A health agenda comes to the 2015 Oscars

The 87th annual 2015 Oscars show (#Oscars15) feted more than the movie industry: the event celebrated health in both explicit and subtle ways. Julianne Moore took the golden statuette for Best Actress, playing the title role in Still Alice, the story a woman diagnosed with early-onset Alzheimer’s Disease. In accepting her award, Moore spoke of the need to recognize and “see” people with Alzheimer’s – so many people feel isolated and marginalized, Moore explained. Movies help us feel seen and not alone – and people with Alzheimer’s need to be seen so we can find a cure, she asserted. See Moore’s lovely

Whole (Health) Foods – the next retail clinic?

Long an advocate for consumer-directed health in his company, John Mackey, co-CEO and co-Founder of Whole Foods Market, is talking about expanding the food chain’s footprint in retail health. “Americans are sick of being sick,” Mackey is quoted in “Whole Foods, Half Off,” a story published in Bloomberg on January 29, 2015. Mackey talks about being inspired by Harris Rosen, a CEO in Florida, who has developed a workplace clinic for employees’ health care that drives high quality, good outcomes, and lower costs. Mackey imagines how Whole Foods could do the same, beginning in its hometown in Austin, TX. He

Hug your physician – chances are, s/he’s burned out

If you’re meeting with a physician in the next week or two, put on your empathy hat: chances are, they are feeling burned-out. Overall 46% of physicians report they were burned out in 2014, up from just under 40% last year. Medscape’s Physician Lifestyle Report 2015 finds that at least one-half of physicians are burned-out who work in critical care, emergency medicine, family medicine, internal medicine, general surgery, and infectious disease (including HIV). And, at least 37% of physicians are burned-out working in all other specialties, shown in the first chart. Medscape gauges doctors’ self-assessments of burnout with a lens

Telehealth is in demand, driven by consumer convenience and cost – American Well speaks

Evidence of the rise of retail health grows, with the data point that on-demand health care is in-demand by 2 in 3 U.S. adults. American Well released the Telehealth Index: 2015 Consumer Survey, revealing an American health public keen on video visits with doctors as a viable alternative to visiting the emergency room. Virtual visits are especially attractive to people who have children living at home. [For context, this survey defines “telehealth” as a remote consultation between doctor and patient]. Convenience drives most peoples’ interest in telehealth: saving time and money, not leaving home if feeling unwell, and “avoiding germs

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Health and wellness at CES 2015 – trend-weaving the big ideas

Health is where we live, work, play and pray — my and others’ mantra if we want to truly bend (down) the cost curve and improve medical outcomes. If we’re serious about achieving the Triple Aim — improving public health, lowering spending, and enhancing the patient/health consumer experience (which can drive activation and ongoing engagement) — then you see health everywhere at the 2015 Consumer Electronics Show in Las Vegas this week. With this post, I’ll share with you the major themes I’m seeing at #CES2015 related to health, wellness, and DIYing medical care at home. The meta: from health care to self-care.

Trend-weaving the 2015 health care trends

‘Tis the season for annual health trendcasting, which is part of my own business model. Here’s a curated list of some of my favorite trend reports for health care in the new year, with my Hot Points in the conclusion, below, summarizing the most salient trends among them. TechCrunch’s Top 5 Healthcare Predictions for 2015: In this succinct forecast, Walmart grows its presence as a health plan, startups get more pharm-funding, hospitals channel peer-to-peer lending, Latinos emerge as a “most-desired” health care segment, and Amazon disrupts the medical supply chain. Experian 2015 Data Breach Forecast: Healthcare security breaches will be

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Women-centered design and mobile health: heads-up, 2014 mHealth Summit

This post is written as part of the Disruptive Women on Health’s blog-fest celebrating the 2014 mHealth Summit taking place 7-11 December 2014 in greater Washington, DC. Women and mobile health: let’s unpack the intersection. On the supply side of the equation, Good Housekeeping covered health tracking-meets-fashion bling in the magazine a few weeks ago in article tucked between how to cook healthy Thanksgiving side dishes and tips on getting red wine stains out of tablecloths. This ad appeared in a major sporting goods chain’s 2014 Black Friday pre-print in my city’s newspaper last week. And along with consumer electronics brand faves like

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

Activity tracking is consumers’ #1 demand for smartwatches

Of all the functions a smartwatch could play, it’s activity tracking that’s top of most consumers’ minds. GfK conducted a survey in August 2014 among 5,000 smartphone-owning consumers in five countries — China, Germany, South Korea, the UK, and the U.S. The market research firm found that 29% of people see “activity tracking” the most important function. Phone calls ranked second with 13% of consumers, telling time 11%, and 10% voted for basic apps and navigation system. 7% of consumers noted the smartwatch would be desirable for basic web search. In this survey, activity tracking included the broad definition covering

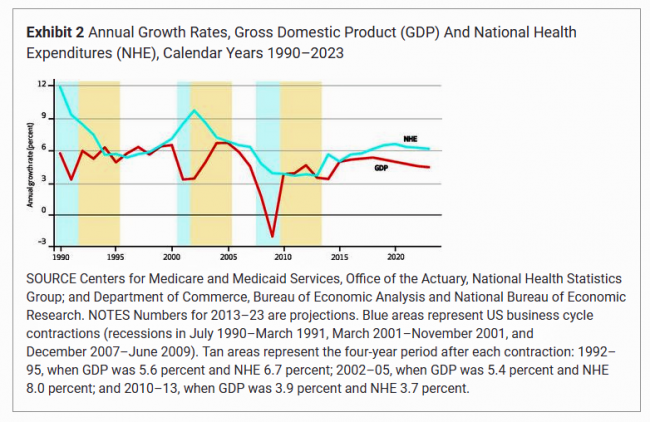

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Blurred lines: health, pharmacy, food and care

In the past few weeks, several events bolster the reality that health and health care are in Blurred Lines mode. Not Robin Thicke Blurred Lines, mind you, but the Venn Diagram overlapping kind. Walmart launched real primary care clinics in South Carolina and Texas. These will provide services beyond urgent care, charging $4 a visit for company employees and $40 a visit for other people The U.S. Department of Agriculture issued a report promoting “nudges” to grocery shoppers enrolled in the Supplemental Nutrition Access Program (SNAP) to buy healthy foods Apple is talking with Cleveland Clinic, Johnson Hopkins, and Mount Sinai Medical

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

Self-care – the role of OTCs for personal health financial management

Make-over your medicine cabinet. That’s a key headline for International Self-Care Day (ISD) on July 24, 2014, an initiative promoting the opportunity for people to take a greater role in their own health care and wellness. Sponsored by the Consumer Healthcare Products Association (CHPA), consumer products companies, health advocacy organizations, and legislators including John Barrow (D-GA), a co-sponsor of H.R. 2835 (aka the Restoring Access to Medications Act), the Day talked about the $102 billion savings opportunity generated through people in the U.S. taking on more self-care through using over-the-counter medicines. After the 2008 Recession hit the U.S. economy, industry analysts

Homo informaticus – the global digital consumer

Consumers around the world are feeling more knowledgeable, self-confident and realistic, enabled by mobile platforms, the democratic power of social “choruses,” and a more sharing economy featuring collaborative consumption. As peoples’ phones get smarter and smarter, they carry more powerful multichannel information devices in their hands which empower Homo Informaticus – the new global digital consumer, described in EY’s report, How to copilot the multichannel journal. EY polled 29,943 consumers in the Consumers on Board survey living in 34 countries: across the Americas, Asia-Pacific, the Middle East, India and Africa. Homo informaticus is the rational consumer smartly using technology to filter information.

People want mobile health by phone, and FICO knows it

Most people (54%) want their mobile phones to enable health care interactions, according to Mobile Thought Leadership, a paper from FICO that summarizes data from a survey conducted with health citizens around the world. FICO conducted research among 2,239 adult smartphone users in the UK, Australia, Brazil, China, France, Germany, India, Italy, Japan, Korea, Mexico, Russia, Turkey and the United States. The data discussed here in Health Populi refer to a subset covering just U.S. consumers. Among the one-half of consumers interested in doing more health care interactions via mobile in the future, the most popular options are: receiving reminders of appointments,

World No Tobacco Day v2014 – let’s raise (more) taxes on tobacco

Tomorrow is World No Tobacco Day. The use of tobacco is one of the most preventable public health issues on the planet. And the global tobacco epidemic contributed to 100 million deaths around the world in the 20th century. 6 million people die every year due to tobacco use — including 600,000 deaths due to exposure to secondhand smoke. About 500 million people living today will be dead from the use of tobacco products if current smoking habits continue, the World Health Organization (WHO) expects. WHO sponsors the World No Tobacco Day every year on May 31. For this year’s

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Will Your Health Plan Be Your Transparency Partner? – Part 3

Three U.S. health plans cover about 100 million people. Today, those three market-dominant health plans — Aetna, Humana and UnitedHealthcare — announced that they will post health care prices on a website in early 2015. Could this be the tipping point for health care transparency so long overdue? These 3 plans are ranked #1, #4 and #5 in terms of market shares in U.S. health insurance. Together, they will share price data with the Health Care Cost Institute (HCCI), a not-for-profit organization dedicated to research on U.S. health spending. An important part of the backstory is that the HCCI was

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

Consumers’ spending on medicine grows – the retailization of health care

People are spending more out of their own pockets on health care, and particularly for medications. There are two sides to the medicine-spending coin: there’s the low-end which are generic drugs, most of which carry a co-pay of $10 or less. Then there’s the high end of specialty pharmaceuticals, a fast-growing category of very expensive products for which many consumers dearly pay — if and when they choose to take their doctors’ recommendations. In Medicine use and shifting costs of healthcare, IMS Institute for Healthcare Informatics reports that while (inexpensive) generic drugs comprise 86% of prescriptions in the U.S., it’s high

Doctors become health economists

The rising costs of health care in America, and consumers’ growing cost burdens, has many impacts on the U.S. health ecosystem. In particular, patients have been self-rationing due to costs, without necessarily paying attention to quality or medical outcomes. Doctors have begun to pay more attention to costs and their impacts on patients in their practices, addressed in today’s New York Times article, Treatment costs could influence doctors’ advice to patients. Andrew Pollack writes in the Times about the morphing role of doctors, some of whom are taking on the mantle of being a “steward of society,” as characterized by

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

FICO scores for health – chatting with a #BigData pioneer

I had the pleasure of spending quality time brainstorming with Mikki Nasch, co-founder of AchieveMint, yesterday. Mikki worked on the early days of building the FICO score with Fair Isaac, so has been involved in Big Data well before it became the well-#hashtagged buzzword it is today. In our conversation, we talked about the history of FICO and how it took about a decade for consumers to understand it, accept it, and use it as a tool for bettering their credit ratings. When a FICO score was below an acceptable threshold to a lender – say, for a new car

People want to DIY with pharma

In our increasingly-DIY society, most consumers expect high levels of access and customer service from the organizations with whom we engage. With more consumers reaching into their pockets to pay for health services and products, the health industry is increasingly a retail-facing environment. So expect quality service levels from their healthcare touch points. The pharmaceutical and prescription drug touch point is not exempt from this expectation, as learned by an Accenture survey analyzed in Great Expectations: Why Pharma Companies Can’t Ignore Patient Services. As the first picture shows, 70% of patients think pharma companies are responsible for bundling information and services

The new retail health: Bertolini of Aetna connects dots between the economy and health consumers

3 in 4 people in America will buy health care at retail with a subsidy within just a few years, according to Mark Bertolini, CEO of Aetna. Bertolini was the first keynote speaker this week at the 2014 HIMSS conference convened in Orlando. Bertolini’s message was grounded in health economics 101 (about which frequent readers of Health Populi are accustomed to hearing). A healthy community drives a healthy local economy, and healthier people are more economically satisfied, Bertolini explained. The message: health care can move from being a cost driver to being an economic engine. But getting to a healthy

Managing cost and utilization are top goals for specialty pharmacy buyers

While the prescription drug bill makes up about 10% of U.S. national health spending, the fastest-growing component of pharmacy spending is specialty medications. These are categorized as “specialty” drugs because they rarely have generic equivalents, and treat serious or life-threatening diseases (such as cancer, MS, and rheumatoid arthritis). They are also “special” because specialty pharmaceuticals average $3,000 per patient per month and can surpass $100,000 a year for certain products. As a result, the top two goals for managing specialty medications among employers are #1, to reduce inappropriate utilization, and #2, to reduce drug acquisition costs, based on a survey

U.S. families face medical financial burdens; health care in the SOTU

A growing proportion of American families are facing money problems related to health care, according to the report, Financial Burden of Medical Care: A Family Perspective, No. 142 in the NCHS Data Brief series from the CDC, published January 2014 and based on 2012 data. 1 in 4 families are dealing with some financial burden due to medical care. “Financial burdens” in health include problems paying medical bills in the past 12 months, shared by 16.5% of families; and medical bills being paid over time, faced by 21.4% of families. 1 in 10 families (9%) have medical bills they are

Food and money matter for health – more hospital admissions at the end of the month

If your wallets are lighter at the end of the month, you’re likely to have less access to quality food, and more likely to be admitted to the hospital if you have diabetes. The hypothesis that people with low incomes whose household budgets are spent before the end of the month have greater health inequities was tested in the article, Exhaustion of Food Budgets At Month’s End And Hospital Admissions For Hypoglycemia, published in the January 2014 issue of Health Affairs. Researchers from the University of California – San Francisco found that, indeed, the health in households with low-income suffer from

mHealth will join the health ecosystem – prelude to the 2014 Consumer Electronics Show

The rise of digital health at the 2014 Consumer Electronics Show signals the hockey-stick growth of consumer-facing health devices for fitness and, increasingly, more medical applications in the hands of people, patients, and caregivers. This year at #CES2014, while the 40% growth of the CES digital health footprint will get the headlines, the underlying story will go beyond wristbands and step-tracking generating data from an N of 1 to tools that generate data to bolster shared-decision making between people and the health system, and eventually support population health. For example: – Aetna is partnering with J&J to deploy their Care4Today

3 Things I Know About Health Care in 2014

We who are charged with forecasting the future of health and health care live in a world of scenario planning, placing bets on certainties (what we know we know), uncertainties (what we know we don’t know), and wild cards — those phenomena that, if they happen in the real world, blow our forecasts to smithereens, forcing a tabula rasa for a new-and-improved forecast. There are many more uncertainties than certainties challenging the tea leaves for the new year, including the changing role of health insurance companies and how they will respond to the Affordable Care Act implementation and changing mandates

Data altruism: people more likely to share personal health data for the sake of others and to save money

While about 53% of people globally are willing to share various types of personal data overall, the kind of data willing-to-be-shared varies by type of information — and what country we’re from. When asked how likely they would be to anonymously share information if it could lead to improvements or innovations in that technology, Americans are less likely to be willing to share any type of personal data — except for gender. When it comes to sharing several specific types of health information, fewer Americans are likely to want to share it as Intel found in their survey published in the company’s Healthcare

Employers will strongly focus on costs in health benefit plans for 2014; so must consumers

Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system. Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers. Key findings are that: Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees They will expand other tactics they believe will help address cost

There’s fear of health care costs in peoples’ retirement visions

While working people in the U.S. are feeling better about the nation’s economy, Americans aren’t putting much money into savings for retirement. The reasons for this are many, but above all is what Mercer calls “the specter of health care costs in retirement” in the Mercer Workplace Survey for 2013. In addition to peoples’ concerns about future health care costs, reasons for not putting money away for the future include flat personal income, slow economic growth and financial literacy challenges around how much 401(k) savings can be tax-deferred. On the slow economic growth perception, Mercer found that, on the upside, people

When health care costs are a side effect

4 in 5 U.S. patients – 81% of them – want an equal say in health care decisions with their care provider, according to a 2013 Institute of Medicine study. At the same time, patients choose to take “drug holidays,” opting out of taking three or more doses of medicines in a row, or adopt “trail mix” approaches to taking prescriptions, casually and inappropriately mixing Rx drugs. Welcome to your world, pharma industry: where people say they want control, but somehow don’t exercise it in the way you — drug companies — define as “compliance” or “adherence.” Customer experience in

Moneytalk: why doctors and patients should talk about health finances

Money and health are two things most people don’t like to talk about. But if people and their doctors spoke more about health and finance, outcomes (both fiscal and physical) could improve. In late October 2013, Best Practices for Communicating with Patients on Financial Matters were published by the Healthcare Financial Management Association (HFMA). Michael Leavitt, former head of the Department of Health and Human Services, led the year-long development effort on behalf of HFMA, with input from patient advocates, the American Hospital Association, America’s Health Insurance Plans, the American Academy of Family Physicians and the National Patient Advocate Foundation, along

Consumers trust and welcome health and insurance providers to go DTC with communications

Consumers embrace ongoing dialog with the companies they do business with, Varolii Corporation toplines in a survey report, What Do Customers Want? A Growing Appetite for Customer Communications. Across all vertical industries consumers trust for this dialogue, health care organizations – specifically doctors, pharmacists, and insurance companies – are the most trusted. Examples of “welcome-comms” would be reminders about upcoming appointments or vaccinations (among 69% of people), notices to reorder or pick up a prescription (57%), and messages encouraging scheduling an appointment (39%). In banking, notices about fraudulent activity on one’s account is the most welcomed message beating out appointment

A new medical side-effect: out-of-pocket health care costs

When we say the phrase “side effects,” what do we think of? The FDA says that “all medicines have benefits and risks. The risks of medicines are the chances that something unwanted or unexpected could happen to you when you use them. Risks could be less serious things, such as an upset stomach, or more serious things, such as liver damage.” There’s a new risk in town in health care, and it’s the equivalent of an upset stomach when it comes to a co-pay for a branded on-formulary drug, or liver damage if it involves a coinsurance percent of “retail”

Delaying aging to bend the cost-curve: balancing individual life with societal costs

Can we age more slowly? And if so, what impact would senescence — delaying aging — have on health care costs on the U.S. economy? In addition to reclaiming $7.1 trillion over 50 years, we’d add an additional 2.2 years to life expectancy (with good quality of life). This is the calculation derived in Substantial Health And Economic Returns From Delayed Aging May Warrant A New Focus For Medical Research, published in the October 2013 issue of Health Affairs. The chart graphs changes in Medicare and Medicaid spending in 3 scenarios modeled in the study: when aging is delayed, more people qualify

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

Taking vitamins can save money and impact the U.S. economy – and personal health

When certain people use certain dietary supplements, they can save money, according to a report from the Council for Responsible Nutrition and Frost and Sullivan, the analysts. The report is aptly titled, Smart Prevention – Health Care Cost Savings Resulting from the Targeted Use of Dietary Supplements. Its subtitle emphasizes the role of dietary supplements as a way to “combat unsustainable health care cost growth in the United States.” Specifically, the use of eight supplements in targeted individuals who can most benefit from them can save individuals and health systems billions of dollars. The eight money-saving supplements are: > Omega-3 > B

Consumers’ out-of-pocket health costs rising faster than wages – and a surprising hit from generic drug prices

U.S. health consumers faced greater out-of-pocket health care costs in 2012, especially for outpatient services (think: doctors’ visits) and generic drugs, as presented in The 2012 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI) published in September 2013. At the same time between 2011 and 2012, wages grew about 3%, remaining fairly flat over the past decade as health care costs continued to grow much faster. HCCI found that per capita (per person) out-of-pocket growth for outpatient visits amounted to an average of $118 between 2011 and 2012. But the biggest share of out-of-pocket costs for

The slow economy is driving slower health spending; but what will employers do?

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America. From biggest line item on down, health spending will go to payments to: Hospitals, representing about 32% of all spending Physicians and clinical costs, 20% of spending Prescription drugs, 9% of spending Nursing, continuing care, and home health care, together accounting for over 8% of health spending (added together for purposes of this analysis) Among other categories like personal care, durable medical equipment, and the cost of health insurance.

Food and the household health budget: one pocket, shrinking access

Over 1 in 5 people in the U.S. have not had enough money to buy food for themselves or their families in the past year, according to the August 2013 Gallup Healthways Index. This is as many consumers as those who couldn’t afford food during the deepest months of the last recession. Lack of access to food is a challenge for a cadre of Americans who lack access to other basic needs such as shelter and health care. Gallup’s Basic Access Index looks at this market basket, and has found that Americans’ access to basic needs at 81.4 in August

Consumers don’t get as much satisfaction with high-deductible health plans

Since the advent of the so-called consumer-directed health care era in the mid-2000s, there’s been a love-gap between health plan members of traditional plans, living in Health Plan World 1.0, and people enrolled in newer consumer-driven plans – high-deductible health plans (HDHPs) and consumer-directed health plans (CDHPs). That gap in plan satisfaction continues, according to the Employee Benefits Research Institute (EBRI)’s poll of Americans’ consumer engagement in health care. The survey was conducted with the Commonwealth Fund. As the bar chart illustrates, some 62% of members in traditional plans were satisfied (very or extremely) with their health insurance in 2012.

People with doctors interested in EMRs, but where’s the easy button?

1 in two people who are insured and have a regular doctor are interested in trying out an electronic medical record. But they need a doctor or nurse to suggest this, and they need it to be easy to use. The EMR Impact survey was conducted by Aeffect and 88 Brand Partners to assess 1,000 U.S. online consumers’ views on electronic medical records (EMRs): specifically, how do insured American adults (age 25 to 55 who have seen their regular physician in the past 3 years) view accessing their personal health information via EMRs? Among this population segment, 1 in 4 people (24%)

Criticizing health reform has jumped the shark for mainstream Americans

You might see potato and I might see po-tah-to when looking at the Affordable Care Act – health reform — but it’s clear we don’t want to call the whole thing off. (Go to 1:44 seconds in this video to get my drift, thanks to the Gershwin’s). I’m talking about the latest August 2013 Kaiser Health Tracking Poll from Kaiser Family Foundation finds a health citizenry suffering ennui or a form of split personality about health reform: while many Americans don’t believe the Affordable Care Act (ACA) will help them, most don’t want Congress to de-fund it, either. Several graphs from

People not up-close-and-personal about personalized medicine…yet

Only 1 in 4 U.S. adults over 30 know what “personalized medicine” (PM) really is, and only 8% of people feel very knowledgeable about the concept based on Consumer Perspectives on Personalized Medicine from GfK, published online in August 2013. GfK surveyed 602 online adults 30 years and over between February and March 2013 drawn from the company’s KnowledgePanel sample of U.S. adults. Only 4% of people who have heard of personalized medicine describe it accurately as “medicine based on genome/genetic make up.” About one-half of people (52%) defined PM as medical care, treatment, or medicine geared toward individual needs. The poll

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Chief Health Officers, Women, Are In Pain

Women are the Chief Health Officers of their families and in their communities. But stress is on the rise for women. Taking an inventory on several health risks for American women in 2013 paints a picture of pain: of overdosing, caregiver burnout, health disparities, financial stress, and over-drinking. Overdosing on opioids. Opioids are strong drugs prescribed for pain management such as hydrocodone, morphine, and oxycodone. The number of opioid prescriptions grew in the U.S. by over 300% between 1999 and 2010. Deaths from prescription painkiller overdoses among women have increased more than 400% since 1999, compared to 265% among men.

Working for health care in 2013: workers’ health insurance cost burden still grows faster than wages

Insurance premium costs grew 4% for families between 2012 and 2013, with workers now bearing 39% of health premiums in 2013 compared with only 26% ten years ago, in 2003. That’s a 50% increase in health plan premium “burden” for working families, by my calculation. This snapshot of health insurance in 2013 comes to us from the 2013 Employer Health Benefits Survey, provided by the Kaiser Family Foundation (KFF) and the Health Research & Educational Trust (HRET). This research is one of the most important annual reports to hit the health care industry every year, and this year’s analysis provides strategic context

Needing a new kind of tracker to track #mhealth investments in 2013

The news this week that Fitbit attracted $42 million investment capital follows Withings’ announcement of $30 million (including Euro11 million from BPIFrance, the French national investment fund), Jawbone’s recent acquisition of Bodymedia for $100 million in April 2013, and MyFitnessPal raising $13 million earlier this month. The quick arithmetic for these four companies alone adds to roughly $200 mm in a few months going to these brands, which are feverishly competing for the heartbeats and footsteps of people who are keen to track their steps and stay healthy. Can you keep up? You need a new kind of activity tracker to track

Eat fruits and vegetables: it’s worth $11 trillion to you and the U.S. economy

More than 127,000 people die every year in America from cardiovascular disease, accruing $17 billion in medical spending. Heart disease is a “costly killer,” according to the Union of Concerned Scientists, who has calculated The $11 trillion reward: how simple dietary changes can save lives and money, and how we get there, published in August 2013. That $11 trillion opportunity is equal to the present value of lives saved. The solution to bolstering heart (and overall health) and saving money (medical spending and personal productivity) is in food. We’re not talking about genetically engineering anything special or out-of-the-ordinary. We are talking

Americans’ health insurance illiteracy epidemic – simpler is better

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week. The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions. Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade. See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do.

People are growing their health-consumer muscles in 2013

Most Americans are concerned about their ability to for medical bills, even when they have health insurance. As a result, most are comfortable asking their doctor about how much their medical treatment will cost. People are becoming savvier health care shoppers largely because they have to: 37% of people in the U.S. have an annual health insurance deductible over $2,000, according to the Spring/Summer 2013 Altarum Institute Survey of Consumer Health Care Opinion, published on 11th July 2013. Many of the media stories coming out of the Altarum survey since its publication have been about people and their trust in

In the US health care cost game, doctors have seen the enemy – and it’s not them

When it comes to who’s most responsible for reducing the cost of health care in America, most doctors put the onus on trial lawyers, health insurance companies, pharma and medical device manufacturers, hospitals, and even patients. But physicians themselves ? Not so much responsibility – only 36% of doctors polled said doctors should assume major responsibility in reducing health care costs. And, in particular, most U.S. physicians have no enthusiasm for reducing health care costs by changing payment models, like penalizing providers for hospital re-admissions or paying a group of doctors a fixed, bundled price for managing population health. Limiting

Health and wellness, the economy and the grocery store

Consumers in America are spending more, and especially at the grocery store. Most people say they want to eat healthy — but, although they’re spending more at the food store, one-half of supermarket shoppers say cost is the main obstacle for healthy eating. 2 in 3 U.S. grocery shoppers define health and wellness as being physically fit and active, and over half believe that feeling good about yourself is another facet of health. Not being overweight equals health for about one-half of U.S. shoppers. The Why? Behind the Buy, from Acosta Sales & Marketing, explores buying patterns among U.S. consumers

Cost prevents people from seeking preventive health care

3 in 4 Americans say that out-of-pocket costs are the main reason they decide whether or not to seek preventive care, in A Call for Change: How Adopting a Preventive Lifestyle Can Ensure a Healthy Future for More Americans from TeleVox, the communications company, published in June 2013. TeleVox surveyed over 1,015 U.S. adults 18 and over. That’s the snapshot on seeking care externally: but U.S. health consumers aren’t that self-motivated to undertake preventive self-care separate from the health system, either, based on TeleVox’s finding that 49% of people say they routinely exercise, and 52% say they’ve attempted to improve eating habits.

Money and health, migraines and sleep: how stress directly impacts health and wealth

There’s an issue that doctors and patients don’t discuss that’s among the most important contributors to ill health: it’s money, and it’s something Alexandra Drane calls an “Unmentionable.” Alex, Founder, Chief Visionary, and Board Chair at Eliza Corporation, coined Unmentionables as those aspects of daily living which everyone deals with, but few like to talk about: like sex (whether too much, too little), drugs (abusing), drinking (too much), toileting problems (such as incontinence or pooping problems), sleep trouble, and caring for others (not ourselves so much). These daily life challenges can negatively impact health, with financial stress being one of

The promise of ObamaCare isn’t comforting Americans worrying about money and health in 2013

In June 2013, even though news about the economy and jobs is more positive and ObamaCare’s promise of health insurance for the uninsured will soon kick in, most Americans are concerned about (1) money and (2) the costs of health care. The Kaiser Health Tracking poll of June 2013 paints an America worried about personal finances and health, and pretty clueless about health reform – in particular, the advent of health insurance exchanges. Among the 25% of people who have seen media coverage about the Affordable Care Act (alternatively referred to broadly as “health reform” or specifically as “ObamaCare”), 3

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

Consumer-directed health isn’t always so healthy

Giving health consumers more skin in the game doesn’t always lead to them making sound health decisions. Over four years in consumer-directed health plans, enrollees used one-quarter fewer visits to doctors every year and filled one fewer prescription drugs. CDHP members also received fewer recommended cancer screenings, and visited the emergency room more often. These rational health consumer theory-busting findings were published in the June 2013 issue of the Health Affairs article, Consumer-Directed Health Plans Reduce The Long-Term Use of Outpatient Physician Visits And Prescription Drugs by Paul Fronstin of the Employee Benefit Research Institute and colleagues from IBM and RxEconomics,

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

A physical activity shortage: Let’s Move!

Only 1 in 5 Americans got the minimum recommended amount of physical activity in 2011, based on guidelines offered by the U.S. Centers for Disease Control. More men than women met the standard: 23.4% of men versus 17.9% of women. There are wide variations across the 50 states, as the map shows, with the healthiest folks exercise-wise living in the west, Alaska, upper midwest, and New England. The range runs from a 12.7% low in West Virginia and Tennessee to 27.3 at the high end in Colorado. That bar is set at 150 minutes a week (that’s 2.5 hours) of

The need for a Zagat and TripAdvisor in health care

Patient satisfaction survey scores have begun to directly impact Medicare payment for health providers. Health plan members are morphing into health consumers spending “real money” in high-deductible health plans. Newly-diagnosed patients with chronic conditions look online for information to sort out whether a generic drug is equivalent to a branded Rx that costs five-times the out-of-pocket cost of the cheaper substitute. While health care report cards have been around for many years, consumers’ need to get their arms around relevant and accessible information on quality and value is driving a new market for a Yelp, Travelocity, or Zagat in

The value of big data in health care = $450 billion

Exploiting Big Data in industry is Big News these days, and nowhere is the potential for leveraging the concept greater than in health care. McKinsey & Company estimates that harnessing big data across five dimensions of health care could yield nearly one-half trillion dollars’ worth of value in The ‘big data’ revolution in healthcare. The chart summarizes McKinsey’s calculations on the value of Big Data in health care at its maximum. Before digging into the value potential, just what is Big Data in health care? Statistics and information are generated in the health care system about patients: say, during visits

Walgreens Steps with Balance program rewards both consumers and the store

Consumers who patronize Walgreens can get rewarded for tracking their physical activity For the Steps with Balance program kickoff, self-tracking consumers can earn 20 points for every mile walked or run and 20 points for tracking weight. Walgreens implemented the Walk with Walgreens program in 2012. The program won an Effie Award for an outstanding marketing program. With the success of Walk with Walgreens, the retail pharmacy company has expanded the program beyond simple steps to include weight tracking and health goals for earning loyalty points. The program enables a few of the most popular self-tracking devices to sync so

U.S. Health Costs vs. The World: Is It Still The Prices, and Are We Still Stupid?

Comparing health care prices in the U.S. with those in other developed countries is an exercise in sticker shock. The cost of a hospital day in the U.S. was, on average, $4,287 in 2012. It was $853 in France, a nation often lauded for its excellent health system and patient outcomes but with a health system that’s financially strapped. A routine office visit to a doctor cost an average of $95 in the U.S. in 2012. The same visit was priced at $30 in Canada and $30 in France, as well. A hip replacement cost $40,364 on average in the

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Gettin’ higi with it: Lupe Fiasco’s foray into public health

The latest in SoLoMo (Social, Local, Mobile) Health is a gamified tool coupled with a hardware kiosk, known as higi. The brainchild of Michael Ferro, a successful dotcom entrepreneur who now owns the Chicago Sun-Times, higi’s mission is to help people – particularly younger peeps – to take better care of themselves by scoring points and, as a result, social connections. Higi’s an African word for origin, so the health tool has some aspects relating to being in a tribe — a kind of health tribe. It also has a fun sound to it, Ferro noted, which sets the vibe

Bill Clinton’s public health, cost-bending message thrills health IT folks at HIMSS

In 2010, the folks who supported health care reform were massacred by the polls, Bill Clinton told a rapt audience of thousands at HIMSS13 yesterday. In 2012, the folks who were against health care reform were similarly rejected. President Clinton gave the keynote speech at the annual HIMSS conference on March 6, 2013, and by the spillover, standing-room-only crowd in the largest hall at the New Orleans Convention Center, Clinton was a rock star. Proof: with still nearly an hour to go before his 1 pm speech, the auditorium was already full with only a few seats left in the

Health is wealth and wealth, health

It’s America Saves Week (February 25-March 2, 2013). Do you know what your savings rate is? If you’re in the center of the American savings bell curve, you probably don’t have a savings plan with specific goals and don’t know your net worth. Two-thirds of U.S. adults say they have sufficient emergency savings for unexpected expenses like a visit to a doctor. However, only one-half of non-retired people believe they’re saving enough for a retirement where they’ll have a “desirable standard of living.” This six annual survey by the Consumer Federation of America, the American Savings Education Council, and the

Required reading: TIME Magazine’s Bitter Pill Cover Story

Today’s Health Populi is devoted to Steven Brill and his colleagues at TIME magazine whose special report, Bitter Pill: Why Medical Bills Are Killing Us, is required reading for every health citizen in the United States. Among many lightbulb moments for readers, key findings from the piece are: Local hospitals are beloved charities to people who live in their market – Brill calls these institutions “Non-Profit Profitmakers). They’re the single most politically powerful player in most Congressional districts The poor and less affluent more often pay the high chargemaster (“retail list”) price for health products and services vs. the wealthy

Health consumers don’t understand overtreatment, and their role in driving health costs

Overuse of health care is defined as the delivery of health care services for which the risks outweigh the benefits, according to a study into the utilization of ambulatory care health services published in the January 28, 2013, issue of JAMA Internal Medicine (the new title for the Archives of Internal Medicine). “Trends in the Overuse of Ambulatory Health Care Services in the United States” found that, of the estimated $700 billion that is wasted annually in U.S. health care, overuse comprises about $280 billion – over one-third of waste — equal to over 10% of total health spending in

Wealthy Americans’ top financial concern is affording health care in retirement

The wealthiest Americans’ top financial concern is being able to afford healthcare and support they’ll need in old age. The #2 financial concern among wealthy investors is worrying about the financial situation of their children and grandchildren, closely followed by a major family health problem occurring and someone to care for them in their old age. These health-financial worries come out of a survey among 2,056 U.S. investors age 25 and over who have at least $250,000 in investable assets conducted by UBS in January 2013. UBS found that staying health and fit is investors’ top objective, with 73% of wealthy

The flu shot economy

4 in 10 Americans got flu shots in this epidemic season, and most of these didn’t receive their immunization in their doctor’s office. The Flu Vaccination Survey from Ipsos Public Affairs, conducted in January 2013, paints a picture of U.S. health consumers who are project managing their personal approaches to preventing the flu in this historically hard-hitting flu season. The most expressed demand for flu shots has been among people 55 and over, one-half of whom have received vaccinations, with the lowest use been in the 25-35 year age group. Geographically, the most covered health citizens live in New England

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Formally tracking health data changes health behavior and drives social health

Most of us keep track of some aspect of our health. Half of all people who track do so “in their heads,” not on paper, Excel spreadsheet, or via digital platform. Furthermore, 36% update their health tracking data at least once a day; but 16% update at most twice a month, and 9% update less than once monthly. Tracking for Health from the Pew Internet & American Life Project paints a portrait of U.S. adults who, on one hand are quantifying themselves but largely aren’t taking advantage of automated and convenient ways of doing so. Overall, 69% of U.S. adults track

Think about health disparities on Martin Luther King Day 2013

On this day celebrating Martin Luther King, Jr., I post a photo of him in Detroit in 1963, giving a preliminary version of his “I Have a Dream” speech he would give two months later in Washington, DC. As I meditate on MLK, I think about health equity. By now, most rational Americans know the score on the nation’s collective health status compared to other developed countries: suffice it to say, We’re Not #1. But underneath that statistic is a further sad state of health affairs: that people of color in the U.S. have lower quality of health than white

The Internet as self-diagnostic tool, and the role of insurance in online health

1 in 3 U.S. adults have enough trust in online health resources that they’ve gone online to diagnose a condition for themselves or a friend. “For one-third of U.S. adults, the Internet is a diagnostic tool,” according to Health Online, the latest survey on online health from the Pew Internet & American Life Project. Nearly one-half of these people eventually sought medical attention. One-third did not. Women are more likely to do online medical diagnoses than men do, as do more affluent, college-educated people. When people perceive they’re ‘really’ sick, 70% get information and care from a health professional and

New Year’s Resolutions for health, and the 2013 Consumer Electronics Show

When it comes to taking on personal responsibility, the #1 New Year’s Resolution is to engage in fitness and exercise, cited by 43% of U.S. adults, followed by healthy eating, noted by 37% of people. Other resolutions involving personal responsibility are Family (26%) Spirituality and faith (22%) Managing personal finances (22%. This survey was undertaken as part of Liberty Mutual’s The Responsibility Project (RP), which is taglined: “Explore what it means to do the right thing.” Launched in 2008, Liberty Mutual’s RP has been diving into the many aspects of daily living for which we, each of us, could take responsibility…including

What Americans Want in 2013: Money, Health, and Family Time, in that order

1 in 2 people wants to improve their financial situation in 2013; 1 in 5 wants to improve their health, and another 1 in 5 seeks more time with friends and family. Ipsos Open Thinking Exchange has polled 18,000 global citizens from 24 countries under the age of 64 in December 2012 to learn that it’s money that people want, first and foremost, in the new year. Health and time for friends and family roughly tie for second place, overall. Not surprisingly, as the data chart for the U.S. shows, more people at the lowest third of household income (HHI) polled

Call them hidden, direct or discretionary, health care costs are a growing burden on U.S. consumers

Estimates on health spending in the U.S. are under-valued, according to The hidden costs of U.S. health care: Consumer discretionary health care spending, an analysis by Deloitte’s Center for Health Solutions. Health spending in the U.S. is aggregated in the National Health Expenditure Accounts (NHEA), assembled by the Department of Health and Human Services (DHHS) Centers for Medicare and Medicaid Services (CMS). In 2010, the NHEA calculated that $2.6 trillion were spent on health care based on the categories they “count” for health spending. These line items include: Hospital care Professional services (doctors, ambulatory care, lab services) Dental services Residential

mHealthpalooza – in or beyond the Hype Cycle?

This week-after-the-mHealth-Summit gives us the opportunity to synthesize several interesting studies on the state of mobile health in the U.S. with a few days of distance from the excitement of the conference. Deloitte’s report on mHealth in an mWorld asks how mobile technology is transforming health care. Consumers are driving mHealth growth, Deloitte believes, with mobile apps “enhancing overall consumer engagement” they say. In a future scenario, Deloitte sees health consumers using social health networks for information, motivation and support, self-directing care, and using sensors to monitor and communicate health metrics. Clinicians will have clinical dashboards informed by Big Data

Food and health: information is not doing the job as the U.S. continues its obesity march

Notwithstanding the fact that most phones on U.S. streets are “smart” ones, most adults surf the net for health information, and most people try to change a health habit each year, Americans haven’t adopted healthier long-term relationships with food. The International Food Information Council has conducted the Food & Health Survey: Consumer Attitudes Toward Food, Safety, Nutrition & Health poll since 2006, thus enabling us to track peoples’ attitudes and behaviors over the past several years. The latest polling results appear in Is it Time to Rethink Nutrition Communications? A 5-Year Retrospective of Americans’ Attitude toward Food, Nutrition, and Health online in

From fragmentation and sensors to health care in your pocket – Health 2.0, Day 1

The first day of the Health 2.0 Conference in San Francisco kicked off with a video illustrating the global reach of the Health 2.0 concept, from NY and Boston to Mumbai, Madrid, London, Tokyo and other points abroad. Technology is making the health world flatter and smarter…and sometimes, increasing problematic fragmentation, which is a theme that kept pinching me through the first day’s discussions and demonstrations. Joe Flowers, health futurist, offered a cogent, crisp forecast in the morning, noting that health care is changing, undergoing fundamental economic changes that change everything about it. These are driving us to what may

HealthcareDIY – from employee wellness incentives to #retailhealth, #pharmacy, & #CDHP

Most U.S. companies will increase the dollar value of health incentives offered to workers in 2012, based on the annual survey from Fidelity Investments and the National Business Group on Health addressing employers’ plans for health benefits. 3 in 4 employers used incentives in 2011 to engage employees in wellness programs, with an average incentive value of $460. This number was $260 in 2009. The poll found that employers expect employees to improve their personal health, and will increasingly ration access to benefits based on employees’ engagement with health criteria. Employers’ approaches to incentives have begun to adopt value-based benefit design strategies that

Nearly 1 in 2 women delayed health care in the past year due to costs – the economic impact on a woman’s physical, emotional, and fiscal health

Nearly 1 in 2 women put off seeking health care because the cost was too high. The kinds of services delayed included visits to the doctor, medical procedures, and filling prescription medications. The fourth annual T.A.L.K. Survey was released this week by the National Women’s Health Resource Center (NWHRC), focusing on the declining economy and its impact on women and three dimensions of their health — physical, emotional, and fiscal. 40% of women say that their health has worsened in the past five years due to increasing stress and gaining weight, according to the survey. One of the most interesting

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for