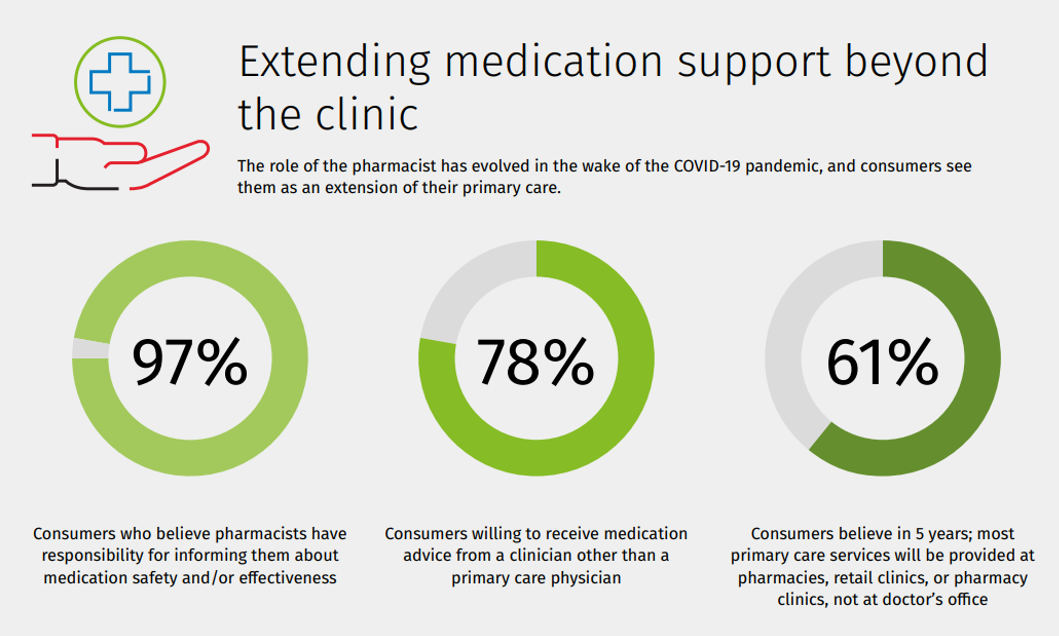

Getting Health Care at a Retail Pharmacy vs a Retail Store: Consumers May Be Favoring the Pharmacist Versus the Retailer

Not all “retail health” sites are created equal, U.S. consumers seem to be saying in a new study from Wolters Kluwer Health, the company’s second Pharmacy Next: Consumer Care and Cost Trends survey. Specifically, consumers have begun to differentiate between health care delivered at a retail pharmacy versus care offered at a retail store — such as Target or Walmart (both named as sites that offer “health clinics in department stores” in the study press release). While 58% of Americans were likely to visit a local pharmacy as a “first step” when faced with a non-emergency medical situation and 79%

Women’s Health on Her Own Terms – “She Knows” What She Needs

Despite some improvement in the representation of women by cinema, TV shows, and brands, distortions in media remain that are risks to women receiving appropriate health care. Breaking through taboos of weight, reproductive services, and mental health are the top 3 factors preventing women from getting proper care, according to Health On Her Terms, a research study from WPP and Ogilvy partnering with SeeHer, an organization of collaborations from media, technology, business, education, and other sectors (including over 7,000 brands) focused on the accurate portrayal of women and girls in society. Taglined as “The Marketer’s Hippocratic Oath to Women, the

Consumers Expect Every Company to Play a Meaningful Role in “My Health” – New Insights from the 2023 Edelman Trust Barometer

People have expanded their definitions of health in 2023, with mental health supplanting physical health for the top-ranked factor in feeling healthy. Welcome to the Edelman Trust Barometer Special Report: Trust and Health, released this week, with striking findings about how the economic, post-pandemic life, pollution and climate change all feed mis-trust among citizens living in 13 countries — and their eroding trust for health care systems. While these factors vary by country in terms of relative contribution to citizen trust, note that in the U.S., social polarization plays an outsized role in factors that “make us

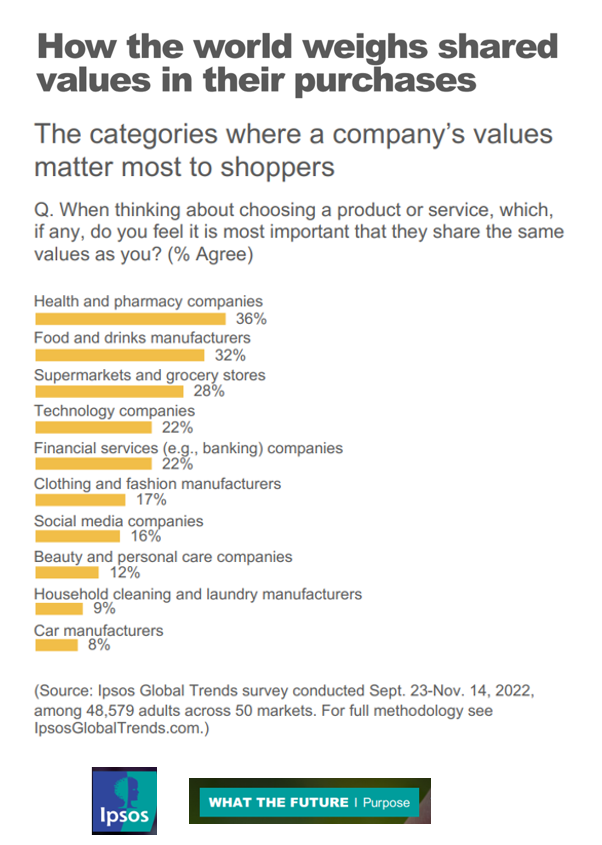

More Consumers Expect Health/Care Companies to Be Purpose-Ful Versus All Other Industries

If your organization serves health consumers, patients, and caregivers, and you’re asking them to spend money on your services or products, then you’ll do well to be clear on your values and sense of purpose. In the latest Ipsos look into the future of “Purpose,” we find that consumers look most to health and pharmacy companies for shared values, compared with other industries people patronize such as food and grocery, technology and banks. To understand where Ipsos is coming from on this aspect of ESG, we’ll start with their territory map

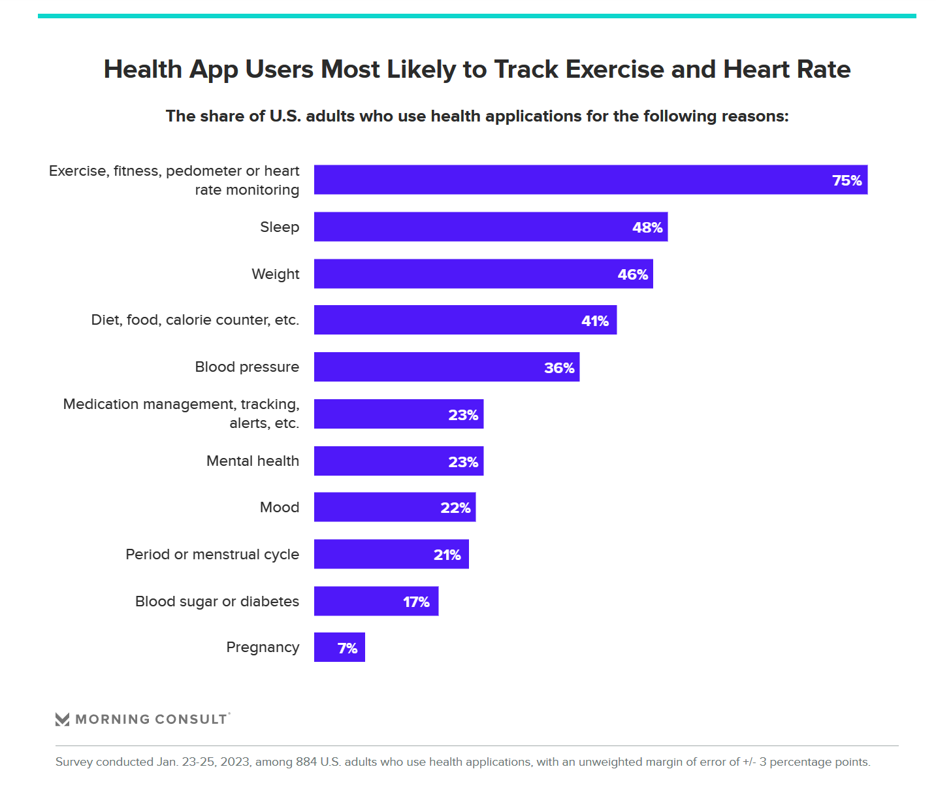

People Using Health Apps and Wearable Tech Most Likely Track Exercise and Heart Rate, Sleep and Weight – But Cost Is Still A Barrier

Over one in three U.S. consumers use a health app or wearable technology device to track some aspect of their health. “The public’s use of health apps and wearables has increased in recent years but digital health still has room to grow,” a new poll from Morning Consult asserts, published today. Among digital health tech users, most check into them at least once every day in the past month. One in four use these tech’s multiple times a day, the first pie chart illustrates. Eighteen percent of people use their digital

The Future of Love and How It Could Shape Health, Well-Being, and Daily Living

“The future of love is bound to the institutions that have historically shaped and defined it,” Ipsos’s What the Future: Love report begins. Consider: religion, government, financial institutions….and the health care ecosystem, as well. On this Valentine’s Day 14th February 2023, it is a good time to consider this convergence as health politics, financial well-being, and emerging technologies will be re-shaping institutions and consumers in the coming months and near-term. The Ipsos researchers have been assessing the future of many aspects of our lives over the past couple of years, such as the future of wellness,

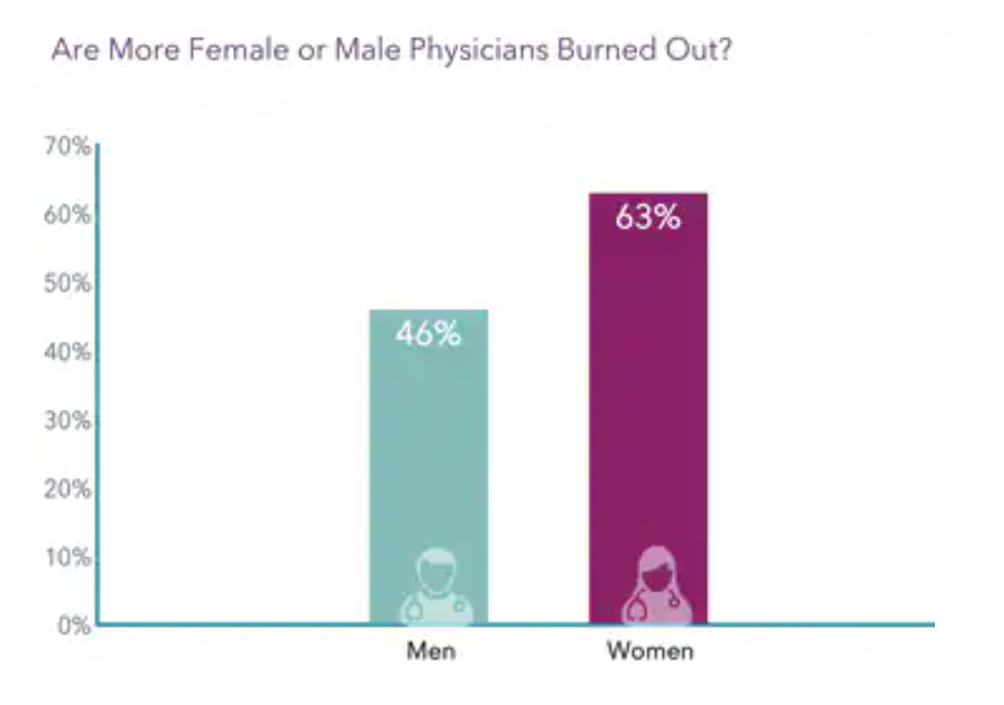

Medscape Diagnoses Worsening Burnout and Depression Among U.S. Physicians

In the organization’s annual study into physicians’ wellbeing, Medscape has diagnosed worsening burnout and depression among America’s doctors. Over one-half of U.S. physicians say they are burned out or depressed, the chart from the U.S. Physician Burnout & Depression Report for 2023 calls out. “I cry but not one cares,” is one of the represented color comments provided by one of the physicians included in the survey of 9,175 physicians polled online between June and October 2022. The study covered 29 specialties, finding most burned out physicians worked in emergency medicine (65% saying

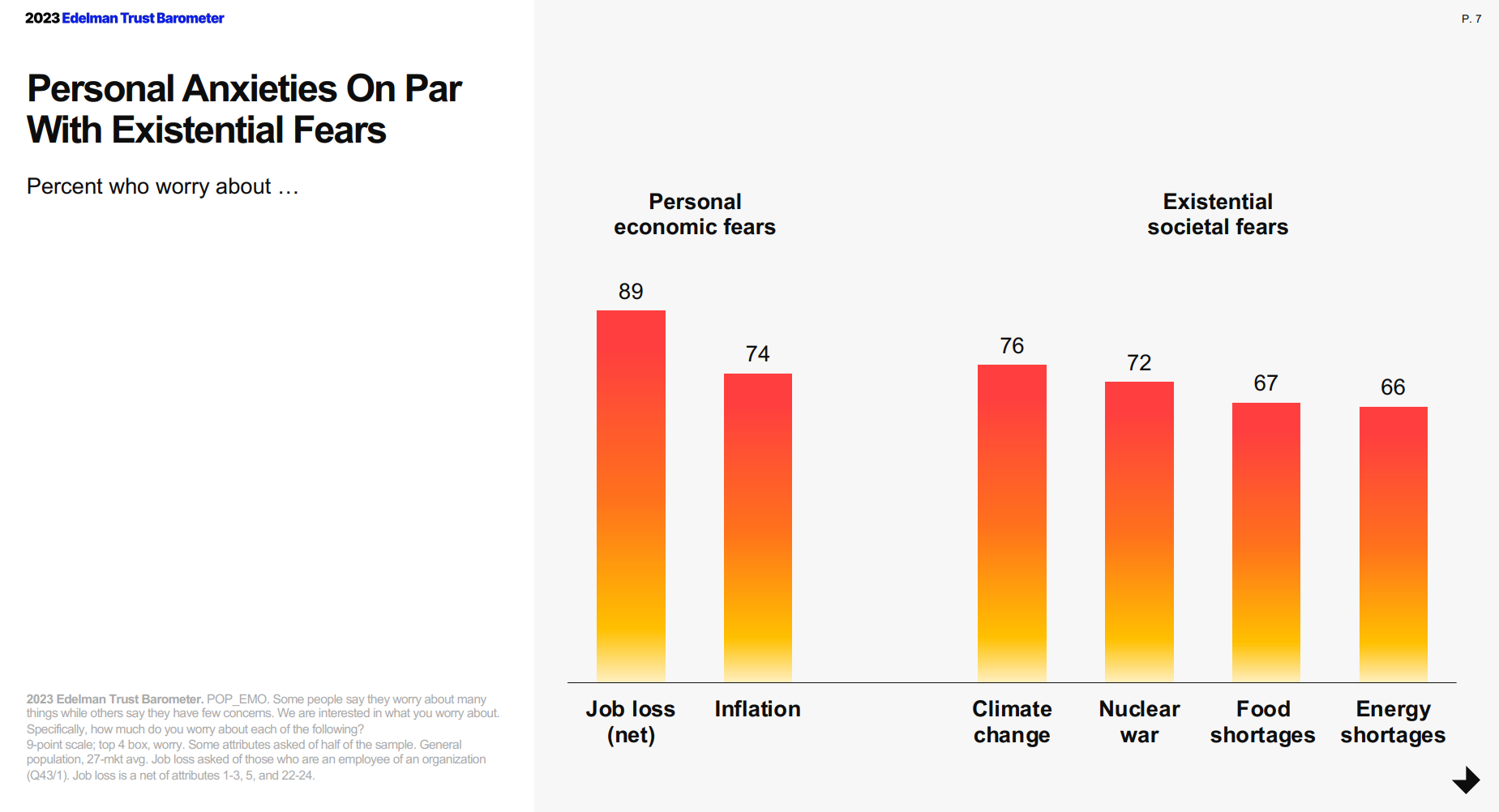

The Polarization of Trust in 2023 – What It Means for Health, via Edelman at Davos WEF 23

For the third year in a row, citizens in most of the world see business as the most-trusted institution, above government, media, and NGOs, found in the 2023 Edelman Trust Barometer, unveiled this week at the annual World Economic Forum in Davos, Switzerland. The Edelman team conducted this 23rd annual study in November 2022 in 28 countries, among over 32,000 people — some 1,150 residents per country polled. (Note that Russia, studied in the surveys between 2007 and 2022, was not included in the 2023 research). The first chart arrays

When Household Economics Blur with Health, Technology and Trust – Health Populi’s 2023 TrendCast

People are sick of being sick, the New York Times tells us. “Which virus is it?” the title of the article updating the winter 2022-23 sick-season asked. Entering 2023, U.S. health citizens face physical, financial, and mental health challenges of a syndemic, inflation, and stress – all of which will shape peoples’ demand side for health care and digital technology, and a supply side of providers challenged by tech-enabled organizations with design and data chops. Start with pandemic ennui The universal state of well-being among us mere humans is pandemic ennui: call it languishing (as opposed to flourishing), burnout, or

Dollar General & CHPA Collaborate to Bolster Health Consumers’ Literacy and Access for OTC Pain Meds and Self-Care

Health is “made” where we live, work, play, pray, learn….and shop. I spend a lot of time these days in the growing health/care ecosystem where retail health is broadening to address social determinants and drivers of health – namely food, transportation, broadband access, education, environment, and financial wellness – all opportunities for self-care and health engagement. For many years, I have followed the activities of CHPA, the Consumer Healthcare Products Association, and have participated in some of their conferences. Their recent announcement of a collaboration with Dollar General speaks to the growing role of self-care for all people.

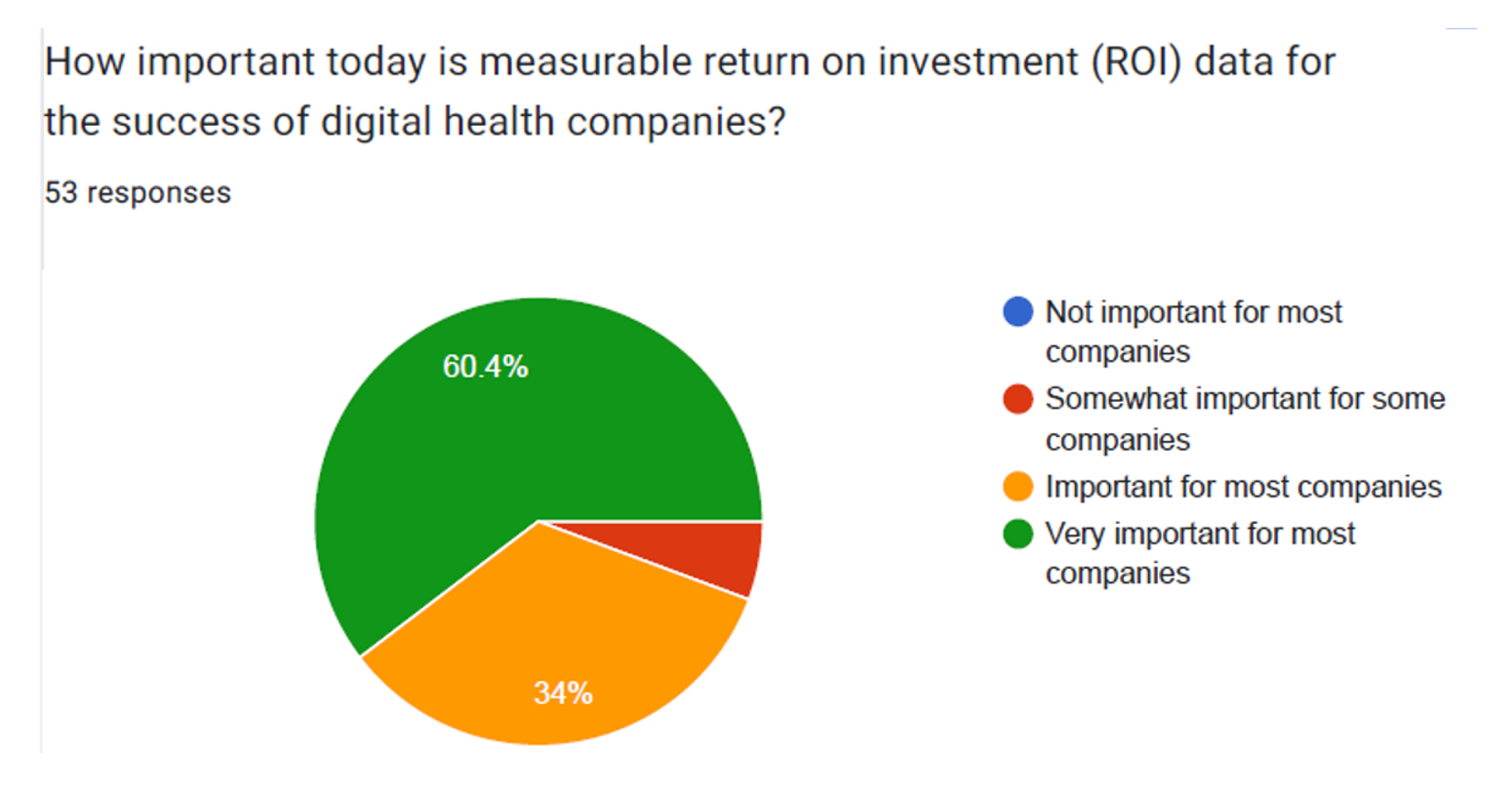

Show Me The Evidence and The ROI: Digital Health Investing in 2023 via GSR Ventures

With valuations of digital health companies expected to decline in 2023, investors in the sector are Missourian in spirit in “Show Me” mode: here, it’s all about the clinical evidence and ROI, according to a survey from GSR Ventures. conducted among over 50 major digital health venture capital investors. Most of the 50+ responses to the survey expect that in 2023, valuations for digital health companies will decrease by over 20%: that’s a net of 83% including 60% expecting valuations to fall 20-40%, and 23% anticipating declines of over 40% of valuations in the next

Consumers Are Feeling Their Healthcare Cost of Living – Research from Qualtrics

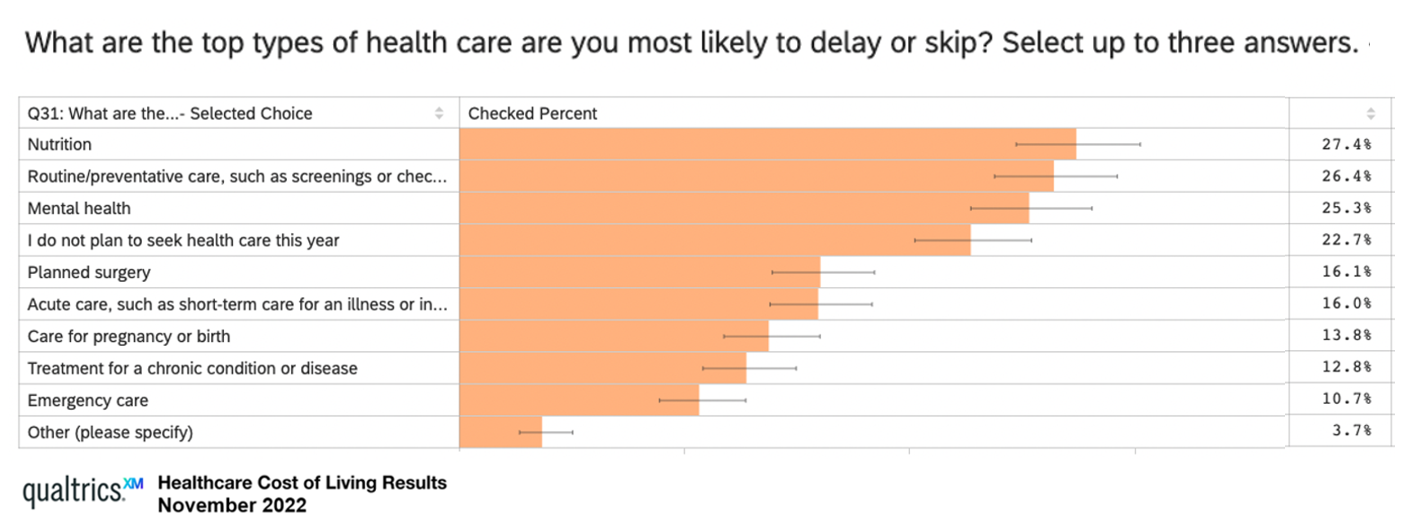

Rising costs are the #1 reason U.S. health consumers are avoiding or delaying health care, replacing concerns about COVID-19, based on survey research from Qualtrics. The company’s Healthcare Cost of Living survey research learned that 48% of U.S. adults chose to defer health care in 2022, split by 31% of consumers skipping care due to cost concerns, and, 17% of people delaying care who had concerns about the coronavirus. Note the types of care delayed or skipped: Over 27% of people delayed care related to nutrition 26% delayed routine or preventive care, such as screenings or

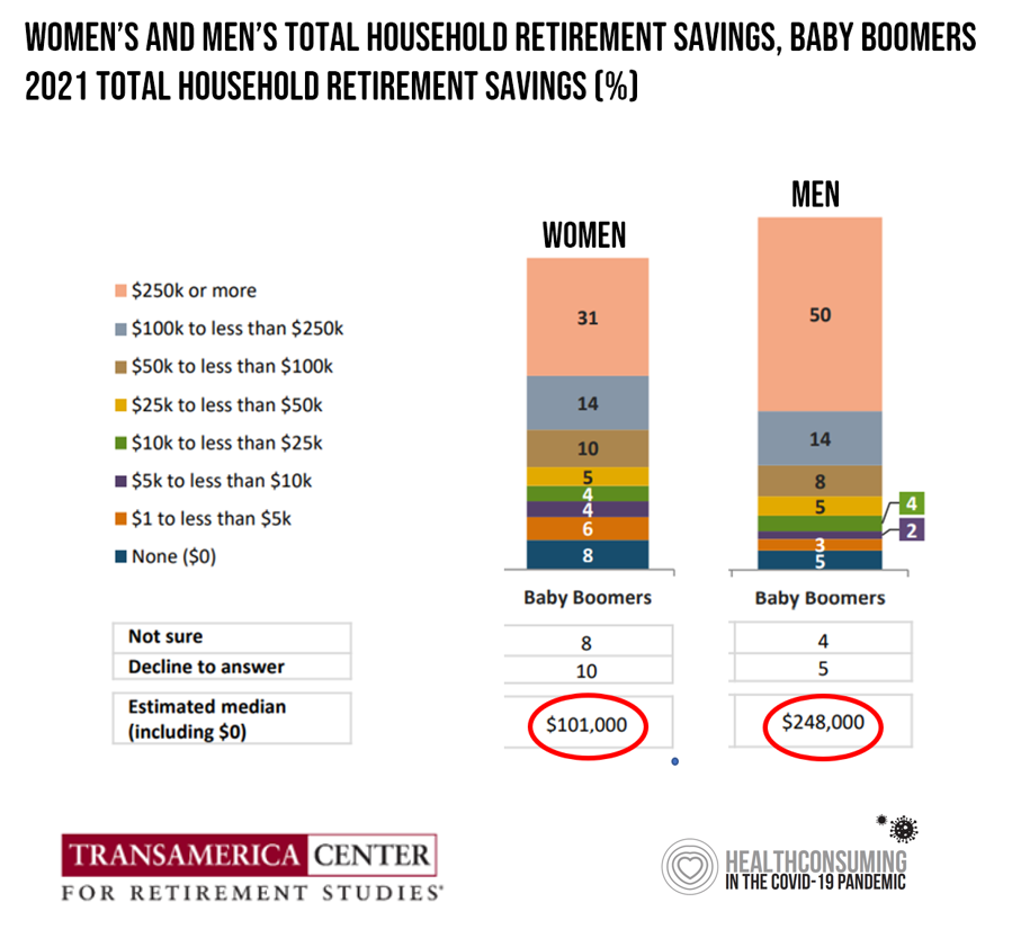

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

Dr. Santa Intends to Deliver Consumer Health-Tech for the 2022 Holidays

Even as consumers’ confess a tighter spending economy for 2022 holiday shopping, peoples’ intent to buy wearable tech for health and fitness and other wellness devices appear on gifting lists in the U.S., according to the 29th Annual Consumer Technology Holiday Purchase Patterns report from the Consumer Technology Association (CTA). In general, technology will be a top-selling category for 2022 holiday gift-giving, somewhat tempered by inflation and the increased cost of living that challenge household budgets in the fourth quarter of 2022. Tech spending will be down about 6% in 2022 according to CTA’s

Thinking Value-Based Health Care at HLTH 2022 – A Call-to-Action

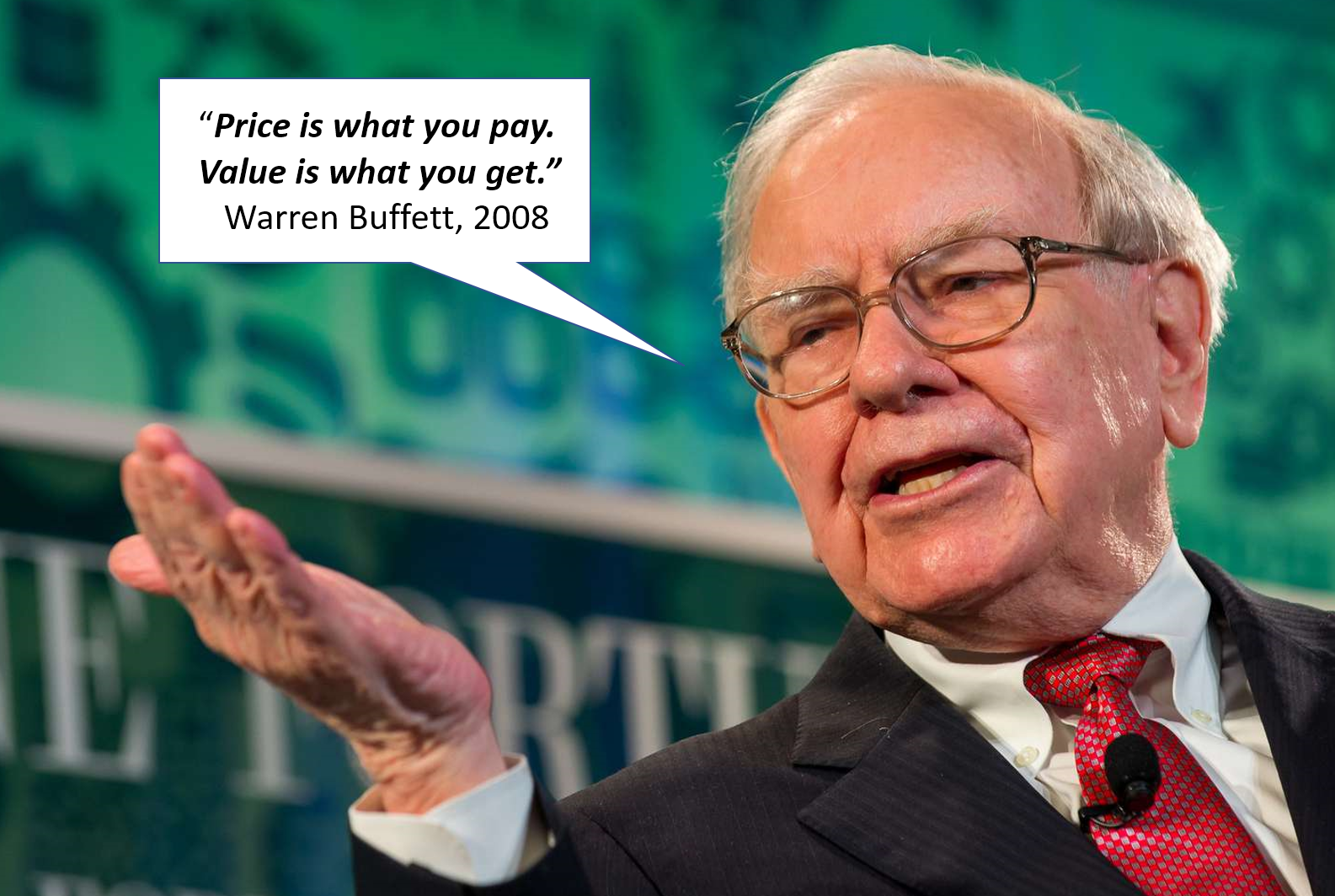

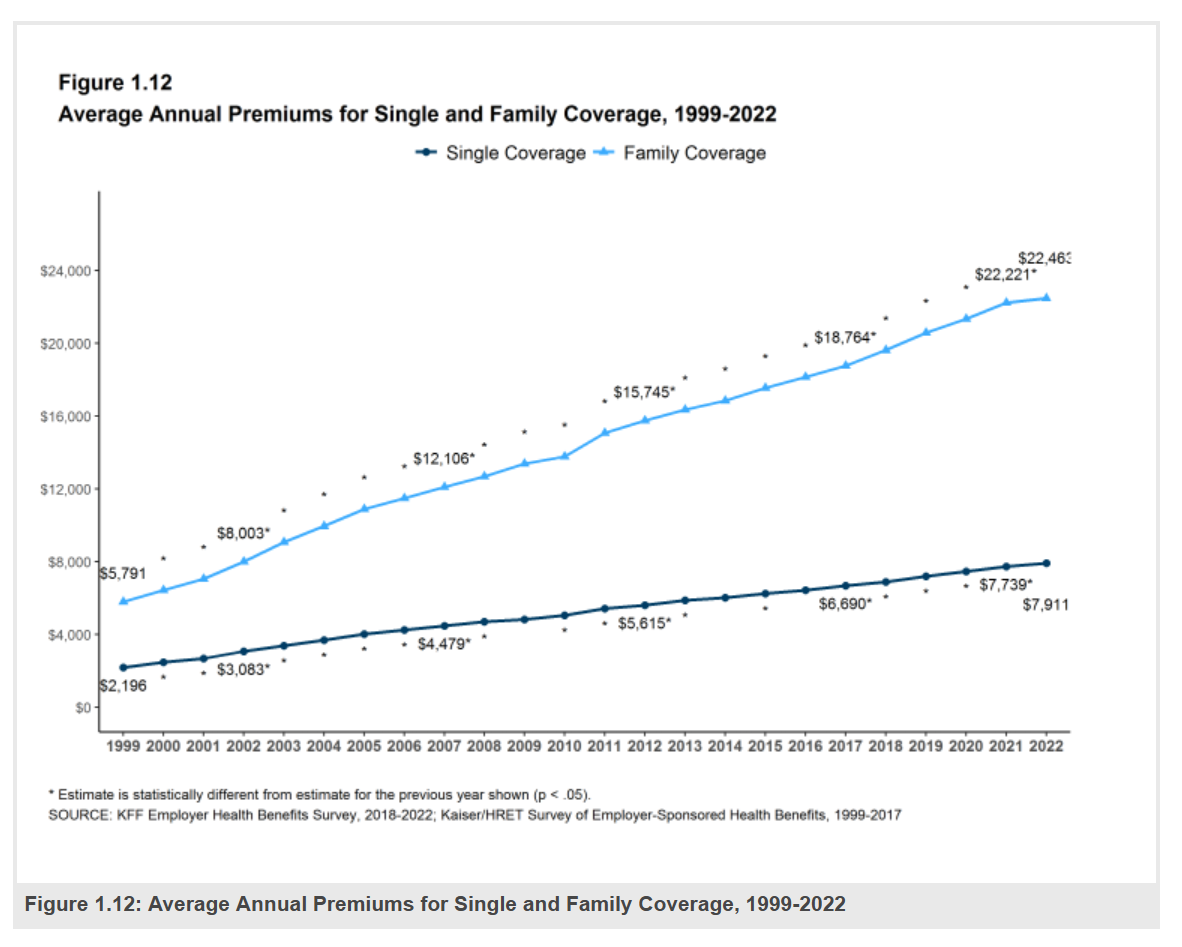

The cost of health insurance for a worker who buys into a health plan at work in 2022 reached $22,463 for their family. The average monthly mortgage payment was $1,759 in mid-2022. “When housing and health both rank as basic needs in Maslow’s hierarchy, what’s a health system to do?” I ask in an essay published today on Crossover Health’s website titled Value-Based Care: Driving a Social Contract of Trust and Health. The answer: embrace value-based care. Warren Buffett wrote Berkshire Hathaway shareholders in 2008, asserting that, “Price is what you pay. Value

$22,463 Can Get You a Year of College in Connecticut, a Round of Ref Work in the Stanley Cup Playoffs, or Health Benefits for a Worker’s Family

Employers covering health insurance for workers’ families will face insurance premiums reaching, on average, $22,463. That is roughly what a year at an independent college in Connecticut would cost, or a round of pay for a ref in the Stanley Cup playoffs. With that sticker-shock level of health plan costs, welcome to the 2022 Employer Health Benefits Survey from Kaiser Family Foundation, KFF’s annual study of employer-sponsored health care. Each year, KFF assembles data we use all year long for strategic and tactical planning in U.S. health care. This mega-study looks at

The Patient as Prescription Drug Payer – The GoodRx Playbook

Patients have more financial skin-in-their-healthcare-games facing high-deductibles and direct out-of-pocket costs for medical bills…including prescription drugs. I collaborated with GoodRx on a “yellow paper” discussing The Health Consumers as Payer, with implications and calls-to-action for pharma and life science companies. You can download the paper at this link. The report is intended to be a playbook for understanding patients’ growing role as consumers and health care payers, providing insights into peoples’ home economic mindsets and how these impact a patient’s adherence to medication based on cost and perceived value. With inflation facing household

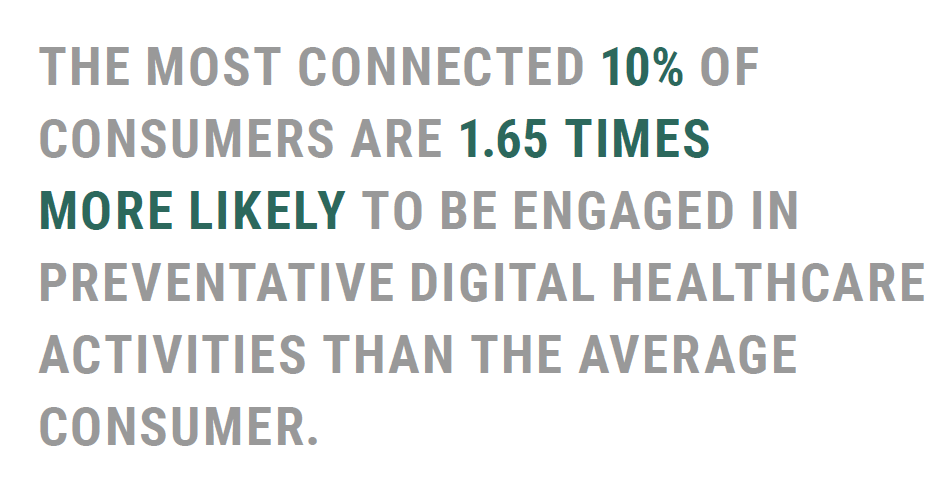

Connected Wellness Growing As Consumers Face Tighter Home Economics

“Consumers are using the Internet to take their health into their own hands,” at least for 1 in 2 U.S. consumers engaging in some sort of preventive health care activity online in mid-2022. The new report on Connected Wellness from PYMNTS and Care Credit profiles American health consumers’ use of digital tools for health care promotion and disease prevention. The bottom-line here is that the most connected 10% of consumers were 1.65 times more likely to be engaged in preventive digital health activities than the average person. Peoples’ engagement with digital health

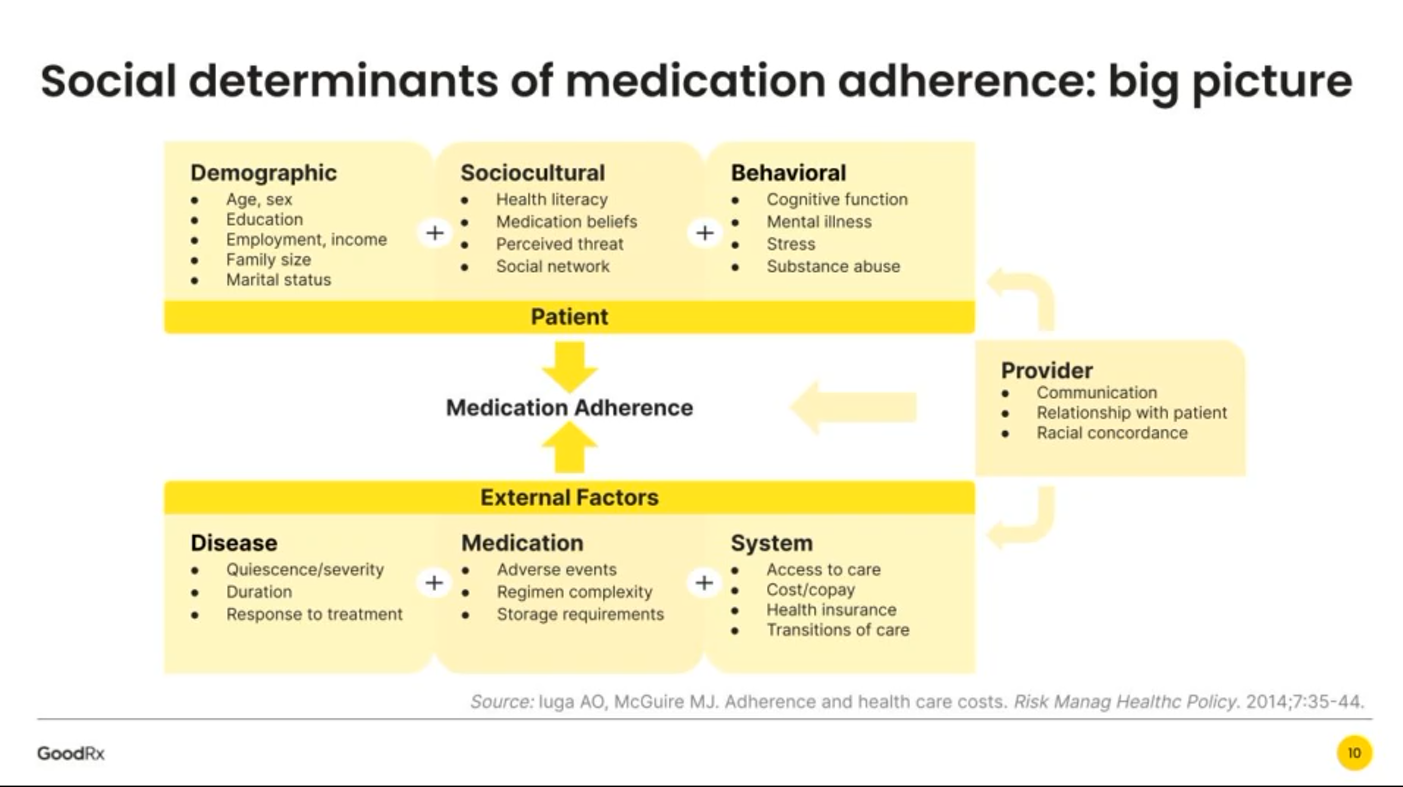

Remember the Social Determinants of Health When Prescribing Drugs

Thinking about the social determinants of prescription drugs, how people take medicines in real life in my latest post in Medecision’s Liberate Health blog. I had one of those special lightbulb moments when listening to Mauricio Gonzalez-Arias, M.D. of NYC Health + Hospitals and Suvida Healthcare discussing medication adherence and what prevents us from taking our meds as prescribed. His discussion on social determinants’ role in shaping our relationship with prescriptions was powerful, and the jumping off point for this essay. Medication adherence is a challenge that fiscally costs the

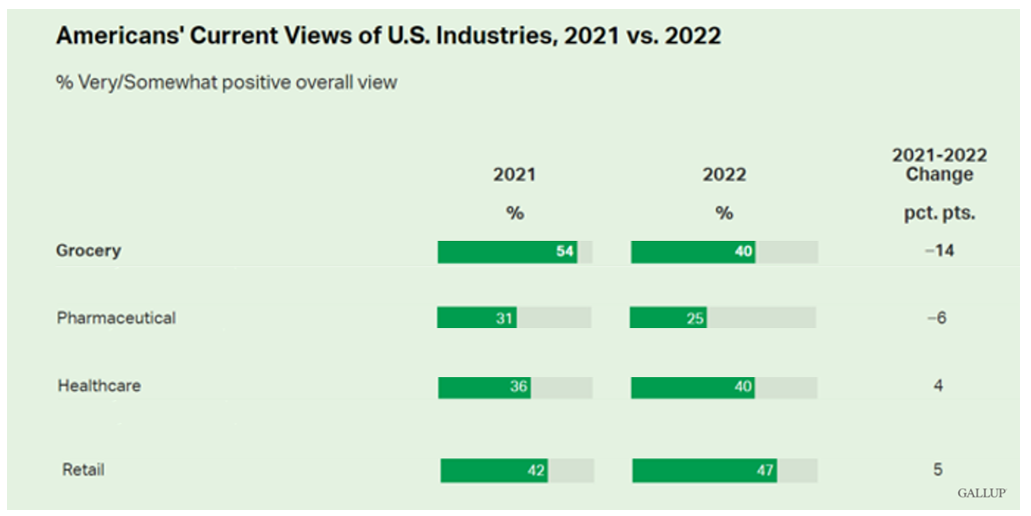

Gallup Reveals Americans’ Views on Industry Are the Lowest Since 2008 – Implications for Healthcare and Pharma

Americans’ positive views of 25 industries in the U.S. have declined in the past year. In their latest look into consumers’ views on business in America, Gallup found that peoples’ ratings on business fell to their lowest ratings overall since 2008. Peoples’ highest ratings of industry in American occurred in 2017 when nearly 50% of people gave business a very or somewhat positive grade. The year-on-year decline from 2021 find oil and gas at the lowest level of positivity, advertising/PR, legal, the Federal government, and pharma at the bottom of the ratings.

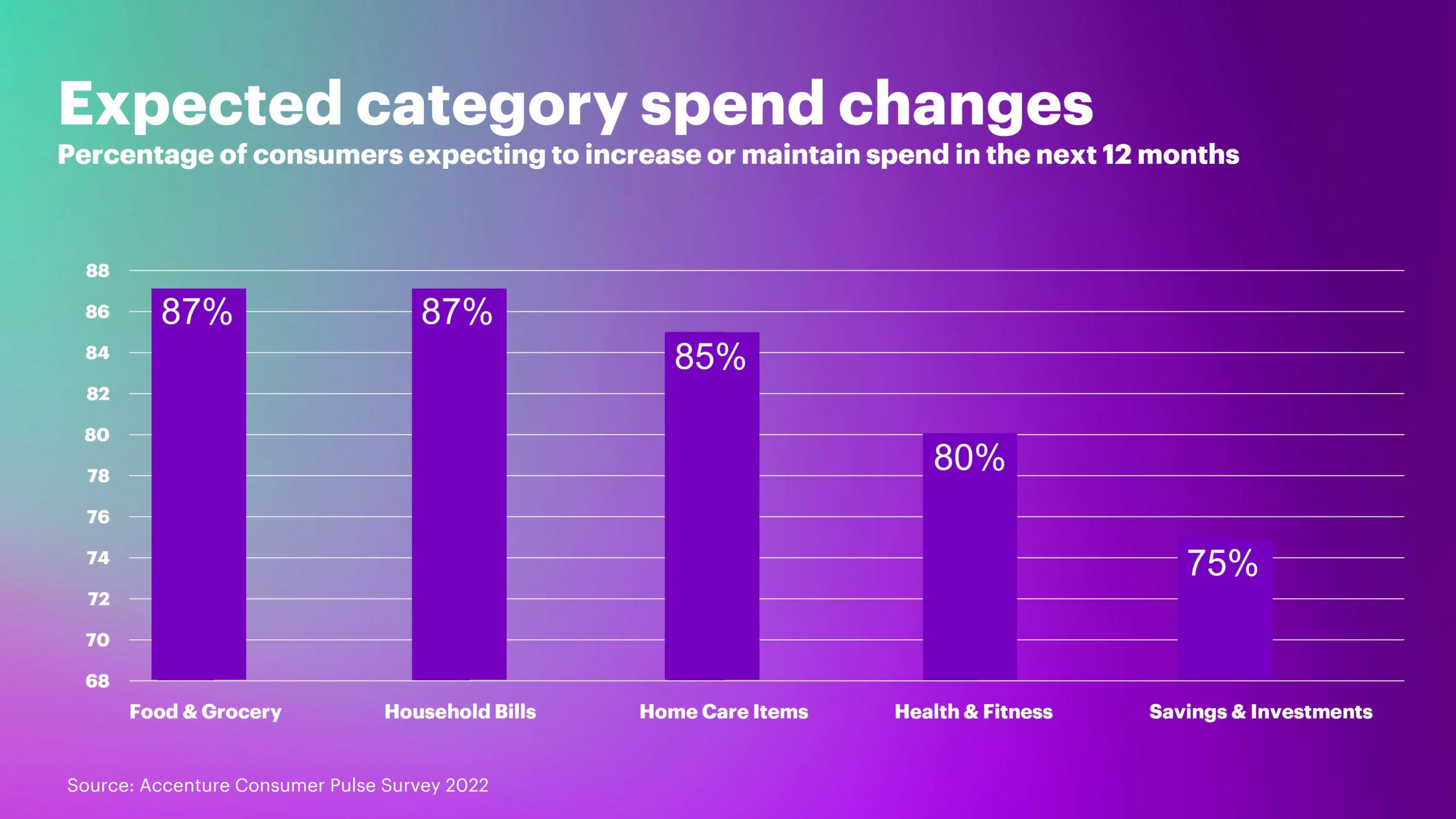

Most Consumers Are Health and Wellness Consumers Even in Hard Financial Times, Accenture Finds

Consumers consider health and well-being as an “essential” household spending category based on new research from Accenture. Accenture polled over 11,000 consumers in 17 countries, considering how people are faring amid “widespread uncertainty and personal financial strains,” in the firm’s words. While two in three consumers feel financially stressed, 4 in 5 intend to grow or hold their personal spending on health and fitness steady in the next year. The first chart graphs data from Accenture’s global survey. In the U.S., more granularly, 26% of consumers intend to increase spending on health and wellness

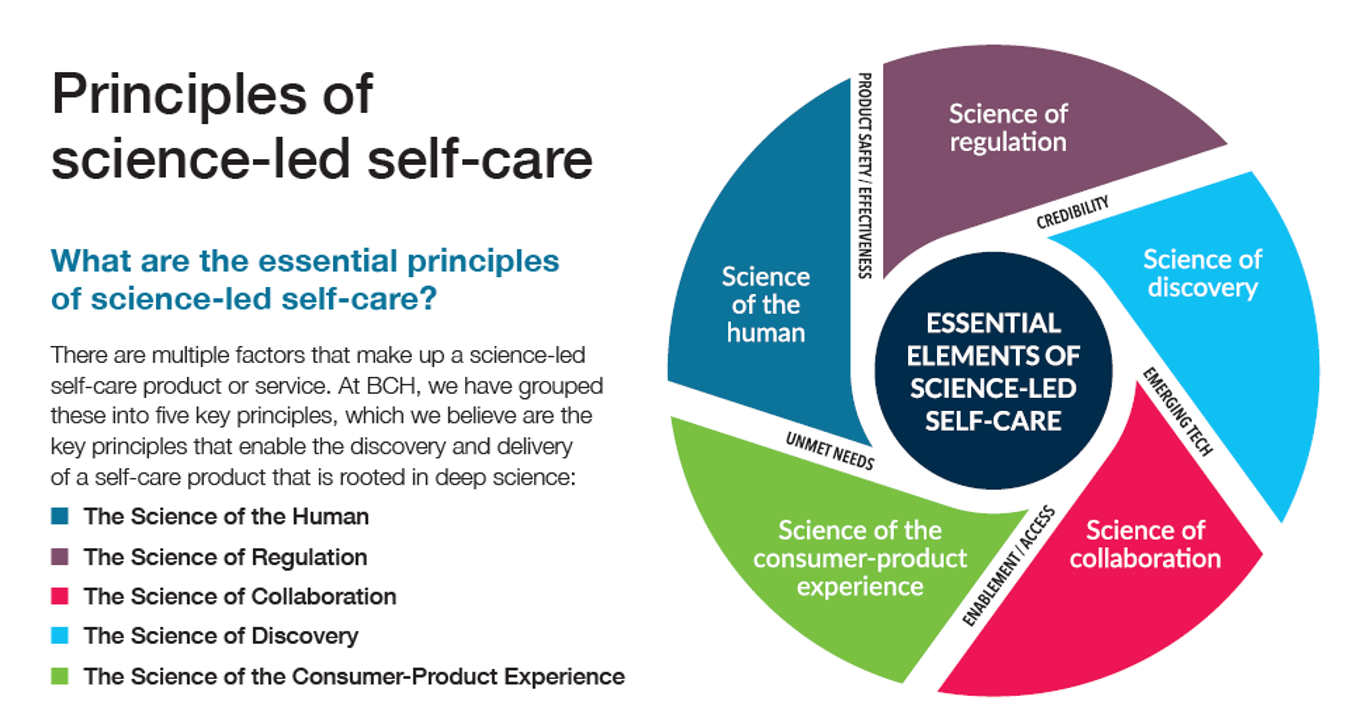

“Beyond the Bubble Bath,” Self-Care Must Be Rooted in Science To Build Trust Among Consumers

The goal of self-care for health-making is to improve lives by scaling health-and-wellness accessible to all, Bayer believes, giving people more control over their personal health. Self-care work-flows must be based in science to ensure products and services are trusted and deliver on their clinical promise, Bayer explains in Science-Led Self-Care: Principles for Best Practice, a paper published this week which the company intends to be a blueprint for the industry. Bayer recognizes that self-care is growing among health consumers around the world — albeit underpinned by peoples’ cultures, demographics, and “readiness”

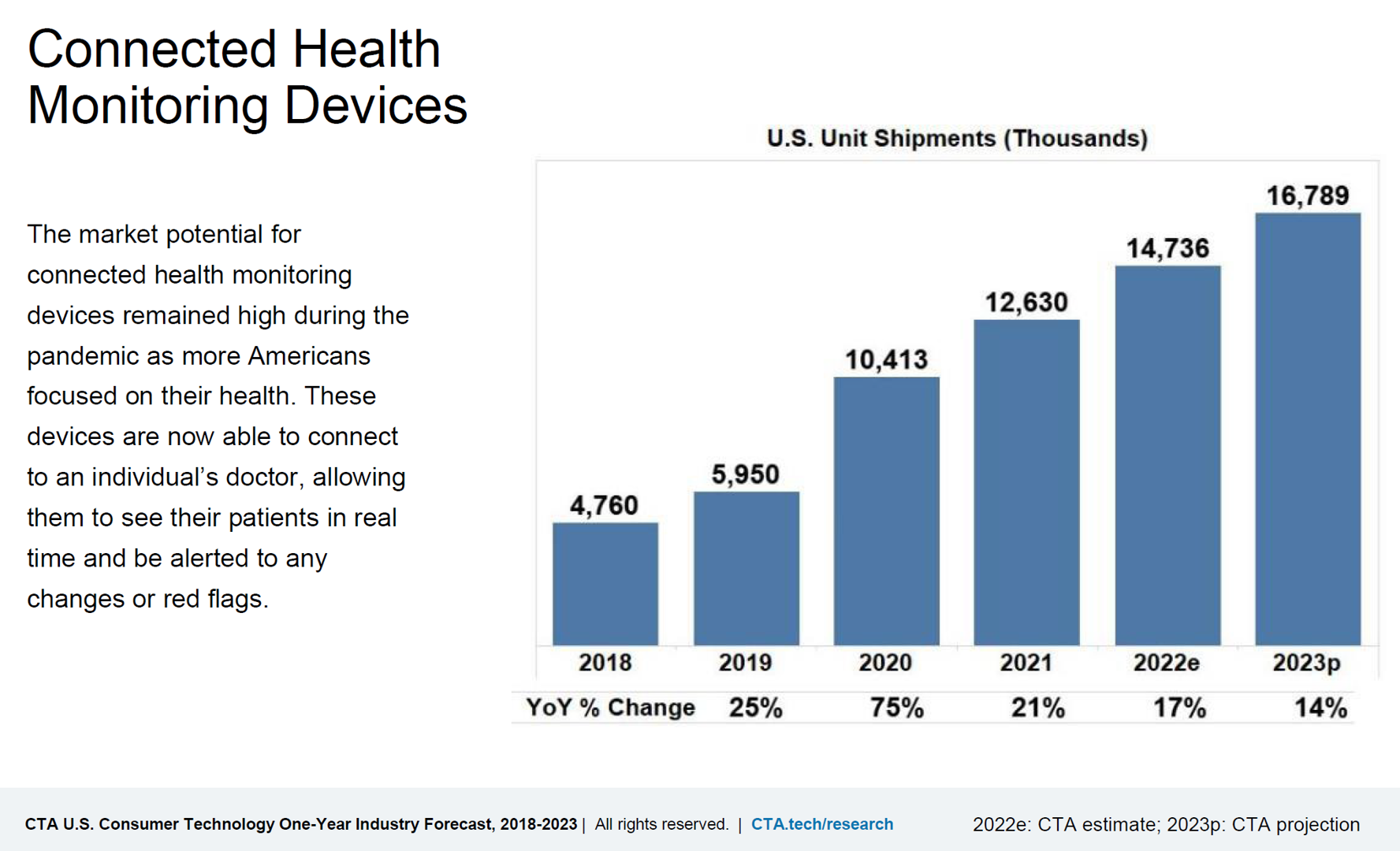

In A Declining Consumer Tech Spending Forecast, Consumer Health Tech Will Grow in 2022: Reading the CTA Tea Leaves

Supply chain challenges, inflation, and plummeting consumer economic sentiment are setting the stage for a decline in consumer electronics revenues for 2022. However, there will be some bright spots of growth for consumer tech spending, for 5G smartphones, smart home applications, gaming, and health technologies, noted in the Consumer Technology Association’s CTA U.S. Consumer Technology One-Year Industry Forecast, 2018-2023. Underneath the overall industry spend of $503 billion, a 0.2% drop from 2021, CTA expects software, gaming, video and audio streaming spending will grow by 3.5% and hardware to fall by 1.4% this year. With

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for