Banks — a new entrant in the health/care landscape

TD Bank gifted free Fitbit activity trackers to new customers signing up for savings accounts in the 2015 New Year. John Hancock is discounting life insurance premiums for clients who track steps and take on preventive care strategies. And Banco Sabadell in Spain, along with Westpac in New Zealand and Standard Chartered in the United Kingdom are all piloting wearable technology for consumer financial management. Financial wellness is an integral part of peoples’ overall health, so financial services companies are putting their collective corporate feet into the health/care market. Banks and consumer investment companies are new entrants in health/care as

Health is where we live, work, and shop…at Walgreens

Alex Gourley, President of The Walgreen Company, addressed the capacity crowd at HIMSS15 in Chicago on 13th April 2015, saying his company’s goal is to “make good health easier.” Remember that HIMSS is the “Health Information and Management Systems Society” — in short, the mammoth health IT conference that this year has attracted over 41,000 health computerfolk from around the world. So what’s a nice pharmacy like you, Walgreens, doing in a Place like McCormick amidst 1,200+ health/tech vendors? If you believe that health is a product of lifstyle behaviors at least as much as health “care” services (what our

John Hancock flips the life insurance policy with wellness and data

When you think about life insurance, images of actuaries churning numbers to construct mortality tables may come to mind. Mortality tables show peoples’ life expectancy based on various demographic characteristics. John Hancock is flipping the idea life insurance to shift it a bit in favor of “life” itself. The company is teaming with Vitality, a long-time provider of wellness tools programs, to create insurance products that incorporate discounts for healthy living. The programs also require people to share their data with the companies to quality for the discounts, which the project’s press release says could amount to $25,000 over the

Workers at work for the health benefits but absent when it comes to talking costs

As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015. Based on a national sample of over 2,000 employees surveyed in October 2014 about workplace benefits. The research re-confirms the long-term reality of workers working in America for the health benefit. Benz/Quantum note that 89% of workers say health benefits play a part in remaining on-the-job, and half say the health benefit is a “major” part of remaining

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

The Affordable Care Act As New-Business Creator

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC. As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA: Supporting telehealth platforms between patients and providers, such as Vivre Health Educating consumers, such as the transparency provider HealthSparq does Streamlining operations to enhance efficiency, the business of Cureate among others

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Whole (Health) Foods – the next retail clinic?

Long an advocate for consumer-directed health in his company, John Mackey, co-CEO and co-Founder of Whole Foods Market, is talking about expanding the food chain’s footprint in retail health. “Americans are sick of being sick,” Mackey is quoted in “Whole Foods, Half Off,” a story published in Bloomberg on January 29, 2015. Mackey talks about being inspired by Harris Rosen, a CEO in Florida, who has developed a workplace clinic for employees’ health care that drives high quality, good outcomes, and lower costs. Mackey imagines how Whole Foods could do the same, beginning in its hometown in Austin, TX. He

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

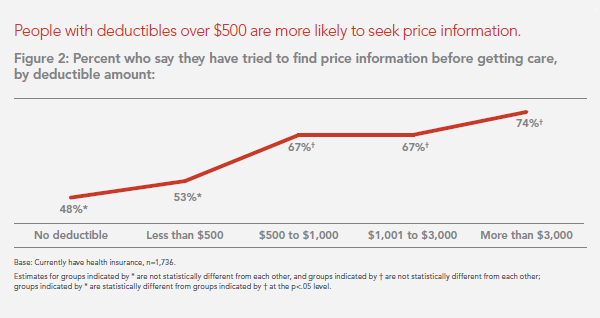

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Women-centered design and mobile health: heads-up, 2014 mHealth Summit

This post is written as part of the Disruptive Women on Health’s blog-fest celebrating the 2014 mHealth Summit taking place 7-11 December 2014 in greater Washington, DC. Women and mobile health: let’s unpack the intersection. On the supply side of the equation, Good Housekeeping covered health tracking-meets-fashion bling in the magazine a few weeks ago in article tucked between how to cook healthy Thanksgiving side dishes and tips on getting red wine stains out of tablecloths. This ad appeared in a major sporting goods chain’s 2014 Black Friday pre-print in my city’s newspaper last week. And along with consumer electronics brand faves like

Health-committed consumers look to food to be healthy, wealthy, and wise

There’s an emerging health-committed consumer, one of over 70% of people who believe they’re less healthy than the generations who came before them. 9 in 10 consumers overall believe that what you eat impacts how you feel. Those who are health-committed spend 70% of their grocery budgets on healthy products, read food labels, spend more and shop more frequently than low health-committed consumers, according to Healthy, Wealthy, & Wise, a survey report from Dunnhumby. The number of health-committed consumers globally grew by 38% since 2009. Most consumers look first to themselves to drive health, then to doctors, and third to food companies

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health care as a retail business

The health care industry is undergoing a retail transformation, according to Retail Reigns in Health Care: The rise of consumer power and its organization & workforce implications from Deloitte. Deloitte’s report published in October 2014 focuses on the health insurance business, which is newly-dealing with uninsured people largely unfamiliar with how to evaluate health plan options. This by any definition requires new muscles for both buyers and sellers on a health insurance exchange: new product access + uninformed consumer = retail challenge. Deloitte notes another supply and demand challenge, and that’s with the health insurance company workforce: while 93% of health

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

Walgreens+WebMD: reinventing retail pharmacy

With the goal of driving a digital health platform for well-informed, effective self-care, the nation’s largest retail pharmacy chain and prominent consumer-facing health information portal are allying to move from serving up pills and information to health “care.” Walgreens and WebMD launched their joint effort on 2nd October 2014, a few weeks after CVS/pharmacy re-branded as CVS Health. Welcome to the reinvention of the retail pharmacy. I spoke for a few minutes with David Schlanger, CEO, WebMD, and Alex Gourlay, President, Customer Experience and Daily Living, Walgreens, the day of the launch, to get early insights into the vision for

Crossing the digital health chasm between consumers and providers – talking with Dr. Eric Topol

More than twice as many patients than physicians are embracing consumers’ use of new digital technologies to self-diagnose medical conditions on their own. On the other hand, 91% of doctors are concerned about giving patients access to their detailed electronic health records, anticipating patients will feel anxious about the results; only 34% of consumers are concerned about anxiety-due-to-EHR-exposure. Welcome to the digital health chasm, that gap between what consumers want out of digital health, and what doctors believe patients can handle at this stage in EHR adoption in doctors’ offices and in patients’ lives. I have the video of Jack

Understanding the patient journey – using real-world data

It’s de rigueur for any organization marketing a product or service in health care to be “patient-centered” these days. “Patient engagement” and “health engagement” are phrases found on health conference agendas, whether pitching to attendees in pharma and life sciences, health IT, health insurance, or healthcare (to hospitals and physicians, alike). One paradigm for patient-centricity that’s more mature than most is IMS Health’s Patient Journey construct, which the data-driven company has been talking about since 2012. While the concept focused mainly on pharmaceutical marketing and medication adherence, it’s useful for all industry segments looking to motivate behavior change in health

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Blurred lines: health, pharmacy, food and care

In the past few weeks, several events bolster the reality that health and health care are in Blurred Lines mode. Not Robin Thicke Blurred Lines, mind you, but the Venn Diagram overlapping kind. Walmart launched real primary care clinics in South Carolina and Texas. These will provide services beyond urgent care, charging $4 a visit for company employees and $40 a visit for other people The U.S. Department of Agriculture issued a report promoting “nudges” to grocery shoppers enrolled in the Supplemental Nutrition Access Program (SNAP) to buy healthy foods Apple is talking with Cleveland Clinic, Johnson Hopkins, and Mount Sinai Medical

Over-the-counter drugs – an asset in the collaborative, DIY health economy

Nations throughout the world are challenged by the cost of health care: from Brazil to China, India to the Philippines, and especially in the U.S., people are morphing into health care consumers. Three categories of health spending in the bulls-eye of countries’ Departments of Health are prescription drugs, and the costs of care in hospitals and doctors’ offices. In the U.S., one tactic for cost containment in health is “switching” certain prescription drugs to over-the-counter products – those deemed to be efficacious and safe for patients to take without seeking treatment from a doctor. Over-the-counter drugs (OTCs) are available every

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

Stress Is US

“Reality is the leading cause of stress among those in touch with it,” Lily Tomlin once quipped. Perhaps in 2014, America is the land of stress because we’re all so in touch with reality. THINK: reality TV, social networks as the new confessional, news channeling 24×7, and a world of too much TMI. So no surprise, then, that one-half of the people in the U.S. have had a major stressful event or experience in the last year. And health tops the list of stressful events in This American Life in the forms of illness and disease (among 27% of people)

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Chaos, then Creation, Part 5

The consumer demand side for healthcare transparency is hungry for the light to shine on health care costs, quality and information that’s relevant and meaningful to the individual. The supply side is fast-growing, with websites and portals, government-sponsored projects, commercial-driven start-ups, and numerous mobile apps. These tools endeavor to: Help people find and access services Schedule appointments Compare peer consumers’ reviews for those providers Calculate and prepare for out-of-pocket co-payments deriving from their health plan Negotiate prices with providers Pay for the services, and Reconcile the payment with a high-deductible health plan or health savings account. On the demand side, consumers

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Will Your Health Plan Be Your Transparency Partner? – Part 3

Three U.S. health plans cover about 100 million people. Today, those three market-dominant health plans — Aetna, Humana and UnitedHealthcare — announced that they will post health care prices on a website in early 2015. Could this be the tipping point for health care transparency so long overdue? These 3 plans are ranked #1, #4 and #5 in terms of market shares in U.S. health insurance. Together, they will share price data with the Health Care Cost Institute (HCCI), a not-for-profit organization dedicated to research on U.S. health spending. An important part of the backstory is that the HCCI was

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

The retailization of digital health: Consumer Electronics Association mainstreams health

The Consumer Electronics Association (CEA) has formed a new Health and Fitness Technology Division, signalling the growing-up and mainstreaming of digital health in everyday life. The CEA represents companies that design, manufacture and market goods for people who pay for stuff that plugs into electric sockets and operate on batteries — like TVs, phones, music playing and listening, kitchen appliances, electronic games, and quite prominent at the 2014 Consumer Electronics Show, e-cigarettes (rebranding “safe smoking” as “vaping” technology). In its press release announcing this news, CEA President and CEO Gary Shapiro says, “Technology innovations now offer unprecedented opportunities for consumers to

Health costs in retirement: the standard of living

On their list of top financial worries, 1 in 2 Americans is most concerned about not having enough money for retirement, not being able to pay medical costs if they get sick, and not being able to maintain a desired standard of living. Gallup’s annual Economy and Personal Finance poll, conducted in early April 2014, finds that even in the wake of a healthier economy, people feel health-finance insecure. While ability to pay medical bills ranked #2 on the list of 9 fiscal worries, the proportion of Americans with this concern fell from a high of 62% in 2012 to

The appification of health – a bullish outlook from Mobiquity

Over half of people using health and fitness apps began using them over six months ago, and one-half of these people who have downloaded health and fitness apps use them daily according to survey research summarized in the report, Get Mobile, Get Healthy: The Appification of Health and Fitness from Mobiquity. The company contracted a survey conducted among 1,000 U.S. adults in March 2014 who use or plan to use mobile apps to track health and fitness. Thus the “N” in this study was a group of people already interested in self-tracking health and not representative of the broader U.S. consumer

Doctors become health economists

The rising costs of health care in America, and consumers’ growing cost burdens, has many impacts on the U.S. health ecosystem. In particular, patients have been self-rationing due to costs, without necessarily paying attention to quality or medical outcomes. Doctors have begun to pay more attention to costs and their impacts on patients in their practices, addressed in today’s New York Times article, Treatment costs could influence doctors’ advice to patients. Andrew Pollack writes in the Times about the morphing role of doctors, some of whom are taking on the mantle of being a “steward of society,” as characterized by

Your health score: on beyond FICO

Over one dozen scores assessing our personal health are being mashed up, many using our digital data exhaust left on conversations scraped from Facebook and Twitter, via our digital tracking devices from Fitbit and Jawbone, retail shopping receipts, geo-location data created by our mobile phones, and publicly available data bases, along with any number of bits and pieces about ‘us’ we (passively) generate going about our days. Welcome to The Scoring of America: How Secret Consumer Scores Threaten Your Privacy and Your Future. Pam Dixon and Robert Gellman wrote this well-documented report, published April 2, 2014 by The World Privacy Forum.

FICO scores for health – chatting with a #BigData pioneer

I had the pleasure of spending quality time brainstorming with Mikki Nasch, co-founder of AchieveMint, yesterday. Mikki worked on the early days of building the FICO score with Fair Isaac, so has been involved in Big Data well before it became the well-#hashtagged buzzword it is today. In our conversation, we talked about the history of FICO and how it took about a decade for consumers to understand it, accept it, and use it as a tool for bettering their credit ratings. When a FICO score was below an acceptable threshold to a lender – say, for a new car

People want to DIY with pharma

In our increasingly-DIY society, most consumers expect high levels of access and customer service from the organizations with whom we engage. With more consumers reaching into their pockets to pay for health services and products, the health industry is increasingly a retail-facing environment. So expect quality service levels from their healthcare touch points. The pharmaceutical and prescription drug touch point is not exempt from this expectation, as learned by an Accenture survey analyzed in Great Expectations: Why Pharma Companies Can’t Ignore Patient Services. As the first picture shows, 70% of patients think pharma companies are responsible for bundling information and services

Why a grocery chain supports health data liquidity

The CEO of a family-owned grocery store chain wrote a letter to New York State lawmakers to support $65 million worth of spending on a computer system for health information in the state. That grocer is Danny Wegman, and that project is the Statewide Health Information Network, aka SHIN-NY. In his letter beginning, “Dear New York Legislator,” Wegman identifies several benefits he expects would flow out of the health IT project: 1. Improve health care for all New Yorkers 2. Lower health care costs, through reducing hospital readmission rates and reducing duplicate testing. 3. Lead to health data “liquidity” (my

Risk-shift: employers continue to push more risk to employees and families for health costs

With health costs increase increasing at 4.4% in 2014, a slightly higher rate of growth than the 4.1% seen in 2013. While this is lower than the double-digit increases U.S. employers faced in 2001-2004, it’s still twice the rate of general consumer price inflation. That’s what the first graph shows, based on the The 19th Annual Towers Watson/National Business Group on Health Employer Survey on Purchasing Value in Health Care. Employers generally want to continue to provide health insurance…for the time being. 92% of companies expect to make changes in health plan provisions in 2014, with 1 in 2 anticipating “significant

HIMSS14 Monday Morning Quarterback – The Key Takeaways

Returning to terra firma following last week’s convening of the 2014 annual HIMSS conference…taking some time off for family, a funeral, the Oscars, and dealing with yet another snowstorm…I now take a fresh look back at #HIMSS14 at key messages. In random order, the syntheses are: Healthcare in America has entered an era of doing more, with less...and health information technology is a strategic investment for doing so. The operational beacon going forward is moving toward The Triple Aim: building population health, enhancing the patient’s experience, and lowering costs per patient. The CEO of Aetna, Mark Bertolini, spoke of the

The new retail health: Bertolini of Aetna connects dots between the economy and health consumers

3 in 4 people in America will buy health care at retail with a subsidy within just a few years, according to Mark Bertolini, CEO of Aetna. Bertolini was the first keynote speaker this week at the 2014 HIMSS conference convened in Orlando. Bertolini’s message was grounded in health economics 101 (about which frequent readers of Health Populi are accustomed to hearing). A healthy community drives a healthy local economy, and healthier people are more economically satisfied, Bertolini explained. The message: health care can move from being a cost driver to being an economic engine. But getting to a healthy

Patients play a starring role at #HIMSS14 – Best In Show

Even before stepping into the Orlando Convention Center on Sunday 23 February 2014, my clairvoyant powers know the forecast of the Best in Show: the growing role of patients in health care, reflected in both the education session at the annual 2014 meeting of HIMSS as well as the product/service mix being proffered on the convention show floor. As a member of HIMSS Connected Patient Committee, I know first-hand the conscious effort and energy that the organization has committed to getting real about patients’-peoples’-caregivers’ central role in health care. The organization was built on providers and technology. When I first

Where’s TripAdvisor for health care? JAMA on physician ratings sites

As more U.S. health citizens enroll in high-deductible health plans – now representing about 30% of health-insured people in America – health plan members are being called on to play the role of consumer. Among the most important choices the health consumer makes is for a physician. Ratings sites and health care report cards ranking doctors by various characteristics have been in the market for over a decade. However, little has been known on the public’s knowledge about the availability of these information sources, nor of peoples’ use of physician rating sites. This question is addressed in Public Awareness, Perception, and

Managing cost and utilization are top goals for specialty pharmacy buyers

While the prescription drug bill makes up about 10% of U.S. national health spending, the fastest-growing component of pharmacy spending is specialty medications. These are categorized as “specialty” drugs because they rarely have generic equivalents, and treat serious or life-threatening diseases (such as cancer, MS, and rheumatoid arthritis). They are also “special” because specialty pharmaceuticals average $3,000 per patient per month and can surpass $100,000 a year for certain products. As a result, the top two goals for managing specialty medications among employers are #1, to reduce inappropriate utilization, and #2, to reduce drug acquisition costs, based on a survey

What CVS going tobacco-free means for health and business

Bravo! to CVS/pharmacy who today announced it would pull tobacco products from store shelves by October 2014. “The sale of tobacco products is inconsistent with our purpose,” the company’s press release asserts. The move will cost CVS $1.5 billion in revenue annually, as the company seeks to consolidate its position as a health company. CVS/pharmacy is part of CVS Caremark, which includes the retail pharmacy chain (the second-largest in the U.S.), a pharmacy benefit management company (Caremark), and retail health clinics (Minute Clinics). CVS Caremark also participates in a healthy communities program issuing grants for projects that focus on health

U.S. families face medical financial burdens; health care in the SOTU

A growing proportion of American families are facing money problems related to health care, according to the report, Financial Burden of Medical Care: A Family Perspective, No. 142 in the NCHS Data Brief series from the CDC, published January 2014 and based on 2012 data. 1 in 4 families are dealing with some financial burden due to medical care. “Financial burdens” in health include problems paying medical bills in the past 12 months, shared by 16.5% of families; and medical bills being paid over time, faced by 21.4% of families. 1 in 10 families (9%) have medical bills they are

Schizo about smoking

There’s truly good news for public health about smoking: January 11th marked the 50th anniversary of the U.S. Surgeon General’s Report on Smoking and Health. That’s five decades’ worth of progress raising peoples’ awareness about the toxic impact of nicotine and chemicals embodied in cigarettes, and deleterious impacts on health and the economy. As a result, smoking rates have been cut in half since 1964, as the downward-sloping graph illustrates. With that happy news in my subconscious, I took a long walk, tracked by my digital device, through the Venetian Hotel in Las Vegas last week, bound for the 2014 Consumer Electronics

Health costs and wellness: can digital tools bridge the gap? Altarum’s Fall 2013 consumer survey

More than twice as many people value the opinions of friends and family for health care provider choices than turn to online ratings for doctors’ bedside manner, waiting times, or clinical quality, according to the Altarum Institute Survey of Consumer Health Care Opinions, Fall 2013, released on January 8, 2014. 1 in 3 consumers also looks into the cost and quality of services recommended by nurses, doctors, labs and hospitals before choosing a provider. However, most people (4 in 5) say they are comfortable asking their doctor about how much treatment will cost: 43% are “very comfortable,” and 38% somewhat comfortable,

mHealth will join the health ecosystem – prelude to the 2014 Consumer Electronics Show

The rise of digital health at the 2014 Consumer Electronics Show signals the hockey-stick growth of consumer-facing health devices for fitness and, increasingly, more medical applications in the hands of people, patients, and caregivers. This year at #CES2014, while the 40% growth of the CES digital health footprint will get the headlines, the underlying story will go beyond wristbands and step-tracking generating data from an N of 1 to tools that generate data to bolster shared-decision making between people and the health system, and eventually support population health. For example: – Aetna is partnering with J&J to deploy their Care4Today

3 Things I Know About Health Care in 2014

We who are charged with forecasting the future of health and health care live in a world of scenario planning, placing bets on certainties (what we know we know), uncertainties (what we know we don’t know), and wild cards — those phenomena that, if they happen in the real world, blow our forecasts to smithereens, forcing a tabula rasa for a new-and-improved forecast. There are many more uncertainties than certainties challenging the tea leaves for the new year, including the changing role of health insurance companies and how they will respond to the Affordable Care Act implementation and changing mandates

A certain forecast: health consumers will be more cost-squeezed in 2014 for Rx and insurance

Gird your wallets, U.S. consumers: watch the dollars flow out-of-pocket for prescription drugs in 2014, as predicted by the 2013-2014 Prescription Drug Benefit Cost and Plan Design Report published by the Pharmacy Benefit Management Institute (PBMI) this week. Constraints covering most plan members are: Step therapy Prior authorization (to get approvals to fill high-cost drugs, notably growth hormones, injectables, controlled substances, Retin-A, and medications for sleep disorders, and Compulsory 90 day refills at retail (90-day dispensing for chronic meds). This Report, sponsored by Takeda, is the gold standard of drug benefit trends, having been published since 1995. Average 30-day copayments

Employers will strongly focus on costs in health benefit plans for 2014; so must consumers

Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system. Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers. Key findings are that: Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees They will expand other tactics they believe will help address cost

Color us stressed – how to deal

Coast-to-coast, stress is the modus vivendi for most Americans: 55% of people feel stressed in every day life, according to a study from Televox. A Stressful Nation: Americans Search for a Healthy Balance paints a picture of a nation of physically inactive people working too hard and playing too little. And far more women feel the stress than men do. 64% of people say they’re stressed during a typical workday. 52% of people see stress negatively impacting their lives. And nearly one-half of people believe they could better manage their stress. As a result, physicians say that Americans are experiencing negative

There’s fear of health care costs in peoples’ retirement visions

While working people in the U.S. are feeling better about the nation’s economy, Americans aren’t putting much money into savings for retirement. The reasons for this are many, but above all is what Mercer calls “the specter of health care costs in retirement” in the Mercer Workplace Survey for 2013. In addition to peoples’ concerns about future health care costs, reasons for not putting money away for the future include flat personal income, slow economic growth and financial literacy challenges around how much 401(k) savings can be tax-deferred. On the slow economic growth perception, Mercer found that, on the upside, people

When health care costs are a side effect

4 in 5 U.S. patients – 81% of them – want an equal say in health care decisions with their care provider, according to a 2013 Institute of Medicine study. At the same time, patients choose to take “drug holidays,” opting out of taking three or more doses of medicines in a row, or adopt “trail mix” approaches to taking prescriptions, casually and inappropriately mixing Rx drugs. Welcome to your world, pharma industry: where people say they want control, but somehow don’t exercise it in the way you — drug companies — define as “compliance” or “adherence.” Customer experience in

Health costs up, credit down: health consumers face tightening credit markets in the face of rising medical costs

People who received health care in the U.S. between the second quarters of 2012 and 2013 faced 38% higher out-of-pocket costs, growing from $1,862 to $2,568 in just one year. These were payments for common procedures like joint replacements, Caesarean sections, and normal births. At the same time, consumers’ access to revolving credit lines fell by $1,000 over the twelve months. (Credit lines here include bank-issued credit cards, store credit cards, and home equity loans). The TransUnion Healthcare Report from TransUnion, the credit information company, paints a picture of tightening money for all consumers in the face of rising household

Moneytalk: why doctors and patients should talk about health finances

Money and health are two things most people don’t like to talk about. But if people and their doctors spoke more about health and finance, outcomes (both fiscal and physical) could improve. In late October 2013, Best Practices for Communicating with Patients on Financial Matters were published by the Healthcare Financial Management Association (HFMA). Michael Leavitt, former head of the Department of Health and Human Services, led the year-long development effort on behalf of HFMA, with input from patient advocates, the American Hospital Association, America’s Health Insurance Plans, the American Academy of Family Physicians and the National Patient Advocate Foundation, along

Mobile health apps – opportunity for patients and doctors to co-create the evidence

There are thousands of downloadable apps that people can use that touch on health. But among the 40,000+ mobile health apps available in iTunes, which most effectively drive health and efficient care? To answer that question, the IMS Institute for Healthcare Informatics analyzed 43,689 health, fitness and medical apps in the Apple iTunes store as of June 2013. These split into what IMS categorized as 23,682 “genuine” health care apps, and 20,007 falling into miscellaneous categories such as product-specific apps, fashion and beauty, fertility, veterinary, and apps with “gimmicks” (IMS’s word) with no obvious health benefit. Among the 23,682 so-called

Consumers trust and welcome health and insurance providers to go DTC with communications

Consumers embrace ongoing dialog with the companies they do business with, Varolii Corporation toplines in a survey report, What Do Customers Want? A Growing Appetite for Customer Communications. Across all vertical industries consumers trust for this dialogue, health care organizations – specifically doctors, pharmacists, and insurance companies – are the most trusted. Examples of “welcome-comms” would be reminders about upcoming appointments or vaccinations (among 69% of people), notices to reorder or pick up a prescription (57%), and messages encouraging scheduling an appointment (39%). In banking, notices about fraudulent activity on one’s account is the most welcomed message beating out appointment

The new era of consumer health risk management: employers “migrate” risk

The current role of health insurance at work is that it’s the “benefits” part of “compensation and benefits.” Soon, benefits will simply be integrated into “compensation and compensation.” That is, employers will be transferring risk to employees for health care. This will translate into growing defined contribution and cost-shifting to employees. Health care sponsorship by employers is changing quite quickly, according to the 2013 Aon Hewitt Health Care Survey published in October 2013. Aon found that companies are shifting to individualized consumer-focused approaches that emphasize wellness and “health ownership” by workers to bolster behavior change and, ultimately, outcomes. The most

Delaying aging to bend the cost-curve: balancing individual life with societal costs

Can we age more slowly? And if so, what impact would senescence — delaying aging — have on health care costs on the U.S. economy? In addition to reclaiming $7.1 trillion over 50 years, we’d add an additional 2.2 years to life expectancy (with good quality of life). This is the calculation derived in Substantial Health And Economic Returns From Delayed Aging May Warrant A New Focus For Medical Research, published in the October 2013 issue of Health Affairs. The chart graphs changes in Medicare and Medicaid spending in 3 scenarios modeled in the study: when aging is delayed, more people qualify

Whither price transparency in health care? The supply side may be growing faster than consumer demand

Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers). Healthsparq partnered with one of the company’s health insurance company clients to conduct this study, which demonstrated that, over two years, consumers who used an online treatment cost estimator saved money on care for hernia conditions, digestive conditions, and women’s health issues. It’s early days for health care price transparency in health care, but HealthSparq’s findings demonstrate positive evidence that when consumers are offered a tool

Economics of obesity and heart disease: We, the People, can bend the curves

The “O” word drives health costs in America ever-upward. Without bending the obesity curve downward toward healthy BMIs, America won’t be able to bend that stubborn cost curve, either. The Economic Impacts of Obesity report from Alere Wellbeing accounts for the costs of chronic diseases and how high obesity rates play out in the forms of absenteeism, presenteeism, and direct health care costs to employers, workers and society-at-large. Among the 10 costliest physical health conditions, the top 3 are angina, hypertension and diabetes — all related to obesity and amenable to lifestyle behavior change. The top-line numbers set the context:

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

Taking vitamins can save money and impact the U.S. economy – and personal health

When certain people use certain dietary supplements, they can save money, according to a report from the Council for Responsible Nutrition and Frost and Sullivan, the analysts. The report is aptly titled, Smart Prevention – Health Care Cost Savings Resulting from the Targeted Use of Dietary Supplements. Its subtitle emphasizes the role of dietary supplements as a way to “combat unsustainable health care cost growth in the United States.” Specifically, the use of eight supplements in targeted individuals who can most benefit from them can save individuals and health systems billions of dollars. The eight money-saving supplements are: > Omega-3 > B

Consumers’ out-of-pocket health costs rising faster than wages – and a surprising hit from generic drug prices

U.S. health consumers faced greater out-of-pocket health care costs in 2012, especially for outpatient services (think: doctors’ visits) and generic drugs, as presented in The 2012 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI) published in September 2013. At the same time between 2011 and 2012, wages grew about 3%, remaining fairly flat over the past decade as health care costs continued to grow much faster. HCCI found that per capita (per person) out-of-pocket growth for outpatient visits amounted to an average of $118 between 2011 and 2012. But the biggest share of out-of-pocket costs for

Food and the household health budget: one pocket, shrinking access

Over 1 in 5 people in the U.S. have not had enough money to buy food for themselves or their families in the past year, according to the August 2013 Gallup Healthways Index. This is as many consumers as those who couldn’t afford food during the deepest months of the last recession. Lack of access to food is a challenge for a cadre of Americans who lack access to other basic needs such as shelter and health care. Gallup’s Basic Access Index looks at this market basket, and has found that Americans’ access to basic needs at 81.4 in August

Consumers don’t get as much satisfaction with high-deductible health plans

Since the advent of the so-called consumer-directed health care era in the mid-2000s, there’s been a love-gap between health plan members of traditional plans, living in Health Plan World 1.0, and people enrolled in newer consumer-driven plans – high-deductible health plans (HDHPs) and consumer-directed health plans (CDHPs). That gap in plan satisfaction continues, according to the Employee Benefits Research Institute (EBRI)’s poll of Americans’ consumer engagement in health care. The survey was conducted with the Commonwealth Fund. As the bar chart illustrates, some 62% of members in traditional plans were satisfied (very or extremely) with their health insurance in 2012.

People with doctors interested in EMRs, but where’s the easy button?

1 in two people who are insured and have a regular doctor are interested in trying out an electronic medical record. But they need a doctor or nurse to suggest this, and they need it to be easy to use. The EMR Impact survey was conducted by Aeffect and 88 Brand Partners to assess 1,000 U.S. online consumers’ views on electronic medical records (EMRs): specifically, how do insured American adults (age 25 to 55 who have seen their regular physician in the past 3 years) view accessing their personal health information via EMRs? Among this population segment, 1 in 4 people (24%)

People not up-close-and-personal about personalized medicine…yet

Only 1 in 4 U.S. adults over 30 know what “personalized medicine” (PM) really is, and only 8% of people feel very knowledgeable about the concept based on Consumer Perspectives on Personalized Medicine from GfK, published online in August 2013. GfK surveyed 602 online adults 30 years and over between February and March 2013 drawn from the company’s KnowledgePanel sample of U.S. adults. Only 4% of people who have heard of personalized medicine describe it accurately as “medicine based on genome/genetic make up.” About one-half of people (52%) defined PM as medical care, treatment, or medicine geared toward individual needs. The poll

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Chief Health Officers, Women, Are In Pain

Women are the Chief Health Officers of their families and in their communities. But stress is on the rise for women. Taking an inventory on several health risks for American women in 2013 paints a picture of pain: of overdosing, caregiver burnout, health disparities, financial stress, and over-drinking. Overdosing on opioids. Opioids are strong drugs prescribed for pain management such as hydrocodone, morphine, and oxycodone. The number of opioid prescriptions grew in the U.S. by over 300% between 1999 and 2010. Deaths from prescription painkiller overdoses among women have increased more than 400% since 1999, compared to 265% among men.

Working for health care in 2013: workers’ health insurance cost burden still grows faster than wages

Insurance premium costs grew 4% for families between 2012 and 2013, with workers now bearing 39% of health premiums in 2013 compared with only 26% ten years ago, in 2003. That’s a 50% increase in health plan premium “burden” for working families, by my calculation. This snapshot of health insurance in 2013 comes to us from the 2013 Employer Health Benefits Survey, provided by the Kaiser Family Foundation (KFF) and the Health Research & Educational Trust (HRET). This research is one of the most important annual reports to hit the health care industry every year, and this year’s analysis provides strategic context

Americans’ health insurance illiteracy epidemic – simpler is better

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week. The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions. Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade. See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do.

The health care automat – Help Yourself to healthcare via online marketplaces

Imagine walking into a storefront where you can shop for an arthroscopy procedure, mammogram, or appointment with a primary care doctor based on price, availability, quality, and other consumers’ opinions? Welcome to the “health care automat,” the online healthcare marketplace. This is a separate concept from the new Health Insurance Marketplace, or Exchange. This emerging way to shop for and access health care services is explored in my latest paper for the California HealthCare Foundation (CHCF), Help Yourself: The Rise of Online Healthcare Marketplaces. What’s driving this new wrinkle in retail health care are: U.S. health citizens morphing into consumers,

People are growing their health-consumer muscles in 2013

Most Americans are concerned about their ability to for medical bills, even when they have health insurance. As a result, most are comfortable asking their doctor about how much their medical treatment will cost. People are becoming savvier health care shoppers largely because they have to: 37% of people in the U.S. have an annual health insurance deductible over $2,000, according to the Spring/Summer 2013 Altarum Institute Survey of Consumer Health Care Opinion, published on 11th July 2013. Many of the media stories coming out of the Altarum survey since its publication have been about people and their trust in

In the US health care cost game, doctors have seen the enemy – and it’s not them

When it comes to who’s most responsible for reducing the cost of health care in America, most doctors put the onus on trial lawyers, health insurance companies, pharma and medical device manufacturers, hospitals, and even patients. But physicians themselves ? Not so much responsibility – only 36% of doctors polled said doctors should assume major responsibility in reducing health care costs. And, in particular, most U.S. physicians have no enthusiasm for reducing health care costs by changing payment models, like penalizing providers for hospital re-admissions or paying a group of doctors a fixed, bundled price for managing population health. Limiting

Health and wellness, the economy and the grocery store

Consumers in America are spending more, and especially at the grocery store. Most people say they want to eat healthy — but, although they’re spending more at the food store, one-half of supermarket shoppers say cost is the main obstacle for healthy eating. 2 in 3 U.S. grocery shoppers define health and wellness as being physically fit and active, and over half believe that feeling good about yourself is another facet of health. Not being overweight equals health for about one-half of U.S. shoppers. The Why? Behind the Buy, from Acosta Sales & Marketing, explores buying patterns among U.S. consumers

Cost prevents people from seeking preventive health care

3 in 4 Americans say that out-of-pocket costs are the main reason they decide whether or not to seek preventive care, in A Call for Change: How Adopting a Preventive Lifestyle Can Ensure a Healthy Future for More Americans from TeleVox, the communications company, published in June 2013. TeleVox surveyed over 1,015 U.S. adults 18 and over. That’s the snapshot on seeking care externally: but U.S. health consumers aren’t that self-motivated to undertake preventive self-care separate from the health system, either, based on TeleVox’s finding that 49% of people say they routinely exercise, and 52% say they’ve attempted to improve eating habits.

Urgent care centers: if we build them, will all patients come?

Urgent care centers are growing across the United States in response to emergency rooms that are standing-room-only for many patients trying to access them. But can urgent care centers play a cost-effective, high quality part in stemming health care costs and inappropriate use of ERs for primary care. That’s a question asked and answered by The Surge in Urgent Care Centers: Emergency Department Alternative or Costly Convenience? from the Center for Studying Health System Change by Tracy Yee et. al. The Research Brief defines urgent care centers (UCCs) as sites that provide care on a walk-in basis, typically during regular

Americans’ health not keeping up with the world: why to spend more on social determinants of health

The American health infrastructure is not First World or First Rate, based on the outcomes. This, despite spending more on health care per-person than any country on the planet. Two seminal reports are out this week reminding Americans that our return-on-investment in health spending is poor. The first research comes from JAMA titled The State of US Health, 1990-2010: Burden of Diseases, Injuries, and Risk Factors. There is some good news in this report at the top line: that life expectancy for Americans increased in the two decades from 75.2 years to 78.2 years. But this positive quantitative outcome comes with

What to expect from health care between now and 2018

Employers who provide health insurance are getting much more aggressive in 2013 and beyond in terms of increasing employees’ responsibilities for staying well and taking our meds, shopping for services based on cost and value, and paying doctors based on their success with patients’ health outcomes and quality of care. Furthermore, nearly one-half expect that technologies like telemedicine, mobile health apps, and health kiosks in the back of grocery stores and pharmacies are expected to change the way people regularly receive health care. What’s behind this? Increasing health care costs, to be sure, explains the 18th annual survey from the National

Health consumers, meet the medical bank

Health consumers, meet a new player in your health care world: the bank. Financial services companies will play a growing role in U.S. health care as patients morph into health care consumers responsible for making more money-based decisions about their health care. This shift could make paying for health care just like paying other bills in the consumer retail market. And that’s a new role for health providers – doctors and hospitals – to fill. The Impact of Growing Patient Financial Responsibility on Healthcare Providers, prepared for Citi Enterprise Payments by Boundary Information Group, discusses what the impact of consumers’ payments in

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

The health and wellness gap between insured and uninsured people

If you have health insurance, chances are you take several actions to bolster your health such as take vitamins and supplements (which 2 in 3 American adults do), take medications as prescribed (done by 58% of insured people), and tried to improve your eating habits in the past two years (56%). Most people with insurance also say they exercise at least 3 times a week. Fewer people who are uninsured undertake these kinds of health behaviors: across-the-board, uninsured people tend toward healthy behaviors less than those with insurance. This is The Prevention Problem, gleaned from a survey conducted by TeleVox

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Nearly 1 in 2 women delayed health care in the past year due to costs – the economic impact on a woman’s physical, emotional, and fiscal health

Nearly 1 in 2 women put off seeking health care because the cost was too high. The kinds of services delayed included visits to the doctor, medical procedures, and filling prescription medications. The fourth annual T.A.L.K. Survey was released this week by the National Women’s Health Resource Center (NWHRC), focusing on the declining economy and its impact on women and three dimensions of their health — physical, emotional, and fiscal. 40% of women say that their health has worsened in the past five years due to increasing stress and gaining weight, according to the survey. One of the most interesting

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,